Tag Archive: repo

Money Markets: Sizing Up the Cavalry

There’s been an unusual level of honesty coming out of Liberty Street of late. Not total honesty but certainly more than the usual nothing denials and dismissals. If you don’t immediately recognize the reference, that’s the street in NYC where FRBNY and its Open Market Desk resides. What is supposed to be the moneyed centered of the universe. After all, as Ben Bernanke famously threatened in November 2002, that’s the printing press.

Read More »

Read More »

More Than A Decade Too Late: FRBNY Now Wants To Know, Where Were The Dealers?

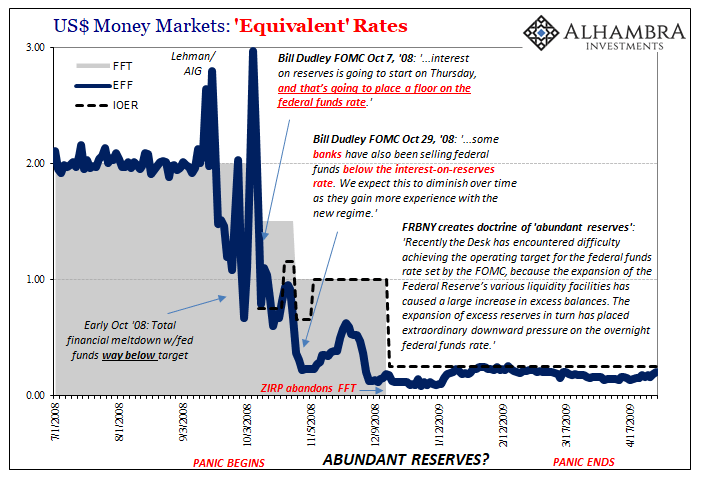

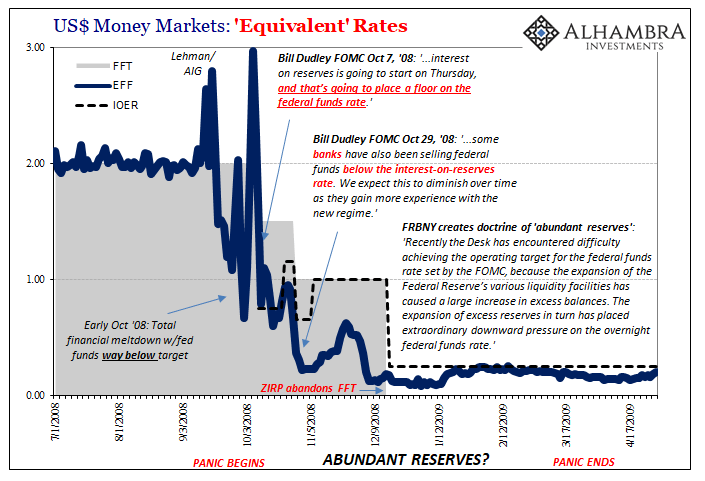

I’ve said it all along; focusing in on bank reserves would leave you dazed and confused. It’s just not how the system works. After all, as I pointed out again not long ago, “our” glorious central bank had the audacity to claim that there were “abundant” reserves during the worst financial panic in four generations. “Somehow” despite that, it was a Global Financial Crisis that lived up to its name – global.

Read More »

Read More »

What’s The Verdict On This Week?

