Tag Archive: United States

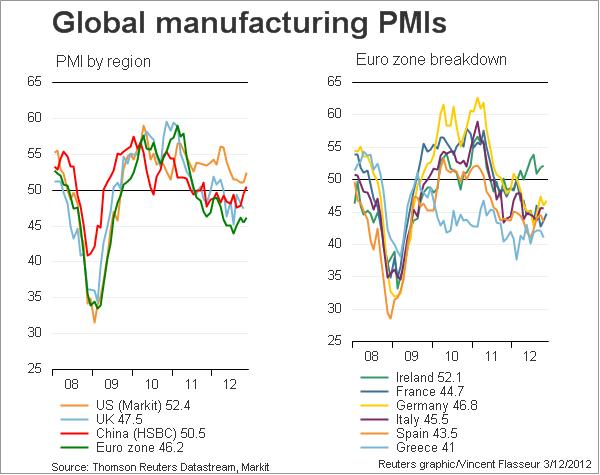

Global Purchasing Manager Indices, Update December 10

Manufacturing PMIs are considered to be the most leading and important economic indicators. Jim O’Neill, Chairman of Goldman Sachs Asset Management, believes the PMI numbers are among the most reliable economic indicators in the world. BlackRock’s Russ Koesterich thinks it’s one of the most underrated indicators. Global Purchasing Manager Indices for the manufacturing industry December 3, 2012 …

Read More »

Read More »

Steen Jakobsen, Chief Economist Saxo Bank, Followed Our Shorts on Gold and Bullishness on USD

Steen Jakobsen, chief economist of Saxo Bank followed our bullishness on US dollar and our shorts on golds and silver of the beginning of October when gold was trading around 1780. At the time, Steen was writing his column, we have already realized some gains on silver and gold shorts. Steen seems to be content with …

Read More »

Read More »

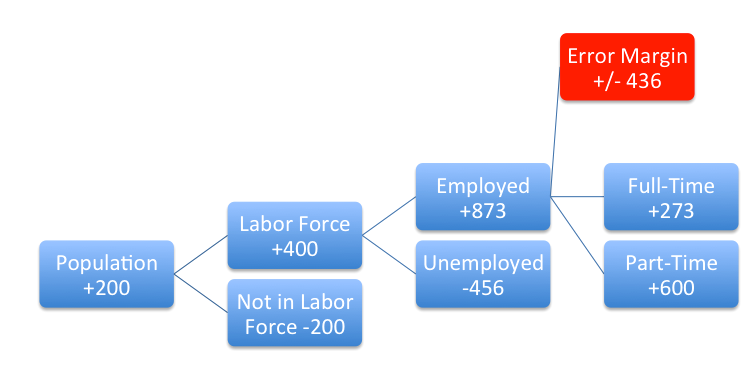

Conspiracy? Why the Jobs Report Was not Cooked, but simply Flawed

Conspiracy ? Huge Differences Between the Payrolls Report and the Household Survey based on the extracts of Robert Oak, Noslaves.com and his blog on Economic Populist It’s a conspiracy! The BLS is trying to swing the election! They’re cookin’ de books! By now you’ve seen the claims, accusations and mumblings by the pundits, press, twitter and blogosphere. So …

Read More »

Read More »

The vicious cycle of the US economy or why the US dollar must ultimately fall again

Just some simple words about the vicious cycle of the US economy and the consequences on the US dollar: A stronger USD will not rescue the US economy, quite the contrary. US companies will not hire in the US, but outsource or hire overseas. If they hire in the US, due to the high number …

Read More »

Read More »

Forget Non-Farm Payrolls, Take US Personal Disposable Income as Lead Economic Indicator

The unreliable Non-Farm Payrolls has far too much importance Interesting to see that markets needed two relatively bad NFPs to really believe that their main indicators, the “Non-Farm Payroll” reports were strongly biased in January and February by a positive weather effect. HFT algorithms that highly influence stock market prices, are not able to take …

Read More »

Read More »

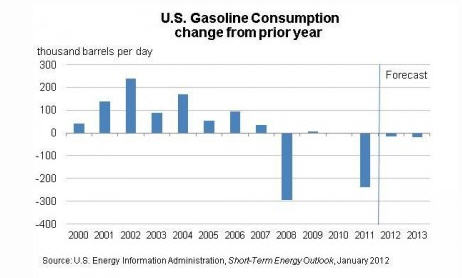

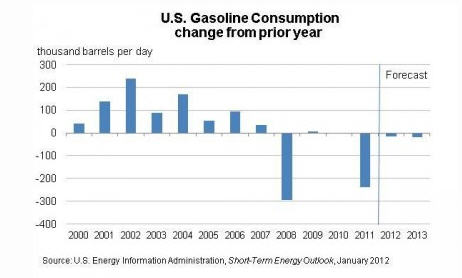

Oil price increases in 2012 and why they are not real

Oil prices Oil prices will rise quickly this year along with the recovery, the Iran issues and last but not least driven by investor demands of yield, implemented in the HFT algos. Interestingly the Iran issues already existed in December, but oil prices were falling, at that moment investors did not believe in a global recovery yet, …

Read More »

Read More »

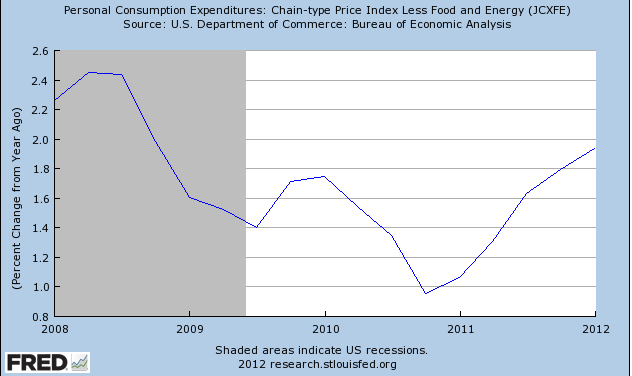

Keynesians vs. Anti-Keynesians: How price deflation has kick started the US growth

In recent posts Keynesians were criticized that hikes in the monetary base like Quantitative Easing (QE2) failed to lift the US economy, but it was the debt ceiling that helped to restore confidence in the US and that austerity can lead to GDP growth. Paul Krugman angrily replied that “even a huge rise in the …

Read More »

Read More »