Tag Archive: The Stock Market

Did You Make Janet Yellen Rich?

The Stress of Losing Billions. Up until the WallStreetBets crowd short squeezed Melvin Capital for a $7 billion loss, Robinhood had it made. But losing billions is stressful. And when your product blows up your customer the clucking that follows comes hot and heavy.

Read More »

Read More »

The Secret to Fun and Easy Stock Market Riches

Post Hoc Fallacy. On Tuesday, at the precise moment Federal Reserve Chairman Jay Powell commenced delivering his semiannual monetary policy report to the House Financial Services Committee, something unpleasant happened. The Dow Jones Industrial Average (DJIA) didn’t go up. Rather, it went down.

Read More »

Read More »

A Pharmaceutical Stock That Is Often Particularly Strong At This Time Of The Year

An Example of Strong Single Stock Seasonality. Many individual stocks exhibits phases of seasonal strength. Being invested in these phases is therefore an especially promising strategy. Danish drug company Novo Nordisk.

Read More »

Read More »

Riding the Type 3 Mega Market Melt Up Train

Beta-driven Fantasy. The decade long bull market run, aside from making everyone ridiculously rich, has opened up a new array of competencies. The proliferation of ETFs, for instance, has precipitated a heyday for the ETF Analyst. So, too, blind faith in data has prompted the rise of Psychic Quants… who see the future by modeling the past.

Read More »

Read More »

The Golden Autumn Season – One of the Most Reliable Seasonal Patterns Begins

The Strongest Seasonal Stock Market Trend. Readers may already have guessed: when the vibrant colors of the autumn leaves are revealed in all their splendor, the strongest seasonal period of the year begins in the stock market – namely the year-end rally. Stocks typically rise in this time period. However, there are questions, such as: how often does a rally take place, how strong is it, and when is the best time for investors to enter the market?

Read More »

Read More »

Scientific Long-Term Study Confirms: Seasonality is the Best Investment Strategy!

A Pleasant Surprise. You can probably imagine that I am convinced of the merits of seasonality. However, even I was surprised that an investment strategy based on seasonality is apparently leaving numerous far more popular strategies in the dust. And yet, this is exactly what a recent comprehensive scientific study asserts – a study that probably considers a longer time span than most: it examines up to 217 years of market history!

Read More »

Read More »

Watch Europe – Free Pass for the Elliott Wave European Financial Forecast

Europe at an Important Juncture. European economic fundamentals have deteriorated rather noticeably over the past year – essentially ever since the German DAX Index topped out in January 2018. Now, European stock markets have reached an important juncture from a technical perspective.

Read More »

Read More »

The Bear Market Hook

Has a Bear Market in Stocks Begun? The stock market correction into late December was of approximately the same size as the mid 2015/early 2016 twin downturns, so this is not an idle question. Moreover, many bears seem quite confident lately from an anecdotal perspective, which may invite a continuation of the recent upward correction.

Read More »

Read More »

