Tag Archive: On Economy

The Recline and Flail of Western Civilization and Other 2019 Predictions

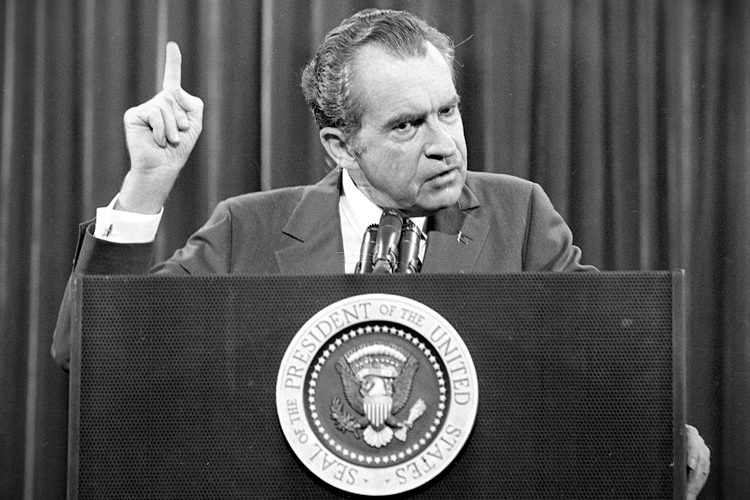

The Recline and Flail of Western Civilization and Other 2019 Predictions. “I think it’s a tremendous opportunity to buy. Really a great opportunity to buy.” – President Donald Trump, Christmas Day 2018. Darts in a Blizzard. Today, as we prepare to close out the old, we offer a vast array of tidings.

Read More »

Read More »

How Faux Capitalism Works in America

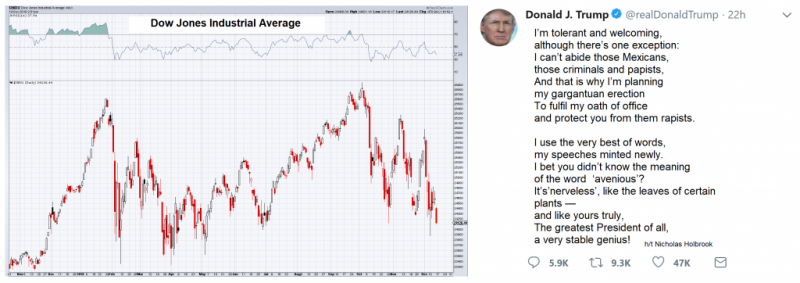

Stars in the Night Sky. The U.S. stock market’s recent zigs and zags have provoked much squawking and screeching. Wall Street pros, private money managers, and Millennial index fund enthusiasts all find themselves on the wrong side of the market’s swift movements. Even the best and brightest can’t escape President Trump’s tweet precipitated short squeezes.

Read More »

Read More »

Pushing Past the Breaking Point

Schemes and Shams. Man’s willful determination to resist the natural order are in vain. Still, he pushes onward, always grasping for the big breakthrough. The allure of something for nothing is too enticing to pass up.

Read More »

Read More »