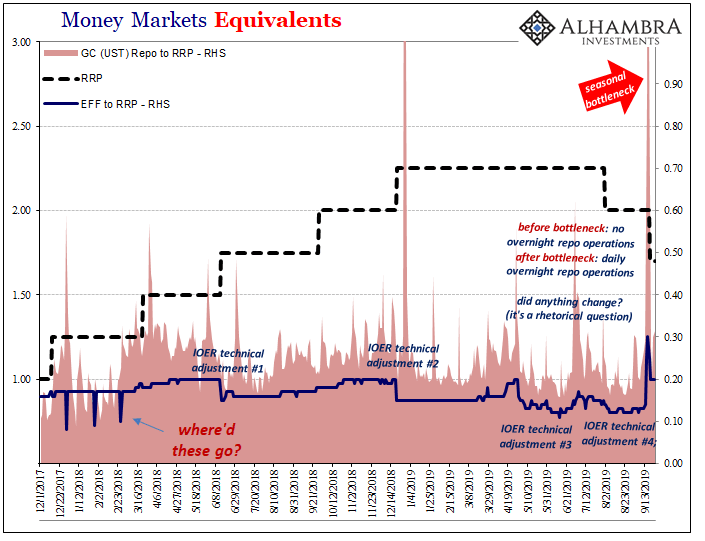

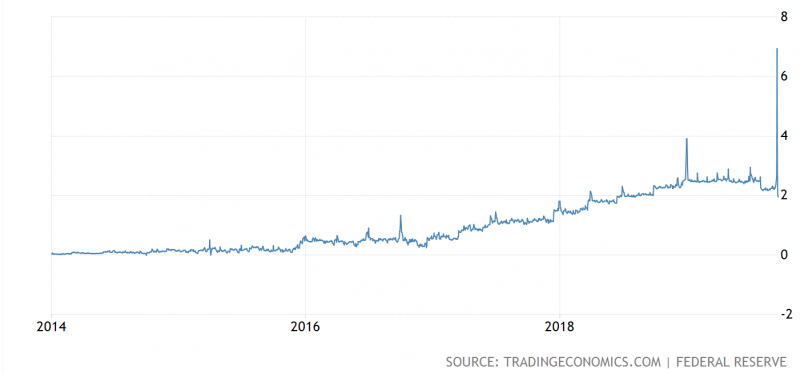

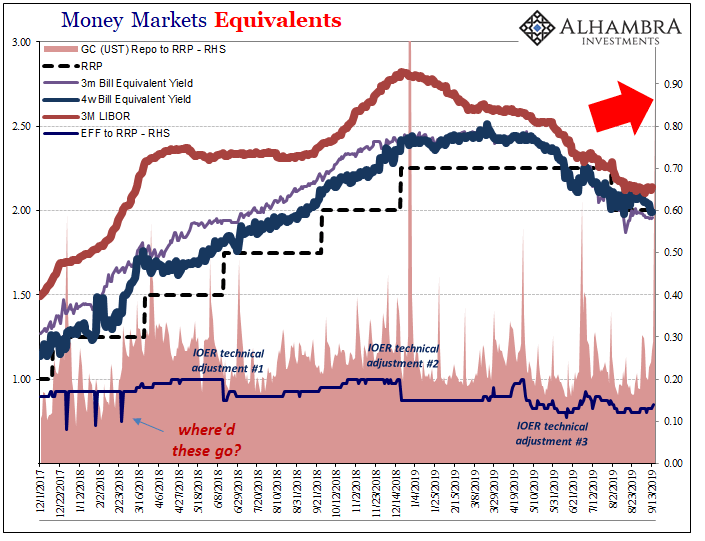

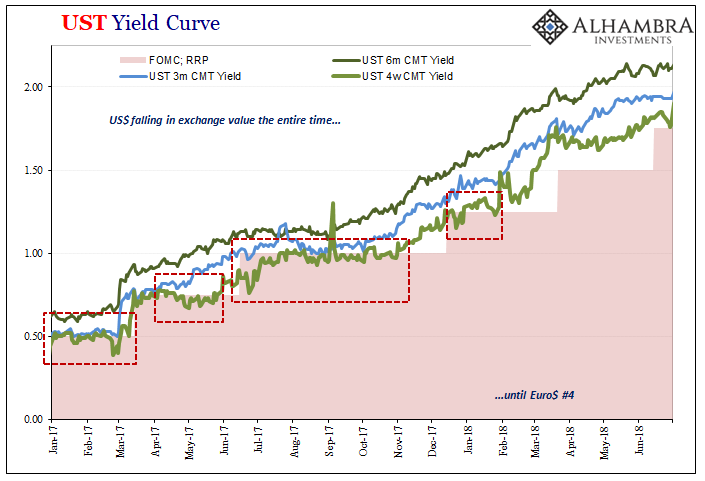

Jay Powell’s disastrous week is coming to a close, not yet his long nightmare. He has been battling fed funds (meaning repo) for his entire tenure dating back to February 2018. This week wasn’t the conclusion to the contest, just the latest and biggest round of it.

