Tag Archive: U.S. Chicago PMI

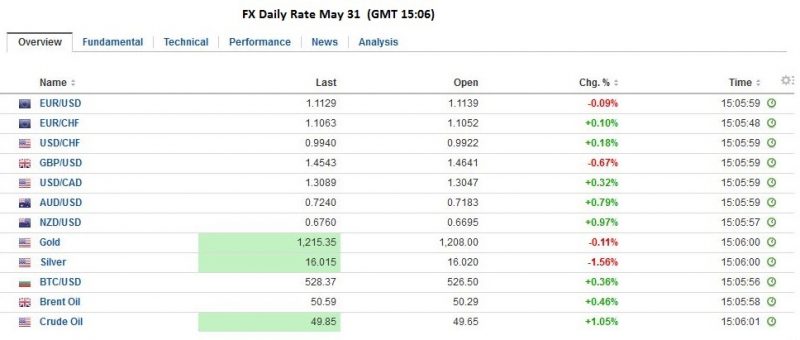

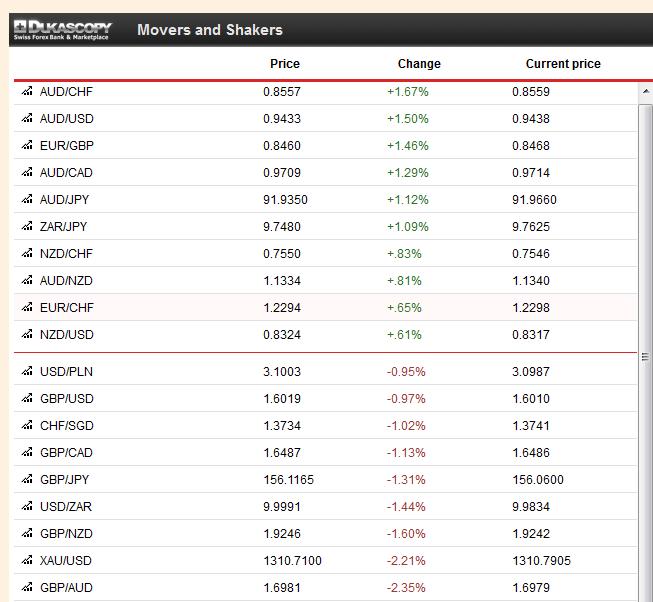

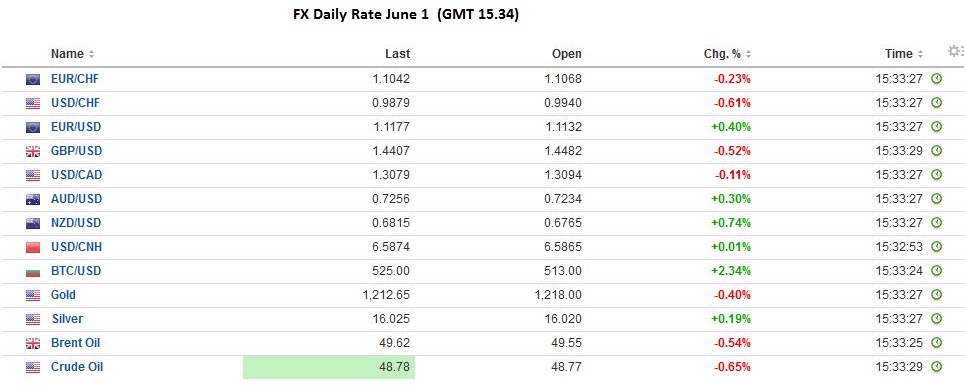

FX Daily, May 31: Sterling Slips and Aussie Pops as Investors Await Fresh Insight into Fed Trajectory

The US dollar is broadly mixed. The main narrative of increased prospects for a Fed hike in June or July has been pushed off center stage as the market reacts to local developments as investors await from US economic data. Ostensibly the data...

Read More »

Read More »

FX Daily, April 29: Dollar Losses Extended Ahead of the Weekend

There are two main forces in the foreign exchange market that are rippling through the capital markets. The first is the continued weaker dollar tone. The combination of what appears to be a stagnating US economy (0.5% annualized pace in Q1) and a market that does not believe the Federal Reserve will hike rates in … Continue reading...