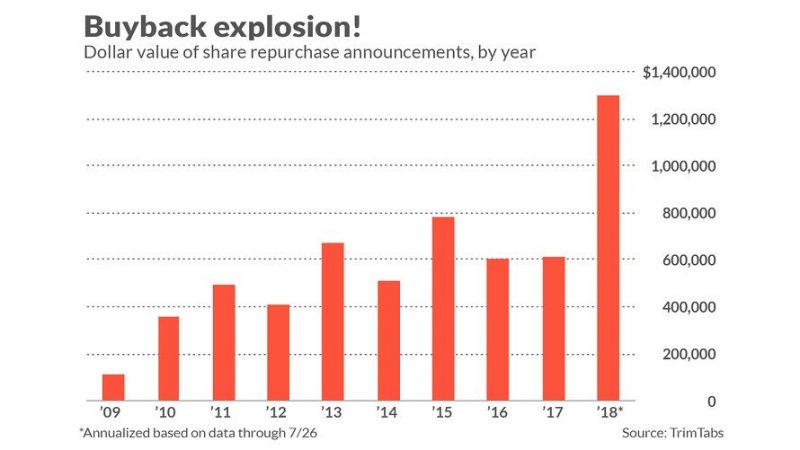

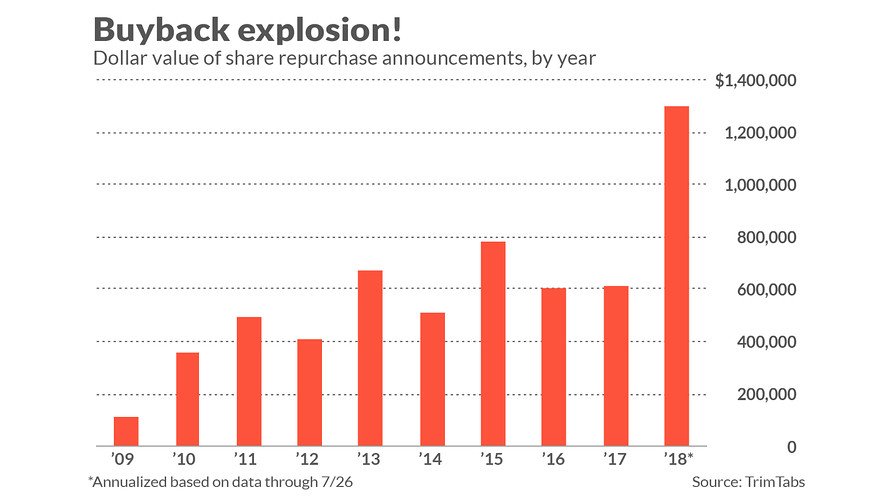

The Intolerable Scourge of Fake Capitalism

All is now bustle and hubbub in the late months of the year. This goes for the stock market too. If you recall, on September 22nd the S&P 500 hit an all-time high of 2,940. This was nearly 100 points above the prior high of 2,847, which was notched on January 26th. For a brief moment, it appeared the stock market had resumed its near decade long upward trend.

Read More »

Read More »

