Tag Archive: Precious Metals

Silver Speculators Gone Wild – Precious Metals Supply and Demand

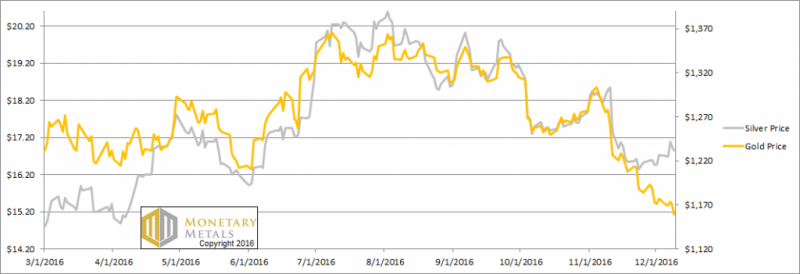

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Adventures in Currency Debasement

The U.S. dollar, as measured by the dollar index, has generally gone up since mid-2014. The dollar index goes up when the U.S. dollar gains strength (value) against a basket of currencies, including the euro, yen, pound, and several others. Conversely, the dollar index goes down when the U.S. dollar loses value.

Read More »

Read More »

Switzerland’s Gold Exports To China Surge To 158 Tons In December

Switzerland's Gold Exports To China Surge To 158 Tonnes In December. Switzerland's gold bullion exports to China saw a huge jump in December, climbing to 158 tons versus a much lower 30.6 tons in November - a jump of 416%.

Read More »

Read More »

The Trump Weak Dollar Report – Precious Metals Supply and Demand

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

A Hint of Gold Backwardation

Keith Weiner’s weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold Bars Worth $800,000 Owned By Prince

Gold Bars Worth $800,000 Owned By Prince. Prince, RIP, owned gold bars worth just over $800,000 according to the statement filed in a Minnesota court last Friday.

Read More »

Read More »

Silver’s Got Fundamentals – Precious Metals Supply-Demand Report

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Gold Price In GBP Up 4 percent On Brexit and UK Risks

Gold Price In GBP Rises 4% On Brexit and UK Economy Risks. Pound fell 2% against gold yesterday after Theresa May created Brexit concerns. May's 'Hard Brexit' denial does not calm markets growing fears. Investors concerned about lack of government strategy and uncertainty. UK Prime Minister bizarrely blames media and "those who print things" for sterling depreciation. GBP gold builds on 31% gain in 2016 with 4% gain so far in 2017.

Read More »

Read More »

Gold Rises In All Currencies In 2016 – 9 percent In USD, 13 percent In EUR and 31.5 percent In GBP

Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY. Gold gains in CNY, INR & most emerging market currencies. Gold surges 31.5% in British pounds after Brexit shock. Gold acted as hedge and safe haven in 2016 … for those who need safe haven. Furthers signs of market having bottomed and bodes well for 2017. What drivers will gold respond to in 2017? EU elections and contagion risk, Geo-politics, terrorism, war and cyber war. Outlook for gold good...

Read More »

Read More »

