Tag Archive: newslettersent

Currywurst? That’ll be 0.0019 bitcoins please

The traditional favourite snack of late night revellers - the currywurst, or curried sausage – has just entered the digital world. It can now be paid for using the cryptocurrency bitcoin in Switzerland. The Wurst & Moritzexternal link company has responded to repeated demand from customers to spend their hard-earned bitcoins in its restaurants in Zurich and Bern.

Read More »

Read More »

Christopher Columbus and the Falsification of History

The Los Angeles City Council’s recent, crazed decision* to replace Christopher Columbus Day with one celebrating “indigenous peoples” can be traced to the falsification of history and denigration of European man which began in earnest in the 1960s throughout the educational establishment (from grade school through the universities), book publishing, and the print and electronic media.

Read More »

Read More »

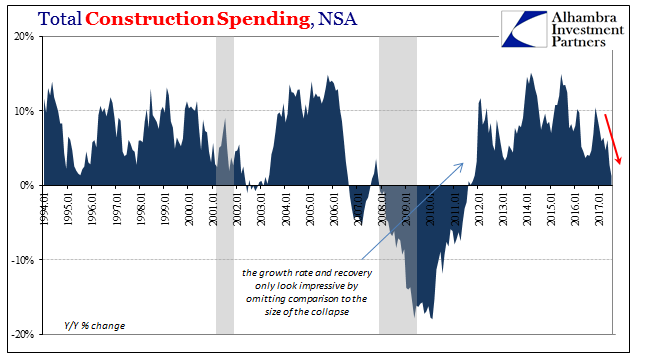

Now Capex?

Of all the high frequency data the Personal Savings Rate is probably the least reliable. It is subject to both regular and benchmark revisions that can change the estimates drastically one way or the other. One step up from that statistic is the figures for Construction Spending. The initial monthly estimates don’t survive very long, and lately they have been quite weak in the first run only to be revised sharply higher over subsequent months.

Read More »

Read More »

Les banques centrales deviennent omnipotentes sur les marchés financiers.

Tel Atlas soutenant le monde, les banques centrales portent sur leurs épaules le marché financier. Cette réalité demeure largement occultée, mais elle détermine pourtant massivement l’avenir de nos économies. Nous avions déjà évoqué ce sujet l’année dernière (Les banques centrales commencent-elles à nationaliser l’économie ?). Il importe d’y revenir car de nouveaux chiffres confirment cette bizarrerie, puisque selon Goldman Sachs, elles détiennent...

Read More »

Read More »

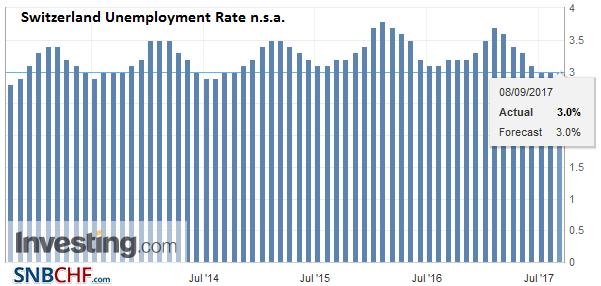

Switzerland Unemployment in August 2017: Remained unchanged at 3.0 percent, seasonally adjusted remains at 3.2 percent

Registered unemployment in August 2017 - At the end of August 2017 135'578 unemployed persons were registered at the Regional Employment Services Centers (RAV), according to the SECO (State Secretariat for Economic Affairs), 1'652 more than in the previous month. The unemployment rate remained at 3.0% in the reporting month. Compared to the previous month, unemployment decreased by 7'280 persons (-5.1%).

Read More »

Read More »

FX Daily, September 08: US Dollar Tracks Yields Lower

The US dollar has been unable to find any traction as US yields continue to move lower. The US 10-year year is slipping below 2.03% in European turnover, the lowest level in ten months. The risk, as we have noted, is that without prospects of stronger growth and inflation impulses, the yield returns to where was before the US election (~1.85%). The two-year note yield, anchored more by Fed policy than the long-end, is also soft. It yielded 1.25%...

Read More »

Read More »

Switzerland’s home ownership illusion

When 10-year mortgage interest rates fall to 1%, home ownership becomes a very attractive alternative to renting. A recent report on home ownership shows why home ownership remains out of reach of the average Swiss household despite very low interest rates.The report, by Credit Suisse, says that despite the strong desire for people to own their own home, fewer and fewer households are able to afford them as the years go by.

