Tag Archive: Switzerland Money Supply

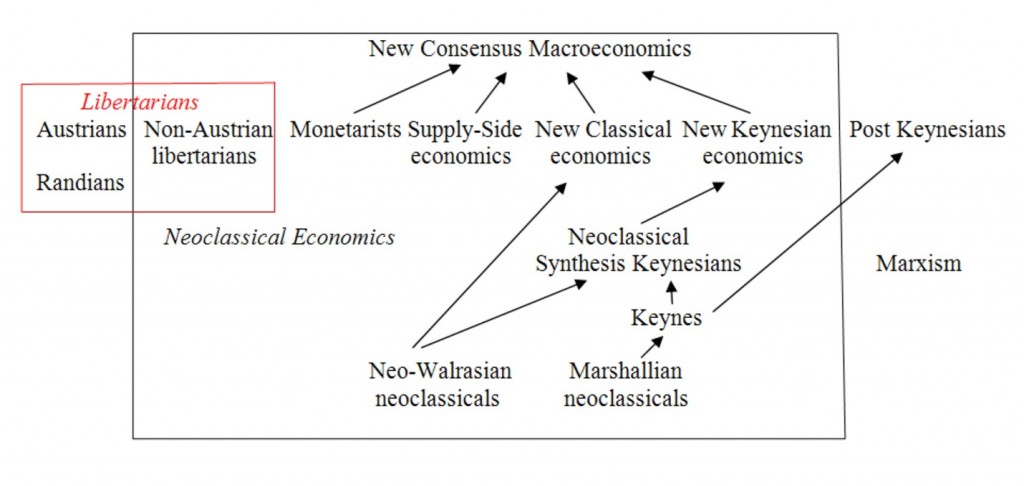

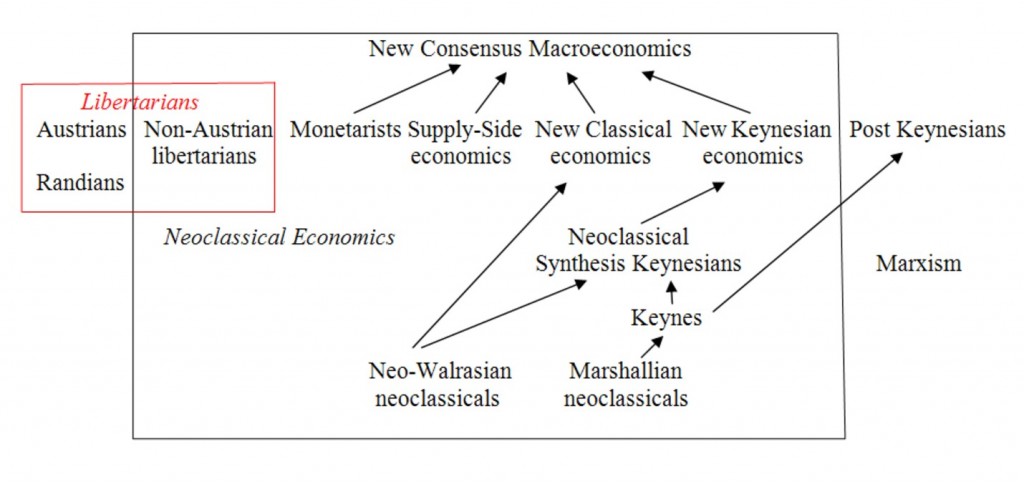

Libertarian and Austrian economic theory

Libertarian economic theories comprises Austrian economists and Free Market economists like Nozick, Narveson, Gathier, Caplan, Bryan Caplan, David Friedman and the Randian philosophy.

Read More »

Read More »

The Natural Rate of Interest/Taylor Rate

Central banks often want to follow two targets: low inflation and low unemployment. to achieve both criteria they look for a formula that incorporates both

Read More »

Read More »

Traditional Monetarist vs. Market Monetarists

Along the double mandate of the federal reserve, monetarists can be divided into. - traditional monetarists that focus on a slow increase of money supply in order to avoid price inflation. - Market monetarists that want to target growth and income instead of inflation.

Read More »

Read More »

