Tag Archive: newslettersent

Wall Street and SNB In Pain: 163 Hedge Funds Are Long AAPL Stock

First it was the blow up of hedge fund darling Valeant that crushed countless funds who were long the name.

Then, one month ago after the collapse of the Allergan-Pfizer deal, we showed (one of the reasons) why the hedge fund world continued to unde...

Read More »

Read More »

US Economy – Gross Output Continues to Slump

The Cracks in the Economy’s Foundation Become Bigger Last week the Bureau of Economic Analysis has updated its gross output data for US industries until the end of Q4 2015. Unfortunately these data are only available with a considerable lag, but th...

Read More »

Read More »

Great Graphic: Measuring Cost of Extend and Pretend

There is a debate. On one hand is Summers, who argues that modern economies have entered an era of secular stagnation. Full utilization of the factors of production and particularly capital and labor is not possible without stimulating aggregate demand in a way that facilitates bubbles. The broad strokes of the argument can be found …

Read More »

Read More »

Greenback Mostly Softer, Sterling Shines

The gains the US dollar registered in the second half are being pared, but it is sterling’s strength that stands out. It is difficult to attribute it to Obama’s push against Brexit, but there does appear to have been a change in sentiment. Sterling is the best-performing currency not only today but for the past …

Read More »

Read More »

The “Canary in the Coal Mine” for Chinese Stocks

The Largest Online Marketplace in the World This company is twice the size of Enron at its peak ($100 billion). Pharmaceutical giant Valeant, which blew up in the last year, was only $90 billion at its peak. Before I get to what the stock is, let m...

Read More »

Read More »

FX Daily April 25: Global Tensions Lessened, but Bound to Increase Ahead of June FOMC Meeting

We expect the FOMC statement this week to recognize the improvement in the global conditions that have been an increasing worry for officials over Q1. At the same, time the soft patch of the US economy is undeniable. We suspect the Fed will look past the weakness of the US economy. The strength of the … Continue reading...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

(from my colleague Dr. Win Thin)

EM ended last week on a soft note. Perhaps the main driver was rising US yields, as markets become wary of a more hawkish Fed this Wednesday. Perhaps it was technical, as the EM rally became over-extended. Wh...

Read More »

Read More »

FX Daily April 25: Dollar Pares Pre-Weekend Gains Against Euro and Yen

The US dollar starts what promises to be an eventful week giving back some the gains score in second half of last week against the euro and yen. Equity markets are extending their pre-weekend losses. Commodities are also trading with a heavier bias. Markets in Australia, New Zealand, and Italy are closed for national …

Read More »

Read More »

Affairs of State: Erdogan and Böhmermann

Insulting Mr. Erdoğan Can Be Dangerous Most of our readers are probably aware by now that the German government finds itself in a rather awkward situation over its relations with Turkey’s government again – with which the EU has just struck a widel...

Read More »

Read More »

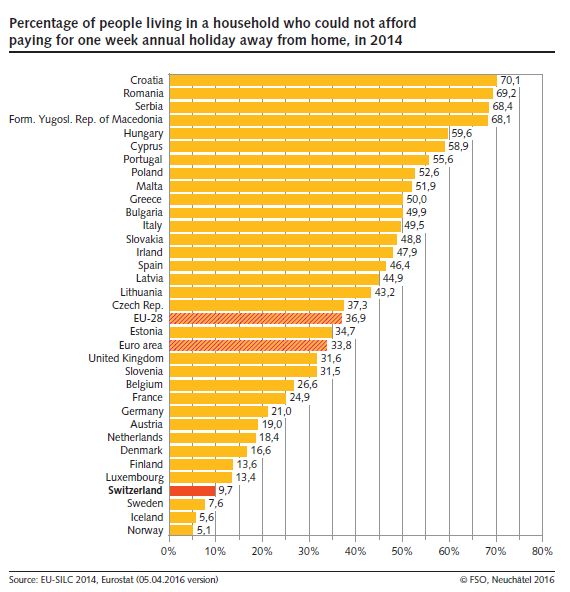

Standard of living in Switzerland remains one of the highest in Europe

In 2014 Switzerland was one of the countries with the highest living standards in Europe. This does not exclude financial difficulties, as 6.6% of the population, i.e. approx. 530,000 people were affected by income poverty. Roughly one person in ten cannot afford a week's holiday away from home according to the Federal Statistical Office's survey on income and living conditions (SILC).

