Tag Archive: Swiss economy

Surprise contraction in Swiss Q3 GDP

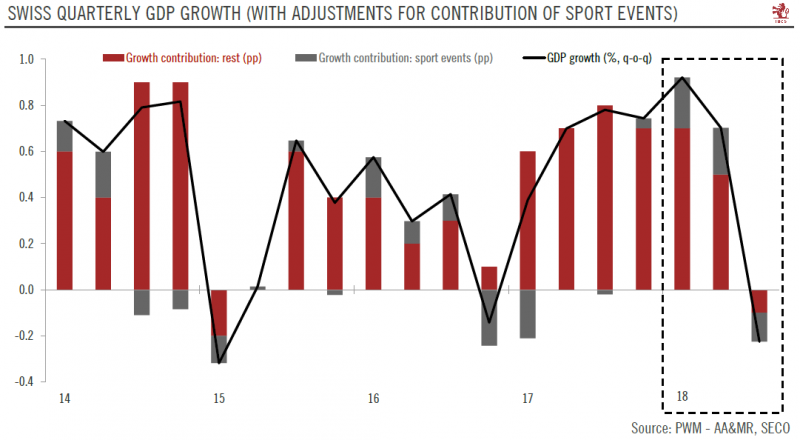

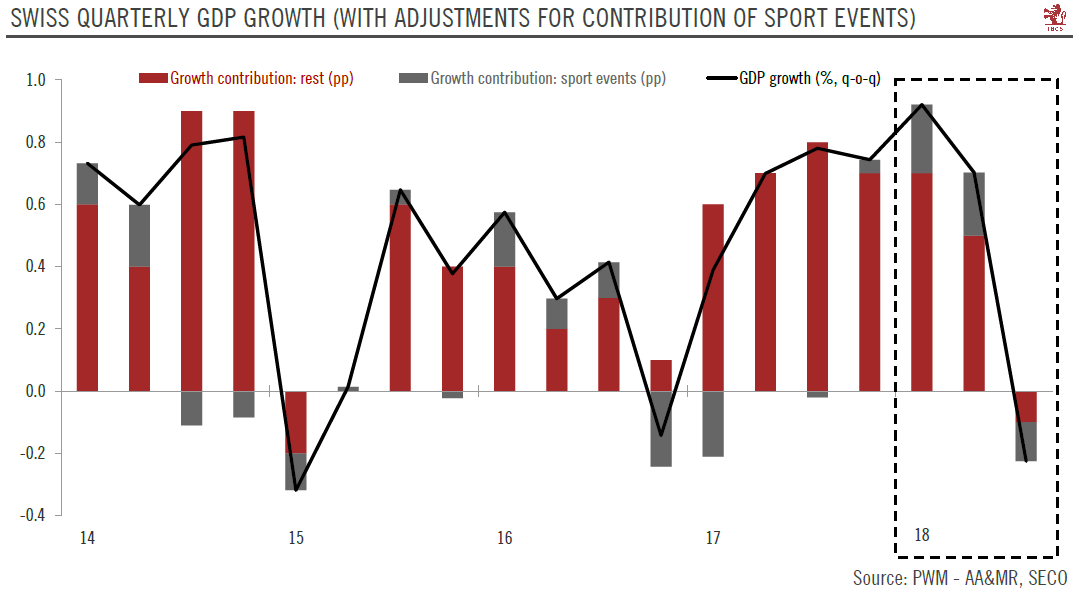

Switzerland’s growth unexpectedly contracted in the third quarter, pushing down our GDP growth forecast for 2018. Recent softening in the euro area also casts doubts about the pace of monetary tightening by the SNB.The strong growth enjoyed by the Swiss economy since Q1 2017 came suddenly to an end in Q3 18, when real GDP shrank unexpectedly by 0.2% q-o-q (-0.9% q-o-q annualised).

