Tag Archive: newslettersent

Disability welfare – fraud investigations expected to save 170 million

By January 2018, the number receiving disability welfare in Switzerland had dropped to 217,200, 40,300 fewer than in 2006 when the number reached a record 257,500. Switzerland’s Federal Social Insurance Office (FSIO) attributes the reduction to an occupational rehabilitation programme started in 2008, and disability welfare fraud investigations.

Read More »

Read More »

Tax Cuts And (Less) Spending

After being rumored and talked about for over a year, at the end of last year the tax cuts were finally delivered. The idea had captured much market attention during that often anxious period of political flirtation. Prices would rise or fall by turn based on whether or not it seemed a realistic possibility.

Read More »

Read More »

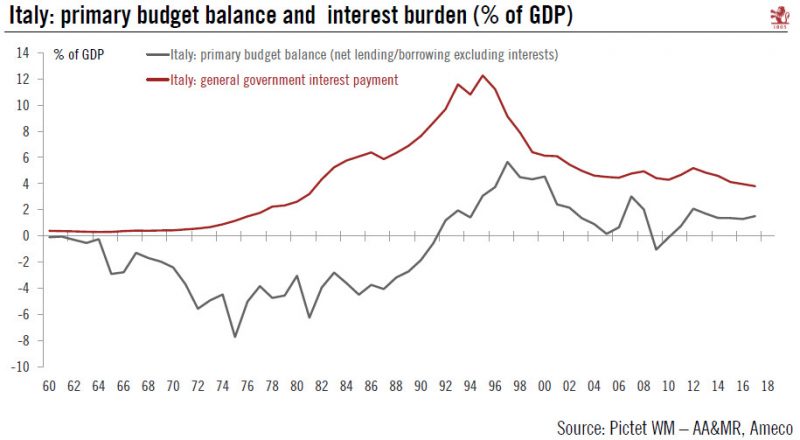

Europe chart of the week – Italy’s fiscal buffers

The incoming government’s fiscal plans could result in a sharp deterioration of Italy’s public finances. However, broader fiscal metrics are better than they were during the euro sovereign crisis.The M5S-League coalition has committed to a significant degree of fiscal easing and to the reversal of some structural reforms. Such policies will put Italy on course for confrontation with Brussels over deficit reduction targets, although at this stage we...

Read More »

Read More »

Median Swiss salary rises

Swiss salaries have risen according to a recently published report by Switzerland’s Federal Statistical Office. The median gross monthly salary was CHF 6,5021 in 2016, CHF 313 higher than in 2014. 50% of Swiss workers earned more than this and 50% earned less.

Read More »

Read More »

FX Daily, May 18: EUR/CHF Continues the Collapse

The US dollar is mostly firmer. US yields have stabilized. Asian equities were mostly higher, while European bourses are struggling. Oil prices are steady. There have been a number of sustained trends in the markets that we have been monitoring. The euro, for example, has fallen each day this week. It recorded its low for the year on Wednesday near $1.1765.

Read More »

Read More »

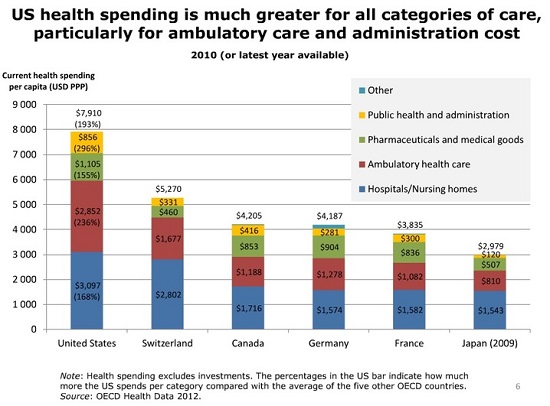

U.S. Healthcare Isn’t Broken–It’s Fixed

If you want to understand why the U.S. healthcare system is bankrupt, financially, morally and politically, then start with this representative anecdote from a U.S. physician. I received this report from correspondent J.F. on the topic of direct advertising of pharmaceutical products to the public (patients).

Read More »

Read More »

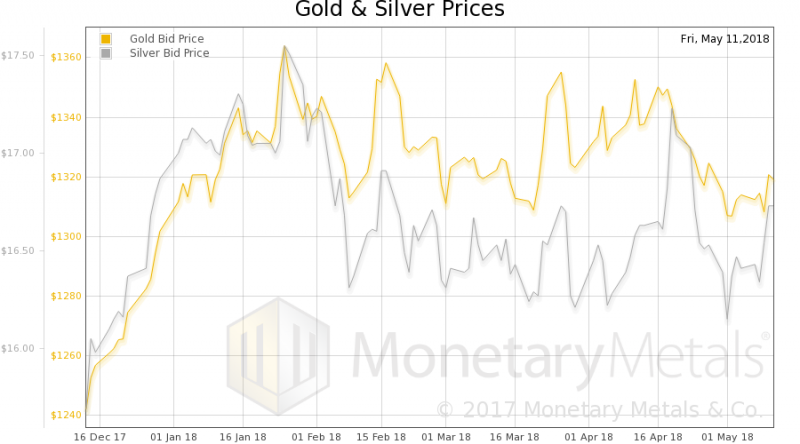

Welsh Gold Being Hyped Due To The Royal Wedding?

