Tag Archive: newslettersent

FX Daily, March 29: Bonds and Stocks are Firm, While the Greenback Consolidates Upticks

The choppy US equity session yesterday, ultimately ending with modest losses as the tech sector remained under pressure, has been shrugged off in Asia and Europe, where modest gains have been seen. The dollar is little changed after yesterday's gains, and bonds are mostly firmer.

Read More »

Read More »

IMF forecasts 2.25 percent Swiss GDP growth in 2018 while pointing to risks

A boost to investment and net exports from the tailwind of strong external demand, together with faster expansion of household spending owing to rising employment, are forecast to lift GDP growth to around 2¼ percent in 2018, said the IMF in a statement referring to Switzerland issued on 26 March 2018.

Read More »

Read More »

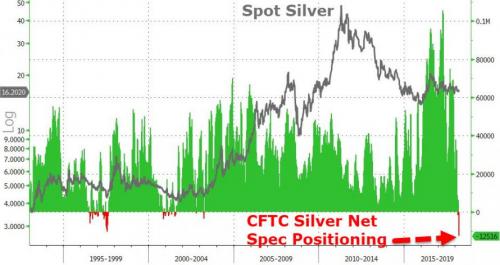

Silver Futures Report and JP Morgan Record Silver Bullion Holding Is Extremely Bullish

Silver Futures Report, JP Morgan Record Silver Bullion Holding Is Extremely Bullish. JP Morgan Continues Adding To Massive Silver Bullion Holdings (see chart). Silver Speculators Go Short – Which Is Extremely Bullish. Stunning Silver COT Report: One For the Ages (see chart).

Read More »

Read More »

Slaves to Government Debt Paper

Picture, if you will, a group of slaves owned by a cruel man. Most of them are content, but one says to the others, “I will defy the Master”. While his statement would superficially appear to yearn towards freedom, it does not. It betrays that this slave, just like the others, thinks of the man who beats them as their “Master” (note the capital M). This slave does not seek freedom, but merely a small gesture of disloyalty.

Read More »

Read More »

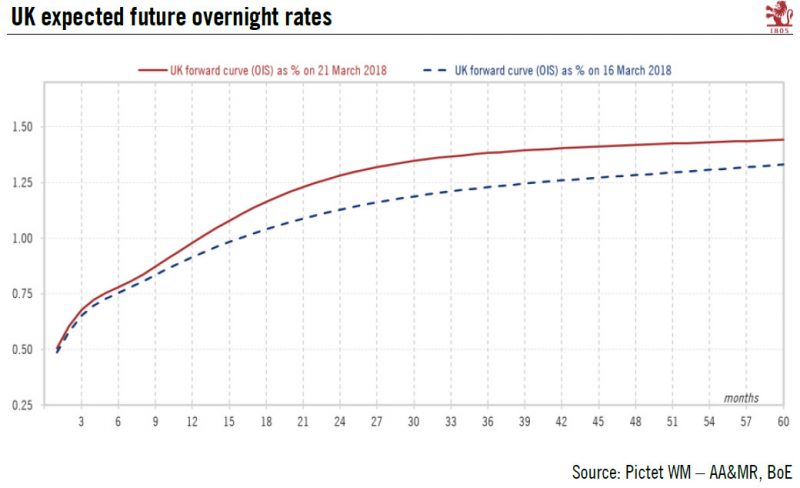

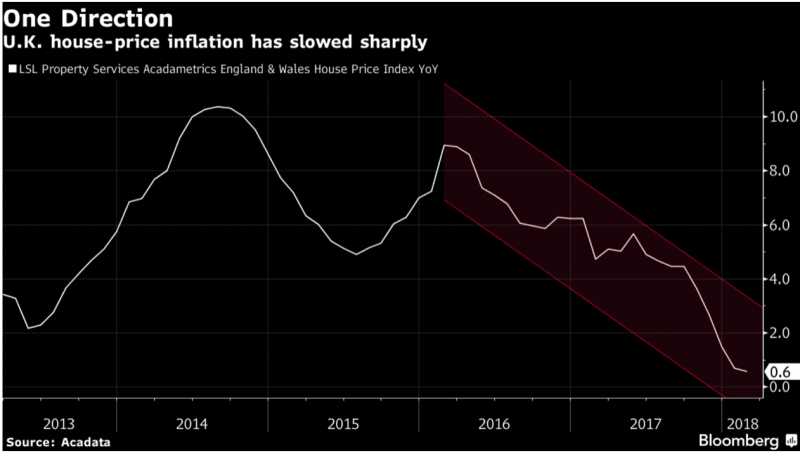

British pound – Smoother transition, stronger sterling

Recent positive developments in the United Kingdom (UK), namely the transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March, call for a more positive short-term outlook for the sterling than previously thought. We therefore revise our projections upward for the sterling on the entire time horizon.

