Tag Archive: newslettersent

Emerging Markets: What Changed

Hong Kong may impose a tax on unsold apartments as an effort to increase supply and cool off the housing market. Bank of Israel’s MPC had a split vote last month for the first time in three years. South Africa President Ramaphosa said the ANC wants Julius Malema of the opposition EFF to rejoin the party. Former South Africa President Zuma will face trial on 16 criminal charges.

Read More »

Read More »

Buy Silver And Sell Gold Now

Buy silver and sell gold now – Frisby. Gold should cost 15 times as much as silver. Silver might have disappointed in short term – But it’s time to buy. Editor’s note: Silver has outperformed stocks, bonds and gold over long term (see table).

Read More »

Read More »

SWISS boss says that Geneva airport routes are not guaranteed

The CEO of Swiss International Air Lines has said that it is not impossible that the carrier’s Geneva operations be taken over by Eurowings, Lufthansa’s low-cost arm, in 2019. In an interview published in the Agefi newspaper on Monday, Thomas Klühr said he remained “confident” that such a scenario would not come about, but that it depended on the Swiss airline making a profit on its Geneva operations through the course of 2018.

Read More »

Read More »

Captation des capitaux retraite LPP, le bras de fer…

C’est une réforme majeure du 2ème pilier qui a été repoussée sous la Coupole fédérale. Dans le cadre de la modification du régime des prestations complémentaires, le Conseil national a refusé de limiter le retrait de l’avoir vieillesse sous forme de capital.

Read More »

Read More »

Checking In on the Four Intersecting Cycles

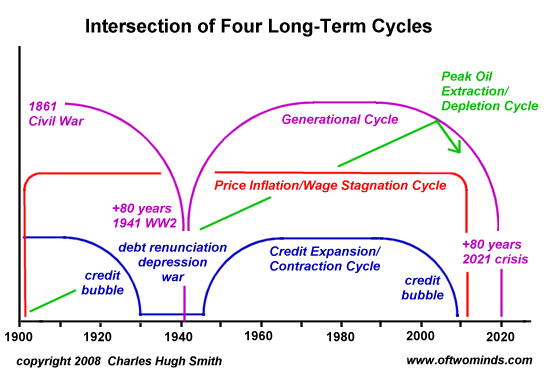

Correspondent James D. recently asked for an update on the four intersecting cycles I've been writing about for the past 10 years. Here's the chart I prepared back in 2008 of four long-term cycles: 1. Generational (political/social).2. Price inflation/wage stagnation (economic). 3. Credit/debt expansion/contraction (financial). 4. Relative affordability of energy (resources).

Read More »

Read More »

How Much Longer Can We Get Away With It?

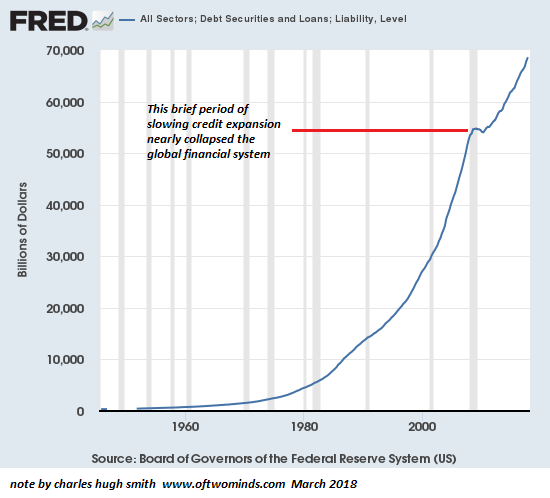

Alas, fakery isn't actually a solution to fiscal/financial crisis.. This chart of "debt securities and loans"--i.e. total debt in the U.S. economy--is also a chart of the creation and distribution of new money, as the issuance of new debt is the mechanism in our financial system for creating (or "emitting" in economic jargon) new currency: when a bank issues a new home mortgage, for example, the loan amount is new currency created out of the...

Read More »

Read More »

