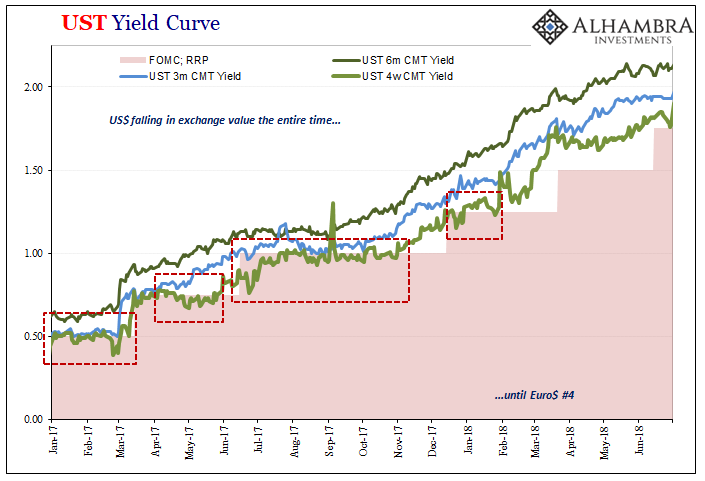

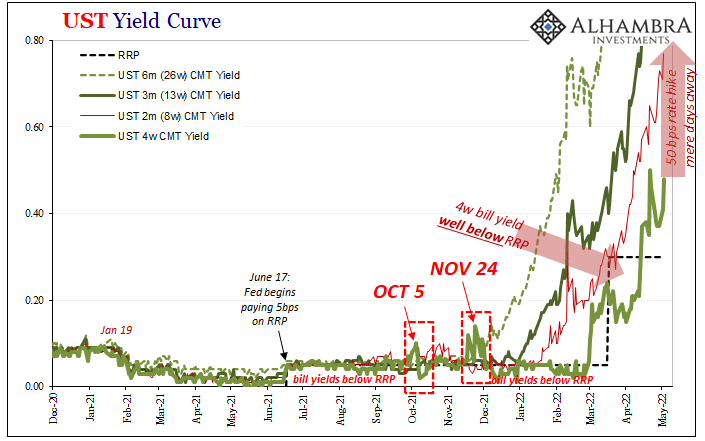

| It’s never just one thing or another. Take, for example, collateral scarcity. By itself, it’s already a problem but it may not be enough to bring the whole system to reverse. A good illustration would be 2017. Throughout that whole year, T-bill rates (4-week, in particular) kept indicating this very shortfall, especially the repeated instances when equivalent bill yields would go below the RRP “floor” and often stay there for prolonged periods.

There was, as I wrote at the time, no mistaking what was really happening nor the straightforward implication. The problem is hardly anyone noticed, and of the few who did no one cared (enough).