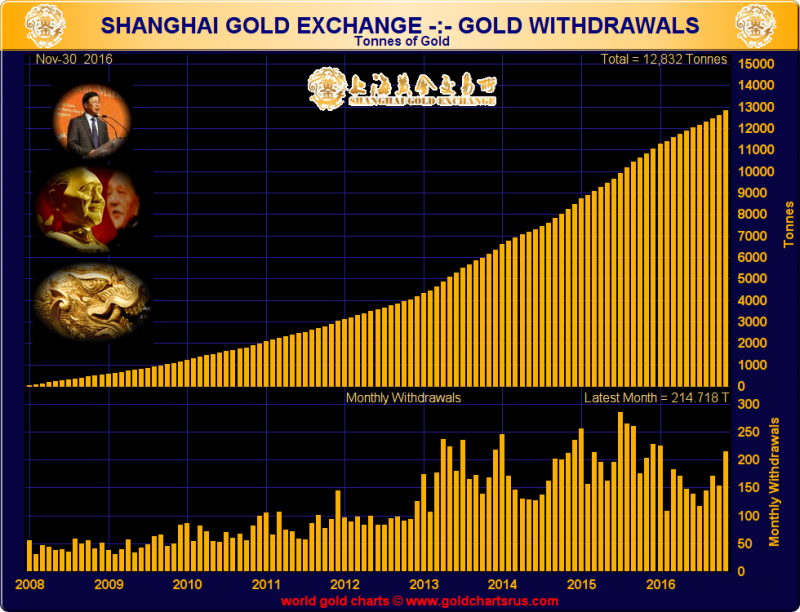

Gold Market Charts – A Month in Review

BullionStar has recently started a new series of posts highlighting charts relating to some of the most important gold markets, gold exchanges and gold trends around the world. The posts include charts of the Chinese Gold Market, the flow of gold from West to East via the London and Swiss gold markets, and the holdings of gold-backed Exchange Traded Funds (ETFs).

Read More »

Read More »

Gold – Ready to Spring Another Surprise

Below is an update of a number of interesting data points related to the gold market. Whether “interesting” will become “meaningful” remains to be seen, as most of gold’s fundamental drivers aren’t yet bullishly aligned.

Read More »

Read More »

As Central Bankers Spin

I know that I resemble the old guy in this cartoon, standing by helplessly as I watch central bankers experiment with the global economy. Bubbles are blown, again, in several asset classes. Negative interest rates have become an acceptable concept, as if they are just words and have no real economic meaning.

Read More »

Read More »

Fed Rate Hike Causes Gold Price Drop

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

The Seasonal Trends of Precious Metals

Long Term Seasonal Price Trends Prices in financial and commodity markets are exhibiting seasonal trends. This applies to the precious metals gold, silver, platinum and palladium as well. The chart below depicts the seasonal trends of the gold price over a time period of 45 years.

Read More »

Read More »

Friction and Gravity

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

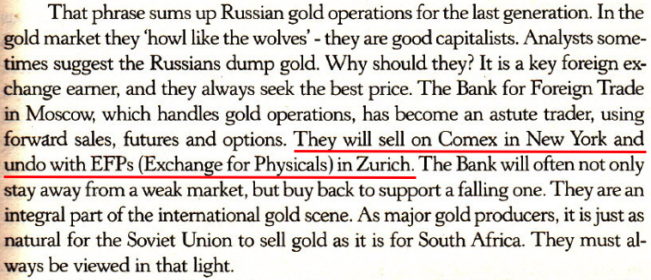

Gold In London And Hong Kong Is Used To Settle COMEX Futures

Physical gold located in Hong Kong and London is used to settle COMEX gold futures contracts through “Exchange For Physical” trading in the over-the-counter market. This post is a sequel to Understanding GOFO And The Gold Wholesale Market and COMEX Gold Futures Can Be Settled Directly With Eligible Inventory - in which Exchange For Physical (EFP) trading is explained and how it can increase or decrease open interest at the COMEX.

Read More »

Read More »

Gold Price Skyrockets in India after Currency Ban – Part V

India’s Prime Minister announced on 8th November 2016 that Rs 500 and Rs 1,000 banknotes will no longer be legal tender. Linked are Part-I, Part-II, Part-III, and Part-IV, which provide updates on the rapidly encroaching police state

Read More »

Read More »

Dang It! Gold was Supposed to Go Up! Precious Metals Supply and Demand

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

Good News and Bad News – Precious Metals Supply/Demand Report

Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price.

Read More »

Read More »

A Note on Gold and India – What is Driving the Gold Price?

It is well-known that India’s government wants to coerce its population into “modernizing” its financial behavior and abandoning its traditions. The recent ban on large-denomination banknotes was not only meant to fight corruption. In fact, as our friend Jayant Bhandari has pointed out, fresh avenues for corruption immediately opened up upon enactment of the ban (see “Gold Price Skyrockets in India After Currency Ban” – Part 1, Part 2 and Part...

