Tag Archive: newslettersent

Geneva’s mega apartment project now underway – 1,000 apartments and 2,500 jobs

Last week, work started on a project to construct 1,000 apartments in Geneva. The project known as the Quartier de l’Etang will unfold over an 11 hectare site in Vernier, not far from Geneva airport. The video above shows the commencement ceremony and a computer animation of the completed project.

Read More »

Read More »

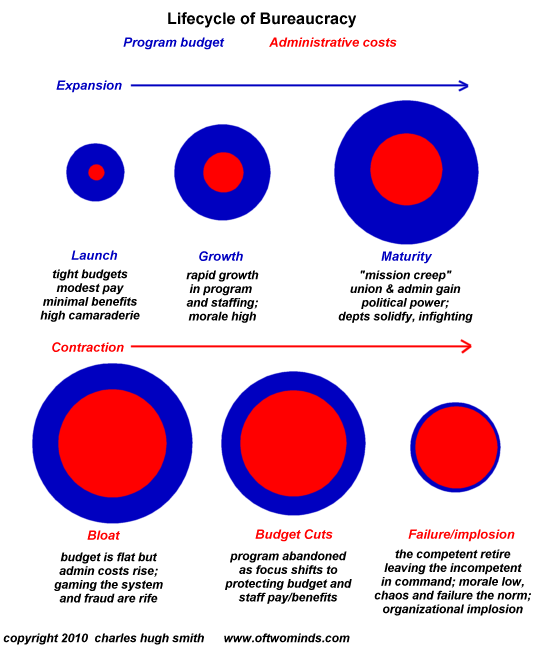

Solutions Only Arise Outside the Status Quo

Solutions are only possible outside these ossified, self-serving centralized hierarchies. Correspondent Dan F. asked me to reprint some posts on solutions to the systemic problems I've outlined for years, most recently in How Much Longer Can We Get Away With It? and Checking In on the Four Intersecting Cycles. I appreciate the request, because it's all too easy to dwell on what's broken rather than on the difficult task of fixing what's broken.

Read More »

Read More »

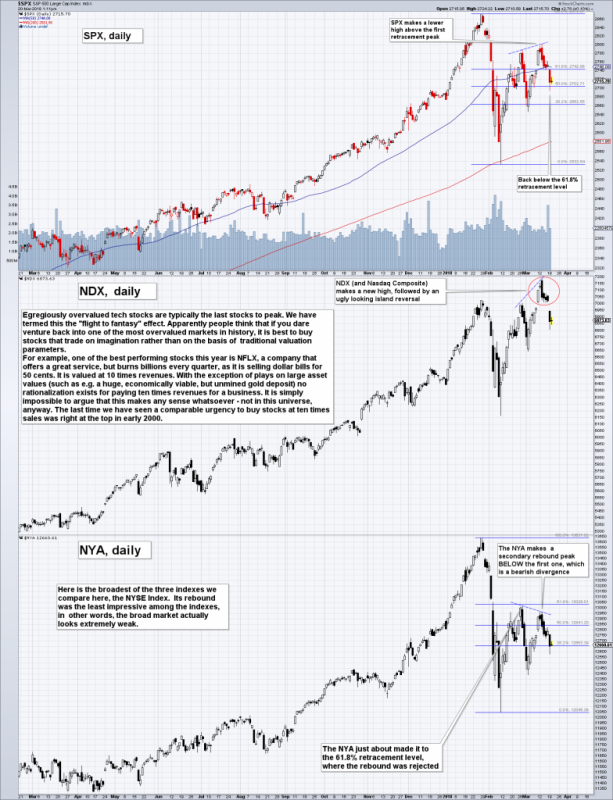

US Stock Market – The Flight to Fantasy

The chart formation built in the course of the early February sell-off and subsequent rebound continues to look ominous, so we are closely watching the proceedings. There are now numerous new divergences in place that clearly represent a major warning signal for the stock market. For example, here is a chart comparing the SPX to the NDX (Nasdaq 100 Index) and the broad-based NYA (NYSE Composite Index).

Read More »

Read More »

„Vollgeld“ ist rotester Kommunismus – lanciert vom Ausland

Schuldfrei“ – so soll unser Geld zukünftig in Umlauf kommen. Das Wort „schuldfrei“ ist positiv besetzt. Wer möchte nicht schuldfrei sein? Jedermann. „Schuldfrei“ ist das zentrale Wort im Initiativtext der kommenden Vollgeld-Initiative, über die das Schweizervolk am 10. Juni 2018 abstimmen wird. Die Initiative kommt daher wie der Wolf im Schafspelz. Absatz 3 des Initiativtextes besagt.