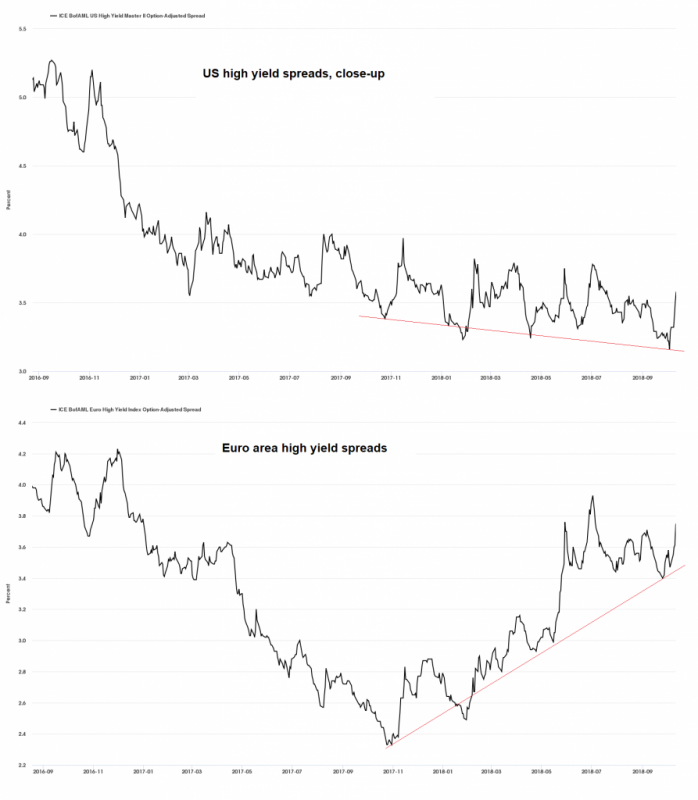

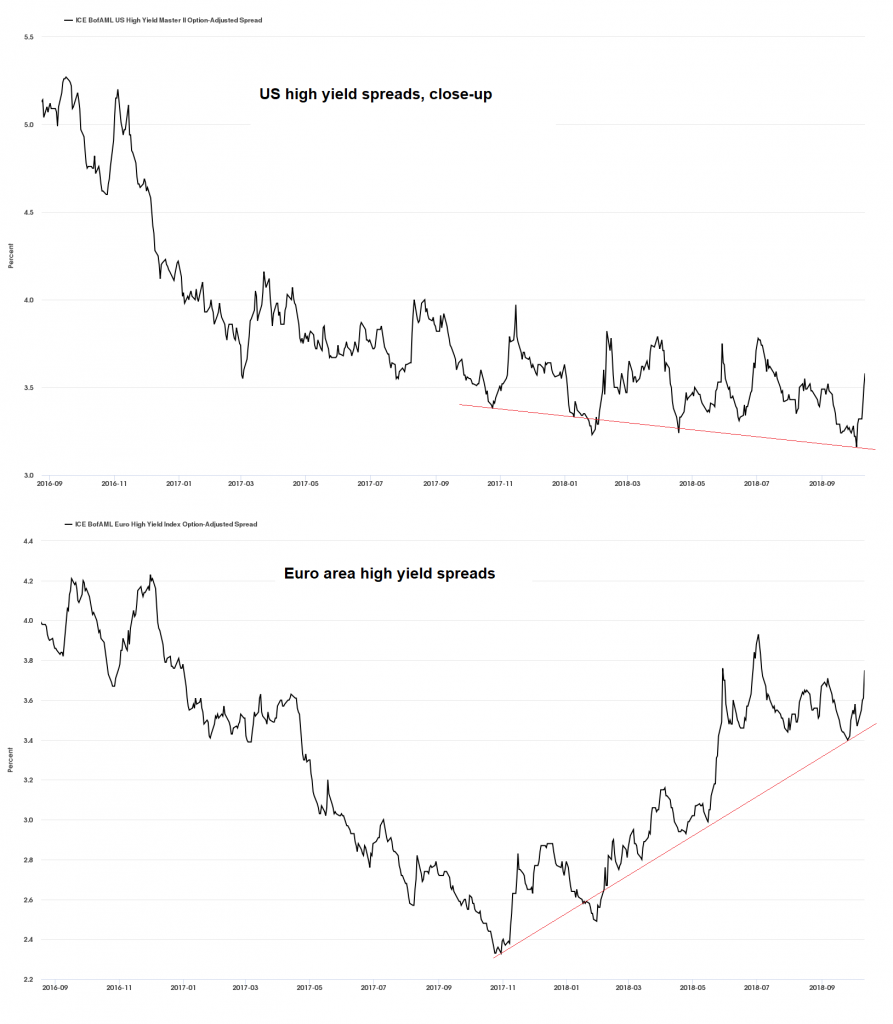

Are Credit Spreads Still a Leading Indicator for the Stock Market?

Seemingly out of the blue, equities suffered a few bad hair days recently. As regular readers know, we have long argued that one should expect corrections in the form of mini-crashes to strike with very little advance warning, due to issues related to market structure and the unique post “QE” environment.

Read More »

Read More »

