Tag Archive: Thomas Jordan

‘Much too early’ to lift interest rates, says SNB chairman

The continued volatility surrounding the Italian elections and the threat of global trade wars make it far too early for the Swiss National Bank (SNB) to consider raising rock bottom interest rates, says chairman Thomas Jordan.

Read More »

Read More »

SNB-Jordan verkündet Kommunistisches – und lädt zum Gratis-Buffet

Es geht um die Sache und Institution – nicht um eine Person. Die Schweizerische Nationalbank (SNB) und ihr Chef Thomas Jordan sind aber mittlerweile dermassen eng miteinander verflochten, dass eine getrennte Beurteilung gar nicht mehr möglich ist. Thomas Jordan ist zum Gesicht der SNB und diese eine „One-Man-Show“ geworden.

Read More »

Read More »

SNB Rejects Vollgeld and Questions ‘Reserves for All’

In the NZZ, Peter Fischer reports that SNB president Thomas Jordan rejects the Vollgeld initiative and stops short of endorsing the ‘reserves for all’ proposal.

Read More »

Read More »

UBS-Präsident Axel Weber wird sein blaues Wunder erleben – mit der Zahlungsunfähigkeit der SNB

Axel Weber hat zwei Seelen in seiner Brust: eine als Ex-Notenbanker, eine als UBS-Präsident. Als Präsident der Deutschen Bundesbank hatte der Deutsche Weber gesagt, es gäbe keine Einlösungsverpflichtung der Deutschen Bundesbank für eine Banknote. „Wirtschaftlich gesehen sind unsere Banknoten eine Verbindlichkeit des Eurosystems.

Read More »

Read More »

UBS chairman warns of ‘bitcoin bubble’

Axel Weber, the board chairman of big bank UBS, has warned of a possible Bitcoin currency crash. With increasing numbers of small investors jumping on the cryptocurrency bandwagon, it is time for regulators to intervene, he says. Bitcoin has surged from $1,000 (CHF9,900) at the start of the year to above $16,000.

Read More »

Read More »

Zuerst verdirbt die SNB unsere Jugend mit Irrlehren, dann lässt sie sie fallen

„Und sie dreht sich doch“ murmelte Galileo Galilei, nachdem ihn die Inquisitoren gezwungen hatten, dem kopernikanischen Weltbild abzuschwören. Dieses widerlegte die damalige heliozentrische Astronomie: Die Sonne drehe sich nicht um die Erde, sondern umgekehrt: Die Erde dreht sich um die Sonne. Eine kopernikanische Wende erleben wir zurzeit in der Geldtheorie: Die Volkswirtschaften drehen sich nicht um die Zentralbanken. Umgekehrt: Die Zentralbanken...

Read More »

Read More »

Switzerland at IMF and World Bank 2017 Spring Meetings in Washington, D.C.

Federal Councillor Ueli Maurer as Head of the Swiss delegation, Federal Councillor Johann N. Schneider-Ammann and Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank, will take part in the joint Spring Meetings of the International Monetary Fund (IMF) and the World Bank Group in Washington, D.C., from 21 to 23 April 2017. Prior to these meetings, Federal Councillor Ueli Maurer will represent Switzerland at the meeting of G20...

Read More »

Read More »

Wie die SNB durch Kapitalsteuern die Schweizer Wirtschaft belastet

Vor dem Hintergrund eines angeblich „schwachen Wirtschaftswachstums“ rechtfertigte SNB-Chef Thomas Jordan neulich in einem Interview in der Tagespresse die SNB-Negativzinsen und bezeichnete diese als „expansiv“. Nur: Sind Negativzinsen wirklich „expansiv“? Sind diese nicht viel eher „restriktiv“ und bremsen unsere Wirtschaft – bewirken also genau das Gegenteil von dem, was die SNB behauptet?

Read More »

Read More »

Swiss banks taking more risks to compensate for record-low interest rates

Swiss banks focused on property lending are taking more risks to compensate for the impact of record-low interest rates, increasing the threat of a real-estate bubble, Swiss National Bank Vice President Fritz Zurbruegg said.

Read More »

Read More »

Swiss central bank can cut rates further if needed, says bank president Jordan

The Swiss National Bank can cut interest rates further into negative territory if needed, President Thomas Jordan said. “We have still some room to go further if necessary,” Jordan said Saturday in an interview in Washington with Bloomberg Television’s Francine Lacqua. Jordan, who is attending the annual meetings of the International Monetary Fund and the World Bank, noted that the bank has already pushed rates quite far.

Read More »

Read More »

Swiss central bank keeps rates on hold as Brexit fallout clouds outlook

The post contains the main-stream view on the Swiss National Bank. It is the "continued intervention pledge". But seven years post the financial we are in the second part of the business cycle. In the second part, the SNB must fear rising inflation more than the ECB. For us, Brexit has not influenced the main driver of global GDP growth, U.S. or European consumers.

