Tag Archive: Swiss National Bank

SNB confirms record profit for 2017

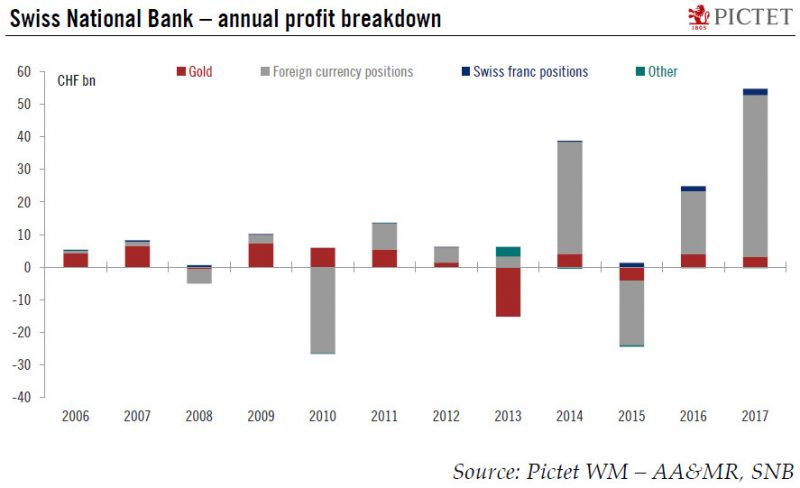

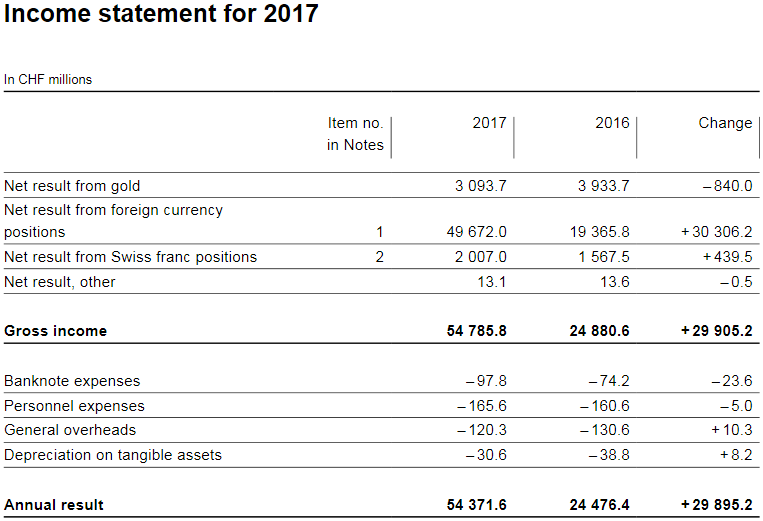

The Swiss National Bank (SNB) published its 2017 annual result today. The SNB confirmed a profit of CHF54.4bn in 2017. This was more than double the 2016 figure (CHF24.5bn) and its biggest profit ever. Earnings from the SNB’s foreign currency positions amounted to CHF49.7bn, its gold holdings increased in value by CHF3.1bn and its Swiss positions by CHF2bn (see Chart below).

Read More »

Read More »

SNB reports a profit of CHF 54.4 billion for 2017

The Swiss National Bank (SNB) reports a profit of CHF 54.4 billion for the year 2017 (2016: CHF 24.5 billion). The profit on foreign currency positions amounted to CHF 49.7 billion. A valuation gain of CHF 3.1 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 2.0 billion.

Read More »

Read More »

E-franc pipe dream fails to arouse Switzerland

Mounting calls for Switzerland to introduce a blockchain-based national cryptocurrency continue to fall on deaf ears at the Swiss National Bank (SNB). Romeo Lacher, chairman of the SIX Groupexternal link that runs the Swiss stock exchange, recently added his voice to the debate by advocating such a virtual currency.

Read More »

Read More »

Currency swap agreement between the Swiss National Bank and the Bank of Korea

The Swiss National Bank (SNB) and the Bank of Korea (BOK) will enter into a bilateral swap agreement. The agreement will be signed on 20 February 2018 in Zurich by the Chairman of the SNB Governing Board, Thomas Jordan, and the Governor of the BOK, Juyeol Lee. The swap agreement enables Korean won and Swiss francs to be purchased and repurchased between the two central banks, up to a limit of KRW 11.2 trillion, or CHF 10 billion.

Read More »

Read More »

South Korea and Switzerland set a currency swap

South Korea and Switzerland are entering into a bilateral currency swap agreement, it was announced on Friday. The move is aimed at strengthening buffers against external financial shocks for both countries. “The swap agreement enables Korean won and Swiss francs to be purchased and repurchased between the two central banks, up to a limit of KRW11.2 trillion, or CHF10 billion [$10.6 billion],” a Swiss National Bank statement saidexternal link.