Read More »

Read More »

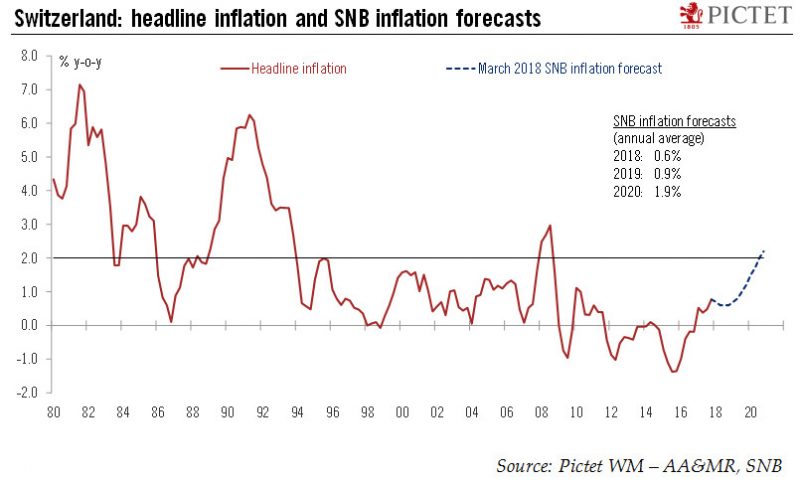

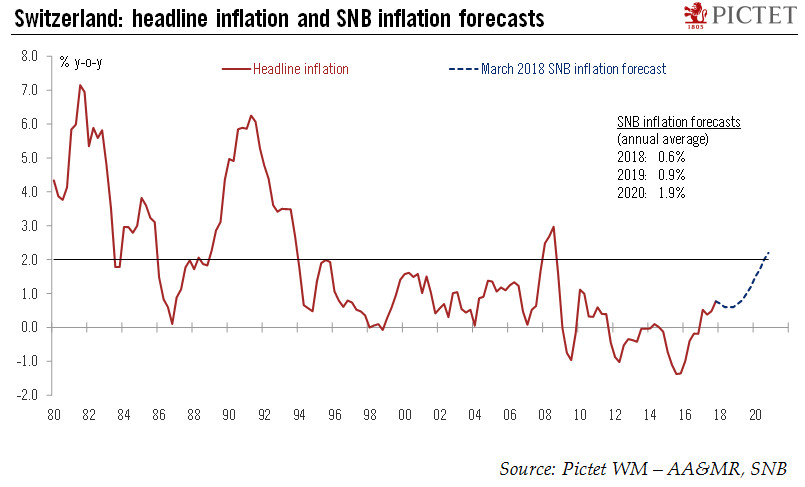

Too early for Switzerland’s central bank to change policy…

At its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to intervene in the foreign exchange market if needed.

Read More »

Read More »

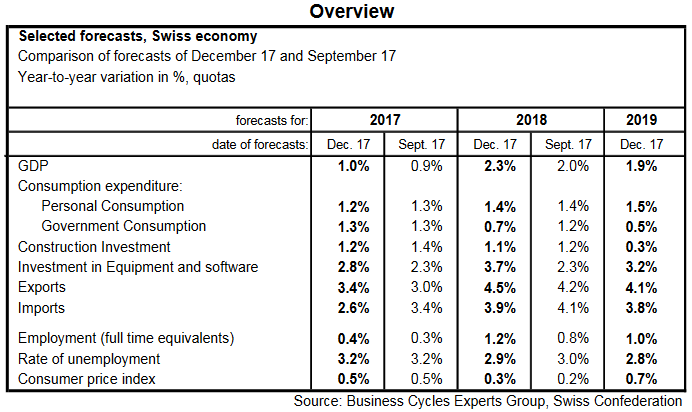

Switzerland’s Economic Recovery gains momentum

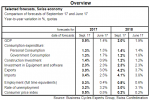

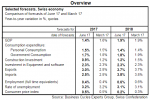

Economic forecasts by the Federal Government’s Expert Group – Winter 2017/2018* The Federal Government’s Expert Group expects the Swiss economy to make a speedy recovery over the next few quarters. While only moderate GDP growth of 1.0% is anticipated in 2017 due to a weak first half of the year, the forecast for GDP growth in 2018 is strong at 2.3% in the course of the global economic upturn.