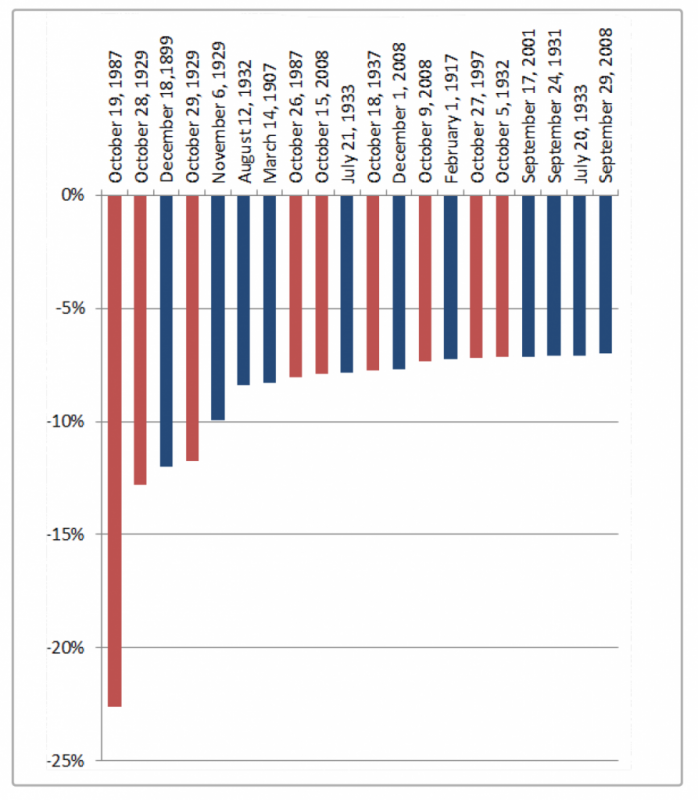

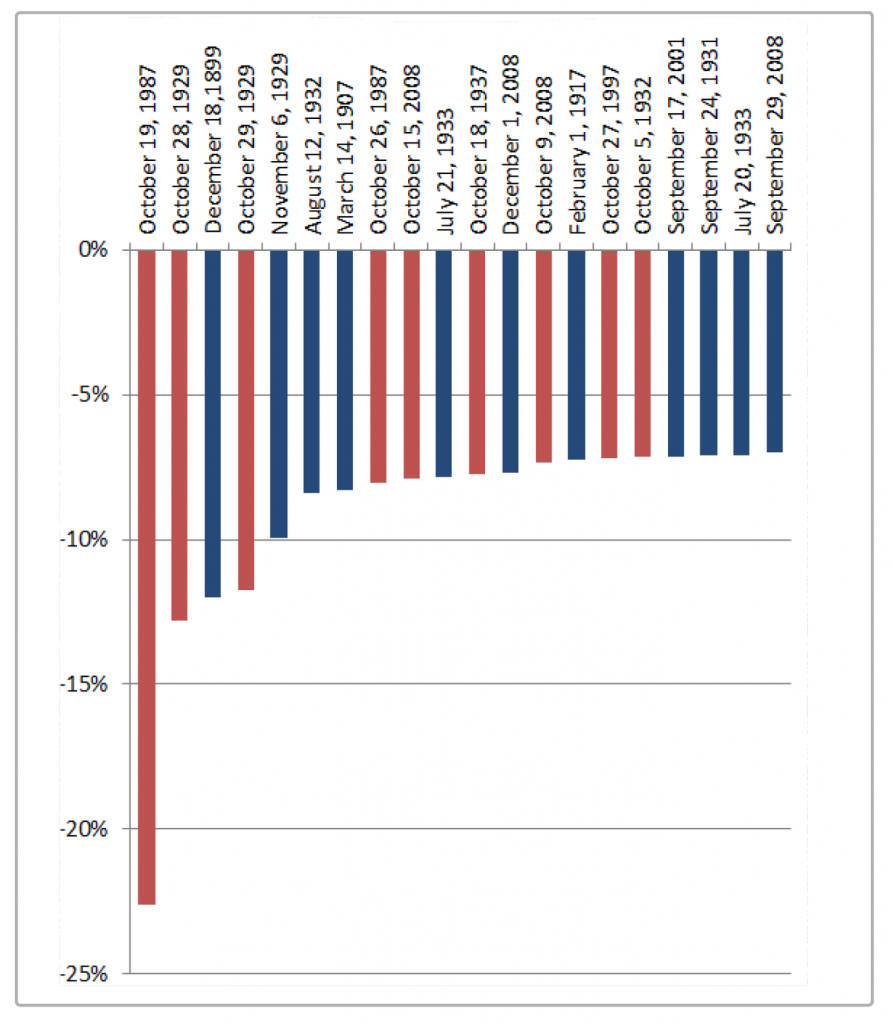

How Dangerous is the Month of October?

A Month with a Bad Reputation. A certain degree of nervousness tends to suffuse global financial markets when the month of October approaches. The memories of sharp slumps that happened in this month in the past – often wiping out the profits of an entire year in a single day – are apt to induce fear. However, if one disregards outliers such as 1987 or 2008, October generally delivers an acceptable performance.

Read More »

Read More »

US Stocks and Bonds Get Clocked in Tandem

At the time of writing, the stock market is recovering from a fairly steep (by recent standards) intraday sell-off. We have no idea where it will close, but we would argue that even a recovery into the close won’t alter the status of today’s action – it is a typical warning shot. Here is what makes the sell-off unique:

Read More »

Read More »

US Equities – Approaching an Inflection Point

A Lengthy Non-Confirmation. As we have frequently pointed out in recent months, since beginning to rise from the lows of the sharp but brief downturn after the late January blow-off high, the US stock market is bereft of uniformity. Instead, an uncommonly lengthy non-confirmation between the the strongest indexes and the broad market has been established.