Europe chart of the week – Employment

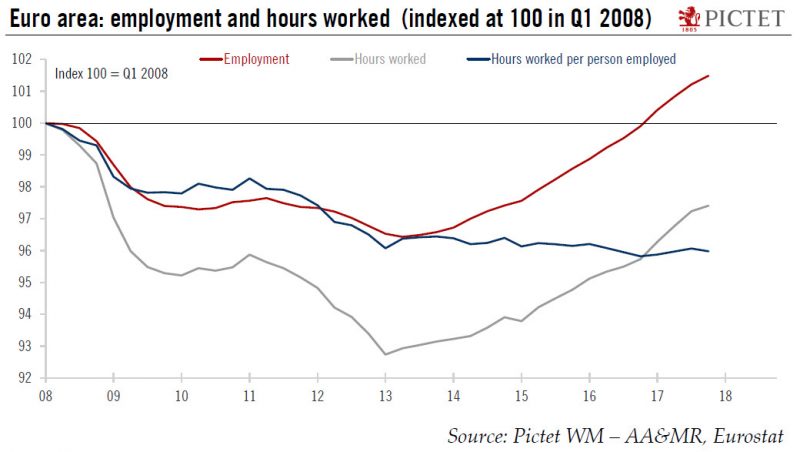

Euro area employment grew for the 18th consecutive quarter in Q4 2017 (+0.3% q-o-q), and is now 1.5% above its pre-crisis (2008) level. By contrast, hours worked per person employed decreased during the same period, remaining 4% below their pre-crisis level. The two data series have followed divergent trends since the start of the economic recovery. Between Q1 2008 and Q2 2013, the total amount of labour input used by firms decreased massively.

Read More »

Read More »

Gold Cup At Cheltenham – Gold Is For Winners, Not For the Gamblers

Gold Cup at Cheltenham – ‘The Olympics’ of the European horse racing calendar. Gold Cup trophy contains 10 troy ounces of gold – worth £9,000. £620 million bets on horses, 230,000 pints of Guinness will be drunk, 9.2 tonnes of potato eaten. Since the 5th century BC, gold has been the ultimate prize to award champions and gold has been constantly and universally awarded as top prize.

Read More »

Read More »

Zurich is the world’s second most expensive city

Only Singapore is more expensive than Zurich, finds an economic survey that compared the prices of more than 150 grocery items in 133 cities around the world. In fact Zurich tied with Paris for second place, followed by Hong Kong, Oslo, and Geneva – which tied with Seoul for sixth place.

Read More »

Read More »

SWISS reports record profits for 2017

Swiss International Air Lines saw an increase in profitability of almost one-third in 2017, the company has reported. The performance is largely due to more efficient and capacious planes. While total income increased by a more modest 3.2% to CHF4.95 billion ($5.24 billion), pre-tax profits jumped by 31% to CHF561 million.

Read More »

Read More »

Three Months Now of After-Harvey Retail Sales; or, The Boom Narrative Goes Boom

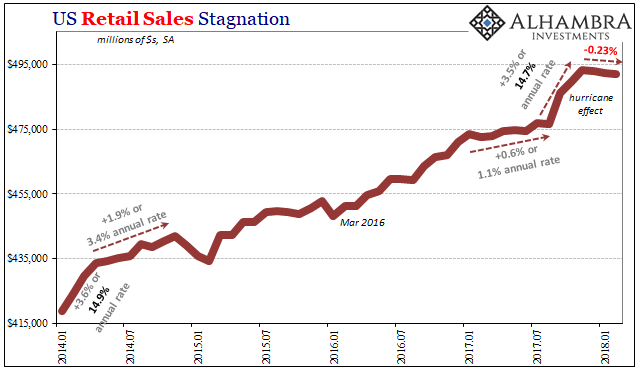

If indeed this inflation hysteria has passed, its peak was surely late January. Even the stock market liquidations that showed up at that time were classified under that narrative. The economy was so good, it was bad; the Fed would be forced by rapid economic acceleration to speed themselves up before that acceleration got out of hand in uncontrolled consumer price gains. On February 1, the Atlanta Fed’s GDPNow tracking model was moved up to...

Read More »

Read More »

Geneva wants to limit Airbnb rentals to 60 days a year

The canton wants the platform to place limits on its use to put the brakes on commercial operators. The 60 day limit was set by Geneva’s State Council. Antonio Hodgers, State councillor in charge of housing told Tribune de Genève that renting on the platform had become a real business for some and that this needs to be controlled.

Read More »

Read More »

BOOM: Wyoming Ends ALL TAXATION of Gold & Silver

Cheyenne, Wyoming (March 14, 2018) – Sound money activists rejoiced as the Wyoming Legal Tender Act became law today. The bill restores constitutional, sound money in Wyoming. Backed by the Sound Money Defense League, Campaign for Liberty, Money Metals Exchange, and in-state grassroots activists, HB 103 removes all forms of state taxation on gold and silver coins and bullion and reaffirms their status as money in Wyoming, in keeping with Article 1,...

