Tag Archive: Precious Metals

To Frexit or Not to Frexit – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold-Silver Divergence – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold – An Overview of Macroeconomic Price Drivers

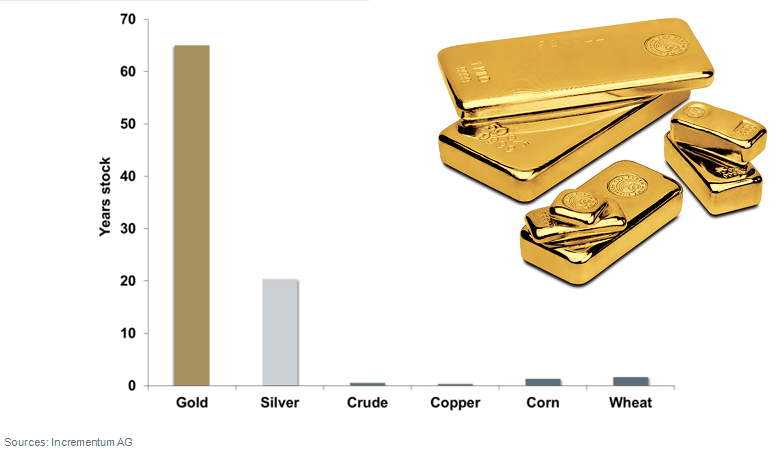

Fundamental Analysis of Gold. As we often point out in these pages, even though gold is currently not the generally used medium of exchange, its monetary characteristics continue to be the main basis for its valuation. Thus, analysis of the gold market requires a different approach from that employed in the analysis of industrial commodities (or more generally, goods that are primarily bought and sold for their use value).

Read More »

Read More »

Mea Culpa – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Strange Moves in Gold, Federal Reserve Policy and Fundamentals

Something odd happened late in the day in Wednesday’s trading session, which prompted a number of people to mail in comments or ask a question or two. Since we have discussed this issue previously, we decided this was a good opportunity to briefly elaborate on the topic again in these pages.

Read More »

Read More »

The Balance of Gold and Silver – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

The Market Has Its Head Buried Deep In The Sand

Several “black swans” are looming which could inflict a financial nuclear accident on the U.S. markets and financial system. I say “black swans” in quotes because a limited audience is aware of these issues – potentially catastrophic problems that are curiously ignored by the mainstream financial media and financial markets.

Read More »

Read More »

Putting Pennies in the Fuse Box – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Technical vs. Fundamental Analysis – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Digital Gold – For Now Caveat Emptor

Bitcoin surpasses gold price - a psychological and arbitrary headline. Royal Mint blockchain gold asks you to trust in the UK government. Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers. Invest in a gold mine using cryptocurrency - but wait until 2022 for your gold and trust the miners that it is there. Blockchain and gold will likely make a "good...

Read More »

Read More »

