Tag Archive: newslettersent

Emerging Markets: What has Changed

(from my colleague Dr. Win Thin)China’s central bank may be leaning less dovish

Turkey has a new central bank governor

Argentina issued external debt for the first time since it defaulted 15 years ago

Brazil's lower house voted to impeach Preside...

Read More »

Read More »

FX Daily, April 22: Capital Markets Mostly Consolidate, Yen Drops

Equity markets are seeing this week's gains trimmed after the S&P 500 fell 0.5% yesterday, recording its biggest loss in two weeks. Disappointing earnings in some tech leaders spurred profit-taking, The US 10-year Treasuries are consolidati...

Read More »

Read More »

100 Years of Mismanagement

Lost From the Get-Go There must be some dark corner of Hell warming up for modern, mainstream economists. They helped bring on the worst bubble ever… with their theories of efficient markets and modern portfolio management. They failed to see it fo...

Read More »

Read More »

Japanese Capital Flows: Six Observations

The following observations are drawn from the weekly report of Japan’s Ministry of Finance unless noted otherwise. We use the weekly data instead of monthly to identify changes of trend earlier. We use simple convention of the week by the last rather than the first day. That means that the report for the week ending April …

Read More »

Read More »

FX Daily, April 21: ECB Takes Center Stage

The ECB meeting is the session's highlight. In recognition of the risk that ECB President Draghi expresses displeasure with the premature tightening of financial conditions through the exchange rate channel is encouraged a modest bout of euro s...

Read More »

Read More »

The Shocking Reason For FATCA… And What Comes Next

Submitted by Nick Giambruno via InterntionalMan.com,

If you’ve never heard of the Foreign Account Tax Compliance Act (FATCA), you’re not alone.

Few people have, and even fewer fully grasp the terrible things it foreshadows.

FATCA is a U.S. ...

Read More »

Read More »

Is the Stock Market Overvalued?

Dismal Earnings, Extreme Valuations The current earnings season hasn’t been very good so far. Companies continue to “beat expectations” of course, but this is just a silly game. The stock market’s valuation is already between the highest and third ...

Read More »

Read More »

Status of 9/11 Bill and the Saudi Threat

There continues to be much discussion among investors of New York Times report last weekend in which a Saudi official threatened to sell $750 bln of US Treasuries and assets if a bill that would allow families of victims to sue the Saudi governm...

Read More »

Read More »

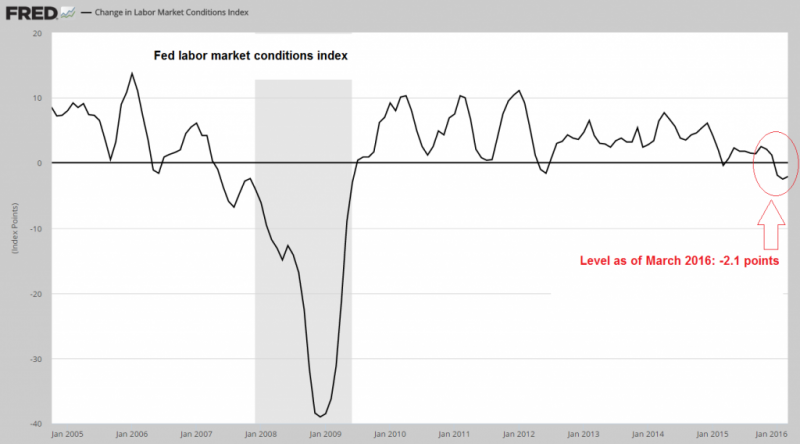

Fighting Recessions with Hot Air

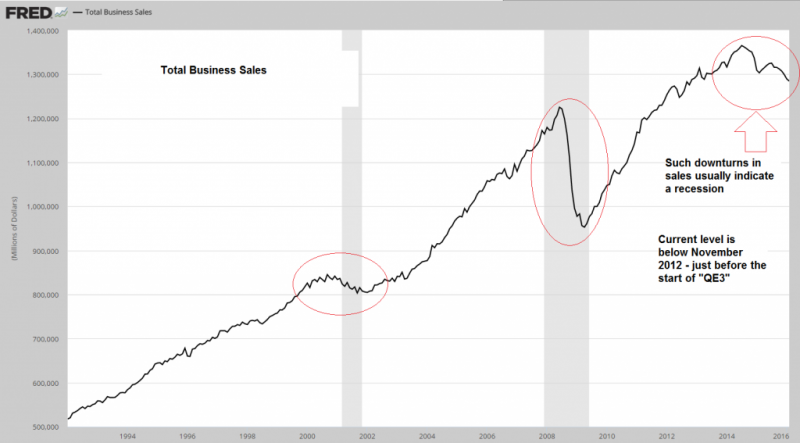

“Prepping” for Recession GUALFIN, Argentina – Stocks are going up all over the world. Meanwhile, it appears to us that the U.S. economy is going down. Go figure. For instance, a labor-market index created by Fed economists… and closely watched by ...

