Tag Archive: U.S. Participation Rate

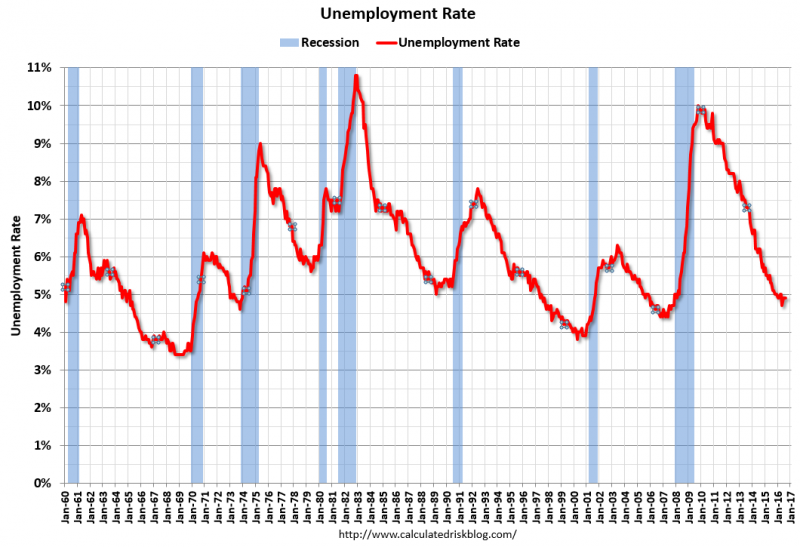

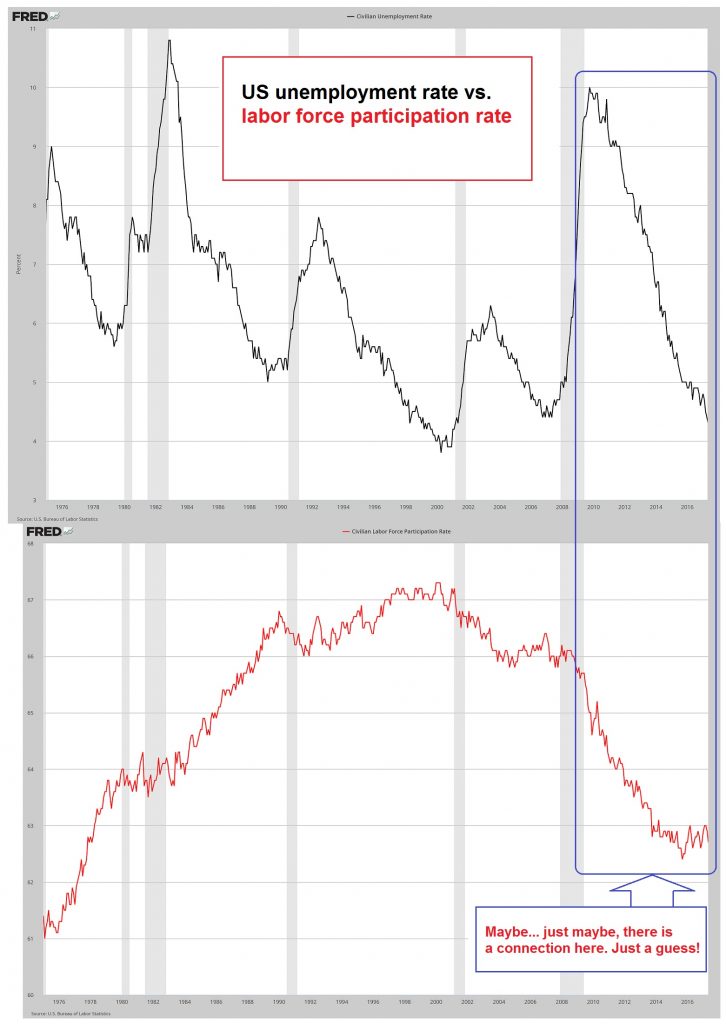

The participation rate is an important indicator of the supply of labor. It measures the share of the working-age population either working or looking for work. The number of people who are no longer actively searching for work would not be included in the participation rate.

FX Daily, June 02: Dollar Marks Time Ahead of US Jobs Report

The foreign exchange market is becalmed, leaving the US dollar narrowly mixed. The euro has been confined to less than a 20-pip range through the Asian session and most of the European morning. The news stream is light. The US withdrawal from the Paris Accord may have garnered the headlines, but as a market force, it is difficult to detect the immediate impact.