Read More »

Read More »

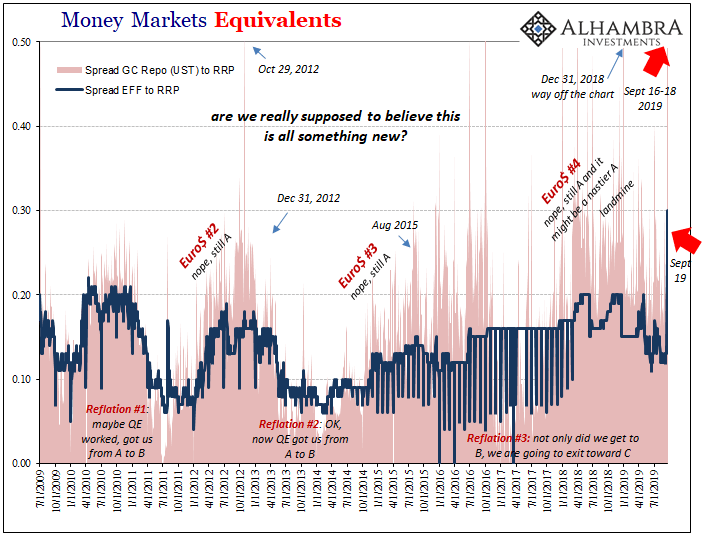

Stuck at A: Repo Chaos Isn’t Something New, It’s The Same Baseline

Finally, finally the global bond market stopped going in a straight line. I write often how nothing ever does, but for almost three-quarters of a year the guts of the financial system seemed highly motivated to prove me wrong. Yields plummeted and eurodollar futures prices soared. It is only over the past few weeks that rates have backed up in what has been the first real selloff since last year.

Read More »

Read More »

How To Properly Address The Unusual Window Dressing

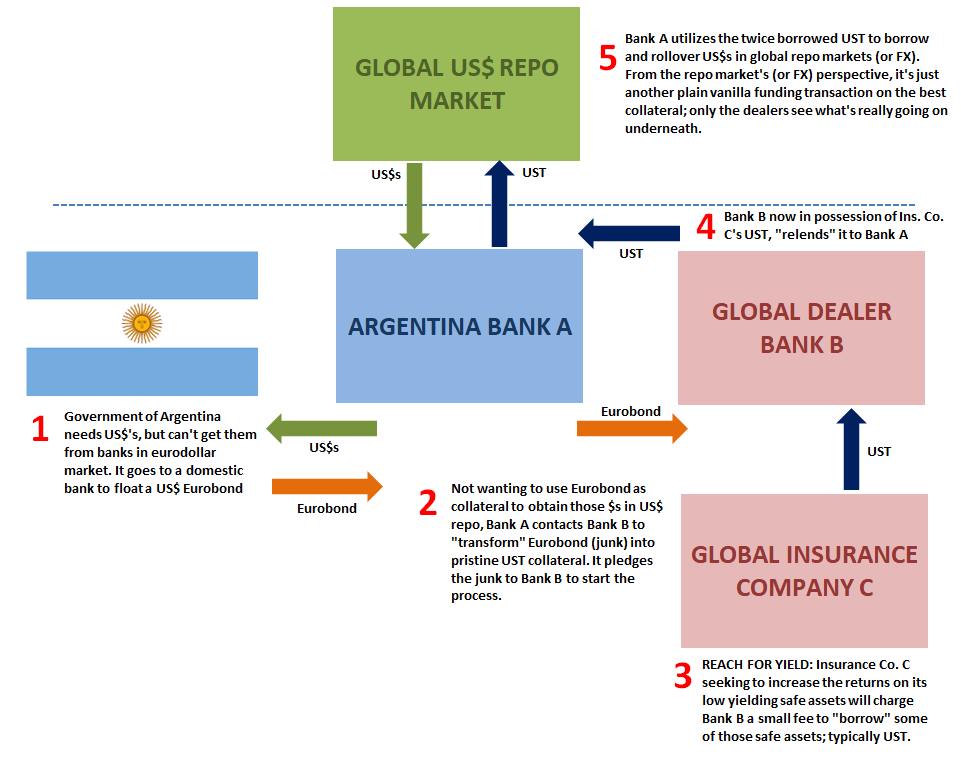

Unable to tackle effective monetary requirements, bank regulators around the world turned to “macroprudential” approaches in the wake of the Global Financial Crisis. It was mostly public relations, a way to assure the public that 2008 would never be repeated. A whole set of new rules was instituted which everyone was told would reign in the worst abuses.