Welsh gold and the misconceptions surrounding it – GoldCore speak to China Central Television (CCTV). Welsh gold mired in misconceptions, namely that it is ‘rarest’ and most ‘sought after’ gold in world. Investors to be reminded that all mined gold is rare and homogenous. Nothing chemically different between Welsh gold and that mined elsewhere. Investors led to believe Welsh gold is more valuable, despite lack of authenticity in some Welsh gold...

Read More »

Read More »

Child care tax deductions set to rise in Switzerland

Switzerland’s Federal Council, or cabinet, plans to increase the maximum annual deduction for child care costs to CHF 25,000 per child, up from CHF 12,100. This would allow parents to deduct up to this amount from their income for federal tax purposes but would not affect canton and commune taxes. Deductions could not exceed the amount spent.

Read More »

Read More »

FX Daily, May 17: US Rates Edge Higher, while Dollar Turns Mixed

The Britsh pound was a cent from yesterday's lows on a press report that claimed the UK cabinet had agreed on seeking to stay in the customs union with the EU beyond the two-year transition period. The report suggested that the UK wanted to still negotiate other trade deals, which would seem to be a Trojan Horse.

Read More »

Read More »

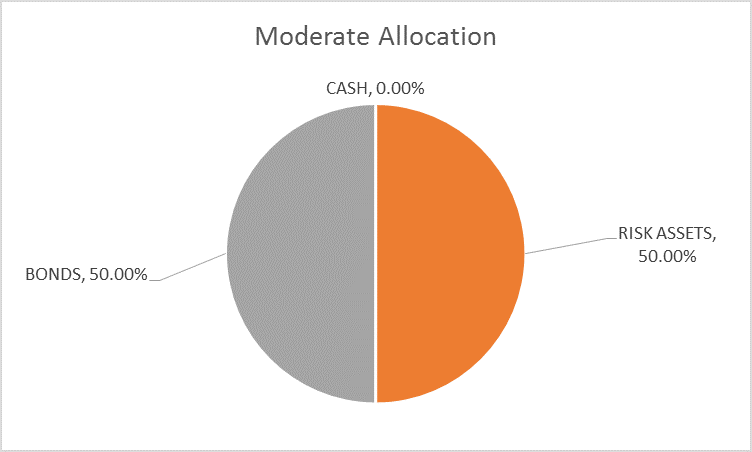

Global Asset Allocation Update

The risk budget changes this month as I add back the 5% cash raised in late October. For the moderate risk investor, the allocation to bonds is still 50% while the risk side now rises to 50% as well. I raised the cash back in late October due to the extreme overbought nature of the stock market and frankly it was a mistake. Stocks went from overbought to more overbought and I missed the rally to all time highs in January.

Read More »

Read More »

Global Turn-of-the-Month Effect – An Update

The “turn-of-the-month” effect is one of the most fascinating stock market phenomena. It describes the fact that price gains primarily tend to occur around the turn of the month. By contrast, the rest of the time around the middle of the month is typically far less profitable for investors. The effect has been studied extensively in the US market. In the last issue of Seasonal Insights I have shown a table detailing the extent of the...

Read More »

Read More »

FX Daily, May 16: US Yields Soften After Yesterday’s Surge

The US dollar is mixed today after the Dollar Index rose to new 2018 highs yesterday. It is being driven by rising US rates, which also punishes short dollar positions. The US 10-year yield rose seven basis points yesterday to nearly 3.10%. It is consolidating near 3.06% now. Many see the yield rising toward 3.20%, which would match the mid-2011 high.

Read More »

Read More »

Will the SNB raise interest rates?

The Swiss National Bank (SNB) could be moving forward in their process of raising interest rates according to current reports with the previous Q4 2019 hike predicted to become reality in Q3. This minor shift in expectations is positive for the Swiss Franc and gives the market some news to be targetting and assessing in deciding the value of the CHF.

Read More »

Read More »

Government defends Swiss Post-Amazon deal

The government has defended the deal struck that will see Swiss Post delivering packages for retail giant Amazon. There is no question of preferential treatment, it said. The response by the government came in response to a parliamentary question raised by politician Olivier Feller (Liberal-Radical), querying the deal that will see Swiss Post delivering Amazon packages within a time frame of 24 hours.