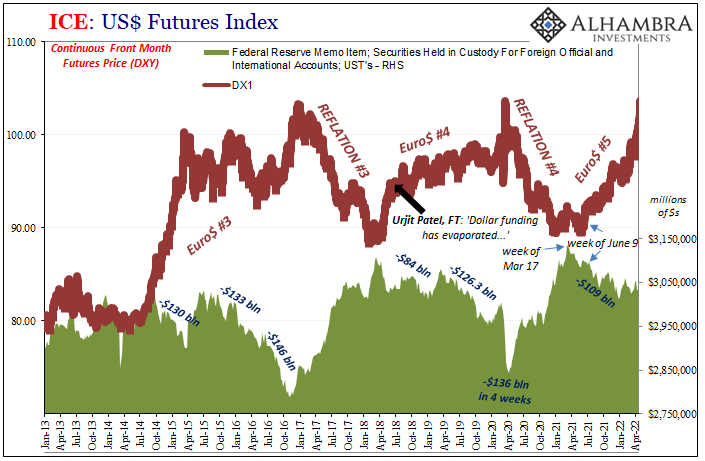

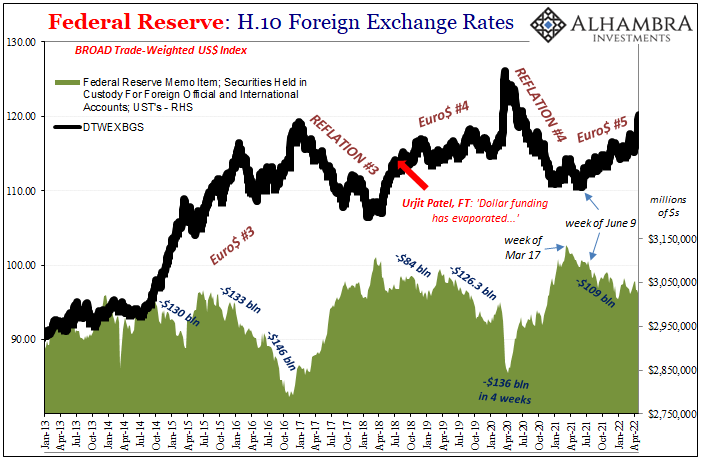

Yet, the US$ exchange value would fall rather than rise all throughout 2017. A collateral event even such as that one, therefore, a necessary but not sufficient condition to halt what was then Reflation #3 and turn it into Euro$ #4. The latter would come only a little later, however. |

|

This is because collateral scarcity at any time is a clear sign of systemic fragility; even a fragile system can carry on (pun intended) for some time without any but the most careful observer having noticed the growing faults in its condition. In this case, the level of bank reserves like the direction and intensity of the Fed’s rate hikes were immaterial.You don’t have to take my word for it, and you can even count some at the Federal Reserve, believe it or not, as among these careful observers. Just two months after what I wrote above, an Economist at the St. Louis Fed branch could only reach the same conclusion (if because there really is no alternative explanation which would remain inside the boundaries of logic, rationality, or just common sense):

|

|

| For what reasons are reserves inferior to T-bills? Basically, reserves can be held only by a restricted set of financial institutions, while T-bills are more widely held and are useful as collateral in financial transactions (e.g., repurchase agreements) in ways that reserves are not. emphasis added