Read More »

Read More »

FX Daily, 02/29: Dollar Mixed, While Equities Skid

It seemed that it was only after Asian equity markets fell did reports begin suggesting disappointment with the G20 meeting. The narrative followed the price action rather than the other way around. Before that, at least, one newswire claimed China was the winner of at the G20 meeting. Its currency policy was not criticized. Many, …

Read More »

Read More »

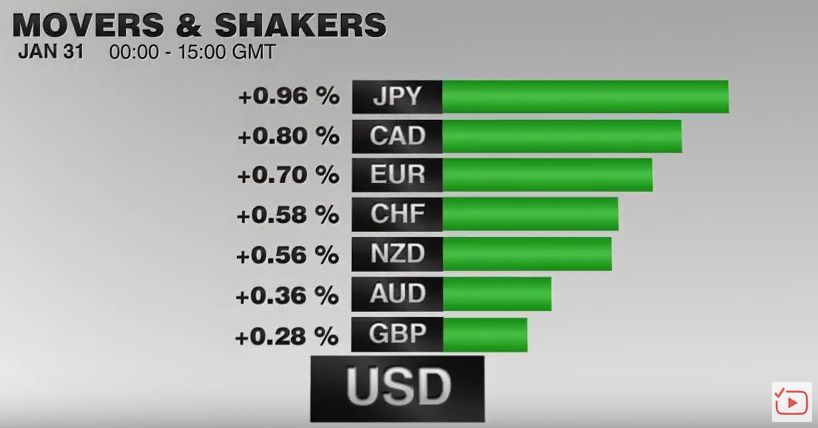

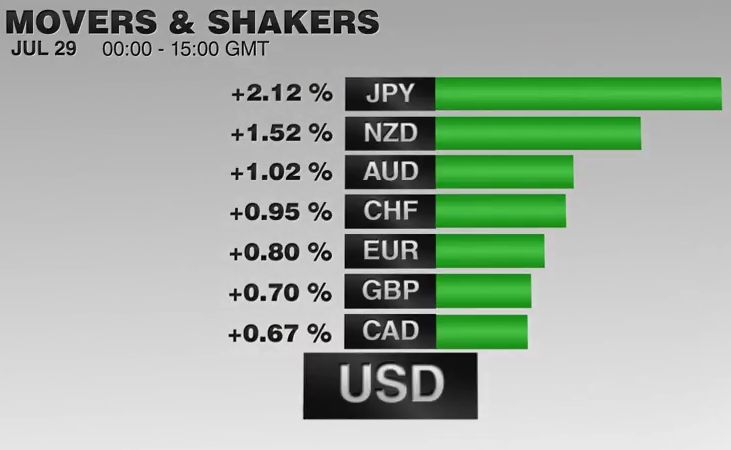

Kuroda Surprises, Introduces Negative Rates in Japan, Sinks Yen

The Bank of Japan surprised the market. It did not expand its asset purchase plan, which was the main focus of many market participants, including ourselves. Instead, following a rash of disappointing data, the BOJ introduced negative interes...

Read More »

Read More »

2015 Draws to a Close

Many financial centers in Asia and Europe are on holiday today, and those that are open, are experiencing a minimum of activity. Turnover may pick up briefly in the North American morning, but conditions will remain thin and only those who need to transact will. The US reports weekly jobless claims and the Chicago PMI. … Continue reading...

Read More »

Read More »

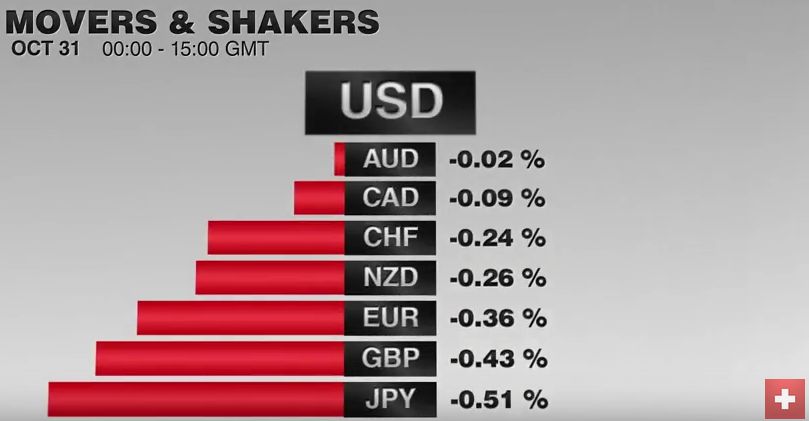

Dollar Edges Higher Ahead of Month-End and Key Events

The US dollar remains firm against most of the major currencies to start what promises to be a critical week for investors. There are two main considerations. The first is the last minute position adjustments ahead the key events that begin with the IMF's SDR decision later today, running through the start-of the month data …