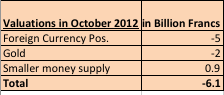

SNB Valuation Losses in October: Around 6 Billion Francs

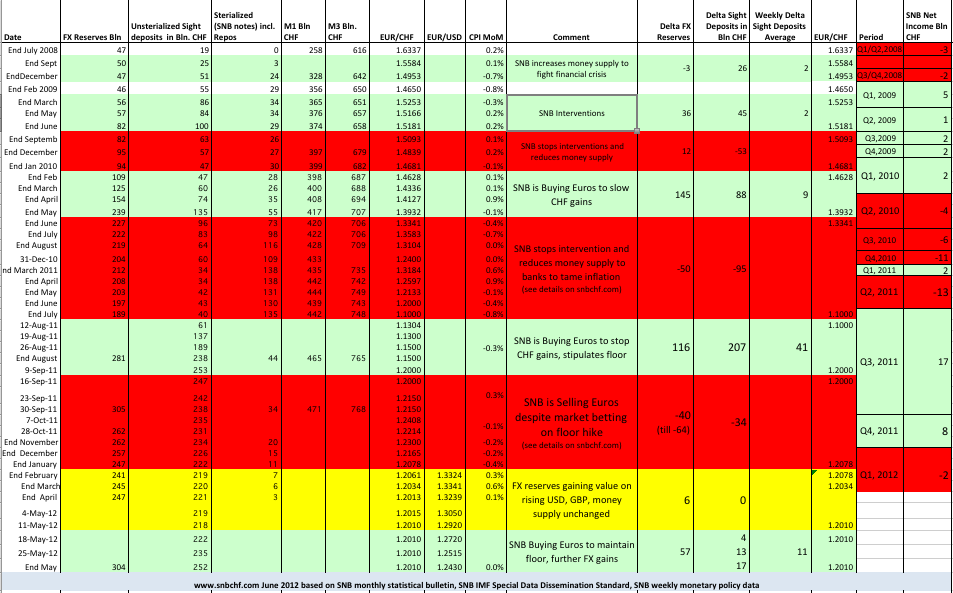

The Swiss National Bank (SNB) had valuation losses of around 6 billion francs in October due to the weaker EUR/CHF exchange rate and a weaker gold price.

Read More »

Read More »

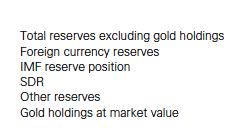

IMF Data: SNB Forex Reserves and Gold in September 2012

This link on the SNB website shows the data the central bank provides to the International Monetary Fund (IMF). It shows the SNB Forex and gold reserves in the last month. It is so-called “IMF Special Data Dissemination Standard (SNB Data)” It is released together with the international investment position, some monetary aggregates and the balance of payments two weeks after …

Read More »

Read More »

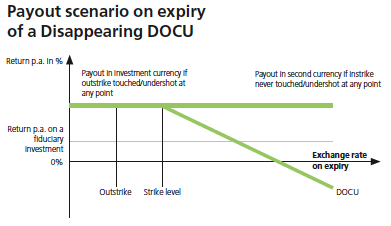

Isn’t it wonderful to trade with a strong central bank behind you?

Isn’t it wonderful to have a strong central bank like the SNB sitting behind you when trading Forex? Losses are limited to the floor of 1.20 and in the meantime you can gain forward swaps with the higher euro zone interest rates. Today the Swiss National Bank (SNB) decided in its monetary policy assessment …

Read More »

Read More »

The next SNB rumor: Wall Street Journal and our response

A bit breathlessly…. The next SNB rumor story comes from the so-well established Wall Street Journal, its columnist Nick Hastings. WSJ: The Swiss National Bank was bold before. And the central bank would be well advised to be just as bold again. When the SNB announced just over a year ago that it was setting a …

Read More »

Read More »

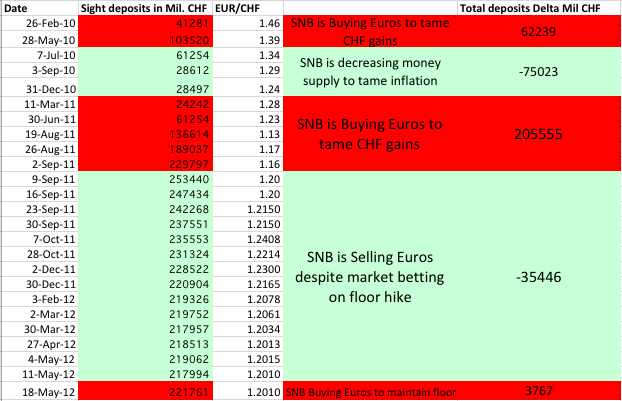

SNB prints nearly 5 billion francs in one week, FX traders poised to get ripped off

As we expected in our post “What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?“, long-time investors, global macro funds and US investment banks are moving into gold and the Swiss franc again. The SNB had to buy euros and print new Swiss francs of around 5 billion francs last week, as … Continue reading »

Read More »

Read More »

What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?

On Friday there was a big movement in the EUR/CHF. First it went up to 1.2154, fell later down to 1.2080 in the main American trading and rose again to 1.21 in the low-volume trading time. We repeat our entry from Friday, because we continuously updated the post after new developments, e.g. after the … Continue reading »

Read More »

Read More »

SNB only major central bank missing at Jackson Hole, are important SNB decisions looming ?