Read More »

Read More »

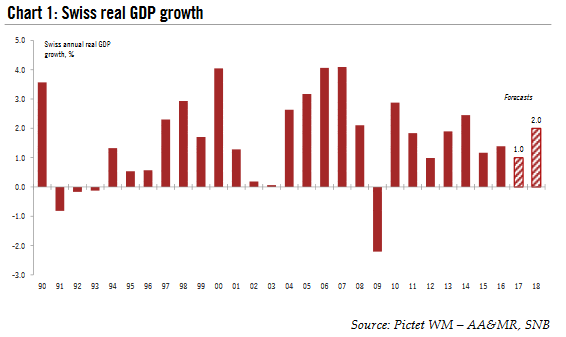

The Swiss economy is gaining momentum

Swiss growth was disappointing at the end of 2016 and in the first half of 2017. Consequently, GDP growth this year is likely to be just 1.0% , its lowest level since 2012 . However, a wide set of statistics are already painting a considerably more positive picture of strengthening growth as we approach the end of 2017. Of particular note is the increasing contribution of manufacturing to real GDP growth.

Read More »

Read More »

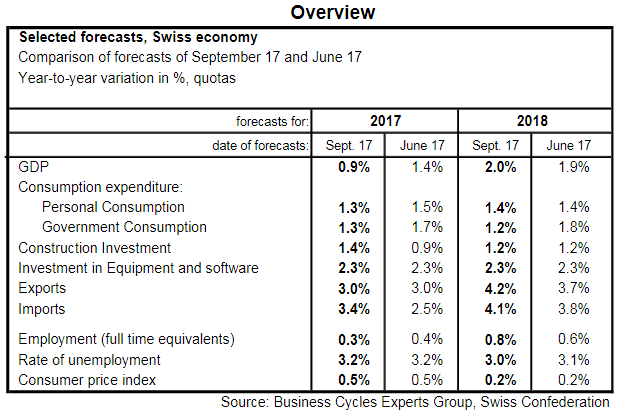

Swiss economy resumes stronger growth

Economic forecasts by the Federal Government’s Expert Group – autumn 2017* - Because of the weak performance in the first half of the year, the Federal Government’s Expert Group anticipates only moderate GDP growth of 0.9% in 2017.

Read More »

Read More »

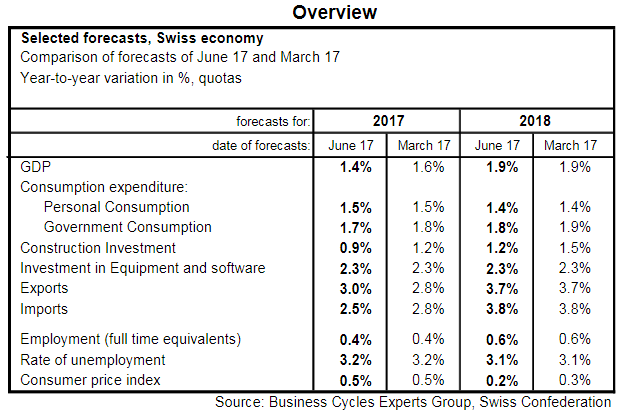

Positive Economic Outlook Continues Despite Tentative Recovery to Date

Economic forecasts by the Federal Government’s Expert Group – summer 2017* - Although growth in the Swiss economy has steadily accelerated over the past two quarters, it has nevertheless fallen short of expectations. A further marked increase in economic momentum is to be expected over the coming quarters given the promising outlook for the global economy and positive leading indicators.