Read More »

Read More »

April Jobs Won’t Change Minds

There is something for everyone in today's US jobs report, and at the end of the day, it is unlikely to sway opinion about the direction and timing of the next Fed move. The greenback itself may remain range bound after the initial flurry. On the other hand, the disappointing but noisy Canadian data underscores the risk of a more dovish slant to the central bank's neutral stance next week.

Read More »

Read More »

FX Daily, May 05: Mixed Dollar Ahead of US Jobs Data and Fed Talk

The US dollar is narrowing mixed as the employment data, and Fed speeches are awaited. Six Fed officials speak today, including Yellen and Fischer. Regional Presidents Williams, Rosengren Evans and Bullard also speak. It will be the first flurry of speeches since the FOMC meeting.

Read More »

Read More »

US Jobs Growth Disappoints

The US jobs growth slowed considerably more than expected in March and the disappointment pushed the dollar and equities initially lower. The US created 98k jobs in March, well below market expectations for around 175k jobs. Adding insult to injury, revisions to the January and February data took off another 38k job.

Read More »

Read More »

Short Note on US Employment Report

The US jobs data is notoriously difficult to accurately forecast consistently. I do not claim to do so now. My intent is more modest. It is simply to point out why I there is risk that the jobs data is disappointing, especially after the stronger than expected ADP estimate.

Read More »

Read More »

Solid US Jobs Report in line with Expectations

The US jobs report was largely in line with expectations. February was the second consecutive month that the US economy created more than 200k jobs. It is the first time since last June and July. The 235k is just below the revised January 238k gain (initially 227k).

Read More »

Read More »

A Few Thoughts about the US Labor Market

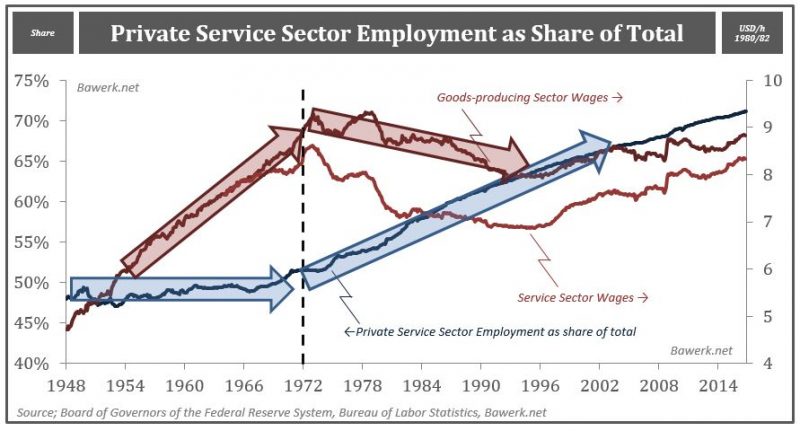

The 94 mln people POTUS claims are not working is true but terribly misleading. What happened to agriculture a century ago is happening to manufacturing. New industries are less labor intensive than smokestack industries.

Read More »

Read More »

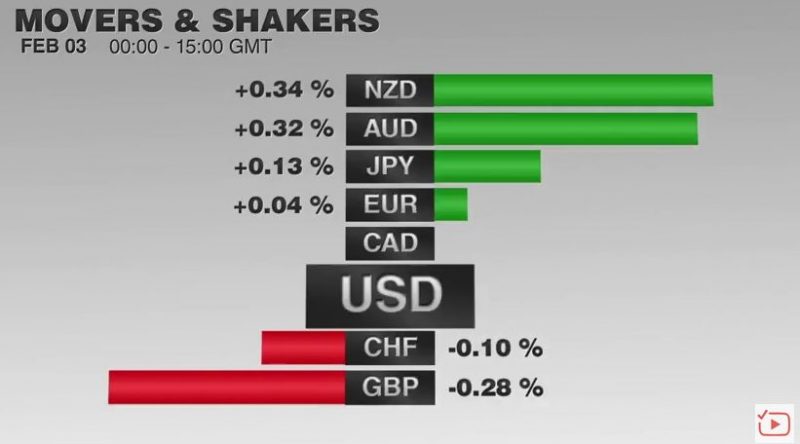

FX Daily, February 03: US Jobs Trump Europe’s Service PMIs

Ahead of the weekend, there are two series of economic reports. The first are Europe's service PMI reports and the second is the US employment report. Neither report is likely to alter views significantly, but the latter has greater potential to move the market.