The Jackson Hole Symposium is traditionally a meeting of global central bankers, here the 2010 attendance list. This year it takes place between August 30 and September 1. Central bankers assemble The annual economic symposium for central bankers staged by the Federal Reserve Bank of Kansas City begins in Jackson Hole, Colorado (until September 1). …

Read More »

Read More »

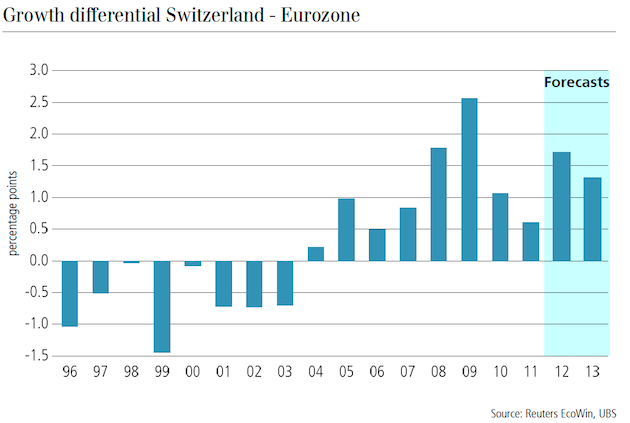

The win of the pro-bailout parties in the Greek elections was no win for the SNB

The win for the pro-bailout parties in the Greek elections was no win for the Swiss National Bank (SNB), even if the fear of an immediate bank-run and extreme money flows into Switzerland are avoided. Also the fact that QE3 is not coming in the next weeks did not help the SNB.

Read More »

Read More »

Another week, another 14 bln. francs printed

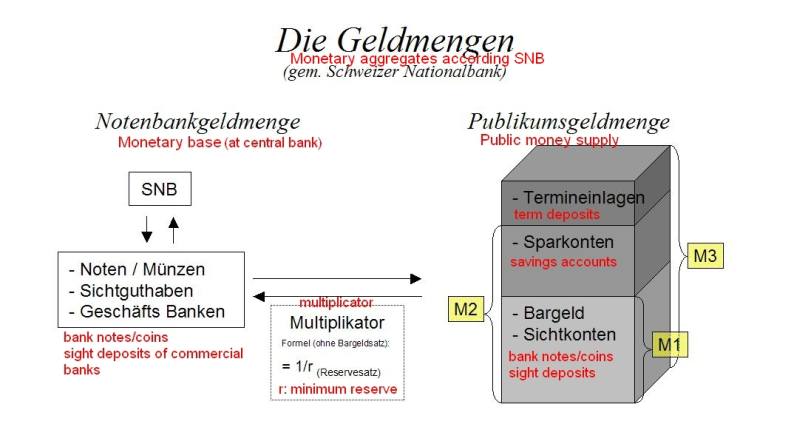

According to the newest monetary data, in the week ending June 8th, the unsterialized money supply (as measured in sight deposits of domestic and foreign banks and deposits by the Swiss confederation) increased by 14 billion Swiss francs.

Read More »

Read More »

A central bank running suicide ? SNB prints at pace never seen since EUR/CHF parity in August 2011

The most recent money supply data from the Swiss National Bank (SNB) has shown increases of huge amounts. As compared with its loss of 19 bln. francs in 2010 (3% percent of the Swiss GDP), the central bank printed tremendous 17.3 bln. in the week ending in June 1st and 13 bln. in the one …

Read More »

Read More »

CNBC rumors: Different peg methods for the SNB

There are currently rumors going on on CNBC that the SNB is planning something this night. As we explained here, the SNB had to strongly restart the printing press and printed tremendous 13 bln francs in one week. Moreover, they probably sold some of their in Q4 2011 and Q1 2012 acquired GBP, JYP and …

Read More »

Read More »

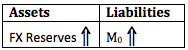

Huge rise in Currency Reserves: The SNB has restarted the printing press

The game for the Swiss National Bank seems to have changed completely. Again the central bank had increase money supply, as measured by deposits at the SNB by local banks and other sight deposits, this time even by 13219 mil. francs (source). This money printing implies that the SNB had to buy in Euros in …

Read More »

Read More »

SNB’s Jordan admits that EUR/CHF floor will not be raised

For the first time the chairman of the Swiss National Bank Jordan has admitted that the EUR/CHF floor of 1.20 will not be raised. In an interview with the Swiss Sonntagszeitung, here also cited by Bloomberg, he said:

Read More »

Read More »

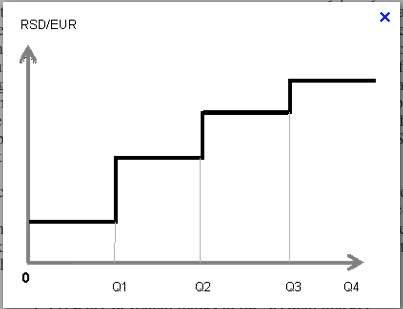

Will the SNB double or triple the forex reserves before they give in ?

Some economists have claimed that the Swiss National Bank (SNB) will be always able to maintain the floor. As opposed to George Soros’ defeat of the Bank of England, the SNB is able to print money ad infinitum, whereas the BoE had limited currency reserves to support sterling. The question, however, is where this “infinitum” …

Read More »

Read More »