Tag Archive: $TLT

FX Daily, September 10: Initial Extension of Euro and Sterling Losses Stall

The US dollar's pre-weekend gains were extended against most the major currencies, but the euro, sterling, and Australian dollar have recovered in the European morning. Emerging markets currencies are mixed. The Indian rupee is the weakest(of the emerging market currencies (~-0.8%) following the widening of the Q2 current account deficit at the end of last week and ahead of the August trade deficit which is expected to show the impact of rising...

Read More »

Read More »

Jump in Hourly Earnings is Key to US Jobs, while Canada adds 40k Full-Time Positions

The 201k rise in US non-farm payrolls edged above the median forecasts, but the 50k downward revision to the past two-months removes the gloss. It is the first August report in seven years that the initial estimate was above the Bloomberg median. The most important part of the report was the 0.4% jump in hourly earnings, lifting the year-over-year rate to a new cyclical high of 2.9%.

Read More »

Read More »

FX Daily, August 28: Greenback Remains On Defensive

Corrective forces continue to weigh on the US dollar. Sometimes the narratives drive the price action and sometimes the price action drives the narratives. Currently the latter appears to hold sway. The dollar's downside correction began around the middle of the month, well before Powell's August 24 Jackson Hole speech.

Read More »

Read More »

FX Weekly Preview: Macroeconomic Considerations

The force that had pushed the US 10-year Treasury yield to 3% and the dollar above JPY113 at the start of the month, and the euro to $1.13 a couple of weeks ago has dissipated. The 10-year yield is near 2.80%. The dollar was near two-month lows against the yen a week ago, and the euro was back toward the middle of its previous $1.15-$1.18 trading range.

Read More »

Read More »

FX Daily, August 21: Trump Comments Hit Dollar, Little Impact on Rates

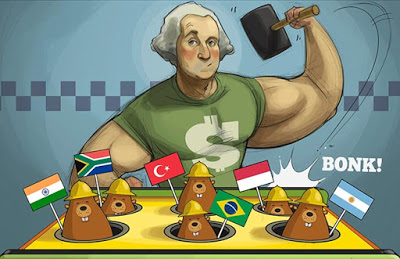

The US dollar is broadly lower following President Trump's comments yesterday, criticising Fed policy and reiterating his previously made claim that China and the EU are manipulating their currencies. We suggested that last week's presidential tweet that identified strong capital inflows into the US may not have been written by President Trump.

Read More »

Read More »

FX Daily, August 14: Brief Respite but Little Relief

Corrective pressures grip the capital markets today, helped by the easing of the selling pressure on Turkey, but its more a respite than a relief as no new policy initiatives are behind the lira's upticks. The implication of this is that it is unlikely to last. In fact, the dollar's low in early Europe a just above TRY6.41 after trading a little above TRY7.23 yesterday may be about the most that can reasonably be expected.

Read More »

Read More »

FX Daily, August 07: Turn Around Tuesday for the Greenback

The US dollar is pulling back today after yesterday's advance. All the major currencies are higher and even the Turkish lira, which plunged nearly 5% yesterday to cap a six-day slide, is trading firmer today ([email protected]). The dollar's losses are modest and appear corrective in nature.

Read More »

Read More »

FX Daily, July 31: BOJ Prepares for QE Infinity

The Japanese yen has been sold following the adjustments to policy and outlook by the BOJ that will allow the unconventional policies continue for an "extended period of time." Cross rate pressure and month-end demand have lifted the euro and sterling through yesterday's highs.

Read More »

Read More »

FX Daily, July 27: Greenback Remains Firm Ahead of Q2 GDP

The US dollar is trading firmly in Europe after consolidating yesterday's gains during the Asian session and ahead of the first look at Q2 GDP. Yesterday's economic reports, including durable goods orders and inventory data, saw the Atlanta Fed's GDPNow tracker lower its forecast to 3.8% from 4.5%.

Read More »

Read More »

FX Daily, July 25: Narrow Ranges Prevail

The US dollar is trapped in narrow trading ranges. That itself is news. At the end of last week ago, the US President seemed to have opened another front in his campaign to re-orient US relationships by appearing to talk the dollar down. Contrary to fears, and media headlines of a currency war, the dollar is fairly stable.