Read More »

Read More »

US Jobs Details Better than the Headline

The dollar and US yields are recouping more of yesterday’s decline. A break of $1.0480-$1.05 would suggest the euro’s upside bounce is exhausted. A dollar move above JPY116.80-JPY117.25 would also hint that the greenback was going to make an other run toward JPY118.30-JPY118.60. Sterling support is seen in the $1.2285-$1.2310 area.

Read More »

Read More »

Toward A New World Order, part III

A new world order is coming of age and the transition is painful to accept for a Western middle class with a deep-seated sense of entitlement. We showed how the West feels threatened globally in Toward a New World Order and followed up explaining how this translate into domestic politics in Toward a New World Order Part II. We will now continue this series by showing how gross economic mismanagement have created the new political class that we...

Read More »

Read More »

Mixed Jobs Report, but Unlikely to Deter Expectations for Fed Hike

The US dollar has slipped lower in response to the jobs data, but quickly recovered. The details are mixed, but is unlikely to change views on the outlook for Fed policy. The headline job creation was in line with expectations at 178k. Job growth of the back two months were shaved by 2k, concentrated in October. The unemployment rate dropped to 4.6%, the lowest since 2007.

Read More »

Read More »

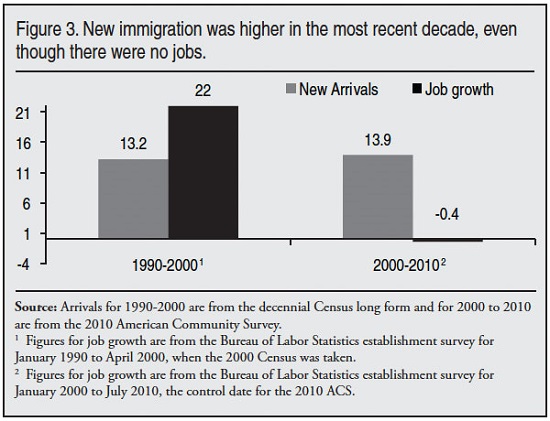

Rising Immigration but no Jobs

The list of pundits jostling for air time to add their two cents to discussions of hot-button issues such as immigration is endless. The airwaves and social media are overflowing with people wanting to comment on hot-button social issues, but when it comes to the the one truly critical dynamic that will shape the future--everyone's strangely silent.

Read More »

Read More »

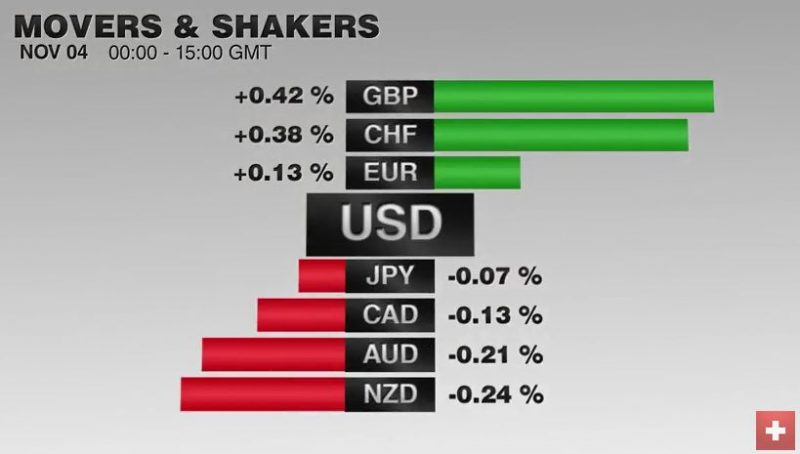

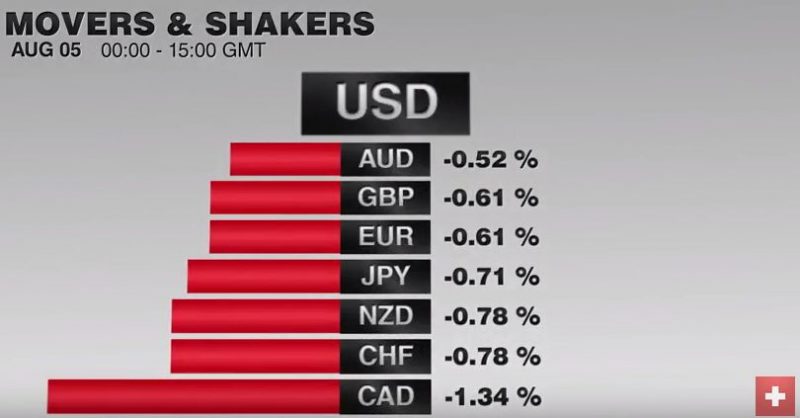

FX Daily, November 04: US Jobs Figures: Another Time the Swiss Franc Strengthens

With the not convincing U.S. jobs number, both the EUR and, in particular, the Swiss Franc could improve. With continuing political uncertainty in the U.S., more speculators closed their short CHF positions

