Tag Archive: newslettersent

Wozniak and Thiel Fuel Bitcoin-Gold Debate: Gold Comes Out On Top

Gold versus bitcoin debate makes further headlines as tech experts weigh in. Peter Thiel tells Saudi conference he believes bitcoin is underestimated and compares to gold. Steve Wozniak tells Money 20/20 that bitcoin is a better standard of value than gold and U.S. dollar. Both men recognise that the US dollar has little value and there are worthy competitors to its crown as reserve currency. Gold continues to hold its value and has multiple uses,...

Read More »

Read More »

What Could Pop The Everything Bubble?

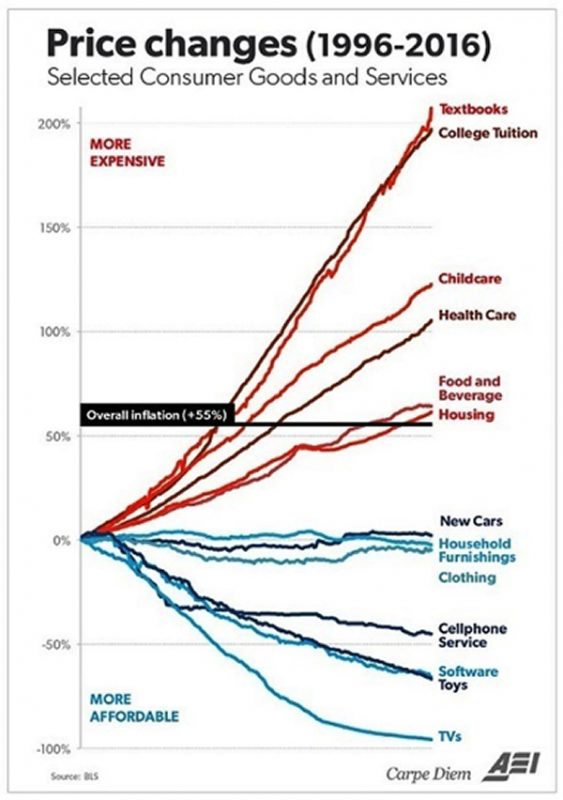

As central bank policies are increasingly fingered by the mainstream as the source of soaring wealth-income inequality, policies supporting credit/asset bubbles will either be limited or cut off, and at that point all the credit/asset bubbles will pop.

Read More »

Read More »

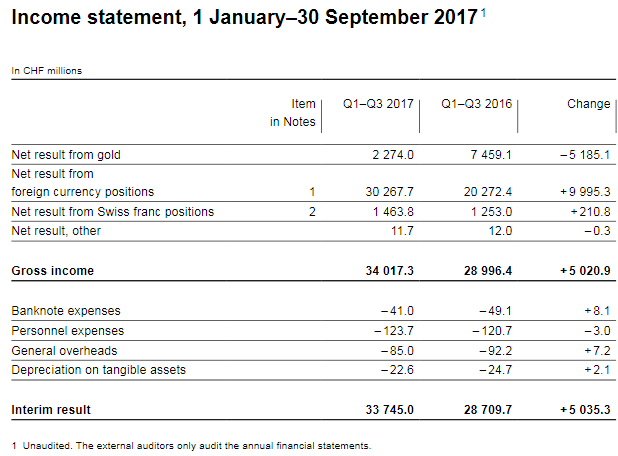

The good years have started, increasing SNB Profits

The Swiss National Bank (SNB) reports a profit of CHF 33.7 billion for the first three quarters of 2017. But in 2017, the picture is changed. Assuming a "biblical" cycle of seven good years and seven bad years, the SNB could now increase profits every year - thanks to a weaker franc and the seven good years.

Read More »

Read More »