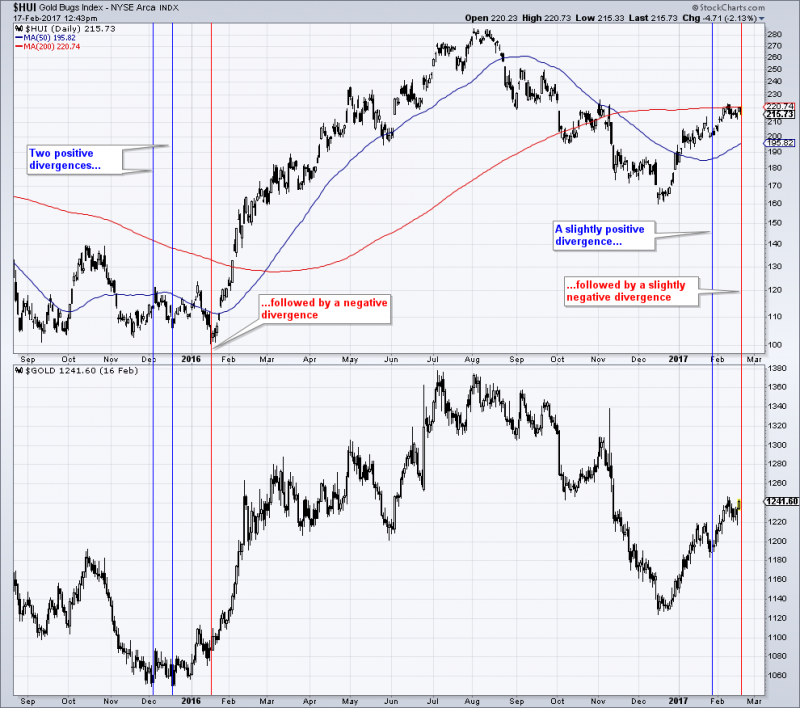

Gold Sector: Positioning and Sentiment

When last we wrote about the gold sector in mid February, we discussed historical patterns in the HUI following breaches of its 200-day moving average from below. Given that we expected such a breach to occur relatively soon, the post turned out to be rather ill-timed. Luckily we always advise readers that we are not exactly Nostradamus (occasionally our timing is a bit better).

Read More »

Read More »

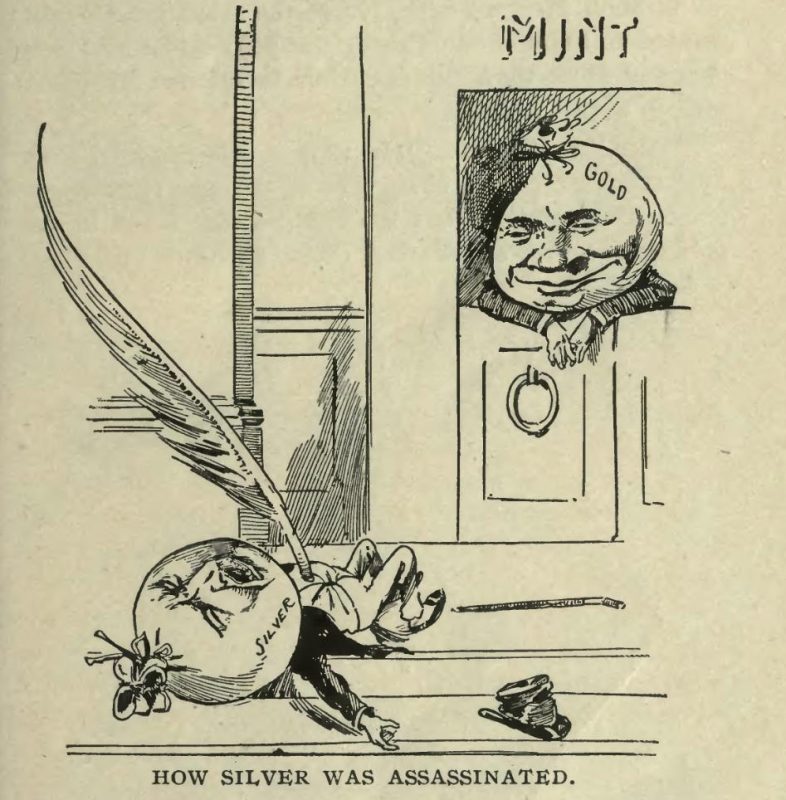

Why Silver Went Down – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

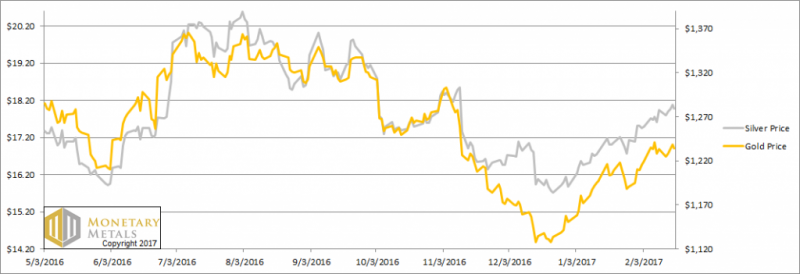

Gold and the Fed’s Looming Rate Hike in March

Long Term Technical Backdrop Constructive. After a challenging Q4 in 2016 in the context of rising bond yields and a stronger US dollar, gold seems to be getting its shine back in Q1. The technical picture is beginning to look a little more constructive and the “reflation trade”, spurred on further by expectations of higher infrastructure spending and tax cuts in the US, has thus far also benefited gold.

Read More »

Read More »

They’re Worried You Might Buy Bitcoin or Gold – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Importance of Hiding Gold Creatively and Securely If Taking Delivery

Why gold retains value? Interesting unknown gold facts. "Prepare your jaws for a sizeable drop!" History, finite, rare and peak gold. "It is beautiful to look at...". 'Heavy metal' - Thud sound of a gold bar (kilo). 'Going for gold' - Olympic gold medals to Chelthenham 'Gold Cup'.

