Tag Archive: newslettersent

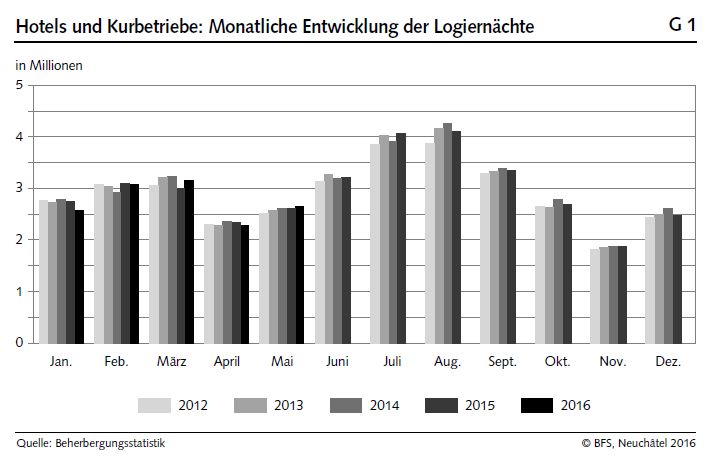

Tourism accommodation statistics in May 2016: Increase in overnight stays during May 2016

The Swiss hotel industry registered 2.7 million overnight stays in May 2016, which corresponds to a growth of 1.3% (+35,000 overnight stays) compared with May 2015. Domestic visitors recorded 1.1 million overnight stays, representing an increase of 1.9% (+21,000). Foreign demand registered 1.5 million overnight stays, i.e. an increase of 0.9% (+15,000). These are provisional results from the Federal Statistical Office (FSO).

Read More »

Read More »

Housing Affordability – A Dose of Reality

First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US.

Read More »

Read More »

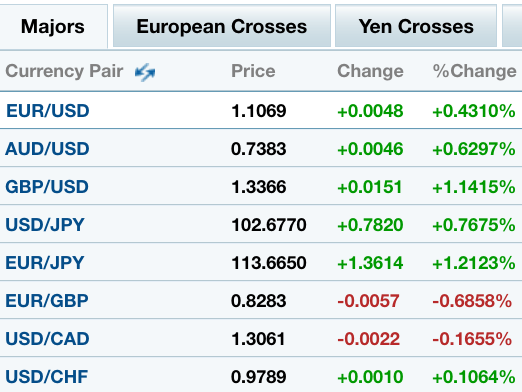

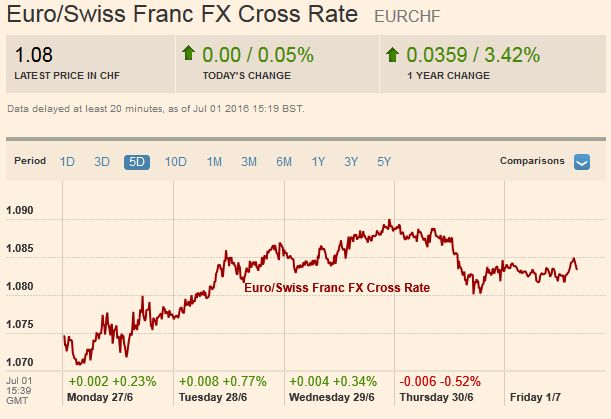

SNB intervenes for 6.3 billion francs in one week, total 10bn Brexit intervention

SNB intervenes for 6.3 bil francs in the week ending last Friday. Once again a record high since January 2015. The SNB raised the intervention level to 1.0850. Apparently conversion of GBP->CHF flows into GBP-> EUR flows – via EUR/CHF purchases. Speculators: are long CHF 10K contracts against USD versus 6.3K last week.

Read More »

Read More »

(1.3.) Let’s improve the way we report FX rates

This post is motivated by recent headlines suggesting that the Chinese yuan has depreciated in recent days. Here's an example: China's yuan weakens to 5-1/2 low as c.bank tolerates depreciation. This headline is completely inaccurate - the Chinese yuan has been appreciating in recent days. So that's one problem I'd like to fix.

Read More »

Read More »

Brexit: BoE Governor Not Optimistic

Stateside, this is a holiday shortened trading week, one that will be dominated by two fundamental events - Wednesday's FOMC minutes and Friday's non-farm payroll (NFP) report for June. With no surprises expected in the minutes, both dealers and investors have very much priced out any possibility of a U.S rate hike occurring within the next 18-months. In respect to the jobs report, is it possible that the U.S can print two disappointing numbers...

