Tag Archive: newslettersent

The Fabian Society and the Gradual Rise of Statist Socialism

The Brexit referendum has revealed the existence of a deep polarization in British politics. Apart from the public faces of the opposing campaigns, there were however also undisclosed parties with a vested interest which few people have heard about. And yet, they have been instrumental in transforming Great Britain into a State based on the principles of democratic socialism.

Read More »

Read More »

Another Serious Real Interest Rate Fallacy

Modern monetary economics is a siren song, especially alluring in a world of falling, zero, and negative interest rates. I urge you not to dash your wealth against the rocks.

Read More »

Read More »

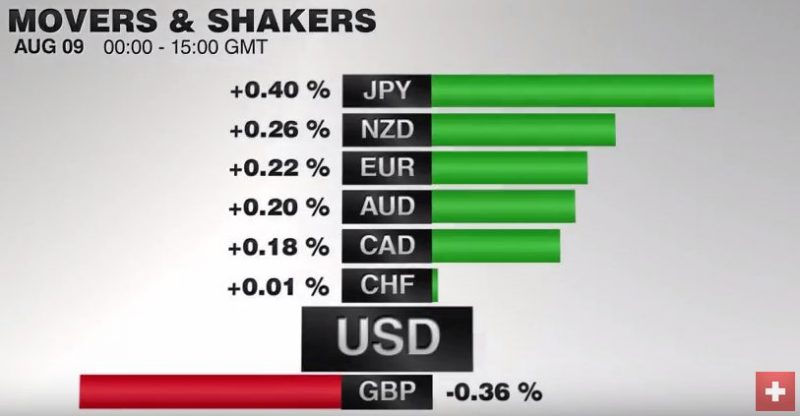

FX Daily, August 09: Sterling Slips to a Four-Week Low, EUR/CHF still trending up

In an otherwise uneventful foreign exchange market, sterling's slide for its fifth consecutive session is the highlight. It was pushed below $1.30 for the first time since July 12. Initial resistance for the North American session is seen near $1.3020, while the $1.2960 area corresponds to a minor retracement objective.

Read More »

Read More »

Bank of England QE and the Imaginary “Brexit Shock”

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame).

Read More »

Read More »

Bernanke’s Advice: More Emphasis on Data, Less on Fed Guidance

Bernanke reviews the changes in the long-term dot plots. There as been a clear trend toward lower long-term growth, unemployment and Fed funds equilibrium. The full adjustment may not be over.

Read More »

Read More »

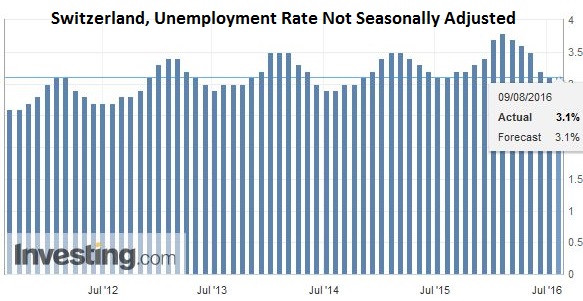

Switzerland Unemployment in July 2016: Remained unchanged at 3.1 percent, seasonally adjusted unchanged at 3.3 percent

At the end of July 2016 there were 139'310 registered as unemployed, 183 more than last month. The unemployment rate remained at 3.1% in June. Compared to the previous month, unemployment increased by 5'556 persons (+ 4.2%). Seasonally adjusted 3.3%, one year ago 3.2%.

Read More »

Read More »