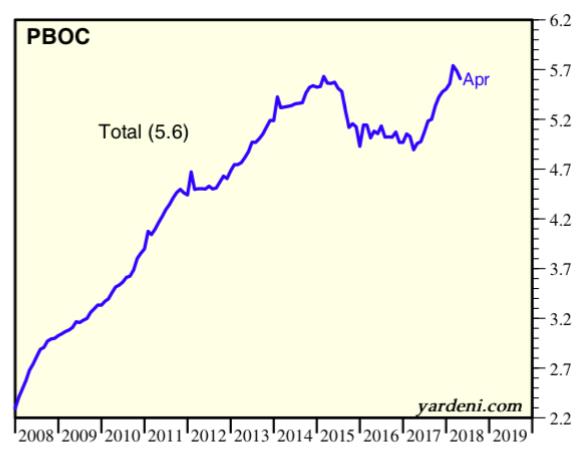

Eastern Monetary Drought

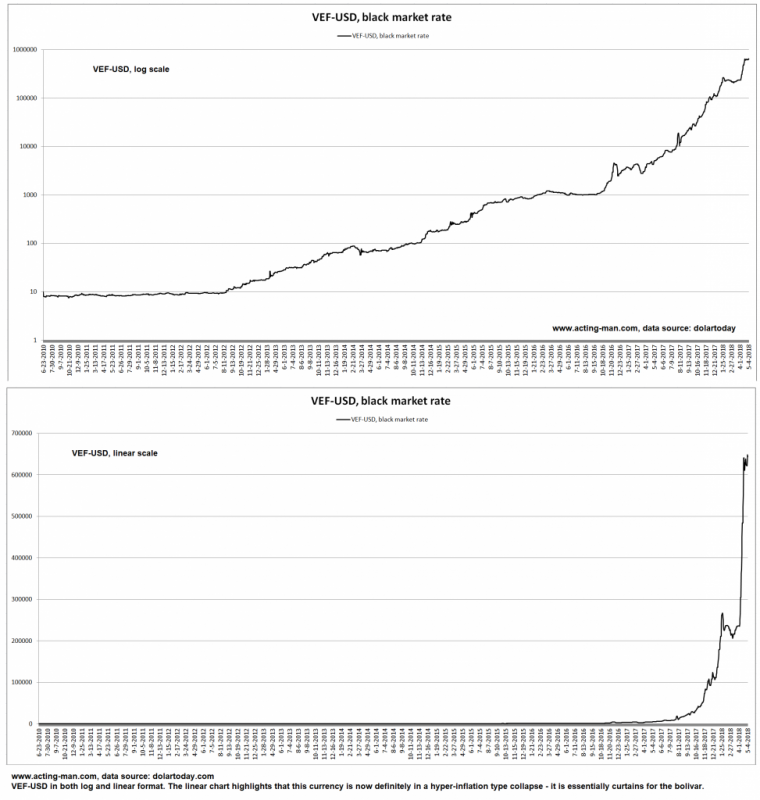

Looking back at the past decade, it would be easy to conclude that central planners have good reason to be smug. After all, the Earth is still turning. The “GFC” did not sink us, instead we were promptly gifted the biggest bubble of all time – in everything, to boot. We like to refer to it as the GBEB (“Great Bernanke Echo Bubble”) in order to make sure its chief architect is not forgotten.

Read More »

Read More »

Switzerland, Model of Freedom & Wealth Moving East – Interviews with Claudio Grass

Last month our friend Claudio Grass, roving Mises Institute Ambassador and a Switzerland-based investment advisor specializing in precious metals, was interviewed by Sarah Westall for her Business Game Changers channel.

Read More »

Read More »

Seasonality in Cryptocurrencies – An Interesting Pattern in Bitcoin

The last time we discussed Bitcoin was in May 2017 when we pointed out that Bitcoin too suffers from seasonal weakness in the summer. We have shown that a seasonal pattern in Bitcoin can be easily identified. More than a year has passed since then and readers may wonder why we have not addressed the topic again.

Read More »

Read More »

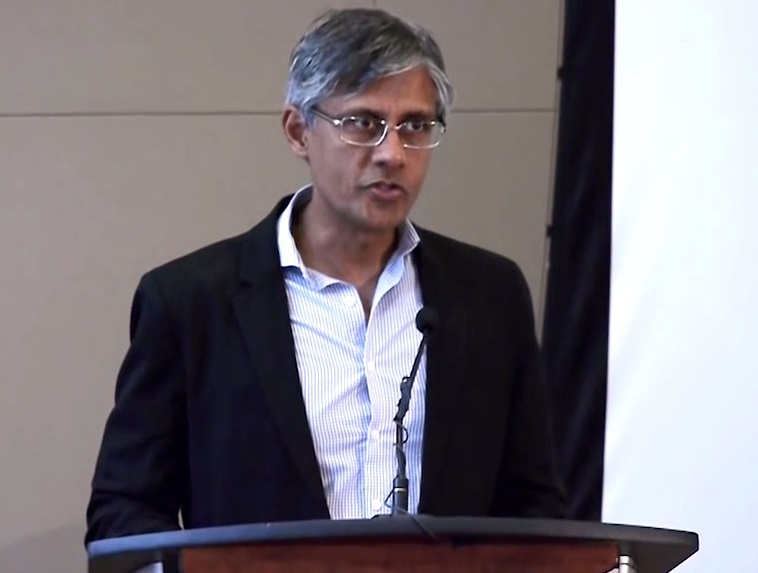

Jayant Bhandari – The US Dollar vs. Other Currencies and Gold

Maurice Jackson Speaks with Jayant Bhandari About Emerging Market Currencies, the Trade War, US Foreign Policy and More. Maurice Jackson of Proven & Probable has recently conducted a new interview with our friend and occasional contributor to this site, Jayant Bhandari, who is inter alia the host of the annual Capitalism and Morality seminar.

Read More »

Read More »

A Fake Brexit and the “Noble Dream” – Claudio Grass Speaks With Godfrey Bloom

Introductory Remarks: The “Anti-Politician” Godfrey Bloom, by PT

Most of our readers will probably remember former UKIP chief whip and European Parliament representative Godfrey Bloom. As far as we know, he is the only politician who ever raised the issue of the workings of the fractionally reserved central bank-directed monetary system in the EU parliament. This system is of course central to the phenomenon of the recurring boom-bust sequences...

