Tag Archive: Thomas Jordan

Prof. Dr. Thomas Jordan – Die Geldpolitik der SNB in Zeiten der Inflation

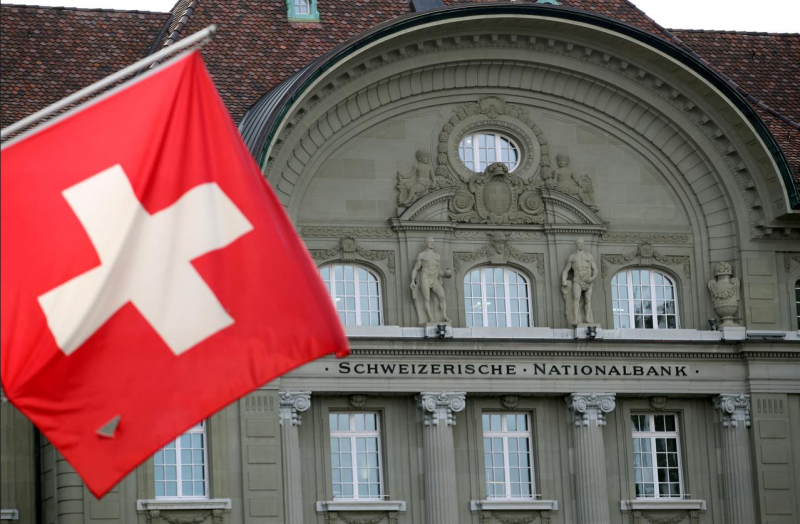

Für die Schweizerische Nationalbank (SNB) sind zwei ordnungspolitische Prinzipien von grosser Bedeutung: Die Unabhängigkeit von der Politik und ein Mandat, das sich auf die Gewährleistung der Preisstabilität konzentriert.

Read More »

Read More »

Swiss National Bank Crime Syndicate THOMAS JORDAN – GOLDFINGER – MARTIN SCHLEGEL FBI Scotland Yard

MAINSTREAM NEWS MEDIA EXTRACTS: I

British Royal Family well seasoned commentators are known to have remarked that the genesis of the Gerald 6th Duke of Sutherland identity theft case lies in the forging of the birth certificate which effectively brought about a wide cadre of public figures who took advantage following the death of his mother and father respectively HRH The Princess Marina Duchess of Kent and George 5th Duke of Sutherland later...

Read More »

Read More »

Macro Week 2022: Thomas Jordan

At this critical juncture for the global economy and monetary policy, the Peterson Institute for International Economics is convening central bankers and finance officials from around the world for our annual Macro Week—a series of speeches and onstage discussions moderated by PIIE President Adam S. Posen.

Thomas Jordan (Chairman, Swiss National Bank) speaks on April 19, 2022.

For more information, visit:...

Read More »

Read More »

Macro Week 2022: Thomas Jordan

At this critical juncture for the global economy and monetary policy, the Peterson Institute for International Economics is convening central bankers and finance officials from around the world for our annual Macro Week—a series of speeches and onstage discussions moderated by PIIE President Adam S. Posen.

Read More »

Read More »

„Jetzt hilft uns, dass Thomas Jordan ein Falke ist“

Der SNB-Chef wurde wegen seiner harten Anti-Inflations-Haltung gescholten, sagt Fabio Canetg, Journalist mit "Geldcast"-Sendung. Nun profitiere die Schweiz davon, weil hier die Preise mit plus 2 Prozent im Vergleich zum Euro-Raum und den USA moderat stiegen. Das wiederum ziehe Vermögen aus dem Ausland an, was den Franken stärke und die Inflation zusätzlich dämpfe.

Read More »

Read More »

Economic cost of pandemic will be enormous: SNB chief

Coronavirus is costing between CHF11 billion and CHF17 billion a month, putting such a strain on the Swiss economy that it will take years to recover. Swiss National Bank (SNB) chairman Thomas Jordan has predicted the worst depression since the 1930s.

Read More »

Read More »

Geldpolitik – Coronavirus-Krise: Zentralbanken starten Notaktion gegen Liquiditätsengpass

Die EZB, die US-Notenbank, die kanadische Notenbank, die Bank von England, Japans Notenbank und die Schweizerische Nationalbank wollen dazu bestehende US-Dollar-Devisentauschabkommen nutzen, wie auch die SNB am späten Sonntagabend ankündigte.

Read More »

Read More »

Wdh Devisen: Euro fällt nach EZB zu Dollar und Franken

Auch zum Franken schwächte sich die Einheitswährung ab und notierte zuletzt bei 1,0707 nach 1,0733 am Morgen. Das Währungspaar USD/CHF stieg auf 0,9699 von 0,9684 Franken. SNB-Chef Thomas Jordan hatte einmal mehr seine Position zu Negativzinsen wiederholt. Diese seien in der Schweiz eine Notwendigkeit, sagte er in einem Interview mit CNBC am Rande des Weltwirtschaftsforums in Davos.

