Tag Archive: newslettersent

Swiss industry has learned to live with strong franc

The recent appreciation of the Swiss franc has sent shockwaves through Swiss firms, resulting in job losses and lower research budgets. But viewed long-term, Switzerland’s export-driven economy has adapted remarkably well to a strong currency.

Read More »

Read More »

Switzerland drops in international pension ranking

The Swiss pension system has ranked eighth in an annual international study looking at the sustainability and efficiency of retirement schemes. This represents a drop of four places in the past two years, largely driven by sustainability issues.The Global Pension Indexexternal link, published by consulting group Mercer, ranks 30 countries according to a methodology based on adequacy (the design of the system), sustainability (breadth of coverage,...

Read More »

Read More »

Emerging Markets: What has Changed

President Xi Jinping’s concepts of socialist thinking were written into China’s constitution. Malaysia Prime Minister Najib presented an expansionary budget for 2018 ahead of elections. Czech billionaire Andrej Babis’ ANO party won the elections. South Africa's mid-term budget statement acknowledged the deteriorating outlook but offered little in the way of solutions. Press reports suggest Germany is working to cut funding for Turkish banks.

Read More »

Read More »

Cool Video: A Tentative Answer to the Low Vol Question

I had the privilege of joining the set of anchors (Julie Chatterley, Scarlet Fu, and Joe Weisenthal on the set of "What'd You Miss" today. The unrehearsed discussion took an unexpected turn when Joe asked about the low volatility.

Read More »

Read More »

Why Governments Will Not Ban Bitcoin

Those who see governments banning ownership of bitcoin are ignoring the political power and influence of those who are snapping up most of the bitcoin. To really understand an asset, we have to examine not just the asset itself but who owns it, and who can afford to own it. These attributes will illuminate the political and financial power wielded by the owners of the asset class.

Read More »

Read More »

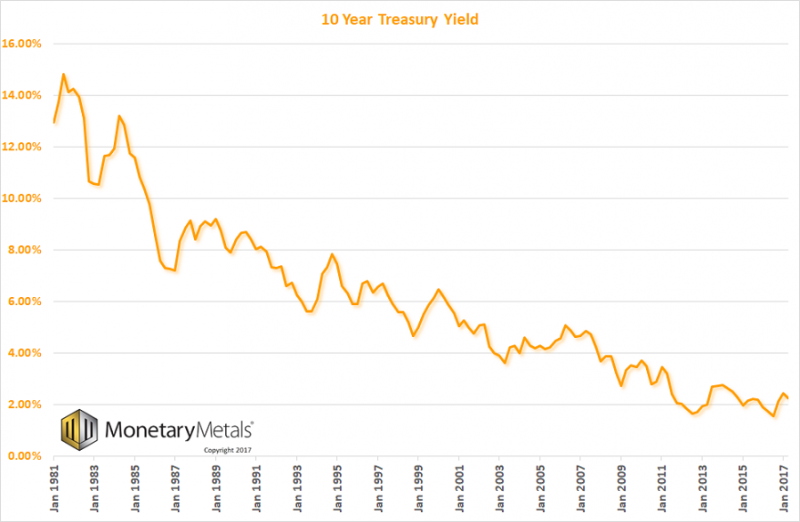

Political Economics

Who President Trump ultimately picks as the next Federal Reserve Chairman doesn’t really matter. Unless he goes really far afield to someone totally unexpected, whoever that person will be will be largely more of the same. It won’t be a categorical change, a different philosophical direction that is badly needed. Still, politically, it does matter to some significant degree. It’s just that the political division isn’t the usual R vs. D, left vs....

Read More »

Read More »

FX Daily, October 27: Greenback Finishing Week on Firm Note

This has been a good week for the US dollar. The Dollar Index's 1.25% gain this week is the largest of the year. The driver is two-fold: positive developments in the US and negative developments abroad. The positive developments in the US include growing acceptance that the Fed will raise rates in December and that there will be more rate hikes next year. The Fed says three.

Read More »

Read More »

Most young Swiss keep informed online

Social media is becoming increasingly dominant in the Swiss media industry, controlling not only consumer habits but also the advertising market. In addition, television is dying. These are the findings of the latest “Yearbook Quality of the Media” by the University of Zurich. They are strong, they are dominant, they have money – and they are located outside the Swiss sphere of influence: the internet giants or “tech intermediaries”.