Read More »

Read More »

FX Daily, March 28: Three Developments Shaping Month-End

Today may be the last day of full liquidity until next Tuesday, after the Easter holidays. We identify three developments that are characterizing the end of the month, quarter, and for some countries and companies, the fiscal year. Equity market sell-off, bond market rally, and the continued rise in LIBOR.

Read More »

Read More »

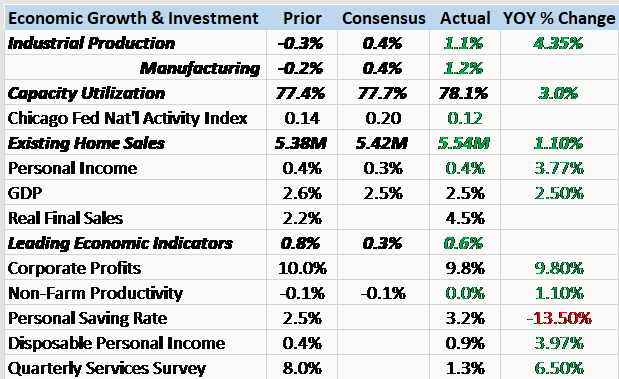

Bi-Weekly Economic Review: Embrace The Uncertainty

There’s something happening here What it is ain’t exactly clear There’s a man with a gun over there Telling me I got to beware I think it’s time we stop, children, what’s that sound Everybody look what’s going down There’s battle lines being drawn Nobody’s right if everybody’s wrong Young people speaking their minds Getting so much resistance from behind It’s time we stop, hey, what’s that sound Everybody look what’s going...

Read More »

Read More »

Maker of the Sniper’s Choice, makes the news – but what is the Swiss company RUAG?

The Swiss company RUAG made the news last week when investigators were called in to look at information relating to the sale of ammunition. But what is this company? According to RTS, the investigation revealed contracts for the sale of ammunition to Russia that had not been properly declared, RUAG triggered the investigation itself when a whistle blower reported irregularities and has filed a criminal complaint.

Read More »

Read More »

Swiss electricity getting cleaner, says energy report

The electricity consumed in Switzerland is ever greener, according to government statistics: some 62% comes from renewable sources, while nuclear has fallen to 17%. The figures (in French/German)external link were released on Monday by the Federal Office of Energy, which gathers each year the sources used by electricity providers in Switzerland. The latest report refers to 2016.

Read More »

Read More »

London House Prices Falling Sharply – UK’s Much Needed Wake-Up Call

London house prices falling at fastest pace since 2009. Values fell by 2.6% in year through January. London house prices likely to be weakest in UK over next five years. Inflated prices make London property more exposed to economic and political shocks. Worries over house prices are having a knock-on effect in wider economy. Physical gold to act as much needed hedge against falling property prices.

Read More »

Read More »

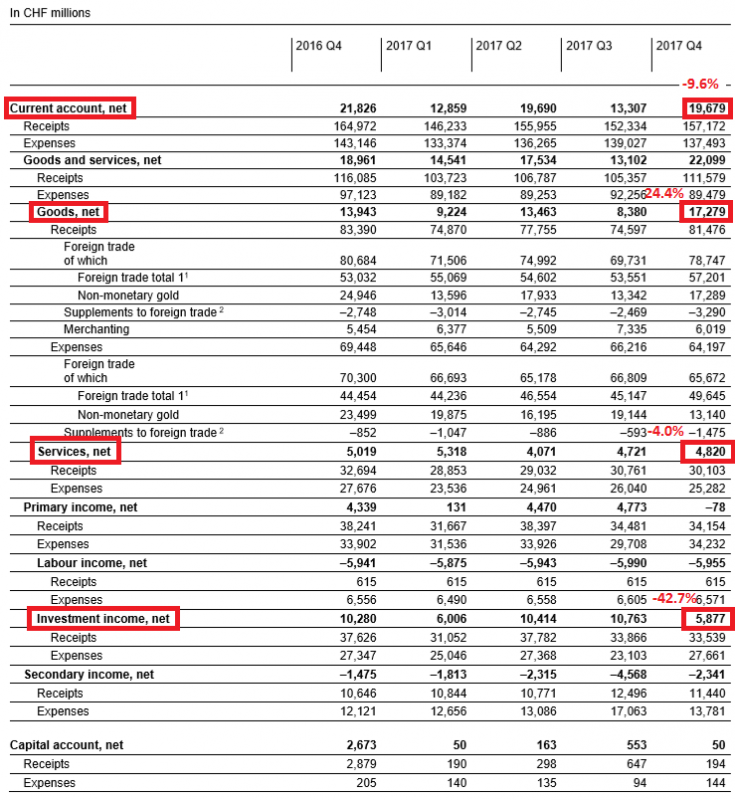

Swiss Balance of Payments and International Investment Position: Q4 2017 and review of the year 2017

Key figures: Current Account: -9.6% against Q4/2016 to 19,679 bn. CHF, Record High Trade Surplus in Goods: +24.4% to 17,279 bn., Services Surplus : -4.0% to 4,820 bn., but Investment Income: down 42.7% to 5,877 bn.

