Tag Archive: Turkey

FX Daily, May 20: Market Stabilize after Yesterday’s Tumultuous Session

US equity indices finished lower, but the real story was their recovery. Asia Pacific equities were mixed, with Australia's 1.5% rally leading the recovery in some markets, including Tokyo and Singapore. Europe's Dow Jones Stoxx 600 is up a little more than 0.5% near mid-session, led by information technology and industrials, while energy and financials lagged with small gains.

Read More »

Read More »

FX Daily, January 21: It is the ECB’s Turn but Little New to be Said or Done

Overview: The S&P 500 and NASDAQ gapped higher yesterday to record-levels, and the reflation theme lifted Asia Pacific shares for the third session today. South Korea, Taiwan, and China led the advance.

Read More »

Read More »

FX Daily, December 15: The Bulls are Emboldened

The S&P fell for the fourth consecutive session yesterday, the longest losing streak of the quarter, and this seemed to encourage profit-taking in the Asia Pacific region today. The MSCI Asia Pacific Index slipped for the second consecutive session, and even confirmation of the Chinese recovery failed to lift the Shanghai Composite.

Read More »

Read More »

FX Daily, November 30: Equities are Heavy and the Dollar Softer to Start New Week

Overview: Month-end profit-taking saw Asia Pacific shares tumble earlier today. Most markets are off 1-2.5% today after the MSCI Asia Pacific Index rose 2.25% last week. European shares are mixed, but little changed. US shares are also trading lower.

Read More »

Read More »

FX Daily, November 27: Dollar Offered Ahead of the Weekend

Equities are finishing the week on a firm tone, while the US dollar remains heavy. In the Asia Pacific, only Australia and India did not end the week on a firm note. The MSCI Asia Pacific completed its fourth consecutive weekly gain, for around a 13% gain.

Read More »

Read More »

FX Daily, November 24: Diverging PMIs Fail to Give the Dollar Lasting Support

Overview: The contrast between the eurozone and US preliminary PMI readings caught the short-term market leaning the wrong way, and the dollar snapped back after extending its recent losses. However, today the US dollar is back on its heels and returning to yesterday's lows against most major currencies.

Read More »

Read More »

FX Daily, November 19: Surging Virus Saps Risk Appetites

Overview: News that the New York City was closing the schools to contain the virus sent stocks reeling in late North American dealings yesterday and spurred some profit-taking in the Asia Pacific and Europe. Equities in the Asia Pacific region were mostly lower, though China, South Korea, and Australia's advanced and Tokyo markets were mixed.

Read More »

Read More »

FX Daily, November 12: Nervous Calm in the Capital Markets

There is a nervous calm in the capital markets today. The equity rally in the Asia Pacific region stalled to end an eight-day rally, though the Nikkei's rally remains intact.

Read More »

Read More »

FX Daily, November 11: Reduced Risk of Negative Policy Rates Lifts Sterling and the Kiwi

Overview: Investors are trying to figure out the impact of the likelihood of a vaccine. One thing that has happened is that the market perceives less chance that the UK or New Zealand will adopt negative rates, and their respective currencies are adjusting higher. Meanwhile, the equity rally is continuing in Asia and Europe.

Read More »

Read More »

FX Daily, November 9: Markets are not Waiting for Official Closure in the US

The new week has begun with robust risk appetites, driving stocks and stocks higher and sending the dollar broadly lower. Nearly all the equity markets in the Asia Pacific region gained more than 1%, except Malaysia and Indonesia.

Read More »

Read More »

FX Daily, November 3: Risk Appetites Return as the US Goes to the Polls

More than 95 mln Americans voted before today, and many observers warn of a cliffhanger that could be decided in the courts. The polls sand surveys show strong odds in favor of a Democratic sweep. Looking at the capital markets, nothing looks amiss.

Read More »

Read More »

FX Daily, October 27: Markets Take Collective Breath and Beijing Tweaks Fixing Mechanism

The surging pandemic sapped the risk-taking appetites as some investors hunker down for what could be a volatile period ahead. The S&P 500 lost nearly 3% at its lows before rebounding 1% in late dealings.

Read More »

Read More »

FX Daily, October 19: Sterling Sparkles in Dollar Setback

Investors have not let the surge of the virus or uncertainty over the UK-EU talks or US fiscal stimulus to stand in their way. Sterling is leading the major currencies higher, returning to the $1.30 area, while global equities are trading higher.