Read More »

Read More »

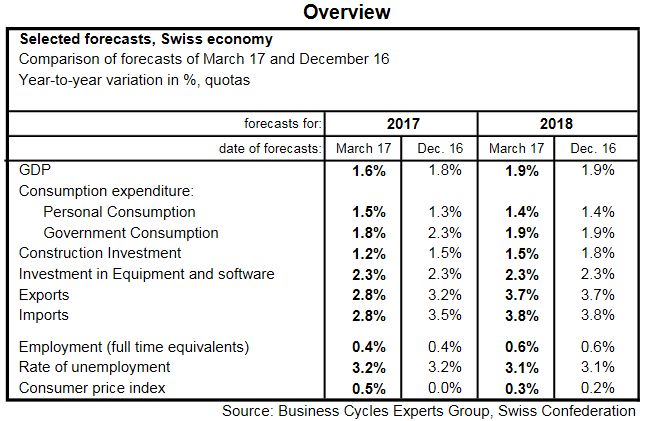

Switzerland’s economic prospects remain positive

Economic forecasts by the Federal Government’s Expert Group – spring 2017*. Swiss economic growth turned out disappointingly weak in the second half of 2016. However, the leading indicators are pointing to a clear upward trend in early 2017 and the global economy is sending out positive signals. The Federal Government’s Expert Group is therefore expecting growth in gross domestic product (GDP) to accelerate to +1.6% in 2017 (previously +1.8%) and...

Read More »

Read More »

Strong Swiss growth lessens chance SNB will act

Swiss real GDP growth data surprised on the upside in Q2, expanding by 0.6% q-o-q (and 2.5% q-o-q annualised). In addition, growth in the three previous quarters was revised significantly higher. As a result, our GDP growth forecast for growth in Switzerland rises mechanically from 0.9% to 1.5% for 2016.

Read More »

Read More »