Read More »

Read More »

FX Daily April 20: Bulls’ Charge Stalls, while Greenback Consolidates Losses

The US dollar has been largely confined to yesterday’s ranges against the major currencies. China’s yuan slipped lower for the first time in four sessions, while the Shanghai Composite fell 2.3%, the most since the end of February. While a few equity markets in Asia managed to follow suit after US equity market gains carried …

Read More »

Read More »

Making Sense of China’s Gold Fix and Hungary’s Dim Sum Offering

Earlier today, China launched its first gold fix. It will offer a fixing twice a day going forward yuan. The Shanghai Gold Exchange established the fix the same way it is done in London and New York, by prices submitted by financial institutions. In China’s case, 18 institutions, including two foreign banks, participate in the …

Read More »

Read More »

Some Thoughts on US Fiscal Policy

The US presidential selection process is well underway, and yet there has been no coherent discussion of fiscal policy. In part, this is because it does not appear particularly urgent. The US deficit peaked in 2009 at 10.1% of GDP. Last year it stood at what for most OECD countries an enviable 2.6%. This year and next … Continue reading...

Read More »

Read More »

FX Daily April 20: Markets Build on Yesterday’s Dramatic Recovery

Global capital markets staged an impressive recovery after the initial reaction to the failure to freeze oil output sent reverberations through the oil markets, commodities, and Asian equities. The sharp reversal begun in Europe and extended in N...

Read More »

Read More »

A Morally Sound Tax Reform Proposal

The Oppressed U.S. Taxpayer This year, Americans’ day of tribute to their federal overlords falls on April 18. As calculated by the Tax Foundation, the average American will work from January 1 to April 24 (Tax Freedom Day) to pay his share of tax...

Read More »

Read More »

Malaysia CDS Spike After Abu Dhabi Puts Scandal-Ridden 1MDB In Default, Funds hidden in Switzerland

Over the better part of the past year, we’ve documented the curious case of 1MDB, Malaysia’s government investment fund founded in 2009.

It’s a long and exceptionally convoluted story that doesn’t exactly lend itself to a concise summary but suffice...

Read More »

Read More »

US Economy – Ongoing Distortions

Business under Pressure A recent post by Mish points to the fact that many of the business-related data that have been released in recent months continue to point to growing weakness in many parts of the business sector. We show a few charts illust...

Read More »

Read More »

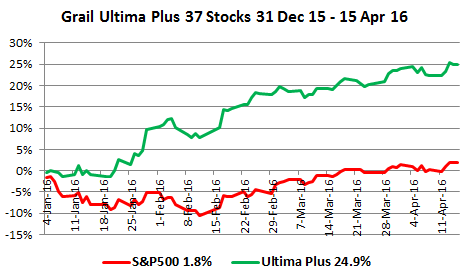

Stunning results achieved by Grail’s Free Portfolio in just two Months!

I am very pleased to report that the free portfolio in its deadline week exceeded my target of 15%, having reached a return of 16.84%, helped by a gain of 2.7%!

The purpose of the portfolio was to give readers irrefutable evidence of the unique power of the Grail Equity Management System (GEMS) to generate high returns with no more risk than the S&P 500. The first graph shows that the mother portfolio has a margin of safety vis-à-vis the index of...

Read More »

Read More »

Panama Papers Names Revealed: Multiple Connections to Clinton Foundation, Marc Rich

There has been much confusion, at time quite angry, how in the aftermath of the Soros-funded Panama Papers revelations few, if any, prominent U.S. name emerged as a result of the biggest offshore tax leak in history. Now, thanks to McClatchy more U.S...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

(from my colleague Dr. Win Thin)

EM ended last week on a firm note. Given the absence of any Fed-specific risks or any major US data releases, that firmness could carry over into this week. The failure to reach an agreement in Doha by oil pro...

Read More »

Read More »

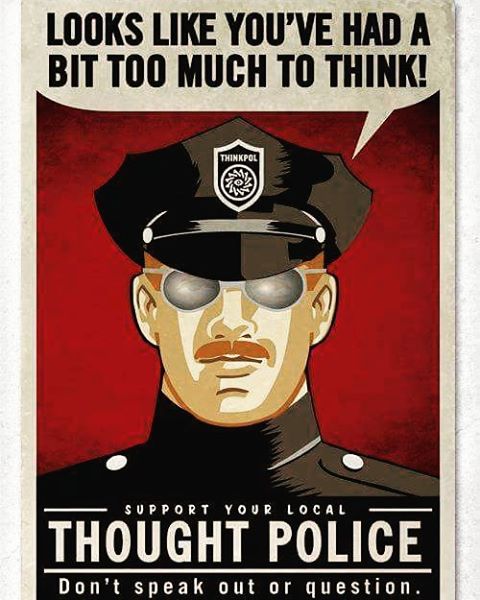

Cultural Marxism and the Birth of Modern Thought-Crime

What the Establishment Wants, the Establishment Gets If a person has no philosophical thoughts, certain questions will never cross his mind. As a young man, there were many issues and ideas that never concerned me as they do today. There is one que...

Read More »

Read More »