Read More »

Read More »

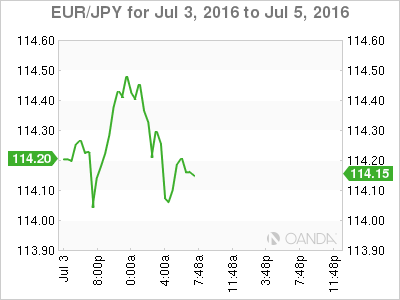

FX Daily, July 04: Four Things that Happened on the Anniversary of the Original Brexit

Inflation expectations fall in Japan. UK construction PMI fell sharply before Brexit. The Australian dollar recovers from the dip as investors await more results. It is not clear that Brexit has sparked a wave of nationalism or anti-EU sentiment.

Read More »

Read More »

Emerging Markets: Preview for the Week Ahead

EM and risk recovered nicely from the Brexit turmoil last week. Yet we think markets are getting too carried away with the "low rates forever" theme and are likely underestimating the capability of the Fed to tighten before 2018. This Friday, the June jobs data could spark a shift in sentiment with a strong reading. Consensus is currently 175k jobs created, up from 38k in May.

Read More »

Read More »

FX Weekly Preview: If No Article 50 Soon, What are the Fundamental Drivers?

Impact of Brexit will take some time to be seen, but the U.K. is already losing influence. U.S. employment data is not sufficient to get the Fed to hike this month. Pressure continues to build on the BOJ to act.

Read More »

Read More »

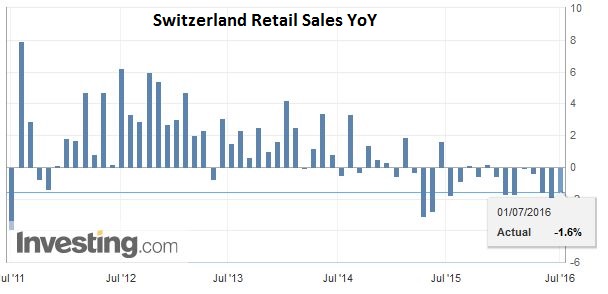

Swiss Retail Sales -2.3 percent nominal (YoY) and -1.6 percent real (YoY)

Turnover in the retail sector fell by 2.3% in nominal terms in May 2016 compared with the previous year. This decline has been ongoing since January 2015. Seasonally adjusted, nominal turnover fell by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

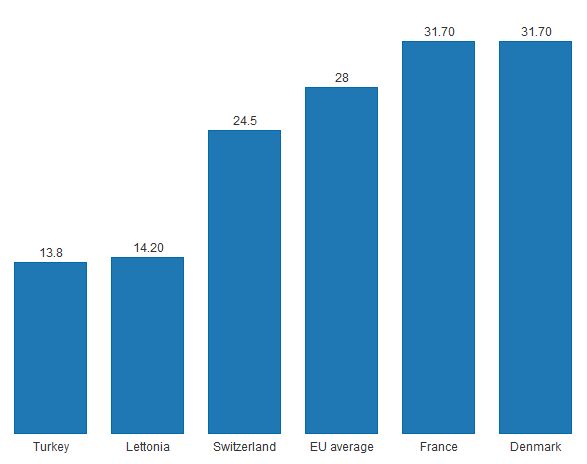

Swiss Social Security Accounts 2014: Social security expenditure accounted for 24.5percent of GDP

In 2014 expenditure on social benefits from the Swiss social security system amounted to CHF 157 billion. This corresponds to a 24.5% share of the gross domestic product (GDP).

Read More »

Read More »

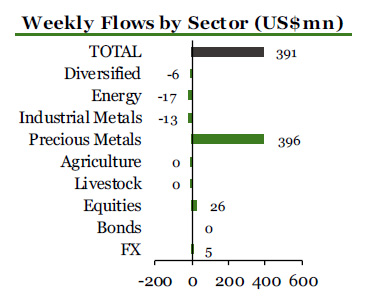

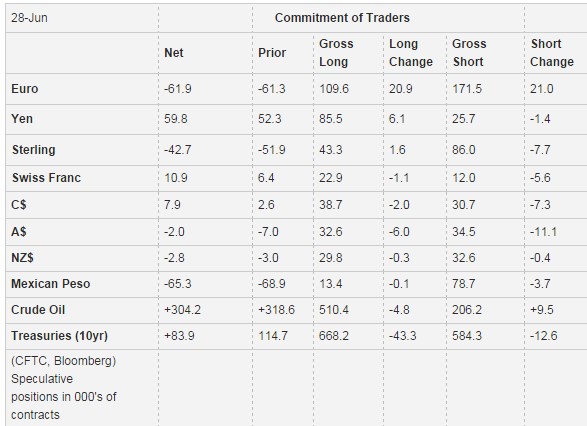

Weekly speculative Positions: Bulls and Bears Saw Speculative Opportunity in Euros

In the sessions before and after the UK referendum speculators in the currency futures did three things. First, they generally reduced exposure. This means gross longs and short positions were reduced. CHF long positions increased to 10K Speculators were divided about what to do with the euro.