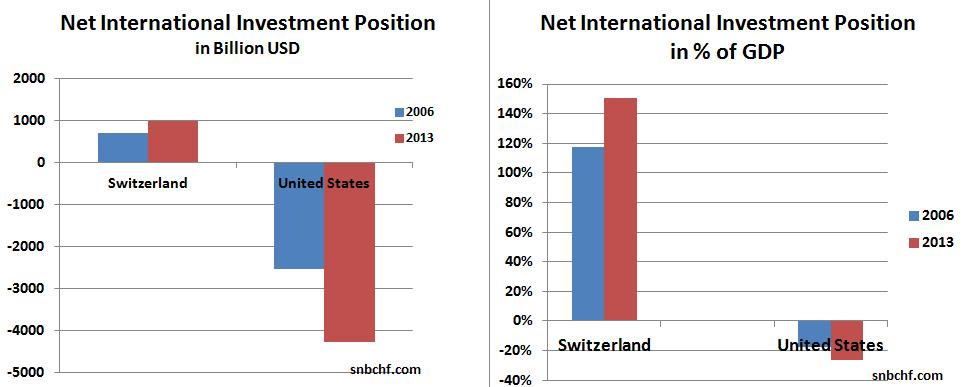

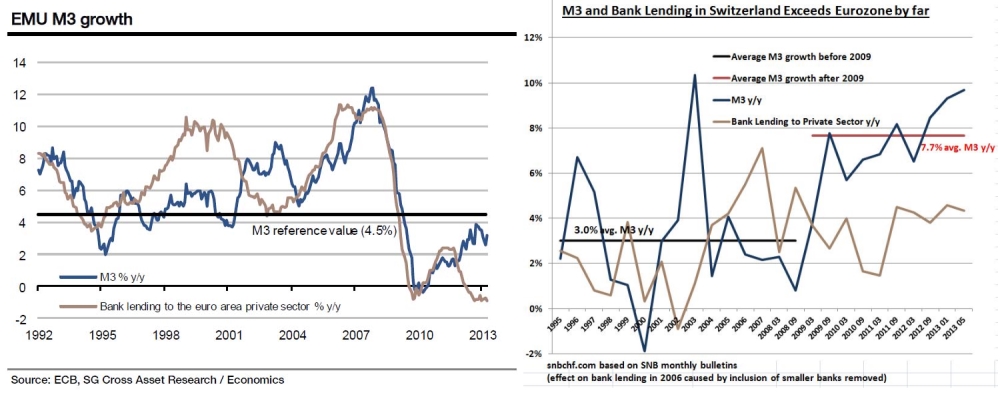

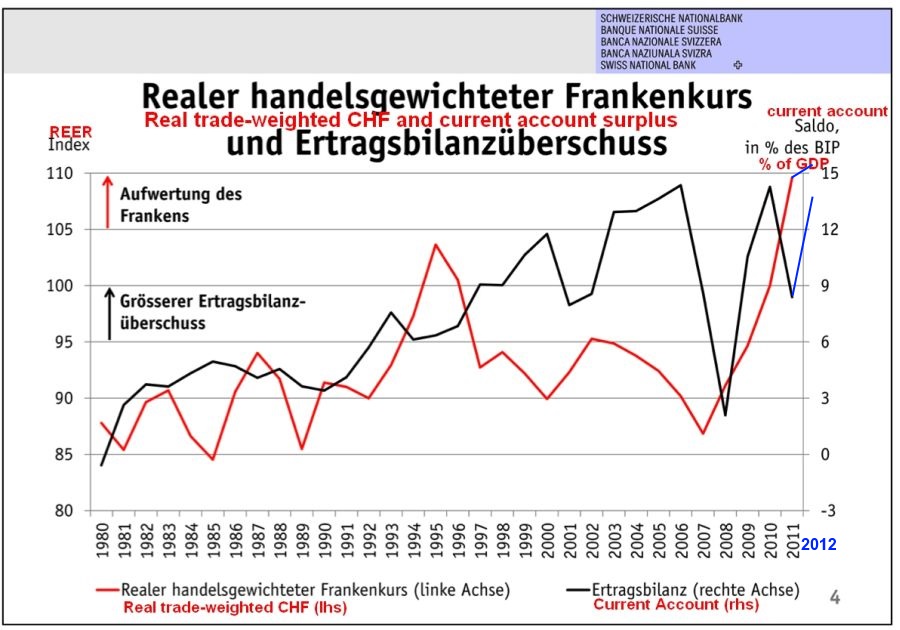

Ex-Post FX Evaluation: Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?

(post written originally in March 2013)

We reckon that the Swiss National Bank (SNB) will have issues maintaining the EUR/CHF floor in the longer term, because the expected yields on Swiss investments abroad will not be sufficiently higher than the yield on investments in Switzerland. Because of this insufficient risk-reward relationship, outflows in the capital account of the Swiss balance of payments will not cover the persistent Swiss current...

Read More »

Read More »

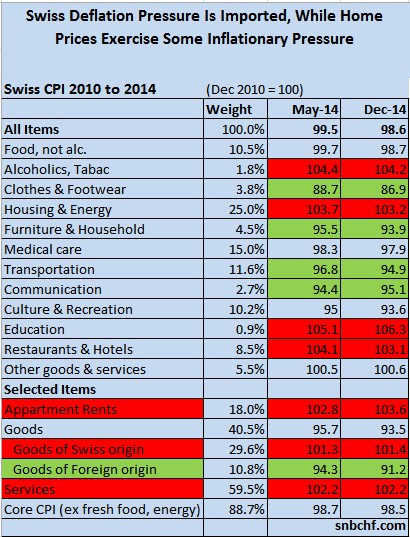

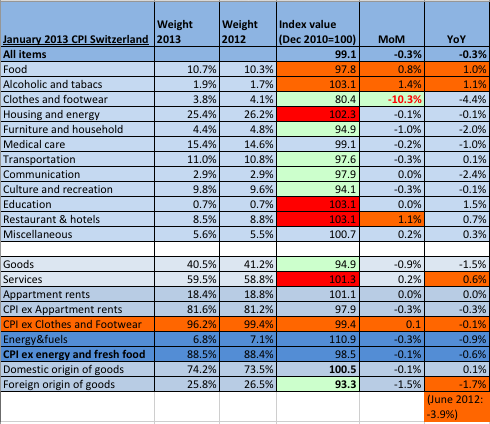

Downwards and Upwards Drivers of Swiss Inflation

In the following we present the drivers of Swiss price inflation. We first present the components of the consumer price index. Then we explain which are upwards-drivers of inflation and which ones cause downwards adjustments.