Read More »

Read More »

Donate to SNBCHF.com

Donate to SNBCHF.com Via Paypal or Bitcoin To Help Keep the Site Running

Please consider making a small donation to Snbchf.com. Thanks

Bitcoin wallet: bc1qa2h6hgd0xkuh7xh02jm5x25k6x8g7548ffaj3j

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

USD/CHF stays above 0.9100 nearing the highs since October

4 days ago -

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

4 days ago -

Pound Sterling falls back as upbeat US Retail Sales strengthen US Dollar

4 days ago -

Canadian Dollar remains vulnerable after strong US Retail Sales

4 days ago -

2024-04-09 – Martin Schlegel: Interest rates and foreign exchange interventions: Achieving price stability in challenging times

10 days ago

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 17.0 billion francs compared to the previous week

4 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Gold Buying Ramps Up Globally, but Silver Could Get Interesting

Gold Buying Ramps Up Globally, but Silver Could Get Interesting -

Boost Your Savings: Strategies for the Accumulation and Distribution Phases

Boost Your Savings: Strategies for the Accumulation and Distribution Phases -

4-19-24 Did You Pay Your Fair Share of Taxes?

4-19-24 Did You Pay Your Fair Share of Taxes? -

Swiss Fintech Awards 2024 Announce Top 10 Swiss Fintech Startups

Swiss Fintech Awards 2024 Announce Top 10 Swiss Fintech Startups -

Navigating Market Bubbles and Lessons on Shorts – Andy Tanner

Navigating Market Bubbles and Lessons on Shorts – Andy Tanner -

Is The Gold Price Too High To Buy? The Train Hasn’t Left The Station!

Is The Gold Price Too High To Buy? The Train Hasn’t Left The Station! -

Understanding the Recent Inflation Spike and the Federal Reserve’s Reaction

Understanding the Recent Inflation Spike and the Federal Reserve’s Reaction -

Mit dem Flugzeug pendeln, um Miete zu sparen? ️ #pendeln

Mit dem Flugzeug pendeln, um Miete zu sparen? ️ #pendeln -

Mein YouTube Einnahmen: Totale Transparenz

Mein YouTube Einnahmen: Totale Transparenz -

Renato Moicano Cares About His Country More Than Sohrab Ahmari

More from this category

A perfect storm in the making

A perfect storm in the making 15 Feb 2024

Gold Hits New All Time Highs

Gold Hits New All Time Highs2 Nov 2023

This Will Be The Biggest Theft of This Century

This Will Be The Biggest Theft of This Century10 Feb 2023

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton

[Video] Gold in 2023 Will Be Driven by Real Rates – Mike Singleton27 Oct 2022

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!

Ben Bernanke Wins Nobel Prize for Kicking Can Down the Road!16 Oct 2022

Rick Rule – Gold Helps Me Sleep at Night

Rick Rule – Gold Helps Me Sleep at Night14 Oct 2022

Were the UK pension funds just the canary in the gold mine?

Were the UK pension funds just the canary in the gold mine?9 Oct 2022

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!

Ed Steer Gold And Silver – We Ain’t Seen Nothing Yet!5 Oct 2022

Episode 5 of The M3 Report with Steve St. Angelo

Episode 5 of The M3 Report with Steve St. Angelo28 Sep 2022

US CPI Data Release Update

US CPI Data Release Update17 Sep 2022

What Problem Does Gold Solve?

What Problem Does Gold Solve?14 Sep 2022

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks10 Sep 2022

When markets forget that Central Banks cannot fix the world with interest rates

When markets forget that Central Banks cannot fix the world with interest rates4 Sep 2022

The Russian Gold Standard

The Russian Gold Standard28 Aug 2022

History Of Money and Evolution Suggests a Crash is Coming

History Of Money and Evolution Suggests a Crash is Coming27 Aug 2022

Why we couldn’t be happier that gold is boring

Why we couldn’t be happier that gold is boring23 Aug 2022

More energy blows are dealt to Europe, causing a cold chill to be even colder

More energy blows are dealt to Europe, causing a cold chill to be even colder13 Aug 2022

Will Silver Prices Go Up to $300?

Will Silver Prices Go Up to $300?11 Aug 2022

A muddled message from The Fed

A muddled message from The Fed29 Jul 2022

When Rock begins to beat Paper

When Rock begins to beat Paper24 Jul 2022