Read More »

Read More »

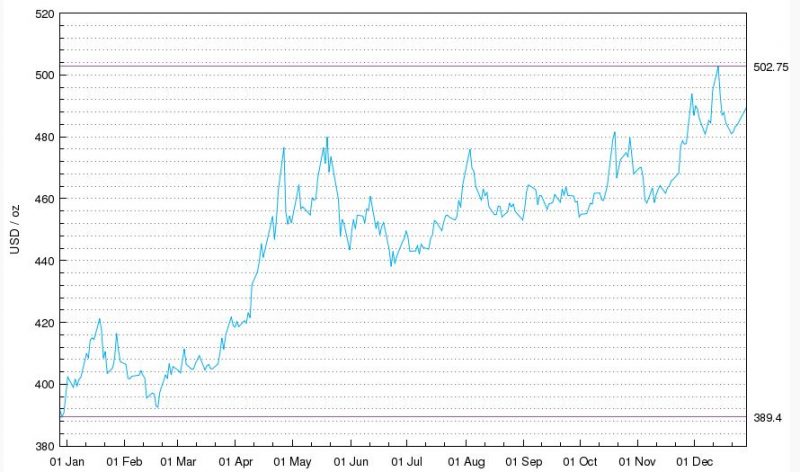

Russia Buys 34 Tonnes Of Gold In September

Russia adds 1.1 million ounces to reserves in ongoing diversification from USD. 34 ton addition brings Russia’s Central Bank holdings to 1,779t; 6th highest. Russia’s gold reserves are at highest point in Putin’s 17-year reign. Russia’s central bank will buy gold for its reserves on the Moscow Exchange.

Read More »

Read More »

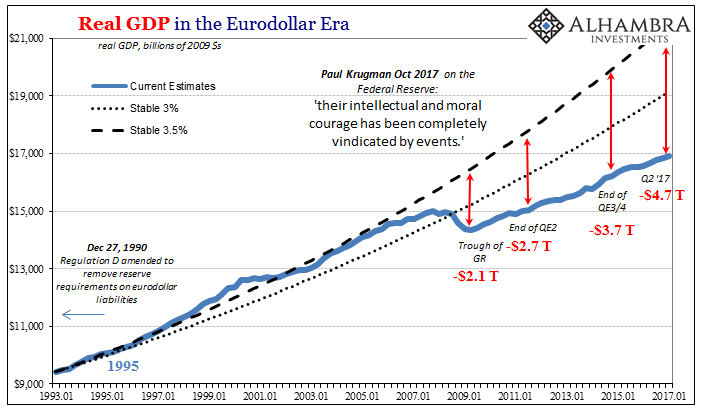

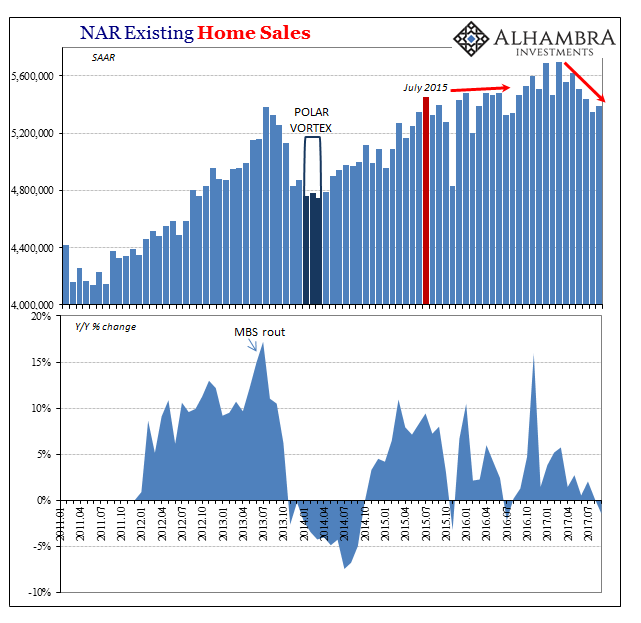

Housing Isn’t Just About Real Estate

The National Association of Realtors (NAR) reported today that sales of existing homes (resales) were up slightly in September 2017 on a monthly basis. At a seasonally-adjusted annual rate of 5.39 million last month, that was practically unchanged from the 5.35 million estimate for August that was the lowest in a year.