Read More »

Read More »

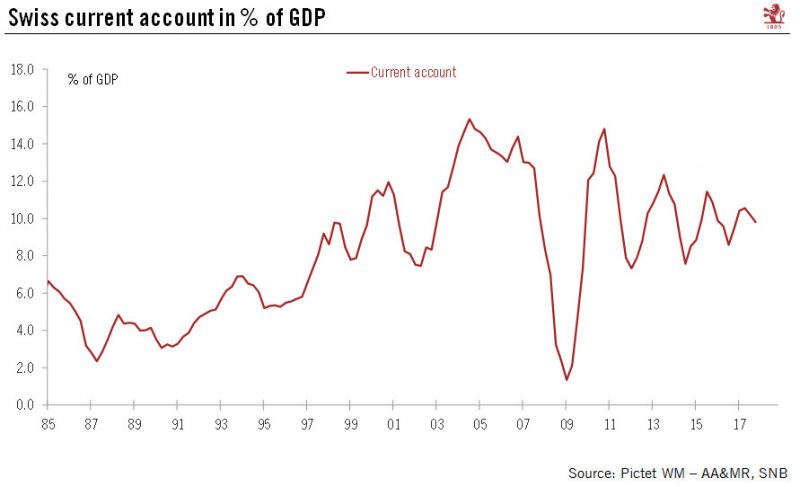

Disentangling the Swiss current account

Following the Swiss National Bank’s (SNB) publication of Switzerland’s balance of payments data for Q4 2017, in this note we look deeper into the Swiss current account to try to find out why Switzerland persistently runs a surplus and whether or not the current account balance can be used to assess the fair value of the Swiss franc.

Read More »

Read More »

FX Daily, March 27: Global Equities Follow US Lead, Dollar Steadies

We argued that the talk of trade war was exaggerated. The confrontation, strong demands and a climb down is the Art of the Deal, and is part of the way the Trump Administration negotiates. We see striking parallels between the policymakers and tactics with the Reagan Administration's attempt to pry open Japanese markets.

Read More »

Read More »

Weekly Technical Analysis: 26/03/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/JPY, GBP/JPY, USD/CHF

The USDCHF pair provided negative trades after 0.9488 proved its strength against the recent positive attempts, to keep the bearish trend scenario valid efficiently in the upcoming period, supported by the EMA50 that pushes negatively on the price, waiting to test 0.9373 initially.

Read More »

Read More »

Fintech lending platform Loanboox eyes French expansion

Award-winning Swiss fintech firm Loanboox is planning further expansion into Europe having obtained a foothold in Germany. The digital portal for matching institutions with investors plans a move into France and is also looking at other European markets.

Read More »

Read More »

FX Daily, March 26: Equity Meltdown Aborted, Dollar Eases

After a poor start in Asia, equities recovered. The MSCI Asia Pacific initially extended last week's losses and fell to its lowest level since February 12 before recovering to finish near its highs, 0.4% above last week's close. European markets followed suit. They did not have to take out last week's lows. The Dow Jones Stoxx 600 is up about 0.4% in late morning turnover.

Read More »

Read More »

FX Weekly Preview: The Investment Climate

The investment meme of a synchronized global upturn has been undermined by the recent string of US and European economic data. The flash March eurozone composite reading fell to 55.3, the lowest reading since January 2017. Although Q4 17 US GDP may be revised higher (toward 2.8% from 2.5%) mostly due to greater inventory accumulation, the curse of weak Q1 GDP appears to be showing its hand again, with forecasts now coming in below 2%.

Read More »

Read More »

Swiss gold refiners accused of sourcing illegal and conflict gold

A report by the NGO Society for Threatened Peoples (STP) has accused Swiss gold refiner Metalor of procuring gold from controversial suppliers in Peru. Metalor denies the charge. The reportexternal link, released on Thursday to time with the opening of the Baselworld Watch and Jewellery Fair, says that in all likelihood, Metalor continues to procure illegally mined and sold Peruvian gold, which is linked to tax evasion and environmental destruction.

Read More »

Read More »

Swiss government set to remove ‘mariage tax penalty’

In Switzerland, married couples file one combined tax return. Because tax rates rise in line with income it means that second incomes of married couples are taxed at a higher rate than those of single cohabitating ones. Those campaigning to have this changed argue that it is unfair and acts as a disincentive for second income earners.

Read More »

Read More »