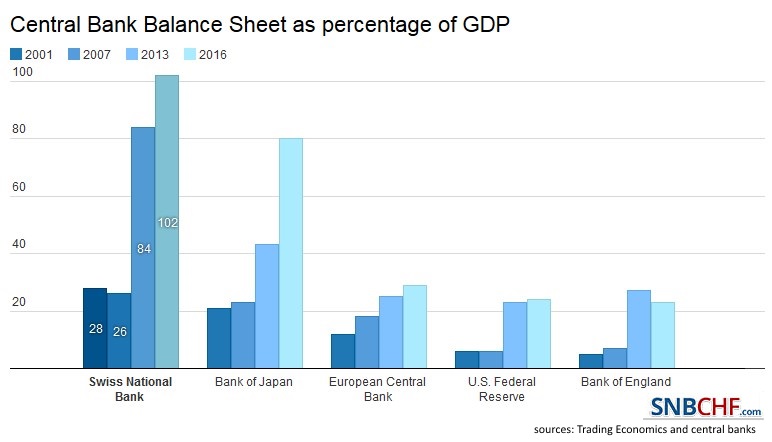

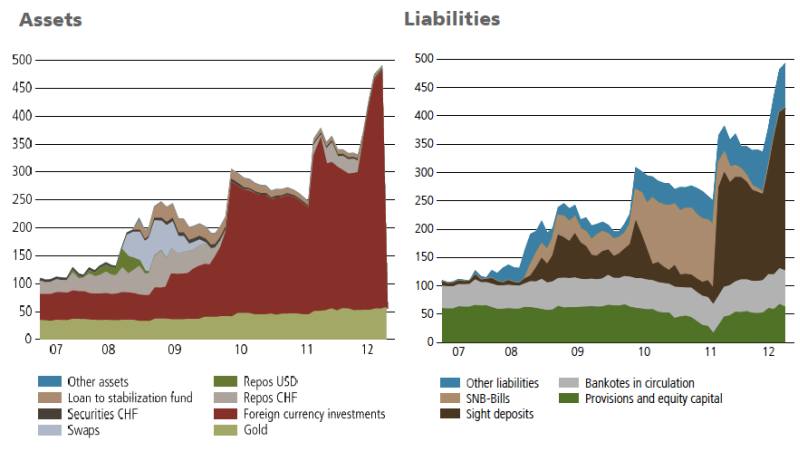

Since 2008 the balance sheet of the Swiss National Bank has risen from 28% to 102% of Swiss GDP. Balance sheets of other central banks have strongly risen, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Tag Archive: Switzerland Money Supply

Greenspan explains negative Swiss Yields

For Alan Greenspan, negative Yield Reflect Spread between Italian and Swiss Bonds. For him, bond prices in general have risen too much.

Read More »

Read More »

Should the Gold Price Keep Up with Inflation?

The popular belief is that gold is a good hedge against inflation. Owning gold will protect you from rising prices. Is that true?

Read More »

Read More »

The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers.

Read More »

Read More »

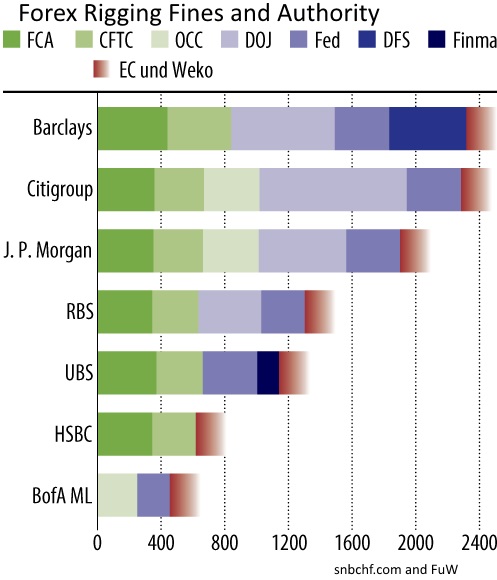

The SNB and the Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it's economic data. That's because the vast majority do...

Read More »

Read More »

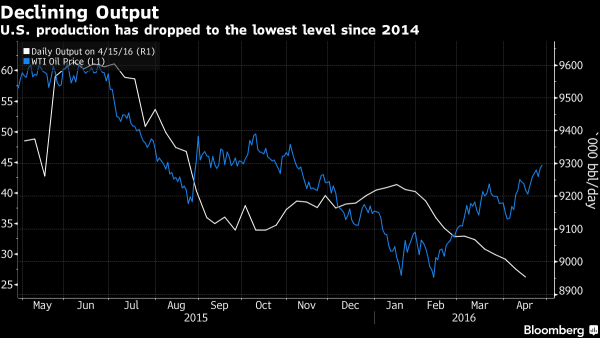

Global Risk Off: China Reenters Bear Market, Oil Tumbles Under $30; Global Stocks, US Futures Gutted

"We're gonna need a bigger Bullard"

- overheard on a trading desk this morning.

Yesterday, when looking at the market's "Bullard 2.0" moment, which was a carbon copy of the market's kneejerk surge higher response to Bullard's "QE4" comments fr...