Read More »

Read More »

Physical Gold In Vault Is “True Hedge of Last Resort” – Goldman Sachs

Physical gold is “the true currency of the last resort” – Goldman Sachs. “Gold is a good hedge against geopolitical risks when the event leads to a debasement of the dollar” . Trump and Washington risk bigger driver of gold than risks such as North Korea. Recent events such as N. Korea only explain fraction of 2017 gold price rally. Do not buy gold futures or ETFs rather “physical gold in a vault” [is] the “true hedge”.

Read More »

Read More »

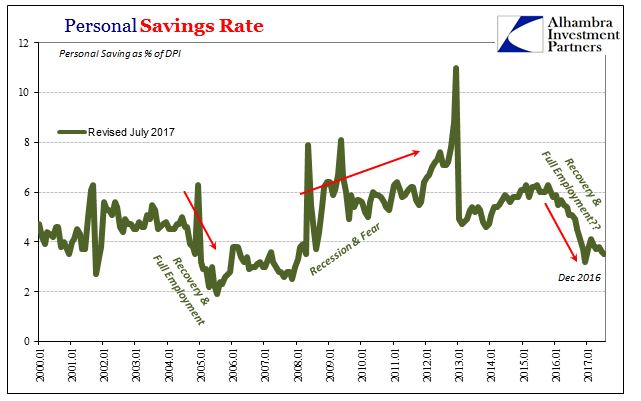

Toward The Housing Bubble, Or Great Depression?

During the middle 2000’s, one more curious economic extreme presented itself in an otherwise ocean of extremes. Though economists were still thinking about the Great “Moderation”, the trend for the Personal Savings Rate was anything but moderate, indicated a distinct lack of modesty on the part of consumers. In early 2006, the Bureau of Economic Analysis calculated that the rate had been negative for all of 2005. It was the first time in seventy...

Read More »

Read More »

Zuerst verdirbt die SNB unsere Jugend mit Irrlehren, dann lässt sie sie fallen

„Und sie dreht sich doch“ murmelte Galileo Galilei, nachdem ihn die Inquisitoren gezwungen hatten, dem kopernikanischen Weltbild abzuschwören. Dieses widerlegte die damalige heliozentrische Astronomie: Die Sonne drehe sich nicht um die Erde, sondern umgekehrt: Die Erde dreht sich um die Sonne. Eine kopernikanische Wende erleben wir zurzeit in der Geldtheorie: Die Volkswirtschaften drehen sich nicht um die Zentralbanken. Umgekehrt: Die Zentralbanken...

Read More »

Read More »

FX Daily, September 07: ECB Focus for Sure, but not Only Game in Town

The US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that have played down such expectations, and warn a decision on next year’s intentions may not be...

Read More »

Read More »

Swiss retailers called on to remove palm oil from their products

Two Swiss NGOs have started a petition calling for Swiss retailers to reduce or remove palm oil from their products. Present in many processed foods, cosmetics and detergents, the ingredient has a bad reputation. The NGOs Bread for All and the Swiss Catholic Lenten Fund want to see a reduction in palm oil consumption. They believe voluntary initiatives by the palm oil sector to clean up the industry have done nothing to address the real problems...

Read More »

Read More »

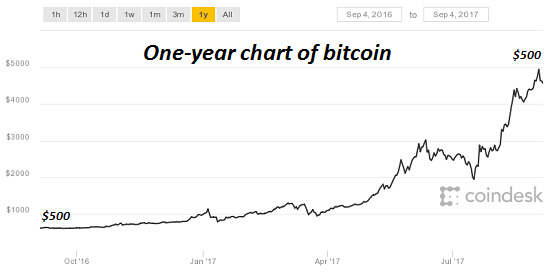

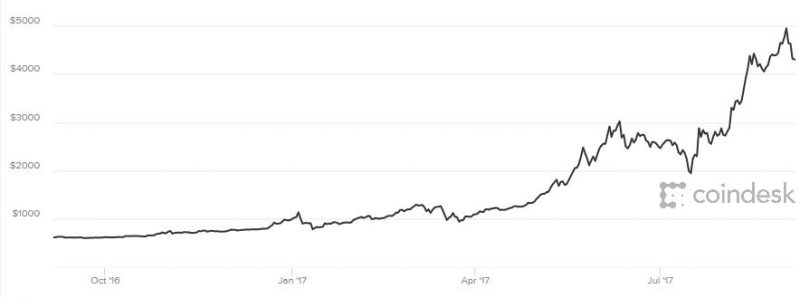

Bitcoin, Sour Grapes and the Institutional Herd

The point is institutional ownership of bitcoin is in the very early stages.