Read More »

Read More »

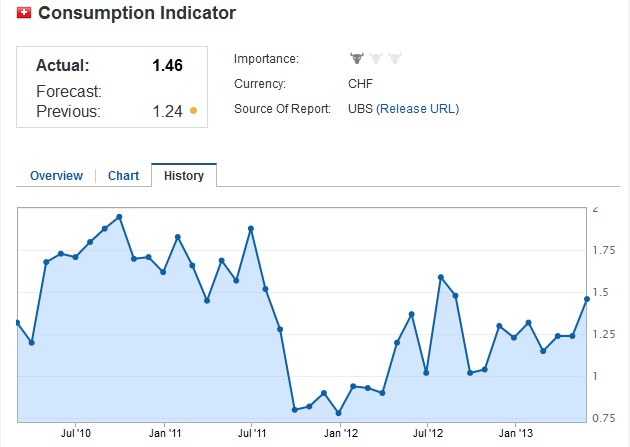

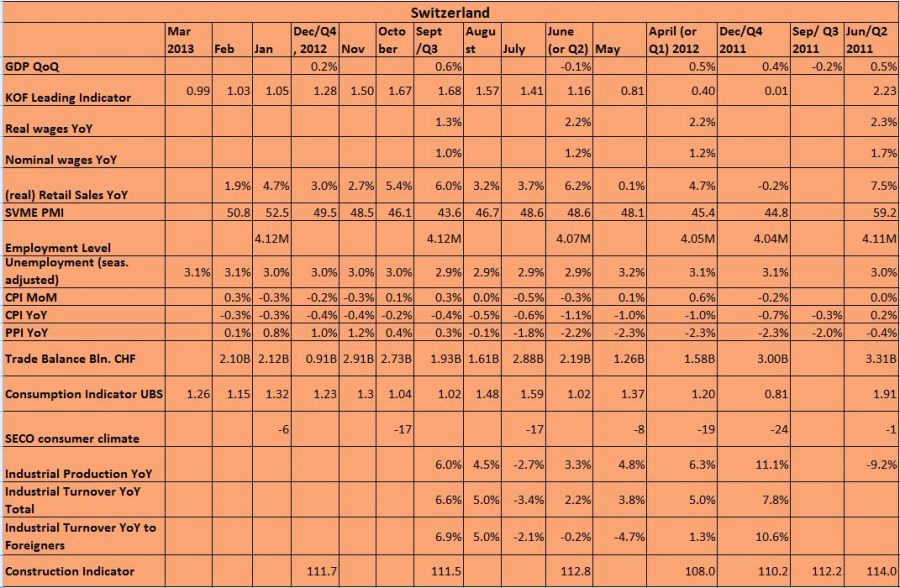

UBS Consumption Indicator Points to 2.5 Percent Swiss GDP Growth in 2014

FacebookShare As usual, the Swiss economy seems to be better than economists thought. After 1.40 still in December, the UBS consumption indicator has risen to 1.81, a value higher than the ones in 2012, when private consumption increased by 2.4%. Similarly as last year, the latest reading contradicts UBS’s own growth forecasts, albeit this year …

Read More »

Read More »

