Tag Archive: newslettersent

What Just Changed?

The illusion that risk can be limited delivered three asset bubbles in less than 20 years. Has anything actually changed in the past two weeks? The conventional bullish answer is no, nothing's changed; the global economy is growing virtually everywhere, inflation is near-zero, credit is abundant, commodities will remain cheap for the foreseeable future, assets are not in bubbles, and the global financial system is in a state of sustainable...

Read More »

Read More »

Seasonality of Individual Stocks – an Update

Readers are very likely aware of the “Halloween effect” or the Santa Claus rally. The former term refers to the fact that stocks on average tend to perform significantly worse in the summer months than in the winter months, the latter term describes the typically very strong advance in stocks just before the turn of the year. Both phenomena apply to the broad stock market, this is to say, to benchmark indexes such as the S&P 500 or the DJIA.

Read More »

Read More »

SNB-Jordan verkündet Kommunistisches – und lädt zum Gratis-Buffet

Es geht um die Sache und Institution – nicht um eine Person. Die Schweizerische Nationalbank (SNB) und ihr Chef Thomas Jordan sind aber mittlerweile dermassen eng miteinander verflochten, dass eine getrennte Beurteilung gar nicht mehr möglich ist. Thomas Jordan ist zum Gesicht der SNB und diese eine „One-Man-Show“ geworden.

Read More »

Read More »

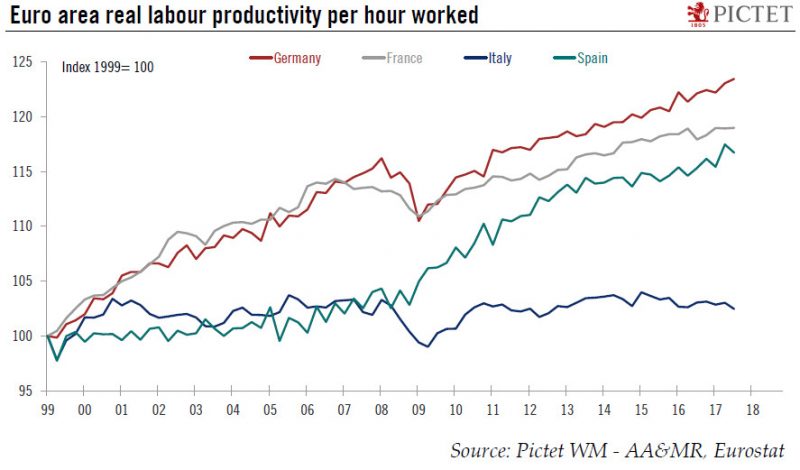

Europe chart of the week – Italian productivity

With less than 30 days to go, the Italian general election remains highly unpredictable. The new electoral system and the fact that 37% of seats are to be allocated on a ‘first-past-the-post’ system make projecting seats from voting intentions particularly hard. Importantly, Italy is going into this election with an economy that is performing relatively strongly relative to recent history. However, cyclical strength is masking structural...

Read More »

Read More »

FX Daily, February 14: Investors Remain Uneasy even as Equities Stabilize

There is an unease that continues to hang over the market. It is as if a shoe fell last week, and most investors seem to be waiting for the other shoe to drop. It is hard to imagine the kind of body blow that the equities took last week without some kind of follow through and knock-on effects. Moreover, the focus today on US CPI may prove for nought.

Read More »

Read More »

Great Graphic: Stocks and Bonds

The relationship between stocks and bonds does not appear to have changed much. It is difficult to eyeball correlations. Question the meaning of a chart that has two time series and two scales and.

Read More »

Read More »

Swiss businesses in China upbeat after record export year

According to a survey, 72% of Swiss business leaders in China expect “higher” or “substantially higher” sales of goods from Switzerland to China and Hong Kong in 2018 than in 2017, when exports reached a record CHF16.7 billion ($17.9 billion). Just 5% of business leaders anticipated lower export figures this year, according to the preliminary results of the 2018 Swiss Business in China Survey, which were released Tuesday by Swiss Centers...

Read More »

Read More »

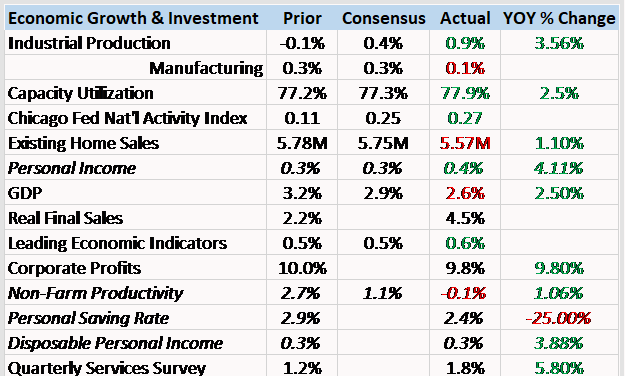

Bi-Weekly Economic Review

Personal income for December was better than expected at up 0.4% on the month and 4.11% year over year. Wages and salaries were up 0.5%. Unfortunately, that rate of rise is not even up to the lower end of the range we’ve seen in past expansions when 5% income growth was a precursor to recession. Still, it is, sadly, about average for this expansion.

Read More »

Read More »

Currency swap agreement between the Swiss National Bank and the Bank of Korea

The Swiss National Bank (SNB) and the Bank of Korea (BOK) will enter into a bilateral swap agreement. The agreement will be signed on 20 February 2018 in Zurich by the Chairman of the SNB Governing Board, Thomas Jordan, and the Governor of the BOK, Juyeol Lee. The swap agreement enables Korean won and Swiss francs to be purchased and repurchased between the two central banks, up to a limit of KRW 11.2 trillion, or CHF 10 billion.