Read More »

Read More »

Marc Faber, Freedom of Speech & Capitalism

Political Correctness Hampers Honest Debate. What would the world be like today had Europeans never colonized Americas, Africa, the Middle East, Australia, New Zealand, and South Asia? Most of these societies would still not have discovered the wheel. It takes a huge amount of reality-avoidance and ineptitude for outsiders who travel there not to realize that a billion or more people in the Third World still wouldn’t have discovered the wheel.

Read More »

Read More »

FX Daily, October 26: Draghi’s Day

It is all about the ECB meeting today. The market was hoping for more details last month, but Draghi pointed to today. The broad issue is well known. While growth has been strong, price pressures are still not, according to the ECB, on a durable path toward its "close but lower than 2%" target. The ECB judges that substantial additional stimulus is needed.

Read More »

Read More »

Wie Sozialisten den Kapitalismus prägten – Teil 3

Im zweiten Teil dieser Analyse wurde zu zeigen versucht, weshalb es für das eigentliche Verständnis unseres heutigen Geldsystems und dessen spezifischen Eigenschaften wenig sinnvoll ist, in der Kritik desselbigen zwischen Staat, Zentralbank und Geschäftsbank zu unterscheiden. Alle drei Akteure sind für die in Teil Zwei beschriebene «monetäre Revolution» unabdingbar und haben die von der natürlichen Knappheit losgelöste Kreditgeldschöpfung erst...

Read More »

Read More »

Switzerland ranks highly in youth employment survey

Switzerland has the second-best labour market for young Europeans behind Denmark, according to a ranking of over 30 countries. Denmark came top, followed by Switzerland, Austria, Germany and the Netherlands in the latest KOF Youth Labour Market Indexexternal link, which analysed the year 2015. The ranking is produced annually by the Economic Institute (KOF) at the Federal Institute of Technology in Zurich (ETHZ).

Read More »

Read More »

Can Switzerland Save the World?

Switzerland: Far from Flawless, but still a Unique Country – An Interview with Claudio Grass. Our friend Claudio Grass has discussed Switzerland in these pages before, and on one of these occasions we added some background information on country’s truly unique political system (see “The People Against the Establishment” for the details).

Read More »

Read More »

Next Wall Street Crash Looms? Lessons On Anniversary Of 1987 Crash

Next Wall Street Crash looms? Lessons on anniversary of crash. 30 years since stock market ‘Black Monday’ crash of 1987. Dow Jones Industrial Average fell 22.6% on October 19, 1987. S&P 500, FTSE and DAX fell 20%, 11% & 9% respectively. Gold rose 24.5% in 1987 (see chart), acting as safe haven. Prior to crash, stocks hit successive record highs despite imbalances. Imbalances that lead to 1987 crash are much worse today

Read More »

Read More »

The World’s Largest ICO Is Imploding After Just 3 Months

Earlier this summer, Tezos smashed existing sales records in the white-hot IPO market after the company’s pitch to build a better blockchain for cryptocurrencies made it one of the buzziest ICOs in the world. As we noted at the time, the company capitalized on that buzz by courting VC firms and other institutional investors with a $50 million token pre-sale. After the company opened up selling to the broader public, demand soared as investors...

Read More »

Read More »

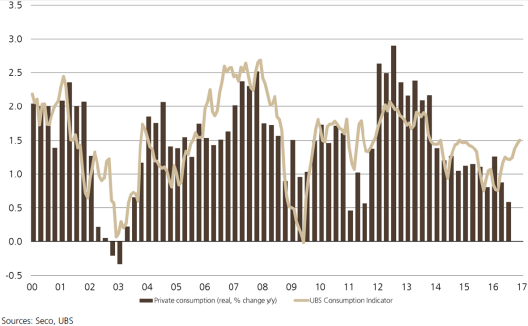

Switzerland UBS Consumption Indicator September: Higher expectations in the retail industry

The UBS consumption indicator rose to 1.56 points in September, signalling consumption growth slightly above the long-term average. The indicator was supported by significantly higher expectations in the retail industry, but UBS still projects consumer spending to grow 1.3 percent for the year overall.

Read More »

Read More »

FX Daily, October 25: Sterling and Aussie Interrupt the Waiting Game

Most participants seemed comfortable marking time ahead of tomorrow's ECB meeting, and an announcement President Trump's nominations to the Federal Reserve. However, softer than expected Australian Q3 CPI and a stronger than expected UK Q3 GDP injected fresh incentives. Australia reported headline CPI rose 0.6% in Q3.

Read More »

Read More »