Read More »

Read More »

FX Daily, October 07: Sterling Stabilizes After Harrowing Drop, Now Jobs

Sterling again steals the limelight. In early Asia, sterling inexplicably dropped nearly eight cents in minutes (to ~$1840), and on some platforms, may have traded below $1.1380. It almost immediately rebounded but has not resurfaced above $1.2480.

Read More »

Read More »

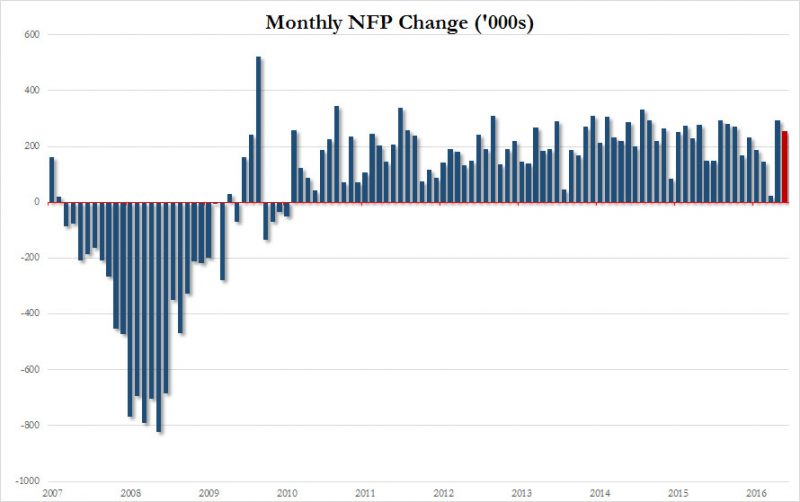

US Jobs Disappoint, Risk of Sept Hike Recedes, Dollar Falls

Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged.

Read More »

Read More »

FX Daily, September 2: US Jobs Data–Higher Anxiety, Thank You Mr. Fischer

The US dollar is little changed ahead of the job report. Our near-term bias is for a lower dollar. Sterling is flat and is holding on to about a 1% gain this week. The Japanese yen is about a 0.3% lower and is off 1.7% this week. The euro was coming into today for the week.

Read More »

Read More »

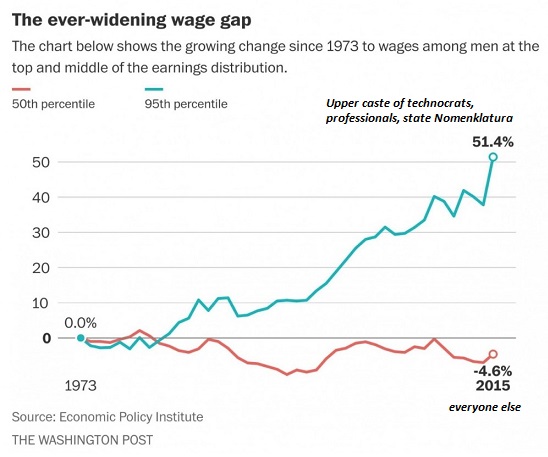

Why Wages Have Stagnated–and Will Continue to Stagnate

Mainstream economists are mystified why wages/salaries are still stagnant after 7+ years of growth / "recovery." The conventional view is that wages should be rising as the labor market tightens (i.e. the unemployment rate is low) and demand for workers increases in an expanding economy.

Read More »

Read More »

US Jobs Surprise, Canada Disappoints

Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged.

Read More »

Read More »

FX Daily, August 05: US Jobs Data on Tap, but Don’t Expect Miracles

The focus is squarely on the US employment data today, ahead of which the capital markets are mostly consolidating yesterday's Bank of England inspired moved. The Australian and New Zealand dollars, alongside sterling, which is up about half a cent after losing two yesterday.

Read More »

Read More »

Helping Robots Find Jobs…

When the cost of capital goes down to zero, a company with access to that cheap – or even free – money can afford to pay almost an infinite amount of money to get rid of its employees and hire robots.

“Zero-interest-rate policy is really a full robot employment program.”

Read More »

Read More »