Read More »

Read More »

Switzerland’s parliament rejects plan to cut health insurance discounts

Switzerland has a system of compulsory health insurance. Residents must choose an insurer and pay. Those who don’t are automatically signed up and sent a bill. Other than shopping around, choosing a policy with an excess, a sum that must be covered out of your own pocket before the insurance kicks in, is one of the few ways to reduce your premium.

Read More »

Read More »

Swiss accounts blocked over suspected Nigerian oil bribery case

The Office of the Attorney General of Switzerland (OAG) has blocked various bank accounts in Switzerland regarding an alleged oil bribery scheme linked to Nigeria. Executives from oil giants Shell and Eni are due to stand trial in Milan, Italy, in May.

Read More »

Read More »

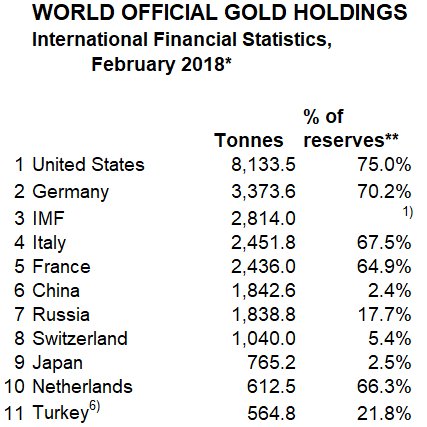

Four Charts: Debt, Defaults and Bankruptcies To See Higher Gold

$8.8B Sprott Inc. sees higher gold on massive consumer debt, defaults & bankruptcies. Rising and record U.S. debt load may cause financial stress, weaken dollar and see gold go higher. Massive government and consumer debt eroding benefits of wage growth (see chart).

Read More »

Read More »

Is Profit-Maximizing Data-Mining Undermining Democracy?

As many of you know, oftwominds.com was falsely labeled propaganda by the propaganda operation known as ProporNot back in 2016. The Washington Post saw fit to promote ProporNot's propaganda operation because it aligned with the newspaper's view that any site that wasn't pro-status quo was propaganda; the possibility of reasoned dissent has vanished into a void of warring accusations of propaganda and "fake news" --which is of course propaganda in...

Read More »

Read More »

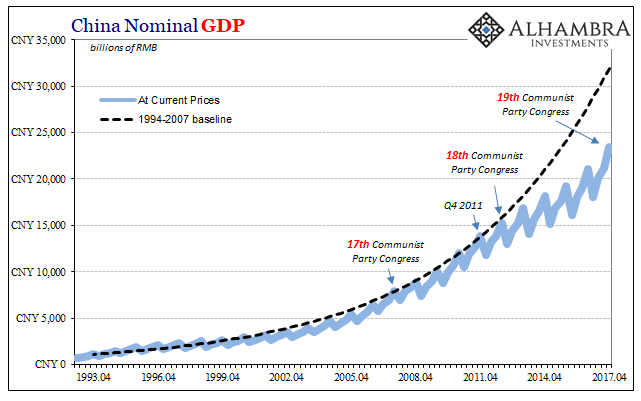

The Boom Reality of Uncle He’s Globally Synchronized L

Top Chinese leadership is taking further shape. With Xi Jinping’s continuing consolidation of power going on right this minute, most of the changes aren’t really changes, at least not internally. To the West, and to the mainstream, what the Chinese are doing seems odd, if not more than a little off. Unlike in the West, however, there is determined purpose that is in many ways right out in the open. Many here had been expecting that outgoing PBOC...

Read More »

Read More »

BNS; les liquidités des banques suisses au service du QE de la communauté monétaire internationale

La BNS s’est arrimée à l’euro en 2011 sous le prétexte de soutenir les exportateurs suisses.Ce serait donc la raison de sa transformation en hedge fund. De notre côté, nous avons toujours soutenu depuis 2011 qu’elle n’avait fait que suivre ses collègues dans la pratique du quantitative easing, dans le but de soutenir les grandes banques et autres hedge funds, en les déchargeant de leurs créances publiques à haut risque.