Read More »

Read More »

The Gold-Silver Ratio Curiously Failed to Fall – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold Sector Update – What Stance is Appropriate?

We wanted to post an update to our late December post on the gold sector for some time now (see “Gold – Ready to Spring Another Surprise?” for the details). Perhaps it was a good thing that some time has passed, as the current juncture seems particularly interesting. We received quite a few mails from friends and readers recently, expressing concern about the inability of gold stocks to lead, or even confirm strength in gold of late. In light of...

Read More »

Read More »

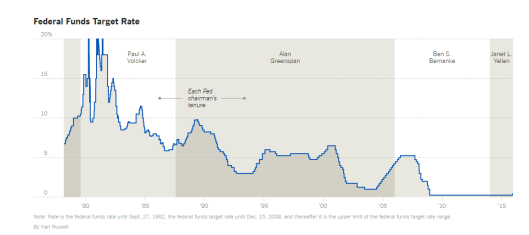

Are Rate Hikes Bad For Gold?

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other. Let’s take the fist chart and see what correlations exist between rate hikes and the US dollar index.

Read More »

Read More »

Don’t Short This Dog – Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Silver Futures Market Assistance – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

12 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Bitcoin: Ich kaufe JETZT!

Bitcoin: Ich kaufe JETZT! -

Was kocht man einem Multimillionär?

-

15 Minuten Stadt wird Realität! Oxford Testlauf | Ernst Wolff Aktuell

15 Minuten Stadt wird Realität! Oxford Testlauf | Ernst Wolff Aktuell -

Paukenschlag in Budapest: Maja T. erwartet URTEIL schon Mittwoch!

Paukenschlag in Budapest: Maja T. erwartet URTEIL schon Mittwoch! -

2-2-26 Bears Are an Endangered Species

2-2-26 Bears Are an Endangered Species -

Vor 5 Minuten: ADAC Präsident tritt zurück! 60.000 Kündigungen!

Vor 5 Minuten: ADAC Präsident tritt zurück! 60.000 Kündigungen! -

UN 20% DE LOS INMIGRANTES NO TRABAJA

UN 20% DE LOS INMIGRANTES NO TRABAJA -

Berlin SCHOCK: “60% der Wärmepumpen zerstört”!!!

Berlin SCHOCK: “60% der Wärmepumpen zerstört”!!! -

Swiss bank Julius Bär posts lower profits

Swiss bank Julius Bär posts lower profits -

Michael Burry warnt, das ist passiert

Michael Burry warnt, das ist passiert

More from this category

A new era for silver?

A new era for silver?28 Aug 2024

A perfect storm in the making

A perfect storm in the making 15 Feb 2024

Gold Hits New All Time Highs

Gold Hits New All Time Highs2 Nov 2023

This Will Be The Biggest Theft of This Century

This Will Be The Biggest Theft of This Century10 Feb 2023

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton27 Oct 2022

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!16 Oct 2022

Rick Rule – Gold Helps Me Sleep at Night

Rick Rule – Gold Helps Me Sleep at Night14 Oct 2022

Were the UK pension funds just the canary in the gold mine?

Were the UK pension funds just the canary in the gold mine?9 Oct 2022

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!5 Oct 2022

Episode 5 of The M3 Report with Steve St. Angelo

Episode 5 of The M3 Report with Steve St. Angelo28 Sep 2022

US CPI Data Release Update

US CPI Data Release Update17 Sep 2022

What Problem Does Gold Solve?

What Problem Does Gold Solve?14 Sep 2022

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks10 Sep 2022

When markets forget that Central Banks cannot fix the world with interest rates

When markets forget that Central Banks cannot fix the world with interest rates4 Sep 2022

The Russian Gold Standard

The Russian Gold Standard28 Aug 2022

History Of Money and Evolution Suggests a Crash is Coming

History Of Money and Evolution Suggests a Crash is Coming27 Aug 2022

Why we couldn’t be happier that gold is boring

Why we couldn’t be happier that gold is boring23 Aug 2022

More energy blows are dealt to Europe, causing a cold chill to be even colder

More energy blows are dealt to Europe, causing a cold chill to be even colder13 Aug 2022

Will Silver Prices Go Up to $300?

Will Silver Prices Go Up to $300?11 Aug 2022

A muddled message from The Fed

A muddled message from The Fed29 Jul 2022