Read More »

Read More »

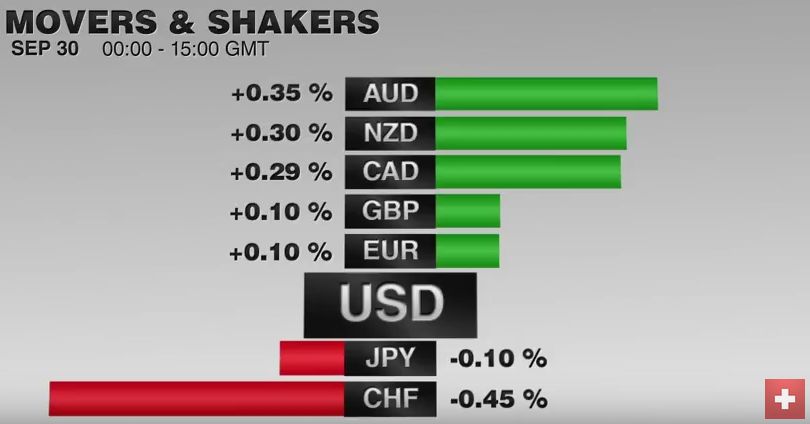

Fundamentals, Gold and FX Movements, Week September 30 to October 4

Our weekly summary of fundamental news on FX that aims to explains price movements, with particular emphasis on the possibly biggest mysteries: the gold price (GLD) and the Swiss franc (FXF) . The clear winner of the week was the Aussie, supported by a positive PMI and positive news from the RBA. In the previous …

Read More »

Read More »