Read More »

Read More »

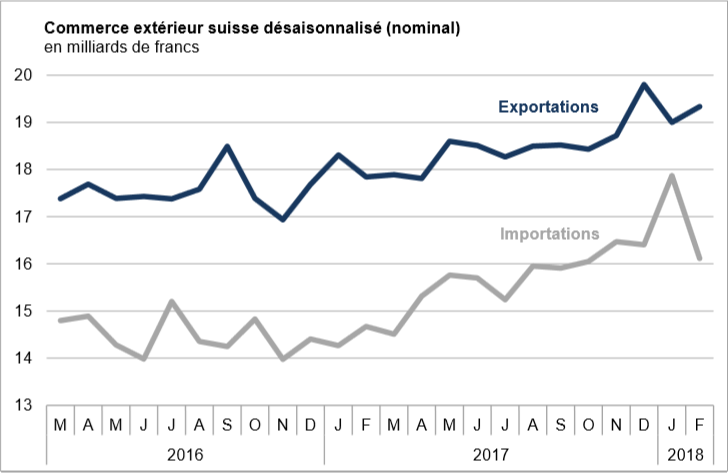

Swiss Trade Balance February 2018: Foreign Trade at a High Level

In February 2018, exports increased by 1.8%, confirming their positive trend. After their January record, imports fell back (-9.8%). However, they continued to grow at a high level, at 16.1 billion francs. At the entrance, the flagship markets Europe and North America led the result.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended Friday under renewed selling pressures, and capped off a mostly softer week. COP, THB, and TWD were the best performers last week, while TRY, RUB, and ZAR were the worst. Despite a widely expected 25 bp hike, this week’s FOMC meeting still has potential to weigh on EM.

Read More »

Read More »

Rolex ‘most reputable global brand’ for third straight year

Swiss watch brand Rolex has topped a ranking of the world’s most reputable brands for a third year in a row. Rolex beat Danish toy firm Lego for the top spot, while Swiss food manufacturer Nestlé jumped 21 places to rank 33rd. The Reputation Institute compiled the list in its annual Global RepTrack 100external link, after asking more than 230,000 people in 15 countries to rank some of the world’s biggest companies based on criteria such as ethical...

Read More »

Read More »

Swiss voters could get to decide on Switzerland’s Winter Olympics bid

In October 2017, when Switzerland’s Federal Council announced the government would stand behind Sion’s bid for the 2026 Winter Olympics, it sparked a backlash. A survey run by Tamedia in February 2018 suggests 59% of the Swiss public are against the bid, according to RTS. The estimated cost to Swiss taxpayers is close to CHF 1 billion. Other costs, to be borne by the host canton Valais and other cantons, are expected on top of this federal...

Read More »

Read More »

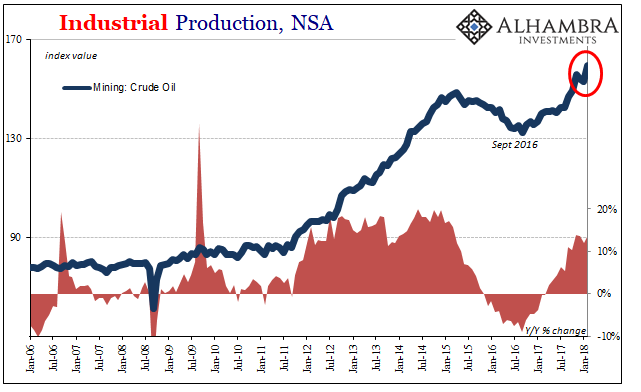

US Industry Experiences The Full 2014 Again in February

In February 2018, it was like old times for the US industrial sectors. Prior to the 2015-16 downturn, the otherwise moribund economy did produce two genuine booms. The first in the auto sector, the other in energy. Without them, who knows what the no-recovery recovery would have looked like. They were for the longest time the only bright spots.

Read More »

Read More »

New CHF200 banknote to be introduced in August

The Swiss National Bank (SNB) has announced that the latest addition to the new banknote series – the CHF200 note ($209) - will go into circulation on August 22. The brown note’s key motif will be physical matter. It will “showcase Switzerland’s scientific expertise”, the SNB said a press release on Monday.

Read More »

Read More »

Bi-Weekly Economic Review

Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for March 15, 2018.

Read More »

Read More »

FX Weekly Preview: The Fed and More

The most significant event in the coming week is the first FOMC meeting under the Chair Powell. At ECB President Draghi’s first meeting he cut interest rates. He cuts rates at his second meeting as well, underwinding the two hikes the ECB approved under Trichet. At BOJ Governor Kuroda’s first meeting, an aggressive monetary policy was announced that was notable not only in its size, but also in the range of assets to be purchased under the...

Read More »

Read More »

Weekly Technical Analysis: 19/03/2018 – USD/JPY, EUR/USD, GBP/USD, NZD/USD, USD/CHF

The USDCHF pair leaned well on 0.9488 level to resume its positive trading, on its way towards our first waited target at 0.9581, as the price moves inside bullish channel that appears on the above chart, supported by the EMA50 that protects trading inside this channel, noting that breaching the targeted level will extend the pair’s gains to reach 0.9675.

Read More »

Read More »