Read More »

Read More »

Stock Market Manias of the Past vs the Echo Bubble

The Big Picture. The diverging performance of major US stock market indexes which has been in place since the late January peak in DJIA and SPX has become even more extreme in recent months. In terms of duration and extent it is one of the most pronounced such divergences in history.

Read More »

Read More »

“Sell In May And Go Away” – A Reminder: In 9 Out Of 11 Countries It Makes Sense To Do So

Most people are probably aware of the adage “sell in May and go away”. This popular seasonal Wall Street truism implies that the market’s performance is far worse in the six summer months than in the six winter months. Numerous studies have been undertaken in this context particularly with respect to US stock markets, and they confirm that the stock market on average exhibits relative weakness in the summer.

Read More »

Read More »

Global Turn-of-the-Month Effect – An Update

The “turn-of-the-month” effect is one of the most fascinating stock market phenomena. It describes the fact that price gains primarily tend to occur around the turn of the month. By contrast, the rest of the time around the middle of the month is typically far less profitable for investors. The effect has been studied extensively in the US market. In the last issue of Seasonal Insights I have shown a table detailing the extent of the...

Read More »

Read More »

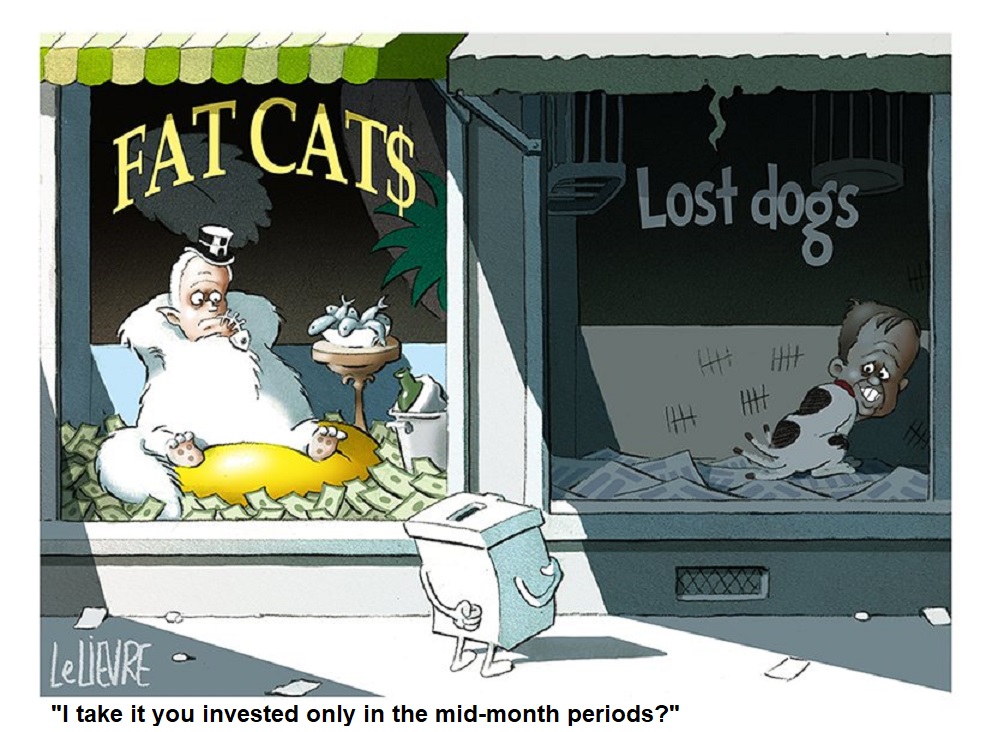

The “Turn of the Month Effect” Exists in 11 of 11 Countries

I already discussed the “turn-of-the-month effect” in a previous issues of Seasonal Insights, see e.g. this report from earlier this year. The term describes the fact that price gains in the stock market tend to cluster around the turn of the month. By contrast, the rest of the time around the middle of the month is typically less profitable for investors.

Read More »

Read More »