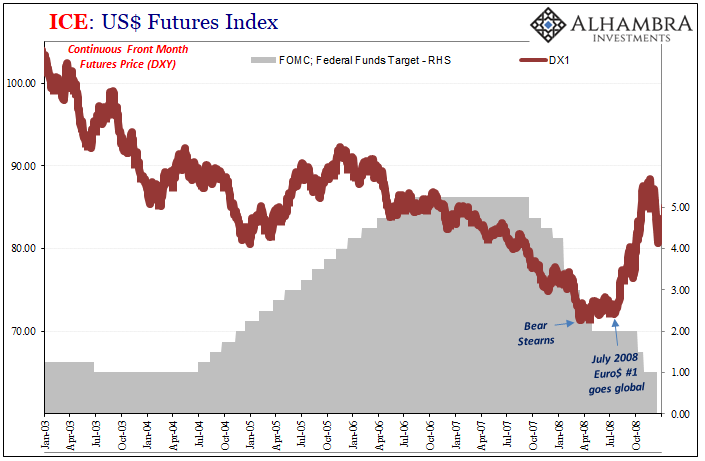

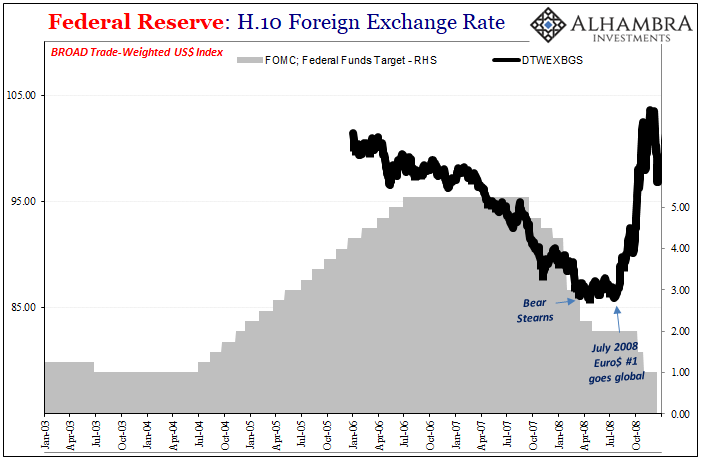

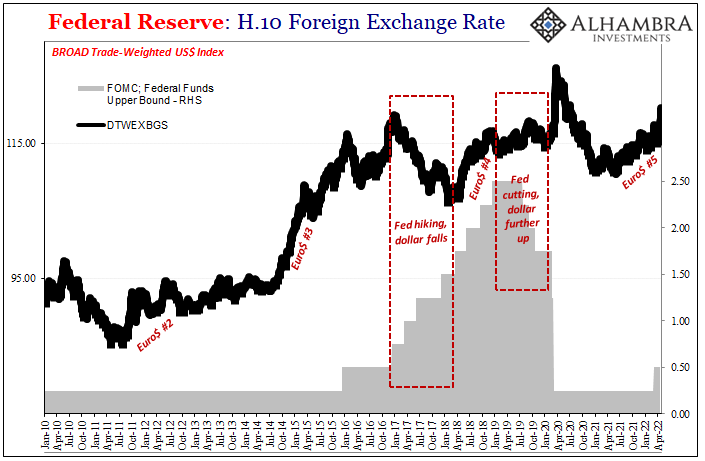

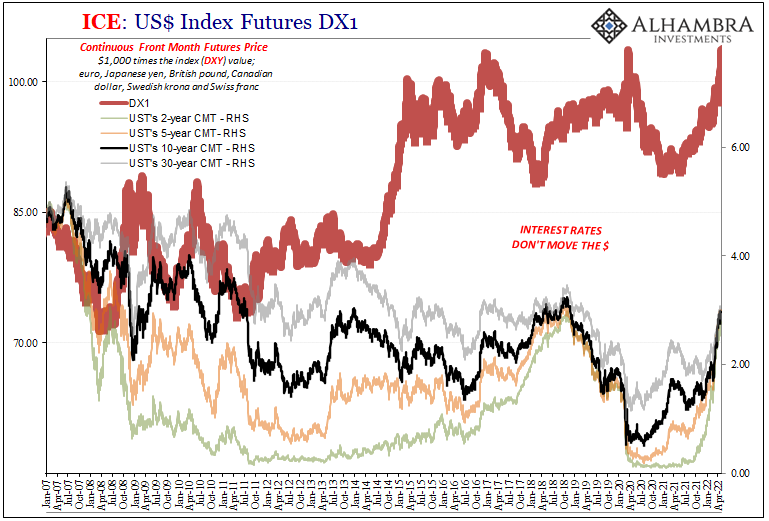

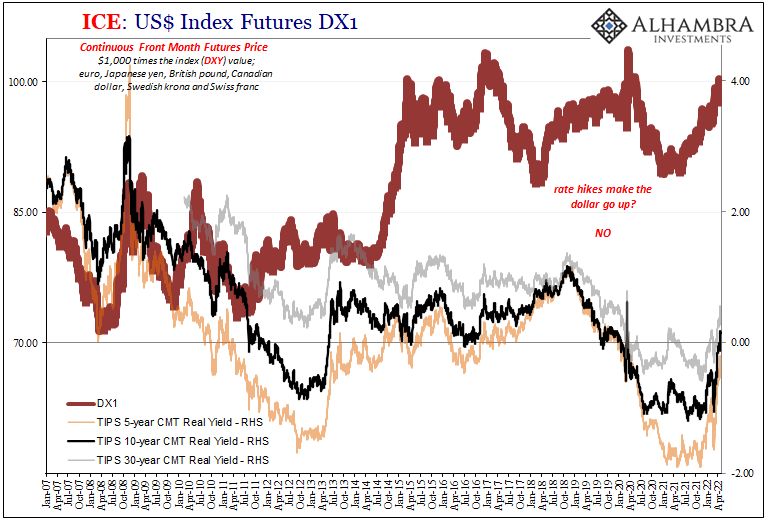

A clear and obvious liquidity premium on the best of the best (of the best) collateral. But if this Fed guy figured it out, why almost five years later does there continue to be no policy consideration for collateral let alone any mainstream talk about these clear, and clearly dangerous, shortfall situations? It’s all about the puppet show. Top-level policymakers still, to this very day, believe that they can convince the world to dance to their tune; playing the federal funds “market” as the sole instrument in the accompanying FOMC Orchestra. The intended audience for this pitiful display includes, ridiculously, collateral suppliers and multipliers. That very fact alone gives it away. No one uses nor really cares about fed funds except those in the media who then give the public a distinct monetary impression that is plainly false. This illiteracy even goes so far as to have linked, in the public mind, the Fed’s fetish for fed funds with the mighty movements of the almighty dollar. Even now, you’ll hear it said that the dollar goes up because of rate hikes to either the FOMC’s fed funds target (pre-2009) or its range plus instruments (like RRP and IOER). The Fed does not matter. Only Euro$. |

|

| No matter how you slice it, there’s nothing holding rate hikes (or cuts) under the dollar’s movements. Whether the period leading up to the first Global Financial Crisis (GFC1, or Euro$ #1) or after, there’s far more contrary than not (especially GFC1’s second and more destructive half; the Fed was cutting fed funds target, the dollar was screaming higher, and collateral went from scarce to short to oh my god).