Read More »

Read More »

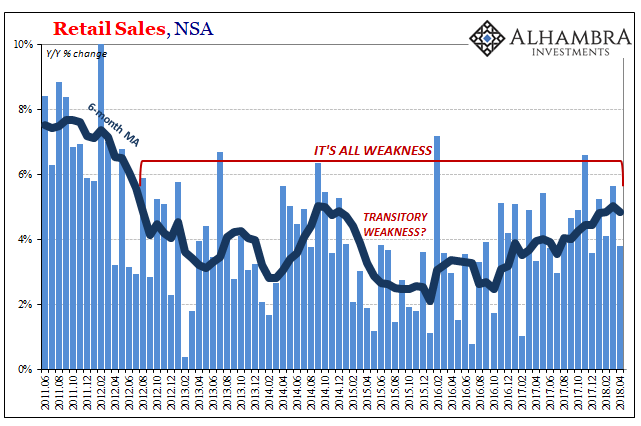

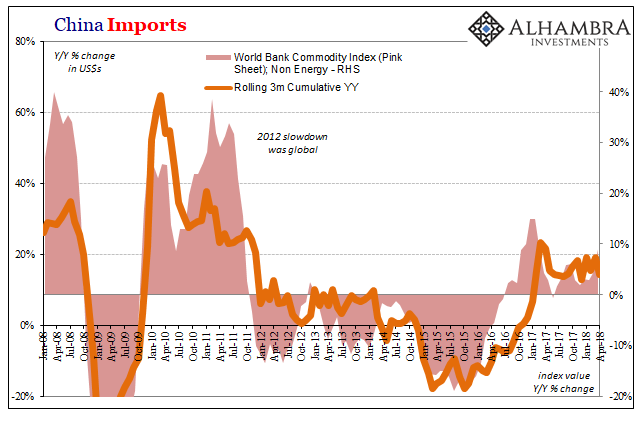

All The World’s A (Imagined) Labor Shortage

Last year’s infatuation with globally synchronized growth was at least understandable. From a certain, narrow point of view, Europe’s economy had accelerated. So, too, it seemed later in the year for the US economy. The Bank of Japan was actually talking about ending QQE with inflation in sight, and the PBOC was purportedly tightening as China’s economy appeared to many ready for its rebound.

Read More »

Read More »

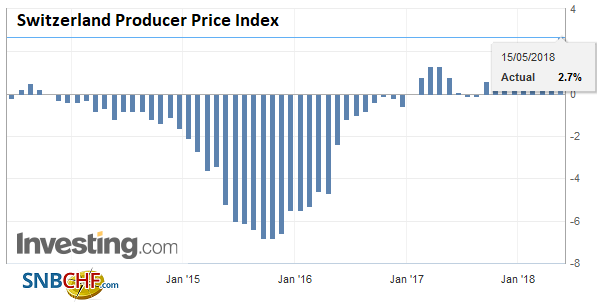

Swiss Producer and Import Price Index in April 2018: +2.7 percent YoY, +0.4 percent MoM

The Producer and Import Price Index increased in April 2018 by 0.4% compared with the previous month, reaching 102.8 points (December 2015 = 100). The rise is due in particular to higher prices for petroleum products and machinery. Compared with April 2017, the price level of the whole range of domestic and imported products rose by 2.7%.

Read More »

Read More »

Internships – Switzerland’s Young Socialists caught preaching one thing and practicing another

In collaboration with the Swiss union Unia, Switzerland’s Young Socialists have launched a protest against the exploitation of interns. To get on the career ladder, many young people feel compelled to take internships offering little or no pay. The Young Socialists are demanding interns be better paid. Recent data from the Federal Statistical Office shows that 23% of young workers (15-24) are on short-term contracts, 41% of them interns.

Read More »

Read More »

FX Daily, May 15: Firm US Rates Underpin Greenback

US 10-year rates are again probing the air above 3%, and this is encouraging a push back toward JPY110, with the euro slipping toward $1.19. Asian equities fell, with the MSCI Asia Pacific shedding 0.8%, the most in nearly a month, snapping a three-day advance. China and India were able to buck the regional move. China's economic data was mostly softer than expected and is consistent with a gradual turn in the cycle as the Lunar New effect fades.

Read More »

Read More »

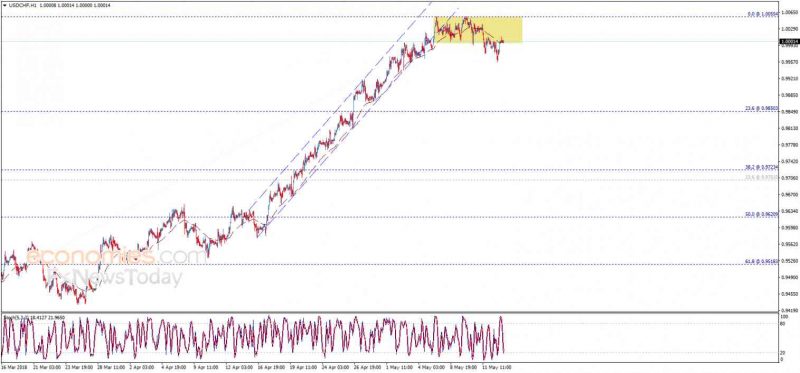

Weekly Technical Analysis: 14/05/2018 – USD/JPY, EUR/USD, EUR/JPY, GBP/USD, USD/CHF

The USDCHF pair provided positive trading yesterday to test 1.0000 level and settles around it, and as long as the price is below this level, our bearish overview will remain valid, noting that our next target is located at 0.9900, while breaching 1.0000 followed by 1.0055 levels represent the key to regain the main bullish trend again. Expected trading range for today is between 0.9920 support and 1.0055 resistance.

Read More »

Read More »