Read More »

Read More »

SNB Rejects Vollgeld and Questions ‘Reserves for All’

In the NZZ, Peter Fischer reports that SNB president Thomas Jordan rejects the Vollgeld initiative and stops short of endorsing the ‘reserves for all’ proposal.

Read More »

Read More »

Swiss franc could hit 1.22 by year end, according to economists

According to Le Matin, economists at Swiss Life think the rise of the Swiss franc could be over and predict it will weaken to 1.22 to the euro by the end of the year. At the same time they point to risks that could send the currency in the opposite direction, such as the election in Italy, Brexit negotiations and uncertainty surrounding government in Germany.

Read More »

Read More »

Dividendes de la BNS: le compte n’y est pas

La Banque nationale suisse s’attend à un bénéfice de 54 milliards de francs pour l’exercice 2017. Celui-ci résulte de: Un gain de 49 milliards de francs sur ses positions en monnaies étrangères. D’une plus-value de 3 milliards de francs sur l’or. D’un bénéfice de 2 milliards de francs sur ses positions en franc.

Read More »

Read More »

UBS-Präsident Axel Weber wird sein blaues Wunder erleben – mit der Zahlungsunfähigkeit der SNB

Axel Weber hat zwei Seelen in seiner Brust: eine als Ex-Notenbanker, eine als UBS-Präsident. Als Präsident der Deutschen Bundesbank hatte der Deutsche Weber gesagt, es gäbe keine Einlösungsverpflichtung der Deutschen Bundesbank für eine Banknote. „Wirtschaftlich gesehen sind unsere Banknoten eine Verbindlichkeit des Eurosystems.

Read More »

Read More »

Swiss National Bank expects annual profit of CHF 54 billion

According to provisional calculations, the Swiss National Bank (SNB) will report a profit in the order of CHF 54 billion for the 2017 financial year. The profit on foreign currency positions amounted to CHF 49 billion. A valuation gain of CHF 3 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to CHF 2 billion.

Read More »

Read More »

In Unprecedented Intervention, Swiss Central Bank Bails Out Firm That Prints Swiss Banknotes

In the most ironic story of the day, the company that makes the paper that Swiss banknotes are printed on was just bailed out by the money-printing, stock-purchasing, plunge-protecting, savior-of-global equities…Swiss National Bank. While The SNB has a long and checkered history of buying shares in companies… as we have detailed numerous times.

Read More »

Read More »

Swiss National Bank acquires majority stake in Landqart AG

Yesterday, the Swiss National Bank (SNB) acquired 90% of the shares in Landqart AG. The remaining 10% of the share capital will be purchased by Orell Füssli Holding Ltd. The vendor is a subsidiary of Fortress Paper Ltd, which is listed on the Toronto stock exchange.

Read More »

Read More »

Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well.

Read More »

Read More »

Swiss Perfectionism

In Der Bund, Adrian Sulc comments on the Swiss National Bank’s perfectionism. Keine andere Schweizer Organisation kommuniziert so professionell wie die SNB, keine andere Organisation kann so gut dichthalten.

Perfectionism is costly. Der Personalbestand ist in den letzten fünf Jahren um 18 Prozent auf 795 Vollzeitstellen gestiegen. … Die durchschnittlichen Lohnkosten pro Mitarbeiter betragen mittlerweile 155 000 Franken pro Jahr. Dies weil gemäss...

Read More »

Read More »

Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm.

Read More »

Read More »

News conference Swiss National Bank, Thomas Jordan

It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I will then hand over to Fritz Zurbrügg, who will speak about current developments in the area of financial stability. After that, Andréa Maechler will review the situation on the financial markets and the progress in reference interest rate reform. Finally, we...

Read More »

Read More »

News conference Swiss National Bank 2017, Fritz Zurbrügg

In my remarks today, I would like to address some of the developments currently taking place in the field of financial stability. I shall look at the big banks first before turning to the domestically focused banks. I will conclude with a few words on the new banknote series.

Read More »

Read More »

Less Retail Jobs, More Amazon Robots: Get Used To It

When it comes to job creation in the United States, President Trump will be displeased to hear the latest findings from Quartz: 170,000 fewer retail jobs in 2017 - and 75,000 more Amazon robots. In November, we explained that while everyone likes to point the finger at Amazon, America’s retail apocalypse can’t be tied to just one catalyst (see: A Look At America’s Retail Apocalypse In Charts), however, fierce competition in the industry has induced...

Read More »

Read More »

FX Weekly Preview: FOMC and ECB Highlight Central Banks’ Last Meetings of the Year

No fewer than thirteen central banks meet in the week ahead. The UK and the US report the latest inflation figures, and the US and eurozone report industrial production. The eurozone sees the flash PMI for December, and the Japan's latest Tankan business survey will be released.

Read More »

Read More »

SNB: It’s A Bonfire Of The Absurdities

This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my head now and then to “WTF” moments several times a week.

Read More »

Read More »