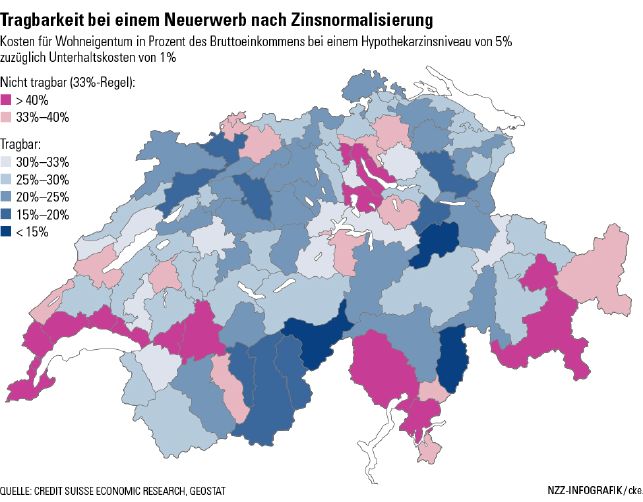

Pros and Cons of the Swiss Countercyclical Capital Buffer

Switzerland is currently living in a big real estate boom. The bubble bursting would imply that banks' collateral in the form of real estate falls in value. Therefore the banks' assets might fall because many home buyers might not be able to repay their mortgage. If a real estate bubble pops, then banks should be better capitalized to absorb such a shock. Therefore the Swiss National Bank introduced macro-prudential measures, like the so-called...

Read More »

Read More »

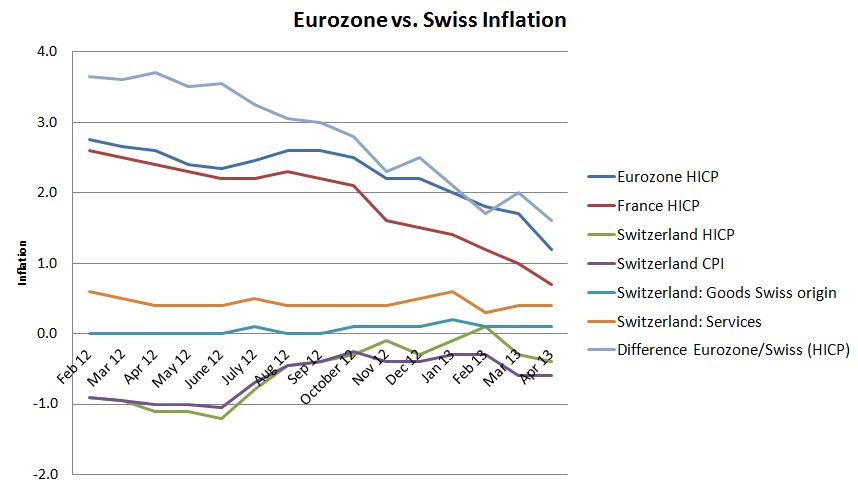

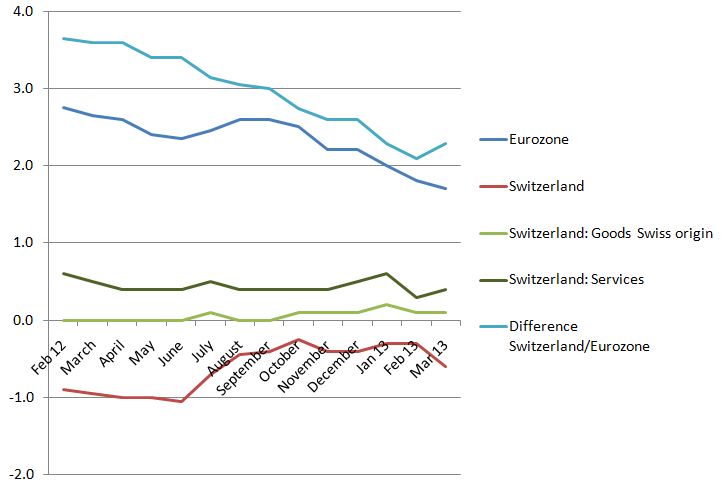

Swiss Inflation Rises, Services Up 0.6 percent YoY, Goods Swiss Origin +0.3 percent, Energy Tames

Cheaper energy prices and long-lasting contracts help against inflation. Swiss inflation increased by 0.1% against April. According to Swiss Statistics, on a year basis, the CPI fell by 0.5%. Major reasons for lower figures were the 6.3% YoY decrease in energy prices, 4.5% YoY lower clothes and footwear price and technological improvements in communication that caused … Continue reading »

Read More »

Read More »

UBS’s Consumption Indicator 1.46 Contradicts UBS’s Swiss GDP Forecast

UPDATE, February 2014 According to the latest data from the SECO,Swiss GDP rose by 2% in 2014 and not by 0.9% as the UBS predicted. Once again the Swiss economy seems to be stronger than expected. UBS’s consumption indicator for April came out at 1.46 (details). This number seems at odds with the weak private … Continue reading...