Read More »

Read More »

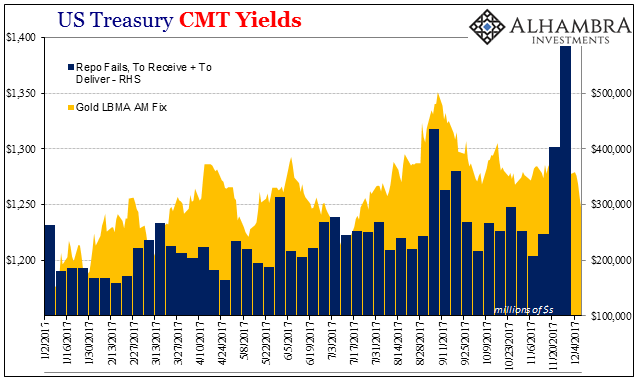

COT Blue: Distinct Lack of Green But A Lot That’s Gold

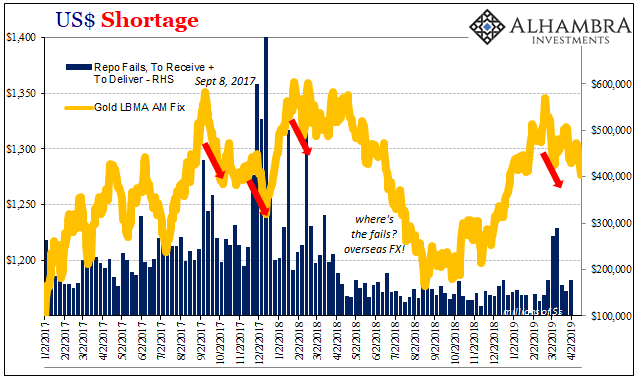

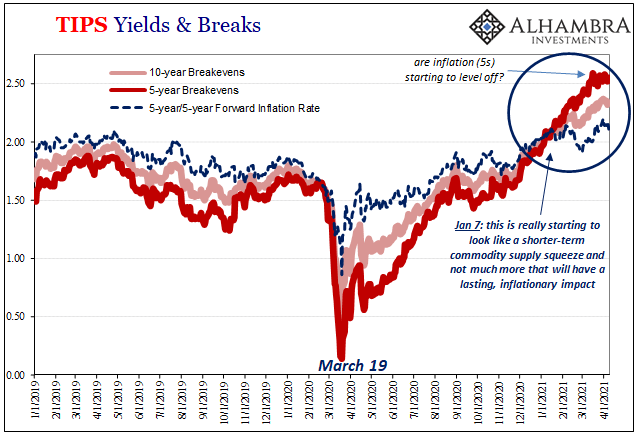

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge.

Read More »

Read More »

Phugoid Dollar Funding

On August 12, 1985, Japan Airways flight 123 left Tokyo’s Haneda Airport on its way to a scheduled arrival in Osaka. Twelve minutes into the flight, the aircraft, a Boeing 747, suffered catastrophic failure when an aft pressure bulkhead burst.

Read More »

Read More »