If I had a bitcoin for every time some pundit declared bitcoin is a bubble, I'd be a billionaire. There are three problems with opining that bitcoin and cryptocurrencies are bubblicious:

Read More »

Read More »

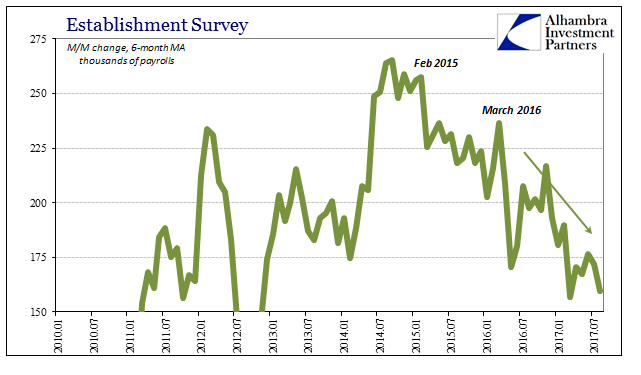

2017 Is Two-Thirds Done And Still No Payroll Pickup

The payroll report for August 2017 thoroughly disappointed. The monthly change for the headline Establishment Survey was just +156k. The BLS also revised lower the headline estimate in each of the previous two months, estimating for July a gain of only +189k. The 6-month average, which matters more given the noisiness of the statistic, is just +160k or about the same as when the Federal Reserve contemplated starting a third round of QE back in 2012.

Read More »

Read More »

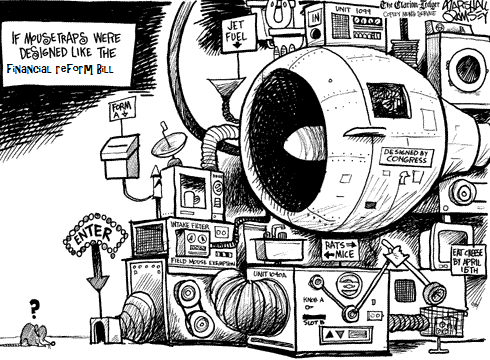

How to Make the Financial System Radically Safer

Clear thinking and discerning rigor when it comes to the twisted state of present economic policy matters brings with it many physical ailments. A permanent state of disbelief, for instance, manifests in dry eyes and droopy shoulders. So, too, a curious skepticism produces etched forehead lines and nighttime bruxism.

Read More »

Read More »

Dommage que Monnaie pleine ait omis de prévoir des mesures pour brider les risques que fait porter la BNS sur le contribuable.

Le peuple suisse va voter sur une initiative qui porte le nom de « monnaie pleine ». Cette initiative est partie du constat que les banques émettent de la monnaie scripturale dite monnaie-dette ou monnaie bancaire, et souhaite rendre la BNS seule responsable de la création monétaire, comme c’est d’ailleurs prévue par la Constitution.

Read More »

Read More »

FX Daily, September 06: Wake Me up when September Ends

The US dollar fell to new lows since mid-2015 against the Canadian dollar yesterday. It is flattish today as the market awaits the central bank's decision. We are concerned that given the strong performance and market positioning, a rate hike could spur "buy the rumor, sell the fact" activity. Alternatively, a disappointment if the Bank does not hike could also lead to some Canadian dollar sales.

Read More »

Read More »

Bitcoin Falls 20 percent as Mobius and Chinese Regulators Warn

Bitcoin falls 20% as Mobius and Chinese regulators warn. “Cryptocurrencies are beginning to get out of control” – warns respected investor Mark Mobius. Mobius believes governments will begin to clamp down on cryptocurrencies sparking rush to gold. Yesterday China’s PBOC ruled Initial Coin Offerings (ICOs) are illegal and all related activity to halt. China is home to majority of bitcoin miners.

Read More »

Read More »

Switzerland’s most expensive apartments in Zurich, Maloja and Lavaux

According to data from comparis.ch, Switzerland’s most expensive apartments are found in Zurich, Maloja – home to Saint-Moritz, and Lavaux-Oron. One square metre will cost you CHF 12,250 (US$ 13,000) in Zurich, CHF 11,500 in Maloja and CHF 11,250 in Lavaux-Oron. Lavaux-Oron contains posh parts of Greater Lausanne, such as Lutry, and the UNESCO-listed wine terraces of Lavaux on the shore of Lake Geneva.

Read More »

Read More »

Great Graphic: Young American Adults Living at Home

This Great Graphic caught our eye (h/t to Gregor Samsa @macromon). It comes from the US Census Department, and shows, by state, the percentage of young American adults (18-34 year-olds).The top map is a snap shot of from 2005. A little more than a quarter of this cohort lived at home. A decade later, and on the other side of the Great Financial Crisis, the percentage has risen to a little more than a third.

Read More »

Read More »