Read More »

Read More »

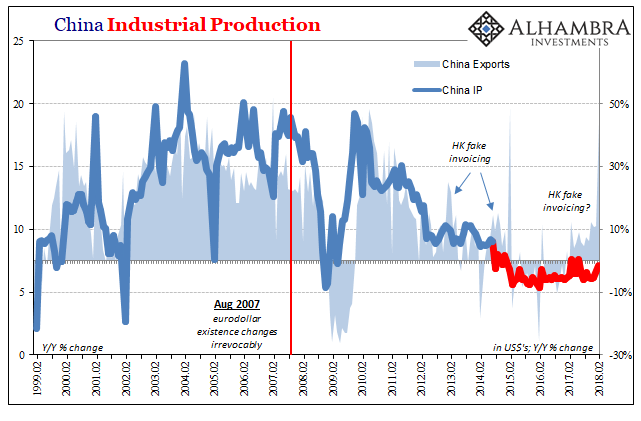

China’s Questionable Start to 2018

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week).

Read More »

Read More »

Les banques centrales financées par les banques commerciales

Vincent Held continue à présenter des extraits dans cette 3ème et dernière vidéo. Les 3 vidéos se trouvent sur le site de Planètes 360. Cette vidéo fait suite à celle sur le marché REPO.

Read More »

Read More »

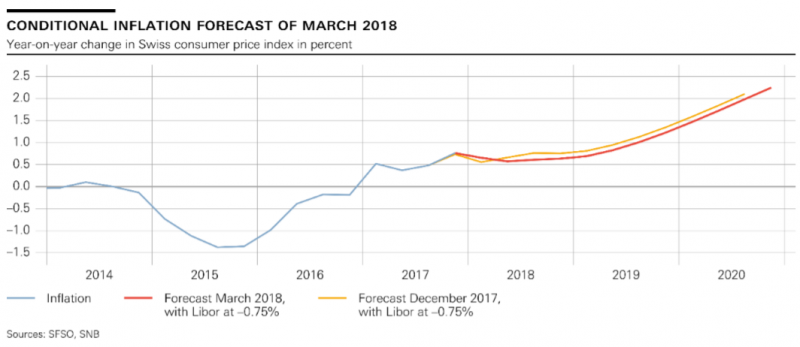

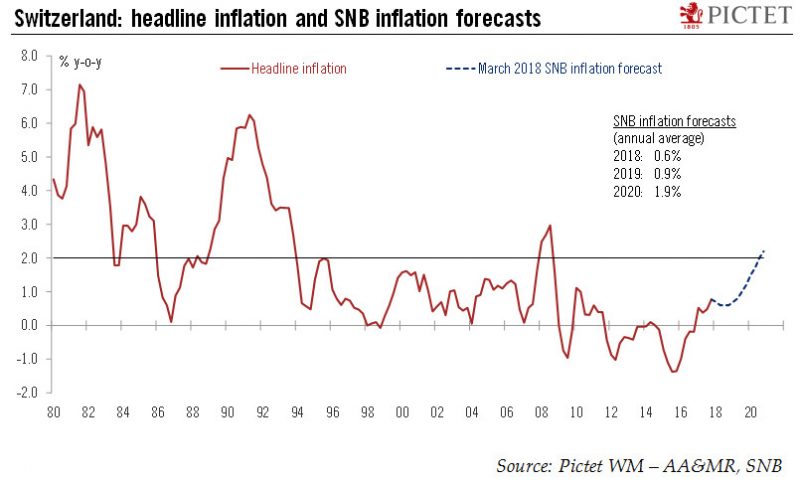

SNB Monetary policy assessment of 15 March 2018

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

Too early for Switzerland’s central bank to change policy…

At its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to intervene in the foreign exchange market if needed.

Read More »

Read More »

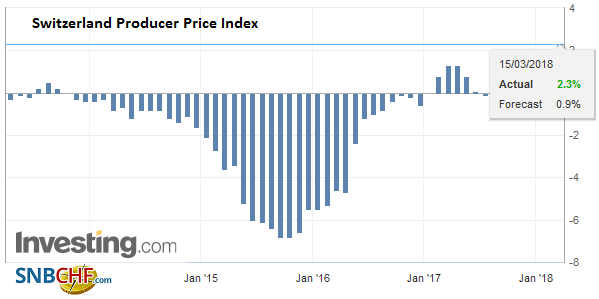

Swiss Producer and Import Price Index in February 2018: +2.3 percent YoY, +0.3 MoM

The Producer and Import Price Index rose in February 2018 by 0.3% compared with the previous month, reaching 102.6 points (December 2015=100). The rise is due in particular to higher prices for chemical and pharmaceutical products. Compared with February 2017, the price level of the whole range of domestic and imported products rose by 2.3%. These are some of the findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Call for pensions paid abroad to be taxed at source

A proposal to tax at source the old-age pensions of Swiss retirees living abroad has been made in parliament. The aim is to prevent differential treatment of pensioners based on where they live. On Wednesday, Christian Democrat senator Peter Hegglin tabled an interpellationexternal link in parliament to address unequal treatment between pensioners who reside in Switzerland those who opt to spend their twilight years abroad.

Read More »

Read More »