Nothing To See Here, It’s Just Everything

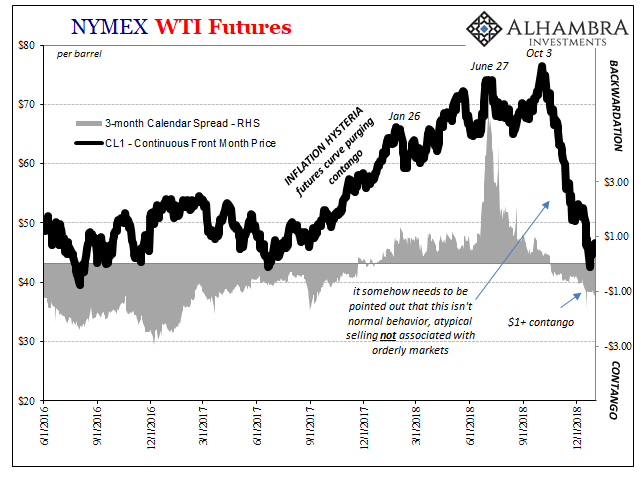

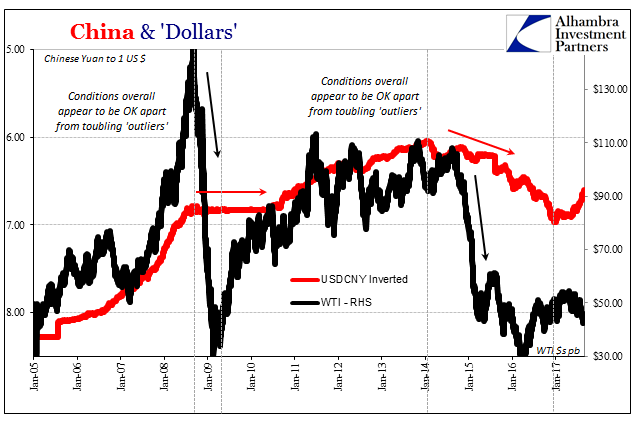

The politics of oil are complicated, to say the least. There’s any number of important players, from OPEC to North American shale to sanctions. Relating to that last one, the US government has sought to impose serious restrictions upon the Iranian regime. Choking off a major piece of that country’s revenue, and source for dollars, has been a stated US goal.

Read More »

Read More »

Insane Repo Reminds Us

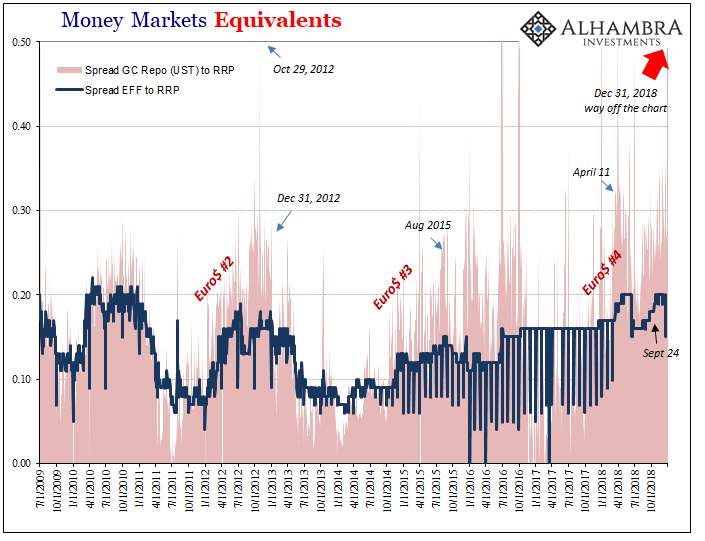

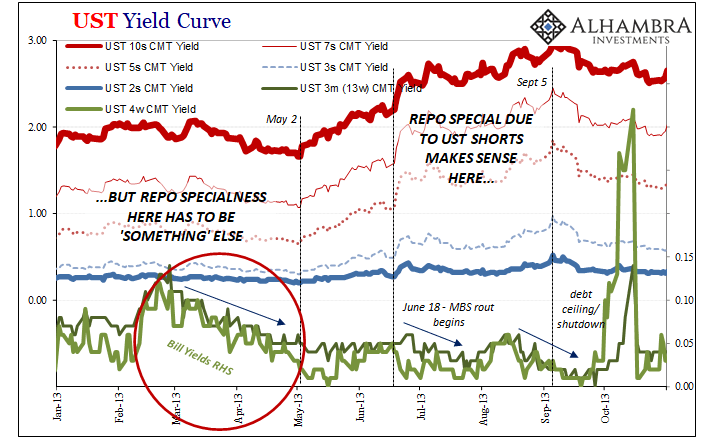

It was only near the quarter end, that’s what made it so unnerving. We may have become used to these calendar bottlenecks over the years, but they still remind us what they are. Late October 2012 was a little different, though. On October 29, the GC repo rate for UST collateral (DTCC) surged to 52.6 bps. The money market floor, so to speak, was zero at the time and IOER (the joke) 25 bps. We also have to keep in mind the circumstances of that...

Read More »

Read More »

Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

For Janet Yellen, during her somewhat brief single term she never made the same kind of effort as Ben Bernanke had. Her immediate predecessor, Bernanke, wanted to make the Federal Reserve into what he saw as the 21st century central bank icon. Monetary policy wouldn’t operate on the basis of secrecy and ambiguity. Transparency became far more than a buzzword.