Read More »

Read More »

Devisen: Euro bewegt sich kaum – Warten auf EZB-Entscheidungen

Auch zum Franken waren die Veränderungen zuletzt gering. Das Währungspaar EUR/CHF notierte am Mittag bei 1,0745 (Morgen: 1,0733), bei USD/CHF waren es 0,9685 (0,9684). SNB-Chef Thomas Jordan wiederholte derweil einmal mehr seine Position zu Negativzinsen. Diese seien in der Schweiz eine Notwendigkeit, sagte er in einem Interview mit CNBC am Rande des Weltwirtschaftsforums in Davos.

Read More »

Read More »

Nationalbank ist vom Nutzen der Negativzinsen überzeugt

Die SNB hält am negativen Leitzins von −0,75% unverändert fest.Die Schweizerische Nationalbank (SNB) belässt den Leitzins und den Zins auf Sichtguthaben bei der SNB unverändert bei -0,75%, wie sie an ihrer geldpolitischen Lagebeurteilung am Donnerstag mitteilte. Sie ist weiterhin bereit, bei Bedarf am Devisenmarkt zu intervenieren und berücksichtigt dabei die gesamte Währungssituation.

Read More »

Read More »

SNB’s Jordan: Swiss franc remains highly valued

Foreign exchange market remains fragile. Negative rates, readiness for intervention still necessary. Danger of a worsening international situation remains large. Imbalances in Swiss real estate market still persist.

Read More »

Read More »

Negative rates might go lower, says Swiss National Bank chairman

Thomas Jordan, chairman of the Swiss National Bank (SNB), told the NZZ am Sonntag newspaper recently that central bank interest rates might need to go further into negative territory. Responding to growing criticism of negative central bank interest rates, Jordan said negative interest rates could continue and a further reduction is possible.

Read More »

Read More »

UBS: “Negative interest rates harm Swiss economy”

A survey of Swiss companies commissioned by UBS bank concludes that negative interest rates are harming the wider economy. Switzerland’s largest bank, UBS, asked 2,500 companies about the impact of negative interest rates. “Nearly two-thirds of respondents said that the cost…for the economy outweighed their benefits overall,” UBS said in a press releaseexternal link on Thursday.

Read More »

Read More »

SNB’s Jordan: Without negative rates, CHF would be more attractive and rise in value

In his prepared remarks delivered to pension managers on Thursday, Swiss National Bank Chairman Thomas Jordan said negative interest rates and readiness to intervene in the forex market was still essential to ease the pressure on the Swiss Franc.

Read More »

Read More »

Nationalbank und SIX kooperieren bei digitalem Zentralbankgeld

Im Kontext des neu gegründeten BIZ-Innovation-Hub-Zentrum in der Schweiz kooperieren die SNB und SIX bei einer Machbarkeitsstudie für digitales Zentralbankgeld. (Bild: Pixabay)Die Schweizerische Nationalbank (SNB) und die Bank für Internationalen Zahlungsausgleich (BIZ) haben am Dienstag eine operative Vereinbarung zum BIZ-Innovation-Hub-Zentrum in der Schweiz unterzeichnet.

Read More »

Read More »

SNB and BIS sign Operational Agreement on BIS Innovation Hub Centre in Switzerland

The Swiss National Bank (SNB) and the Bank for International Settlements (BIS) have today signed an Operational Agreement on the BIS Innovation Hub Centre in Switzerland. The Hub will identify and develop in-depth insights into critical trends in technology affecting central banking, develop public goods in the technology space geared towards improving the functioning of the global financial system, and serve as a focal point for a network of...

Read More »

Read More »

SNB Jordan: Cannot say how long negative interest rates will last

SNBs Jordan on the wiresThe Swiss national banks Jordan is on the wires saying:He cannot say how long negative interest rates will lastNegative rates are necessary for nowInterest rate spreads like important role for exchange ratesThe USDCHF is trading higher today. It currently trades at 0.9861.

Read More »

Read More »

Nationalbank – SNB-Präsident Jordan: Libra könnte Geldpolitik gefährden

Die Schweizerische Nationalbank (SNB) misst Kryptowährungen wie Bitcoin wenig Potenzial zu. Die Chancen darauf, als Zahlungsmittel akzeptiert zu werden, sind aus Sicht der Zentralbank gering. Kryptowährungen hätten "eher den Charakter von spekulativen Anlageinstrumenten als von 'gutem' Geld", sagte der SNB-Präsident in einer Rede an der Universität Basel.

Read More »

Read More »

Die SNB-Zeitbombe tickt, die NZZ nickt

„Die Devisenreserve der SNB sind keine Zeitbombe, die uns einmal um die Ohren fliegt, sondern eine Art Volksvermögen“. Das behauptet die SNB-freundliche NZZ am Sonntag. Das Blatt bedient ein SNB-Klischee nach dem anderen und hat den Ernst der Lage unserer Schweizerischen Nationalbank (SNB) offensichtlich nicht begriffen.

Read More »

Read More »

Federal Council appoints Martin Schlegel as new Alternate Member of the SNB Governing Board

At its meeting of 4 July 2018, the Federal Council appointed Martin Schlegel as the new Alternate Member of the Governing Board of the Swiss National Bank (SNB), following the proposal of the SNB’s Bank Council. He will take up the position of Deputy Head of Department I as of 1 September.

Read More »

Read More »