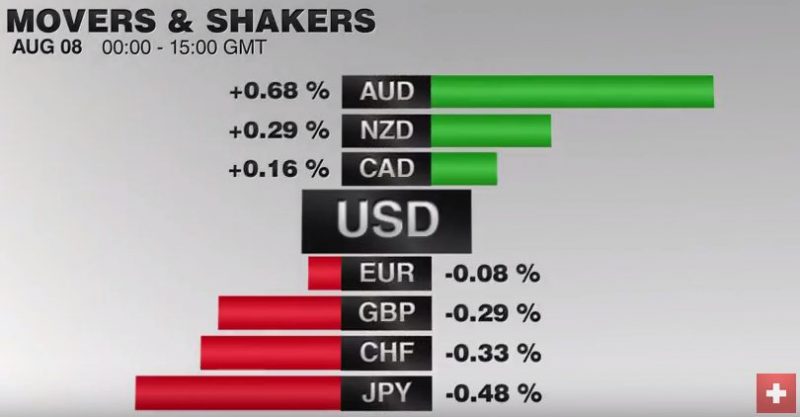

FX Daily, August 08: Stocks Up, Bonds Down, Dollar and Yen are Heavy

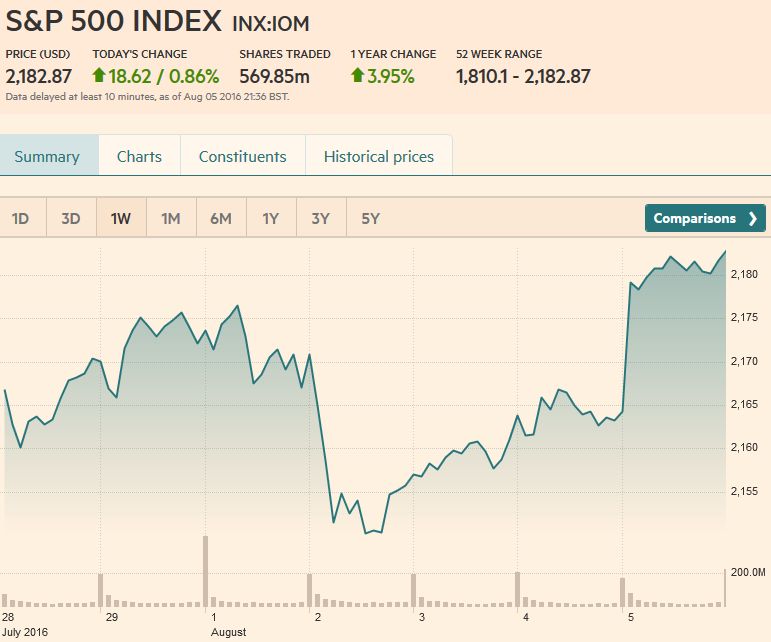

Investors favor risk assets today. Global stocks are moving higher in the wake of the pre-weekend US rally that saw the S&P 500 close at record levels. Bond yields are mostly firmer, again with US move in response to the robust employment report setting the tone in Asia.

Read More »

Read More »

Great Graphic: Oil Recovery Extends

Oil prices extend last week's rally. Last week's rally was driven by the fall of gasoline inventories. Today's advance was helped by speculation over next month's IEA meeting.

Read More »

Read More »

China: Political and Economic Developments

Balance of power in China between "princleling and youth league may be at risk. Foreigners have stopped up their purchases of onshore CNY bonds. Tensions are rising between China and Japan and China and South Korea.

Read More »

Read More »

US Economy – Something is not Right

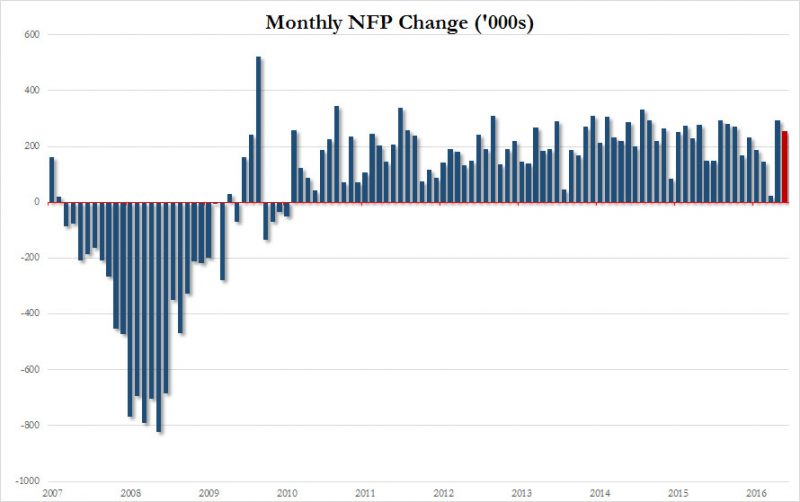

Another Strong Payrolls Report – is it Meaningful? This morning the punters in the casino were cheered up by yet another strong payrolls report, the second in a row. Leaving aside the fact that it will be revised out of all recognition when all is said and done, does it actually mean the economy is strong?

Read More »

Read More »

Swiss Consumer Price Index in July 2016: -0.2 percent against 2015, -0.4 percent against last month

The Swiss Consumer Price Index (CPI) fell by 0.4% in July 2016 compared with the previous month, reaching 100.3 points (December 2015=100). Inflation was -0.2% in comparison with the same month in the previous year. These are the findings of the Federal Statistical Office (FSO).

Read More »

Read More »

States Must Help Restore Sound Money in America

Control the money, and you control the people. Over the last hundred years, the federal government and the Federal Reserve, a privately owned bank cartel conceived of in secret, have waged a war on sound money in America. They’ve ended the free circulation of gold (and, for a time, criminalized its ownership), while imposing taxes on those who trade with it.

Read More »

Read More »

FX Weekly Preview: Light Economic Calendar Week Allows New Thinking on Macro

Policy outlook is clear: ECB and BOJ review next month, FOMC still looking for opportunity. Inventory cycle making quarterly US GDP forecasting difficult, but it looks like re-acceleration still the more likely scenario than recessions.

Why didn't European bank stress tests results have more impact?

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a firm note, despite the stronger than expected July jobs report. As we suspected, one strong US data point is not yet enough to derail the dovish Fed outlook. With the RBA and BOE cutting last week and the RBNZ expected to cut this week, the global liquidity backdrop remains supportive for EM and risk.

Read More »

Read More »

Negative Consumer Financing Rates in Germany, Soon More Negative in Switzerland?

Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one's means.

Read More »

Read More »

FX Weekly Review, August 01 – August 05: Does the Jobs Report Give the Greenback Legs?

The robust US employment report before the weekend allowed the dollar to recoup the losses it experienced earlier in the

week against most of the major currencies. The Australian dollar and Japanese yen managed to hold onto minor gains for the

week.

Read More »

Read More »

Weekly Speculative Positions: Record Sterling Shorts, Net Short in Swiss Francs

For a period that included a BOJ and FOMC meeting and the US GDP, speculators in the currency futures were unusually quiet. Summer holidays with family may be more important. Of the 16 gross currency futures speculative positions we track, 12 of them were less than 5k contracts. There was only one gross position adjustment more than 10k contracts. Euro bears covered …

Read More »

Read More »

US Jobs Surprise, Canada Disappoints

Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged.

Read More »

Read More »