Read More »

Read More »

Anticipating How Welcome This Second Deluge Will Be

Effective federal funds (EFF) was 1.92% again yesterday. That’s now eight in a row just 3 bps underneath the “technically adjusted” IOER. If indeed the FOMC has to make another one to this tortured tool we know already who will be blamed for it.

Read More »

Read More »

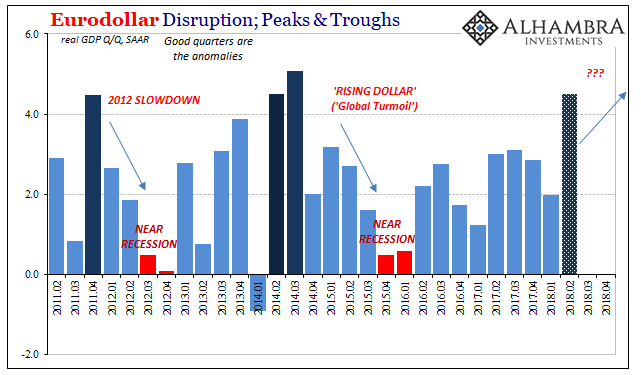

The Top of GDP

In 1999, real GDP growth in the United States was 4.69% (Q4 over Q4). In 1998, it was 4.9989%. These were annual not quarterly rates, meaning that for two years straight GDP expanded by better than 4.5%. Individual quarters within those years obviously varied, but at the end of the day the economy was clearly booming.

Read More »

Read More »