Read More »

Read More »

Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view:

1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present...

Read More »

Read More »

SNB’s IMF data

This IMF data on the SNB website shows SNB Forex and gold reserves in the last month. It is so-called "IMF Special Data Dissemination Standard (SNB Data)"

Read More »

Read More »

Goethe Predicted Dollar Slavery

In 1809 Goethe wrote "None are more hopelessly enslaved than those who falsely believe they are free." According to Keith Weiner, this is today's status of American workers, stuck with debt and the losing value of the dollar.

Read More »

Read More »

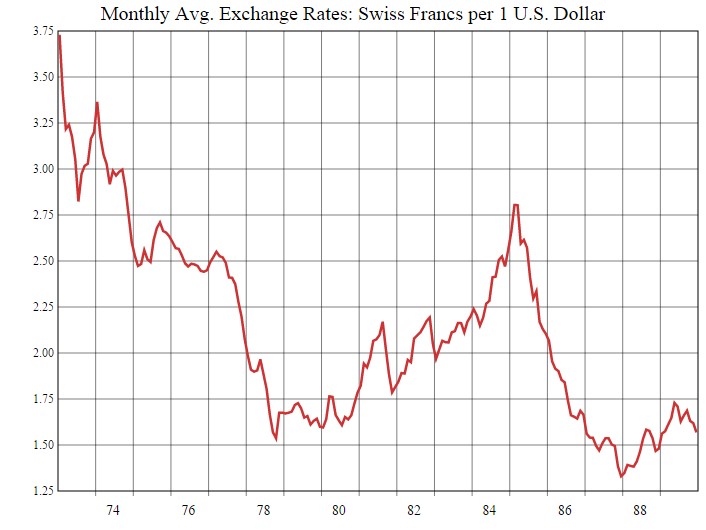

Keith Weiner: SNB Must Keep Euro over 1.20 To Avoid Losses of Swiss Banks

The recognized Austrian economist Keith Weiner and the Wall Street Journal argue that the SNB must keep the euro over 1.20 in order maintain stability in the Swiss banking system. A rapid appreciation of the franc would create losses on the balance sheet of Swiss banks.

Read More »

Read More »

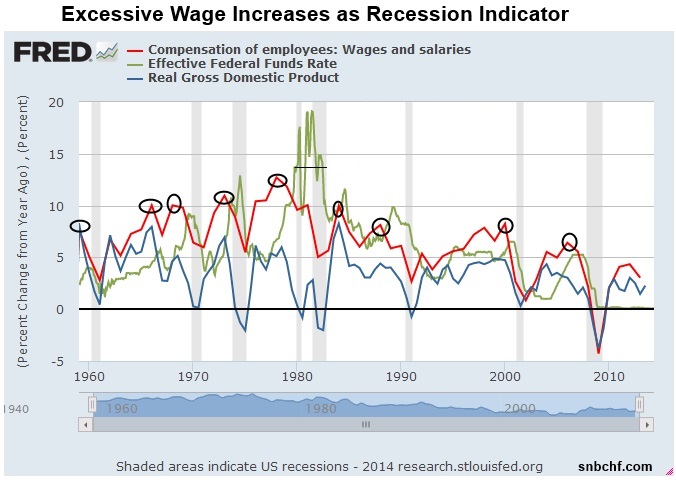

A Little History of Wages, Inflation, Treasuries and the Fed – And What We Learn from it

On this page we show that

Inflation expectations and wages drive the behaviour of the Fed and Treasury bond yields.

Excessive wage increases lead to recessions, more or less voluntarily caused by central bank tightening

Central banks pin down the short end of the yield curve, while financial-market participants price longer-dated yields

Some Emerging Markets seem to copy strong wage increases and inflation that we lived in the 1970s

Quickly...

Read More »

Read More »