Read More »

Read More »

FX Daily, July 23: Dollar Consolidates Trump-Inspired Losses, BOJ Resolve Tested

US Treasury Secretary Mnuchin told G20 finance ministers and central bankers that President Trump was not trying to interfere in the foreign exchange market or encroach upon the Federal Reserve's independence. Trump's comments and tweets last Thursday and Friday effectively capped the dollar as it was looking to break out to the upside.

Read More »

Read More »

FX Daily, July 18: Greenback Extends Gains-For Now

After softening in Europe yesterday, the dollar recovered in the North American session with the help of assurances by Fed Chair Powell who reaffirmed the path gradual path despite clear recognition that tariffs threaten wages and growth. The greenback has extended those gains today and is higher against all the emerging market currencies, expected the Turkish lira, which is slightly firmer.

Read More »

Read More »

FX Daily, July 13: Trump Trips Sterling, but Greenback Enjoys Broad Gains

President Trump weighed in on Brexit and spurred the largest drop in sterling in more than two weeks. Trump encouraged Brexit, but he indicated he "would have done it much differently" and that he "actually told Theresa May how to do it, but she did not listen." Trump cautioned that May's plan would mean it would still be too close to the EU and this would "kill" a free-trade deal with the US. In effect, Trump backed the harder Brexit camp...

Read More »

Read More »

FX Daily, July 11: Escalating Trade Tensions Set Tone for Capital Markets

The US took the first step in making good its threat to put a 10% tariff on $200 bln of Chinese goods in response to the PRC retaliating for the 25% tariff on $34 bln of its exports. The US provided a list of products that will get the new tariffs after the public comment period is completed at the end of next month. This time the list included numerous consumer goods, like digital cameras, baseball gloves, but have left off popular products, like...

Read More »

Read More »

FX Daily, July 10: May Survives to Fight Another Day, but Sterling’s Recovery Falters

The political obituary of UK's May, who many see as an "accidental" Prime Minister, has been written many times in the past year and a half only to be withdrawn. Again, it looked like the resignation of two ministers, and a couple of junior ministers was going to spur a leadership challenge. While this still may come to pass, the hard Brexit camp, which has huffed and puffed, simply does not appear to represent a majority of the Tory Party, and...

Read More »

Read More »

FX Weekly Preview: Macro Considerations for the Capital Markets

The triumphalism that followed the fall of the Berlin Wall nearly three decades ago has evaporated. The Great Financial Crisis and inexorable widening of income and wealth inequalities within countries undermined claims of moral and economic superiority. Liberal democracies are fighting a rearguard action and the rise of illiberal regimes.

Read More »

Read More »

FX Daily, July 03: Markets Trying to Stabilize

The global capital markets are trying to stabilize. US equities recovered from early losses yesterday but this was not enough to stop Asian equities from extending recent losses. The MSCI Asia Pacific Index slipped 0.2% for the sixth decline in the past seven sessions, However, several local markets, including China, Australia, and Korea advanced.

Read More »

Read More »

FX Daily, June 19: America First Clashes With Made in China 2025

The escalation of trade tensions between the world's two largest economies is scaring investors, who are liquidating equities and buying core bonds. The dollar and yen are the strongest of the major currencies. The Swiss franc is mostly steady as it too is benefiting from the unwinding of risk trades.

Read More »

Read More »

FX Weekly Preview Warning: Treacherous Week Ahead

All three of the major central banks met last week and confirmed that monetary policy would continue to diverge for at least another year. The clarity of the trajectory of monetary policy reduces the impact of high-frequency economic data.

Read More »

Read More »

FX Weekly Preview: Busy Week Ahead

The week ahead is eventful. The Federal Reserve, the European Central Bank, and the Bank of Japan hold policy meetings. This would make for a busy week by themselves, but there is more. Trade tensions are likely to escalate further, if the US, as scheduled provides a list of $50 bln of Chinese goods that will face another 25% tariff for intellectual property violations.

Read More »

Read More »