Read More »

Read More »

FX Daily, September 14: UK Presses Ahead, China Strikes Out at German Pork Producers, and Moody’s Weighs on Turkey

A flurry of deals, including the still-evolving Oracle-TikTok tie-up, helped lift equity markets in the Asia Pacific region. South Korea's Kospi, and Indonesia, which had been battered last week, led the advance. The MSCI Asia Pacific Index rose for the third consecutive sessions. European bourses are little changed while US stocks are firmer.

Read More »

Read More »

FX Daily, August 20: FOMC Minutes Spur Profit-Taking

Overview: The FOMC minutes depicted a Federal Reserve that appeared to be not quite ready to take fresh initiatives, whether it is yield curve control or changing the composition or quantities of its bond purchases. This unleashed profit-taking on some of the large moves in equities, the dollar, and gold.

Read More »

Read More »

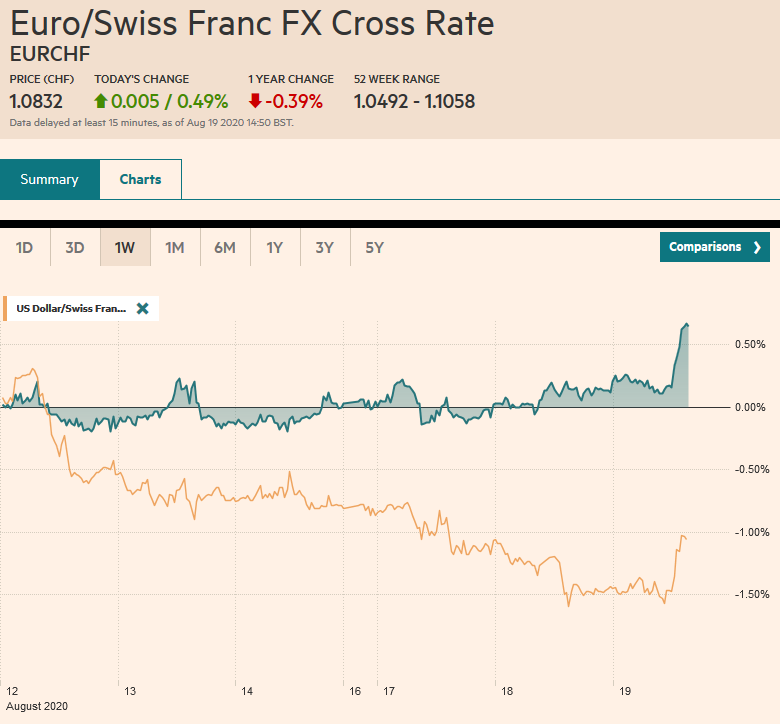

FX Daily, August 19: US Equities Outperform but Does Little for the Heavy Greenback

Overview: The S&P 500 and NASDAQ set new all-time highs yesterday, but the continued outperformance of US equities have failed to lend the dollar much support. It was sold to new lows for the year yesterday against the euro, sterling, the Swedish krona, and the Australian dollar.

Read More »

Read More »

August Survey Data and Beyond

Economists are often lampooned because of their inability to forecast changes in the business cycle. But the pandemic helped them overcome the challenge this time. A record contraction in Q2 was anticipated before in March. Similarly, economists generally expected the recovery after the March-April body blow.

Read More »

Read More »

FX Daily, August 12: Dollar was Sold in Asia and Europe, but is Poised to Bounce in North America

The biggest rise in the US 10-year yield in a couple of months, as the record quarterly refunding, got underway may have helped stabilize the dollar after an earlier decline. The S&P 500 threatened to extend its advance for the eighth consecutive session yesterday, but a late sell-off stopped it cold after scaling to new five-month highs.

Read More »

Read More »

FX Daily, August 10: Monday in August

Overview: The new week has begun slowly with Singapore and Tokyo markets closed for national holidays. The MSCI Asia Pacific Index rose 2% last week and edged higher today, led by 1.5%-1.7% rallies in South Korea and Australia. Hong Kong was a notable exception and eased around 0.6%.

Read More »

Read More »

FX Daily, August 07: Position Adjustment Dominates ahead of US/Canada Employment Reports

Escalating dramas may be behind the position adjustment today ahead of the US jobs data. The US and China feud expanded beyond Tiktok to WeChat, and efforts to tighten disclosure rules for Chinese companies listed in the US are nearing. The negotiations between the White House and the Democrats broke down, preventing or at least delaying additional stimulus.

Read More »

Read More »