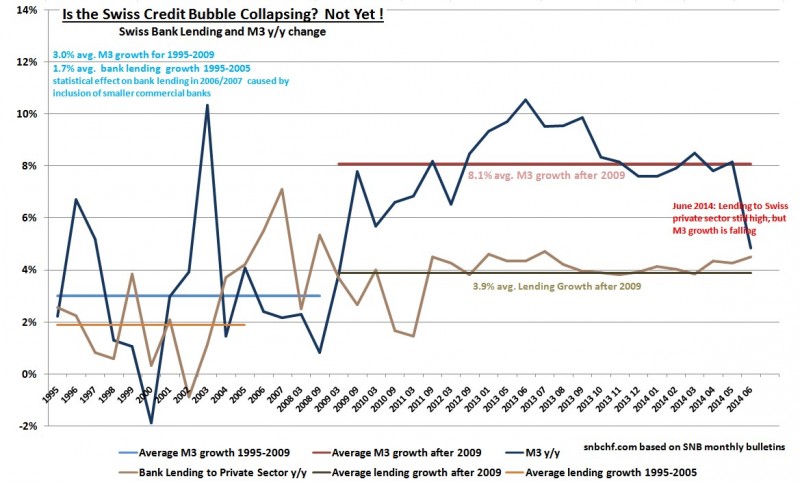

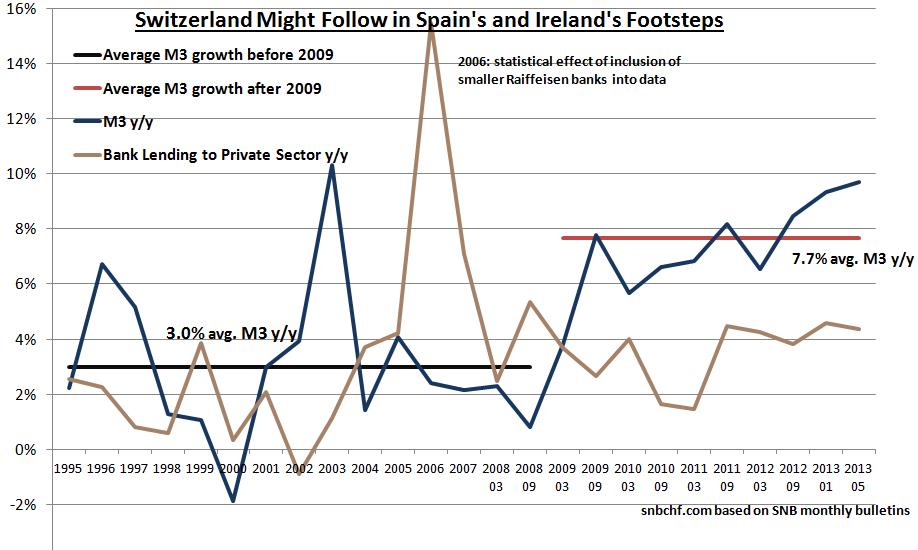

2014: Swiss Credit Bubble Popping? No, Lending to the Swiss Private Sector is even Accelerating!

Despite macro-prudential measures like the countercyclical capital buffer, Swiss credit to the private sector is rising more quickly than previously. On the other side, real estate prices are not increasing so rapidly any more. Global risks let M3 money supply growth slow in June 2014.

Read More »

Read More »

Pros and Cons of the Swiss Countercyclical Capital Buffer

Switzerland is currently living in a big real estate boom. The bubble bursting would imply that banks' collateral in the form of real estate falls in value. Therefore the banks' assets might fall because many home buyers might not be able to repay their mortgage. If a real estate bubble pops, then banks should be better capitalized to absorb such a shock. Therefore the Swiss National Bank introduced macro-prudential measures, like the so-called...

Read More »

Read More »

SNB Balance Sheet Expansion

Since 2008 the balance sheet of the Swiss National Bank is 280% higher, this is the equivalent of 60% of Swiss GDP. So did most other central banks, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

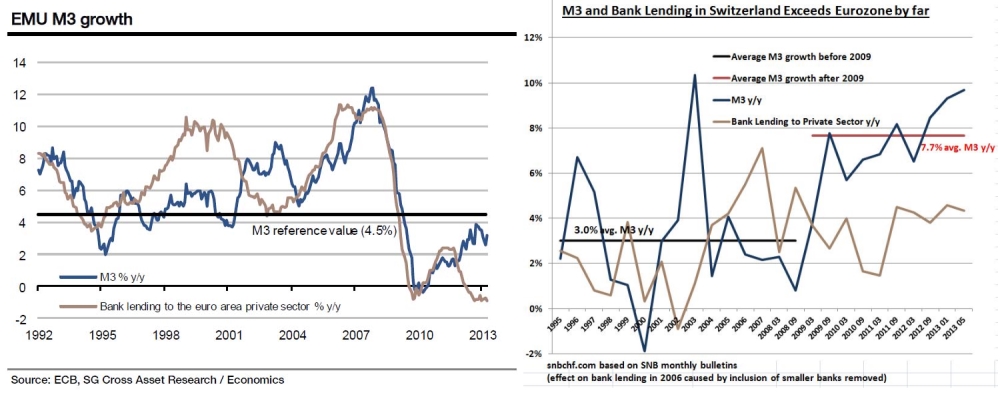

Excessive Money Supply: Switzerland Could Follow in Spain’s and Ireland’s Footsteps

In the Euro zone bank lending is contracting, M3 is rising very slowly. As opposed to that, Swiss bank lending is currently rising by 4.4% per year, M3 is increasing by 10% per year.

Read More »

Read More »

SNB Sight Deposits: Only Slight Increase of 370 Million Francs despite Cyprus

The SNB published the weekly monetary data for the week of the "Cyprus crisis": SNB sight deposits are slightly up 400 million francs, mostly due to local banks. Details

Read More »

Read More »

In Week Before Cyprus SNB Sight Deposits Rise Slightly by 250 Million Francs

The SNB published the weekly monetary data for the week before the Cyprus event: SNB sight deposits are slightly up 250 million francs, mostly due to other sight deposits (companies, the Swiss confederation, foreign banks) while local banks reduced their deposits slightly. Details

Read More »

Read More »