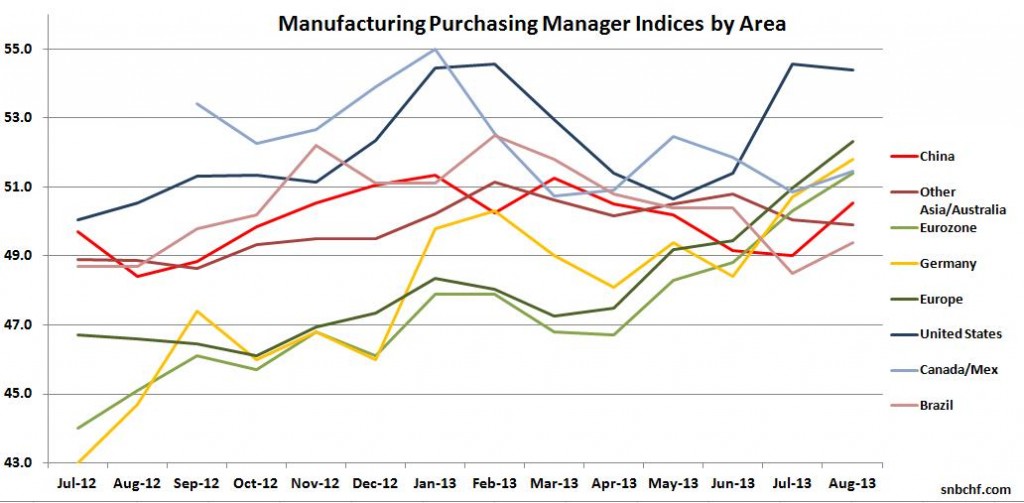

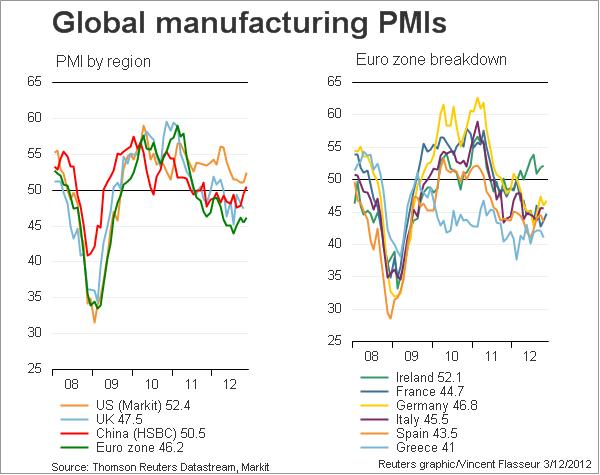

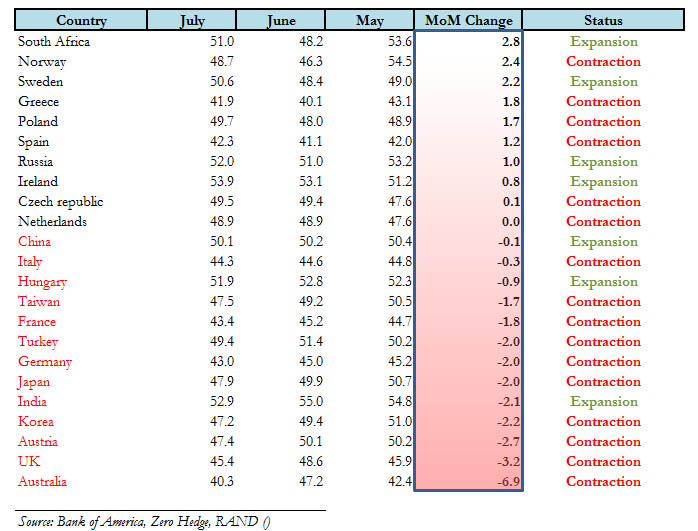

Global Purchasing Manager Indices

Manufacturing Purchasing Manager Indices (PMIs) are considered to be the leading and most important economic indicators. August 2013 Update Emerging markets: Years of strong increases in wages combined with tapering fears have taken its toll: Higher costs and lower investment capital available. EM Companies have issues in coping with developed economies. Some of them …

Read More »

Read More »

Global Purchasing Manager Indices, Update January 25

Manufacturing PMIs are considered to be the leading and most important economic indicators. After a strong slowing in summer 2012 and the Fed’s QE3, this is the fourth month of improvements in global PMIs January 25th Expansion-contraction ratio: There are 15 countries that show values above 50 and 14 with values under 50. Positive-negative-change ratio: …

Read More »

Read More »

Global Purchasing Manager Indices, Update December 17

Manufacturing PMIs are considered to be the leading and most important economic indicators. Since the Fed’s QE3, this is the third month of improvements in global PMIs after a strong slowing in summer 2012. January 25th Expansion-contraction ratio: There are as many countries that show values above 50 as under 50. Positive-negative-change ratio: 18 countries …

Read More »

Read More »

Global Purchasing Manager Indices, Update December 10

Manufacturing PMIs are considered to be the most leading and important economic indicators. Jim O’Neill, Chairman of Goldman Sachs Asset Management, believes the PMI numbers are among the most reliable economic indicators in the world. BlackRock’s Russ Koesterich thinks it’s one of the most underrated indicators. Global Purchasing Manager Indices for the manufacturing industry December 3, 2012 …

Read More »

Read More »

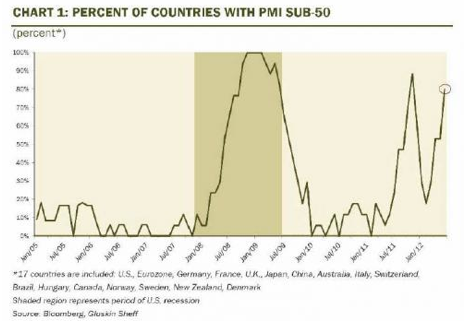

Global PMIs Contracting More – Are Stocks Overvalued?

updated August 05,2012 We publish a detailed analysis of global PMIs and compare them with the main risk indicators S&P500, Copper, Brent and AUD/USD some days after most PMIs came out. Abstract: Thanks to positive US consumer confidence, stock markets are highly valued, whereas the Purchasing Manager Indices (PMIs) for the manufacturing industry are contracting …

Read More »

Read More »

Global Macro with all Global PMIs July 4th

updated July 4,2012 This page inside our macro data menu contains global PMIs compared with the main risk indicators S&P500, Copper, Brent and AUD/USD as of the day after most PMIs came out. JP Morgan’s Global PMI: Click for details inside the table, History of composite PMI

Read More »

Read More »