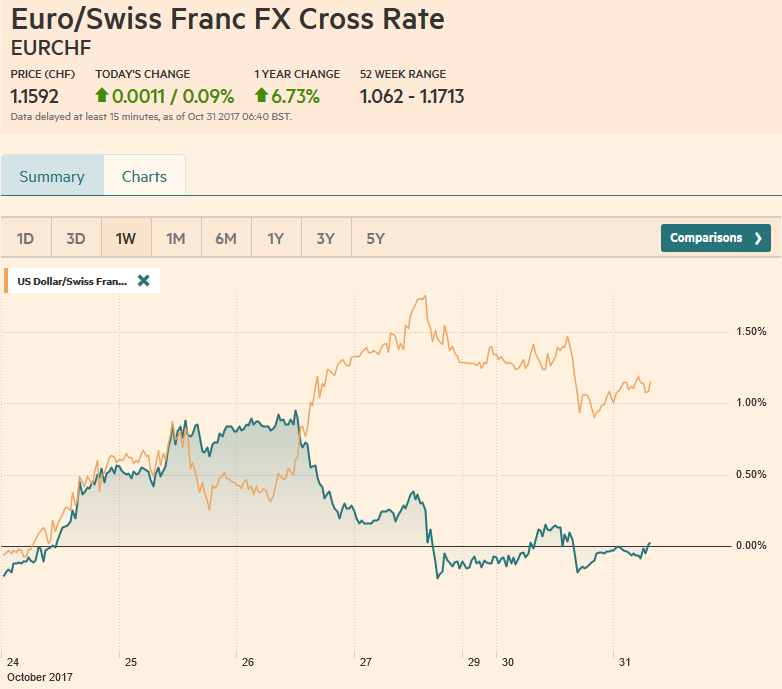

FX Daily, October 31: Month-End Leaves Market at Crossroads

Global equity markets are closing another strong month. The MSCI Asia Pacific Index was little changed on the day, but up 4.3% in October, the 10th consecutive monthly advance. Europe's Dow Jones Stoxx 600 is also flattish today, but up 1.6% on the month. It is the second monthly advance after a June-August swoon. The benchmark is closing in on the high for the year set in May.

Read More »

Read More »

Swiss government says it has a plan to contain healthcare costs

As next year’s health premium bills find their way into Swiss mail or email boxes, the reality of another round of price increases starts to bite. Earlier this week, Switzerland’s Federal Council unveiled 38 measures that will be considered as part of a plan to tackle Switzerland’s rising health costs. A final plan will be presented next spring, according to 20 Minutes.

Read More »

Read More »

Eurozone Crisis Is Back

Gold will be safe haven again in looming EU crisis. EU crisis is no longer just about debt but about political discontent. EU officials refuse to acknowledge changing face of politics across the union. Catalonia shows measures governments will use to maintain control. EU currently holds control over banks accounts and ability to use cash. Protect your savings with gold in the face of increased financial threat from EU.

Read More »

Read More »

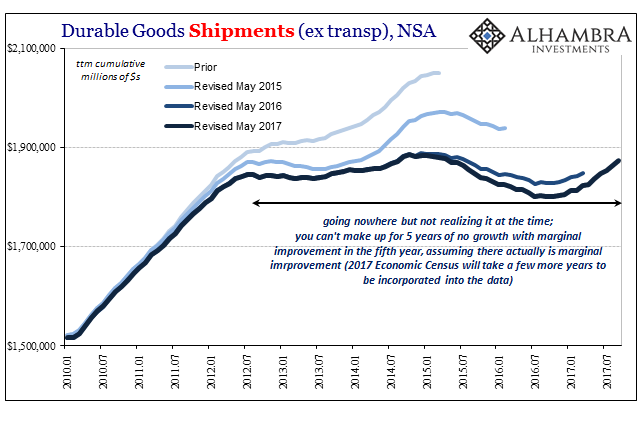

Subject To Gradation

Economic growth is subject to gradation. There is almost no purpose in making such a declaration, for anyone with common sense knows intuitively that there is a difference between robust growth and just positive numbers. Yet, the biggest mistake economists and policymakers made in 2014 was to forget that differences exist between even statistics all residing on the plus side.

Read More »

Read More »

FX Daily, October 30: Dollar Slips in Consolidative Activity

The markets are mixed, mostly responding to idiosyncratic developments, as the week's large events loom ahead. These BOJ, BOE, and FOMC meetings, eurozone flash CPI and US jobs reports. In addition, US President Trump is expected to announce his nomination of the next Fed chair, and the initial House tax bill will be unveiled.

Read More »

Read More »

FX Weekly Preview: Thumbnail Sketch of the Week’s Big Events

Busiest week of Q4. Fed, BOJ, and BOE, only the last is expected to change policy. Flash EMU CPI and US jobs. Positive developments in Italy, less so in Spain.

Read More »

Read More »

Emerging Markets: What has Changed

EM FX gained some limited traction Friday but still capped off another awful week. So far this quarter, the worst EM performers are TRY (-6%), MXN (-5%), ZAR (-4%), COP, and BRL (both -2.5%). We expect these currencies to remain under pressure as political concerns are unlikely to dissipate anytime soon.

Read More »

Read More »

Le vol de l’or de Chine.

L’histoire de la Chine et de son obsession pour l’or a été ravivée cette année, comme nous le prouvent les chiffres des importations effectuées via de Hong Kong et négociées sur le Shanghai Gold Exchange. Mais au vu des articles que nous, commentateurs du marché de l’or, écrivons au sujet de l’amour de la Chine pour l’or, il est surprenant de constater qu’il y a moins de cent ans, le pays perdait l’équivalent de milliers d’années de...

Read More »

Read More »

Stagnation Nation: Middle Class Wealth Is Locked Up in Housing and Retirement Funds

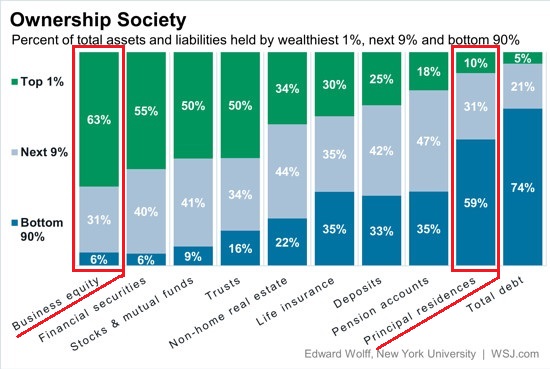

The majority of middle class wealth is locked up in unproductive assets or assets that only become available upon retirement or death. One of my points in Why Governments Will Not Ban Bitcoin was to highlight how few families had the financial wherewithal to invest in bitcoin or an alternative hedge such as precious metals.