Read More »

Read More »

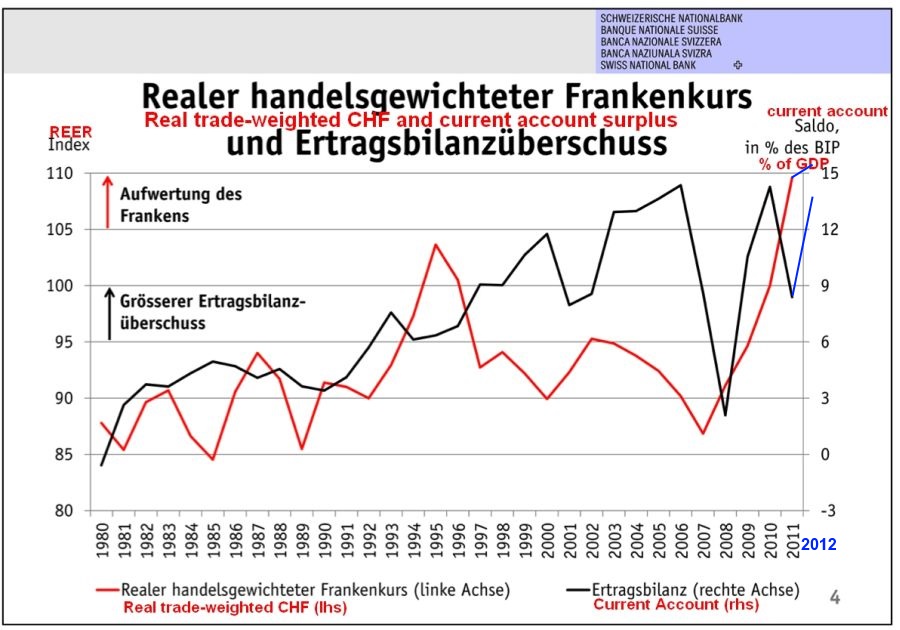

Why Switzerland’s franc is still strong in four charts

Swiss National Bank President Thomas Jordan keeps saying the franc is “significantly overvalued.” And that’s despite the central bank’s record-low deposit rate and occasional currency market interventions.

Read More »

Read More »

Swiss National Bank’s U.S. equity holdings hit record $61.8 billion last quarter

The value of the Swiss National Bank’s U.S. stock portfolio jumped to a record in June, helped by equity market gains. The holdings climbed to $61.8 billion from $54.5 billion at the end of March, according to calculations by Bloomberg based on the central bank’s regulatory filing to the U.S. Securities and Exchange Commission and published on Wednesday.

Read More »

Read More »

Jordan’s “Does the SNB need equity?”, an assault on the Swiss constitution?

Marc Meyer argues that the Swiss National Bank must build up reserves, but this does not mean "foreign exchange reserves", but "Swiss Franc reserves". According to the constitution these reserves are owners' equity denominated in Swiss Franc and some gold. Thomas Jordan famous paper "Does the SNB need equity?" tries to overturn the constitution suggesting that the constitution accepts FX investments as "reserves".

Russia builds up foreign...

Read More »

Read More »

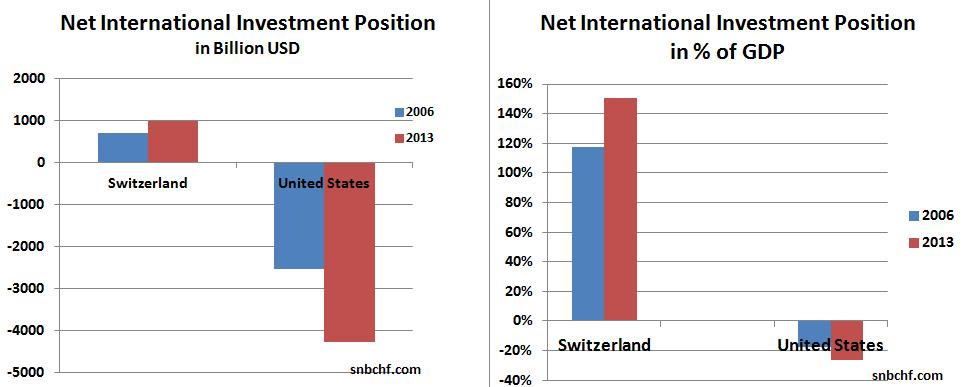

Ex-Post FX Evaluation: Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?

(post written originally in March 2013)

We reckon that the Swiss National Bank (SNB) will have issues maintaining the EUR/CHF floor in the longer term, because the expected yields on Swiss investments abroad will not be sufficiently higher than the yield on investments in Switzerland. Because of this insufficient risk-reward relationship, outflows in the capital account of the Swiss balance of payments will not cover the persistent Swiss current...

Read More »

Read More »

Swiss Current Account Surplus Rises from 8.5 percent to 13.5 percent of GDP

According to latest IMF data the Swiss current account surplus rose from 49 billion CHF in 2011 to 80 billion in 2012, this is from 8.5% of GDP to 13.5%. Details

Read More »

Read More »

SNB Monetary Policy Assessment December 2012: (Nearly) Full Text

The SNB decided to maintain the floor at 1.20 and the Libor target between 0% and 0.25%. As we expected in our outlook on the assessment, there were still important downwards drivers of inflation after the strong appreciation of the franc. Therefore, the SNB has moved its inflation expectations downwards for 2013 to minus 0.1% …

Read More »

Read More »

Jordan: Dropping Peg Is Premature

The Swiss National Bank's cap on the franc of 1.20 per euro remains the right policy tool for now and talk of dropping it is premature, Chairman Thomas Jordan said. See Reuters

Read More »

Read More »

The Swiss television interview with Thomas Jordan, or was it Leonid Brezhnev ?

Today Thomas Jordan gave a quick interview in the Swiss television. Everything was so well prepared and as sterilized. Thomas Jordan learned all answers by heart and was answered the questions about one second after the question was asked. It reminded me of an interview in Soviet television with former Soviet leader Leonid Brezhnev. Each …

Read More »

Read More »