Read More »

Read More »

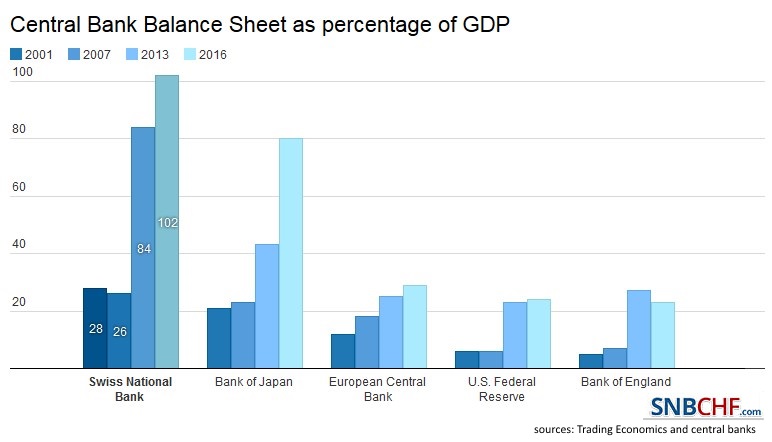

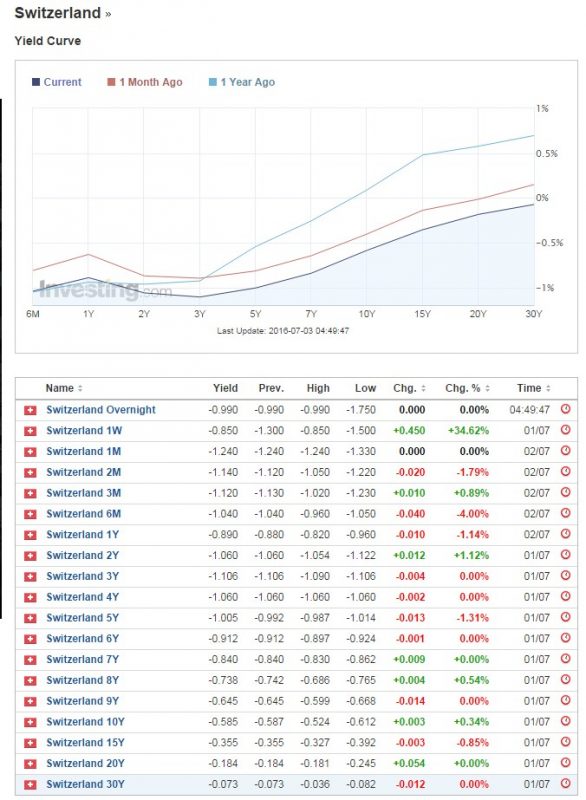

Swiss Bond Yields all Negative up to 30 years: Greatest Bubble in Financial History

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are "more negative than others", because investors expect a slow appreciation of the Swiss franc.

Read More »

Read More »

Mooning the Elite

Dow up 269 points. Was that all there was? Is the “Brexit” scare over? We don’t know… but we’re going to take a pause today. Instead of trying to connect the new dots, we’re going to take a look at the old dots we’ve already strung together

Read More »

Read More »

FX Weekly Review: June 27 – July 01: Swiss Franc Strength Reversed

Week after Brexit.: The Swiss franc (-0.3%) and the yen (-0.5%) were the worst performers, as so-called safe haven buying was reversed.

But the Swiss Franc index is still stronger in the last month than the dollar index.

Read More »

Read More »

If the UK Economy Tanks, Don’t Blame Brexit

If the process of wealth generation is currently in good shape then Britain’s exit from the EU shouldn’t have any negative effect on real economic growth. This, however, might not be the case.

It is likely that the reckless monetary policy of central banks in the UK and the eurozone has inflicted a severe damage to the process of real wealth formation.

Read More »

Read More »

When the Deep State Controls All Wealth

The feds got out the knife in 1971. They changed the money system itself. They severed the link between gold and the dollar – and between value and price. It was so subtle almost no one objected… and so clever almost no one saw what it really meant. It took us more than 40 years to figure it out.

Read More »

Read More »

Emerging Markets: What has Changed

Indonesia’s parliament approved a tax amnesty bill. Korea announced KRW20 trln ($17 bln) in fiscal stimulus. Czech President Zeman said a referendum on EU and NATO membership should be held Russia ended its tourism ban to Turkey. Brazil’s central bank is sending hawkish signals

Read More »

Read More »