Read More »

Read More »

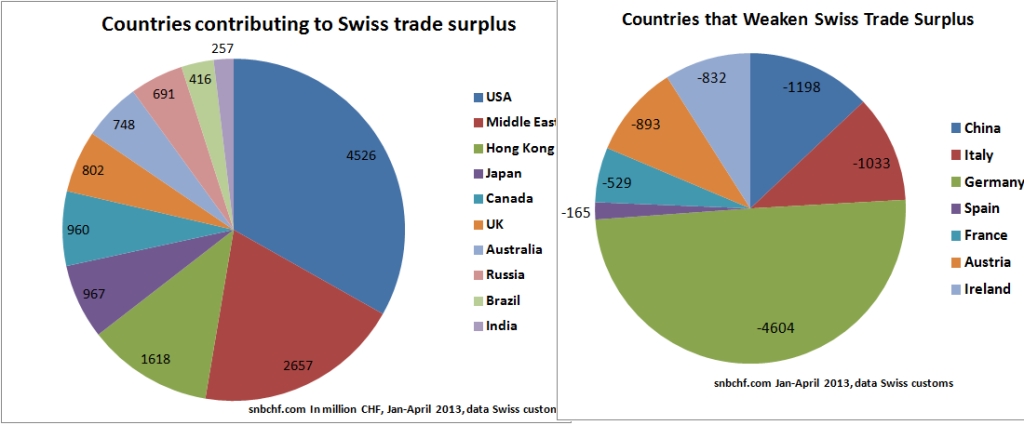

The Swiss Trade Surplus: A Really Global Economy

The Swiss trade balance for goods clearly indicates its global orientation. Switzerland has a trade surplus with the US, Canada, the UK and many emerging markets. Swiss exports are mostly luxury products and pharmaceuticals. The total surplus for the 4 first months in 2013 was 7.7 billion CHF, about 1.2% of GDP, annualized around …

Read More »

Read More »

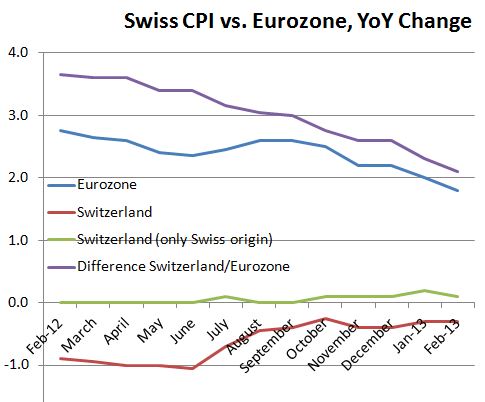

Swiss Inflation Unchanged, HICP Difference Euro Area to Switzerland Down to 1.6 percent

Swiss inflation unchanged in April against March. The inflation difference between the Euro area and Switzerland on a new low. While in early 2012 it was near 4%, if has shrunk now to 1.6%. Details

Read More »

Read More »

March Swiss Inflation Up 0.2 percent MoM, Down -0.6 percent YoY

Swiss inflation edged up 0.2% MoM when seasonal effects on clothes and footware were corrected. On a year basis, the CPI fell by 0.6%. Major reason were the falling energy prices, details

Read More »

Read More »

Swiss Current Account Surplus Rises from 8.5 percent to 13.5 percent of GDP

According to latest IMF data the Swiss current account surplus rose from 49 billion CHF in 2011 to 80 billion in 2012, this is from 8.5% of GDP to 13.5%. Details

Read More »

Read More »

IMF (2013): Sees Considerable Risks on SNB Balance Sheet

The International Monetary Fund (IMF) judges "that the SNB’s net revenue is subject to large fluctuations, and sizeable losses could occur if an appreciation of the Swiss franc was to take place before foreign exchange interventions were unwound."

Read More »

Read More »