But because only some Fed staffers have been let witness the truth without any media outlet, the dollar and all its facets (meaning global money) remain a total public mystery. The Fed sure didn’t influence it, nor actual monetary sufficient in any wider sense, during 2017 and 2018, either. |

|

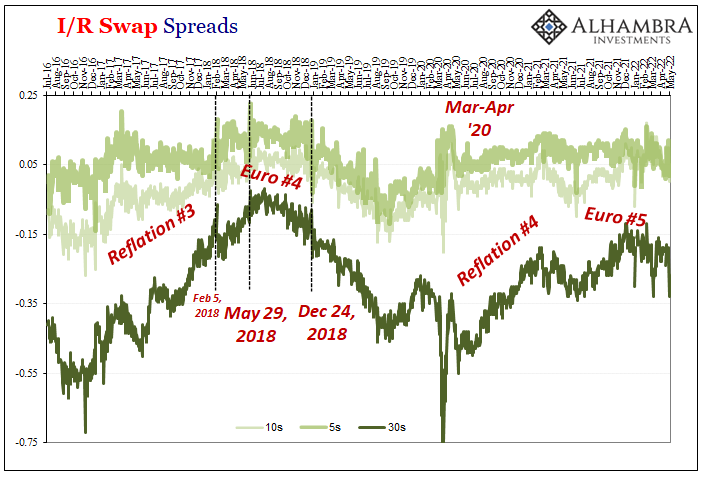

| On the contrary, an entirely fragile system, as shown by T-bills and RRP (or IOER) was left alone too long until a spark (September 5, 2017) lit the fuse which finally erupted (January 2018) into Euro$ #4. By then, it wasn’t one thing like bills/RRP, it quickly became known via everything. Markets as well as global economic data once the global economy suffered enough from the effects.

The mainstream misconception is also intended to address why or how the “unexpected” increase in the dollar’s exchange value happens when “everyone” “knows” its inflationary destruction is imminent. |

|

| In fact, that’s one reason to wrongly go back to rate hikes as a way to avoid having to reconcile these gross inconsistencies. | |

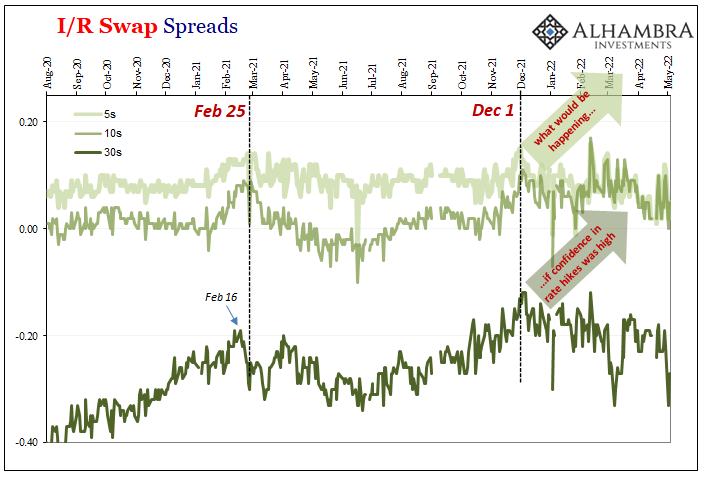

| And here we are all over again. While everyone is purposefully focused on rate hikes to explain the dollar’s decidedly worsening not-inflation trend, reinforcing the narrative about how good the puppet show can be, bill yields started last year with their own 2017-ish warning. Unlike 2018, bills continue to play a huge role in expanding the alarm; one that has been picked up already far and wide.

Euro$ #5, not rate hikes. Collateral is money, not bank reserves. If you go far enough inside the Fed, very quietly, devoid of every bit of fanfare, some’ll even tell you the same thing. |

|

Tags: bank reserves,Bonds,collateral,collateral scarcity,currencies,dollar,DXY,economy,EuroDollar,Featured,federal funds,Federal Reserve/Monetary Policy,FOMC,ioer,Markets,newsletter,QE,QT,rate hikes,repo,T-Bills,US dollar