Read More »

Read More »

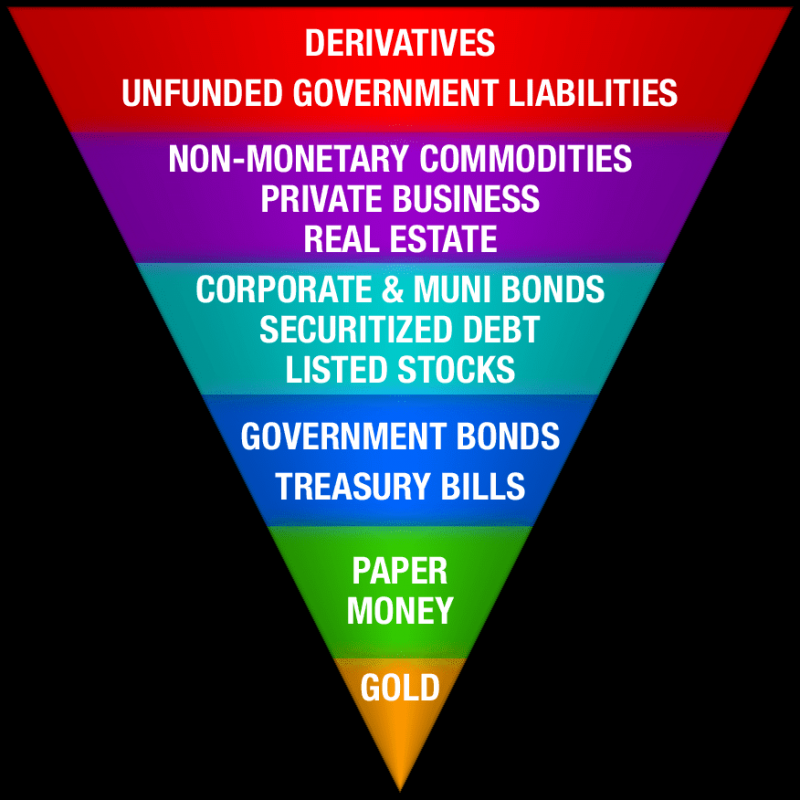

An Inquiry into Austrian Investing: Profits, Protection and Pitfalls

“From a marketing perspective it pays to be overconfident, especially in the short term. The higher your conviction the easier it will be to market your investment ideas. I think the Austrian School is at a disadvantage here because it’s more difficult to be confident about your qualitative predictions and even in terms of investment advice it is particularly difficult to be confident in these times because we don’t really have any historical...

Read More »

Read More »

A Scramble for Capital

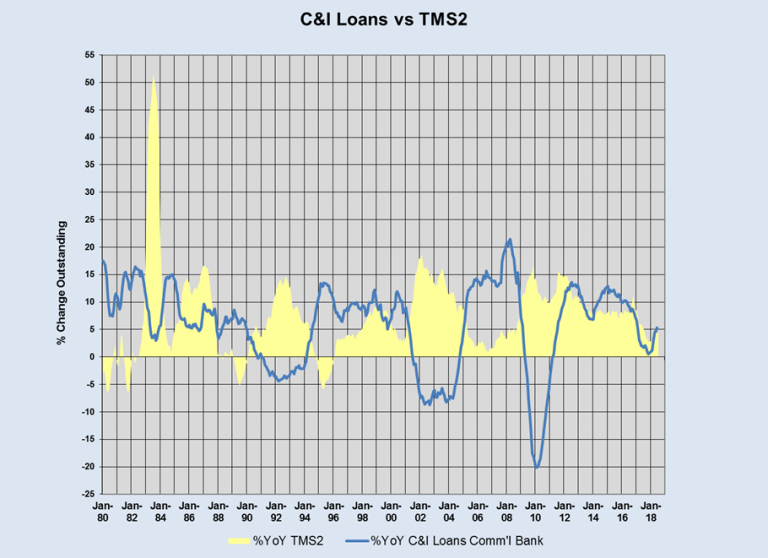

A Spike in Bank Lending to Corporations – Sign of a Dying Boom? As we have mentioned on several occasions in these pages, when a boom nears its end, one often sees a sudden scramble for capital. This happens when investors and companies that have invested in large-scale long-term projects in the higher stages of the production structure suddenly realize that capital may not be as plentiful as they have previously assumed.