Chart of the Week: Collateral

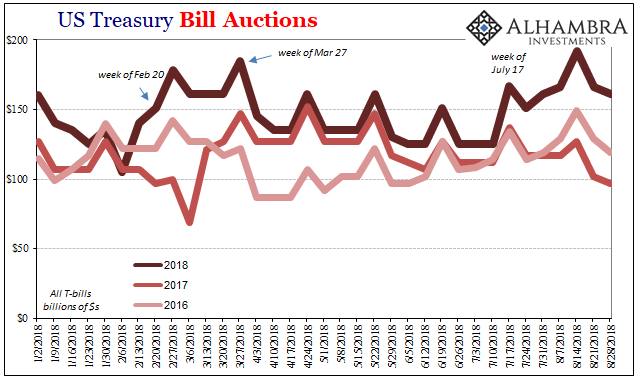

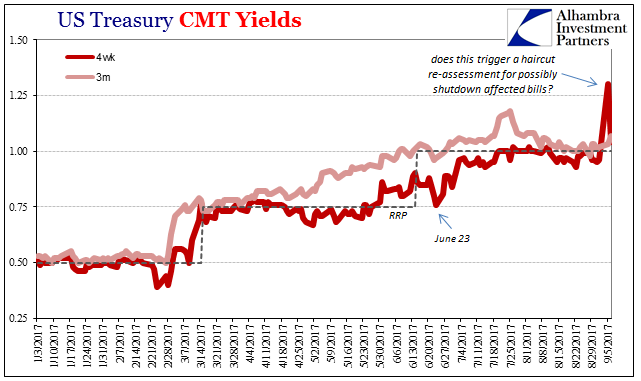

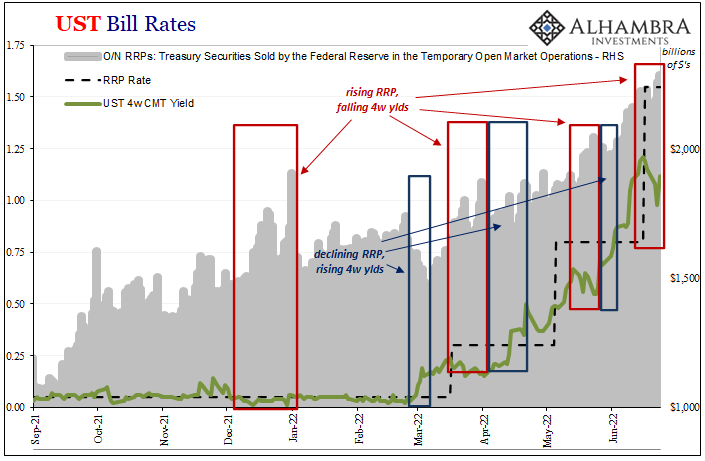

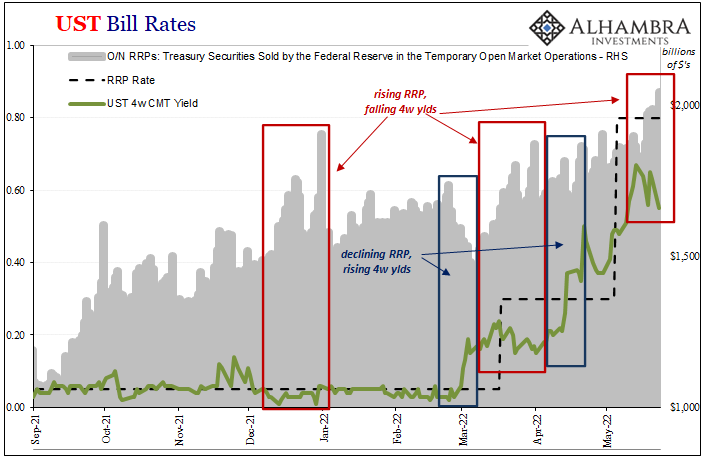

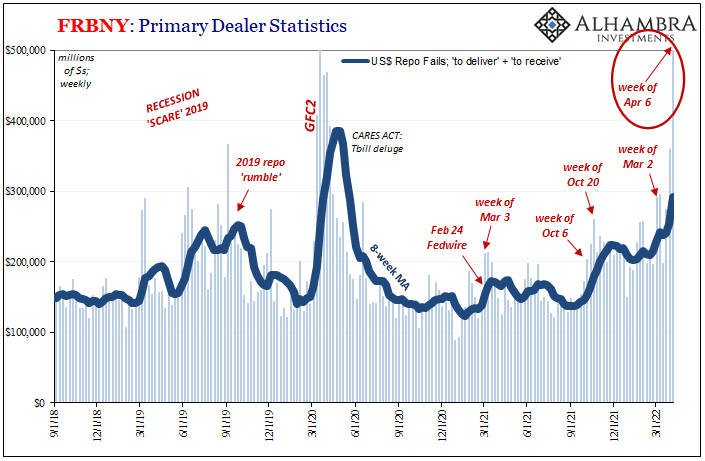

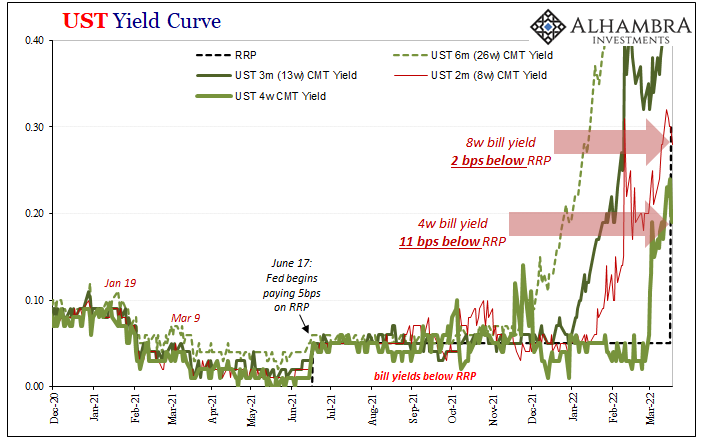

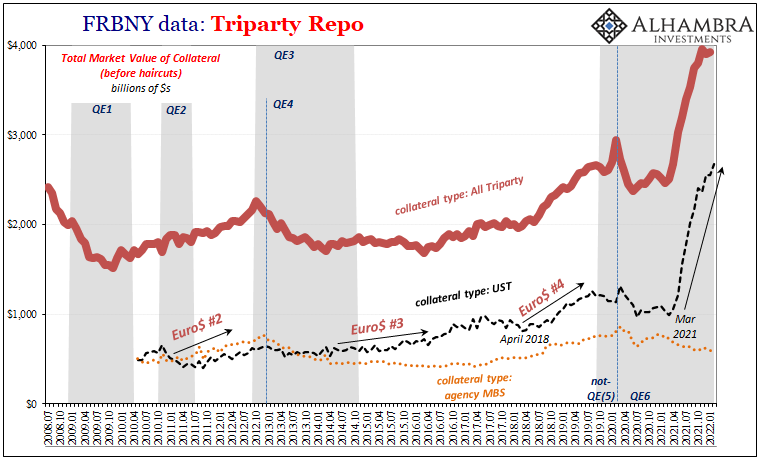

It’s been a week of quite righteous focus on collateral. The 4-week bill equivalent yield closes it at just 114 bps, with only three days left before the RRP “floor” is moved up by the FOMC to 125 bps. That’s too much premium in price, though we know why given what FRBNY reported for repo fails last week.