Read More »

Read More »

Swiss Producer and Import Price Index in January 2018: +1.8 YoY, +0.3 MoM

Neuchâtel, 13 February 2018 (FSO) - The Producer and Import Price Index rose in January 2018 by 0.3% compared with the previous month, reaching 102.2 points (December 2015=100). The rise is due in particular to higher prices for petroleum products, electricity and gas as well as metals and metal products. Compared with January 2017, the price level of the whole range of domestic and imported products rose by 1.8%. These are some of the findings...

Read More »

Read More »

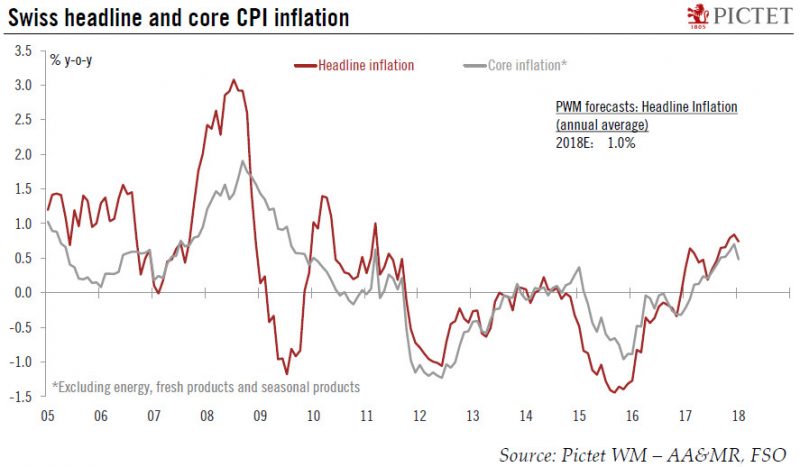

Switzerland: inflation edged lower in January

According to the Swiss Federal Statistical Office (FSO), the headline consumer price index (CPI) inflation eased to 0.7% y-o-y in January from 0.8% y-o-y in December, in line with consensus and our own expectations. Core inflation (CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) also eased, from 0.7 % y-o-y in December to 0.5% y-o-y in January (see Chart 1), back to the level of October 2017.

Read More »

Read More »

FX Daily, February 13: Tuesday’s Two Developments

There are two important developments today. First, the recovery in the global equity markets is being challenged. Second, the yen has strengthened across the board, and is now at its best levels against the dollar since last September's low. The MSCI Asia Pacific Index extended Monday's recovery with another 0.5% gain. However, looking closer, the momentum faltered.

Read More »

Read More »

Justice ministry confirms legal aid requests in Greece-Novartis scandal

Switzerland’s Federal Office of Justice has confirmed it has received two requests for legal assistance from Greece and the United States linked to probes into Novartis and alleged bribes involving the Swiss drugmaker and Greek doctors and public officials. The two requests for legal assistance linked to the Novartis-Greek scandal were received at the end of last year and in January 2018 and are being studied, a justice ministry official confirmed...

Read More »

Read More »

Swiss Post CEO rejects blame for PostBus subsidies scandal

The head of Swiss Post, Susanne Ruoff, has refused to step down for errors she admits were made at the PostBus subsidiary company regarding the manipulation of accounts to claim tens of millions of francs worth of federal and cantonal subsidies. “I neither lied nor did anything wrong,” Ruoff declared in an interview on Sunday in the SonntagsBlick newspaper.

Read More »

Read More »

Swiss Consumer Price Index in January 2018: +0.7 YoY, -0.1 MoM

The consumer price index (CPI) fell by 0.1% in January 2018 compared with the previous month, reaching 100.7 points (December 2015=100). Inflation was 0.7% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

FX Daily, February 12: Equity Markets Find Firmer Footing, Dollar Softens

The most important development today has been the stability in the equity markets after last week's meltdown. The recovery from new lows in the US before the weekend set the tone for today's moves. Tokyo markets were on holiday, and the MSCI Asia Pacific Index excluding Japan snapped a seven-day slide with a nearly 0.6% gain.

Read More »

Read More »

Weekly Technical Analysis: 12/02/2018 – USD/JPY, EUR/USD, GBP/USD, WTI Oil Futures, USD/CHF

The USDCHF pair trading settles below the previously broken support that appears in the image, while stochastic provides negative overlapping signal on the four hours time frame, which supports the continuation of our bearish trend expectations in the upcoming sessions, reminding you that our next target at 0.9254.

Read More »

Read More »

FX Weekly Preview: Recovering from Too Much of a Good Thing?

Too much of a good thing is bad. That, in a nutshell, is an important insight that Hyman Minsky offered about the financial sector, but has broader application. The low volatility that has been a characteristic of the capital markets for the past few years spurred financial innovation to profit from it.

Read More »

Read More »

Emerging Markets: The Week Ahead, February 12

EM FX ended Friday on a mixed note, as risk assets recovered a bit from broad-based selling pressures. Best EM performers on the week were ZAR, PHP, and CNY while the worst were COP, RUB, and ARS. Besides the risk-off impulses still reverberating through global markets, we think lower commodity prices are another headwind on EM.

Read More »

Read More »

Chinese textile firm buys luxury Bally brand

Luxury shoemaker Bally, which was founded in Switzerland in 1851, has again changed hands. China’s Shandong Ruyi has agreed to buy a controlling stake in the firm from Luxembourg-based JAB Holding, the companies said on Friday. “This is an important milestone for Shandong Ruyi Group in our enterprise to become a global leader in the fashion apparel sector,” Yafu Qiu, Chairman of Shandong Ruyi Groupexternal link, said in a statement.

Read More »

Read More »