Read More »

Read More »

Three Developments in Europe You may have Missed

The focus in Europe has been Catalonia's push for independence and the attempt by Madrid to prevent it. Tomorrow's ECB meeting, where more details about next year's asset purchases, is also awaited. There are three developments that we suspect have been overshadowed but are still instructive. First, the ECB reported that its balance sheet shrank last week. With the ECB set to take another baby step toward the exit, many are seeing convergence,...

Read More »

Read More »

Global billionaire club gets bigger and richer

The total wealth of the world’s 1,542 billionaires - including 35 in Switzerland - grew 17% to $6 trillion (CHF5.93 trillion) last year, led by a surge in Asia’s emerging billionaire class and growth in the materials, industrials, financial and technology sectors.

Read More »

Read More »

Swiss tax spy ‘acted out of patriotism’

A Swiss man accused of spying on the German state of North Rhine-Westphalia’s (NRW) tax authority has confessed and named names. In a Frankfurt court on Thursday, the 54-year-old man, identified only as Daniel M., explained via his defence team that he had not acted with criminal intent. Rather his motivation was “patriotism, a desire for adventure, a pursuit of profit, and outrage”.

Read More »

Read More »

Gold Is Better Store of Value Than Bitcoin – Goldman Sachs

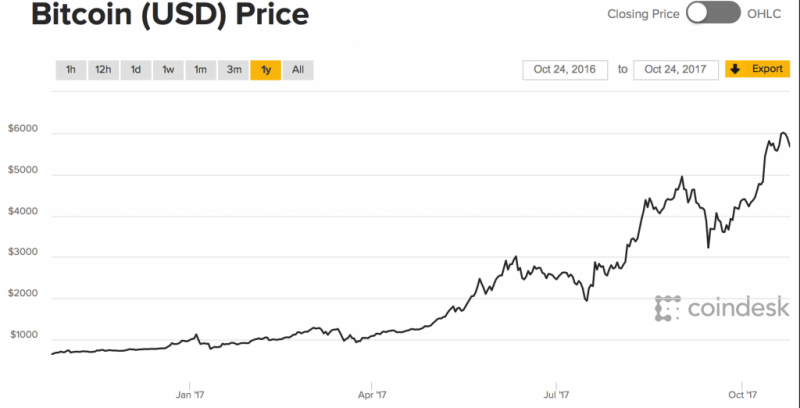

Gold is better store of value than bitcoin – Goldman Sachs report. Gold will continue to perform well thanks to uncertainty and wealth demand. Bitcoin’s volatility continues to impact its role as money. Gold up 12% in 2017, bitcoin over 600%. BTC is six times more volatile than gold – see chart.

Read More »

Read More »

An Unexpected (And Rotten) Branch of the Maestro’s Legacy

The most significant part of China’s 19th Party Congress ended in the usual anticlimactic fashion. These events are for show, not debate. Like any good trial lawyer will tell you, you never ask a question in court that you don’t already know the answer to. For China’s Communists, that meant nominating Xi Jinping’s name to be written into the Communist constitution with the votes already tallied.

Read More »

Read More »

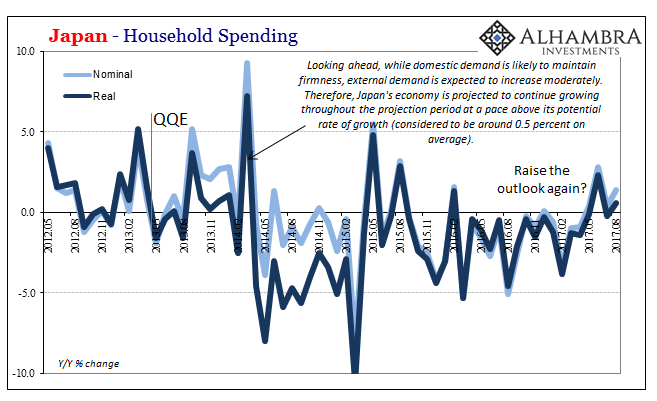

Japan Is Booming, Except It’s Not

Japan is hot, really hot. Stocks are up to level not seen since 1996 (Nikkei 225). Prime Minister Shinzo Abe called snap elections in Parliament to secure a supermajority and it worked. Things seem to be sparkling all over the place, with the arrow pointing up: “Hopes for a global economic recovery and US shares’ strength are making fund managers generous on Japanese stocks,” said Chihiro Ohta, general manager of investment research at SMBC Nikko...

Read More »

Read More »