Read More »

Read More »

US Money Supply and Fed Credit – the Liquidity Drain Becomes Serious

Our good friend Michael Pollaro, who keeps a close eye on global “Austrian” money supply measures and their components, has recently provided us with a very interesting update concerning two particular drivers of money supply growth. But first, here is a chart of our latest update of the y/y growth rate of the US broad true money supply aggregate TMS-2 until the end of June 2018 with a 12-month moving average.

Read More »

Read More »

Merger Mania and the Kings of Debt

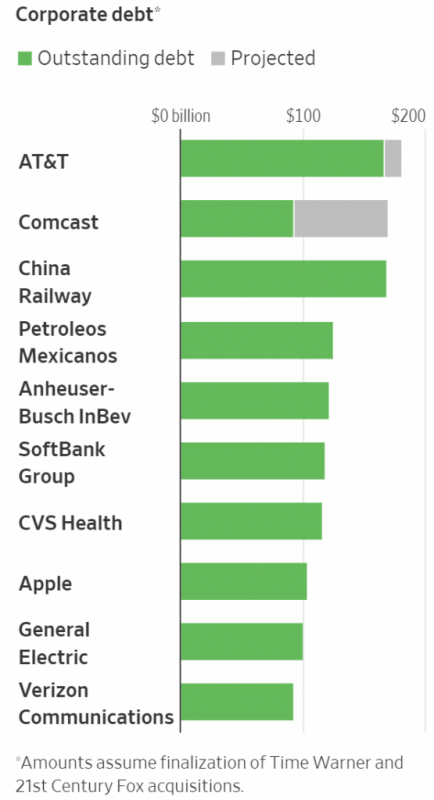

Another Early Warning Siren Goes Off. Our friend Jonathan Tepper of research house Variant Perception (check out their blog to see some of their excellent work) recently pointed out to us that the volume of mergers and acquisitions has increased rather noticeably lately. Some color on this was provided in an article published by Reuters in late May, “Global M&A hits record $2 trillion in the year to date”, which inter alia contained the following...

Read More »

Read More »

How to Get Ahead in Today’s Economy

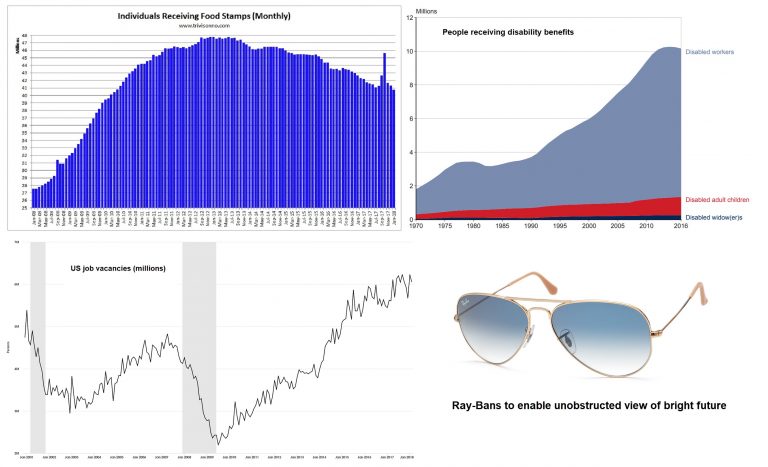

This week brought forward more evidence that we are living in a fabricated world. The popular story-line presents a world of pure awesomeness. The common experience, however, falls grossly short. On Tuesday, for example, the Labor Department reported there were a record 6.6 million job openings in March. Based on the Labor Department’s data, there were enough jobs available – exactly – for the 6.6 million Americans who were actively looking for a...

Read More »

Read More »

US Money Supply Growth Jumps in March , Bank Credit Growth Stalls

There was a sizable increase in the year-on-year growth rate of the true US money supply TMS-2 between February and March. Note that you would not notice this when looking at the official broad monetary aggregate M2, because the component of TMS-2 responsible for the jump is not included in M2. Let us begin by looking at a chart of the TMS-2 growth rate and its 12-month moving average.

Read More »

Read More »

The Capital Structure as a Mirror of the Bubble Era

As long time readers know, we are looking at the economy through the lens of Austrian capital and monetary theory (see here for a backgrounder on capital theory and the production structure). In a nutshell: Monetary pumping falsifies interest rate signals by pushing gross market rates below the rate that reflects society-wide time preferences.

Read More »

Read More »

From Fake Boom to Real Bust

More is revealed with each passing day. You can count on it. But what exactly the ‘more is of’ requires careful discrimination. Is the ‘more’ merely more noise? Or is it something of actual substance? Today we endeavor to pass judgment, on your behalf.

Read More »

Read More »