Read More »

Read More »

The Week Ahead: FOMC, BOJ and More

The last week of April is eventful. The Reserve Bank of New Zealand, the Federal Reserve and the Bank of Japan hold policy meetings. The UK, eurozone, and the US provide the first estimates of Q1 GDP. Japan, the eurozone, and Australia report consumer prices, while the US updates the Fed’s preferred (targeted) inflation measure, the …

Read More »

Read More »

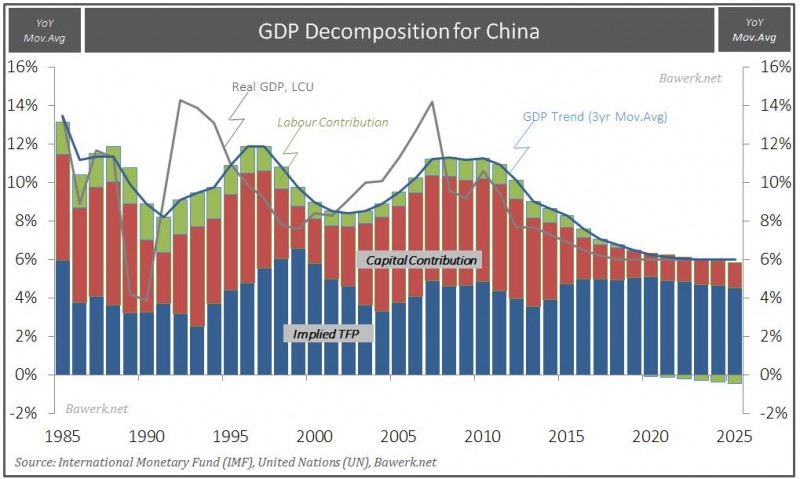

Chinese Dragon: Breathing Credit Fumes

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate.

Read More »

Read More »

Germany’s AFD leader Frauke Petry wants ‘more Switzerland for Germany’

Fauke Petry, leader of the Alternative for Germany (AfD), believes Germany “needs more Switzerland … more democracy” and that Switzerland is some way ahead of her country when it comes to a “culture of democracy”.

Read More »

Read More »

Switzerland Readies Military In Preparation For A New Wave Of Migrants

According to The BBC, the most asylum claims in 2015 occurred in Germany, which saw >500,000...

With the main route (reportedly shut down) being from Turkey to Greece, and up through the Balkans...

With Syrians making up the bulk of migrants tryi...

Read More »

Read More »

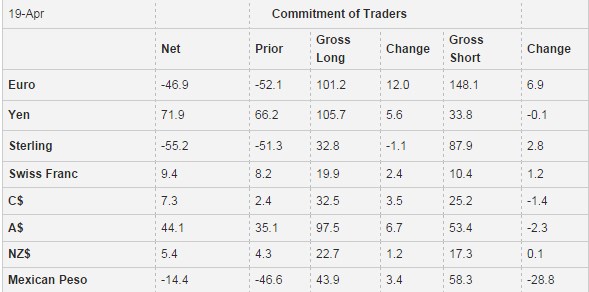

Weekly Speculative Positions: Reduction of US Dollar Exposure at What may be the Bottom

Speculators in the futures market continued to press a bearish view of the US dollar the CFTC reporting week ending April 19. For one and half month traders continue to increase their long CHF position against the dollar. It has risen to 7.3k contracts.

Read More »

Read More »

Dollar’s Technical Tone Improves

It is not that the US dollar had a particularly good week. It was mixed. The best performers were sterling and the Canadian dollar. The pound led with a 1.6% gain, followed closely by the Canadian dollar.

The latest polls suggest that tho...

Read More »

Read More »

The State of the Bull

(here is a draft of my monthly column for a Chinese paper)

The US dollar has had a rough few months. It has fallen against most major and emerging market currencies this year. A critical issue for global investors and policymakers is whether ...

Read More »

Read More »