Read More »

Read More »

It Was Collateral, Not That We Needed Any More Proof

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. Within two days of that move in bills, the GC market for UST 10s had gone insane.To be honest, it was a rhetorical exercise.

Read More »

Read More »

Moscow Rules (for ‘dollars’)

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is coincidence. Three times is an enemy...

Read More »

Read More »

Basic China Money Math Still Doesn’t Add Up To A Solution

There are four basic categories to the PBOC’s balance sheet, two each on the asset and liability sides of the ledger. The latter is the money side, composed mainly of actual, physical currency and the ledger balances of bank reserves. Opposing them is forex assets in possession of the central bank and everything else denominated in RMB.

Read More »

Read More »

Now China’s Curve

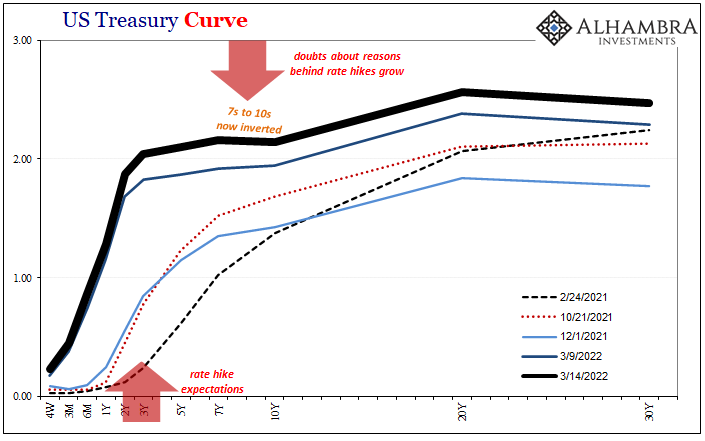

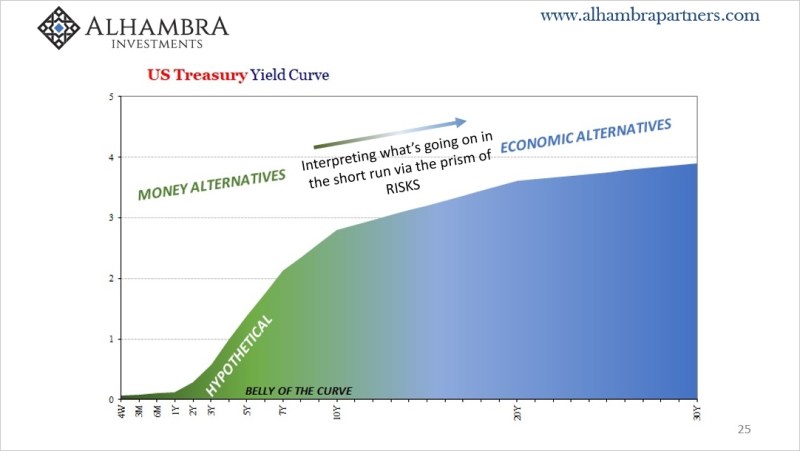

Suddenly central banks are mesmerized by yield curves. One of the jokes around this place is that economists just don’t get the bond market. If it was only a joke. Alan Greenspan’s “conundrum” more than a decade ago wasn’t the end of the matter but merely the beginning. After spending almost the entire time in between then and now on monetary “stimulus” of the traditional variety, only now are authorities paying close attention.

Read More »

Read More »

Not Do We Need One, But Do We Need A Different One

On March 24, 2009, then US President Barack Obama gave a prime time televised press conference whose subject was quite obviously the economy and markets. The US and global economy was at that moment trying to work through the worst conditions since the 1930’s and nobody really had any idea what that would mean.

Read More »

Read More »

Non-Randomly Surveying RMB

China’s central bank, unlike other central banks, is constantly active almost never resting. Because it is always in motion, the PBOC can seem to be “adding” liquidity at the very same time it might be “draining” it. Its specific actions should never be interpreted as standalone procedures related solely to some unknown policy stance. That is particularly true given that we know what their stance is and has been – neutral.

Read More »

Read More »