Tag Archive: newslettersent

The Great Stock Market Swindle

Finding and filling gaps in the market is one avenue for entrepreneurial success. Obviously, the first to tap into an unmet consumer demand can unlock massive profits. But unless there’s some comparative advantage, competition will quickly commoditize the market and profit margins will decline to just above breakeven.

Read More »

Read More »

Insanity, Oddities and Dark Clouds in Credit-Land

Insanity Rules Bond markets are certainly displaying a lot of enthusiasm at the moment – and it doesn’t matter which bonds one looks at, as the famous “hunt for yield” continues to obliterate interest returns across the board like a steamroller.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended the week on a soft note, despite the weaker than expected US retail sales report. Official concern about strong exchange rates is beginning to emerge. First it was Korea, then on Friday it was Brazil as acting President Temer said his country needs to maintain a balanced exchange rate, neither too weak nor too strong. We expect more pushback to emerge if the current

rally is extended. Still, the global liquidity outlook for now favors...

Read More »

Read More »

2 Men, 3 Women 6-Year-Old Kid Burned, Stabbed By 27-Year-Old Attacker On Swiss Train

Seven people are in hospital with stab wounds and burns, police say, after an attack on a train near St.Gallen, Switzerland. The man set the train carriage on fire using a flammable liquid and also stabbed passengers, including a six-year-old child, police said. Details are sparse for now but The BBC reports, the suspected attacker, described as a Swiss man aged 27, was also taken to hospital after the incident near Salez in St Gallen Canton.

Read More »

Read More »

FX Weekly Preview: Thoughts on the Significance of Ten Developments

The GDP deflator may be just as important as overall growth for BOJ considerations and the possibility of fresh action next month. Falling UK rates and a weaker pound are desirable from a policy point of view.

Dudley's press conference may be more important than FOMC minutes.

Two German state elections that will be held next month comes as Merkel's popularity has waned.

Read More »

Read More »

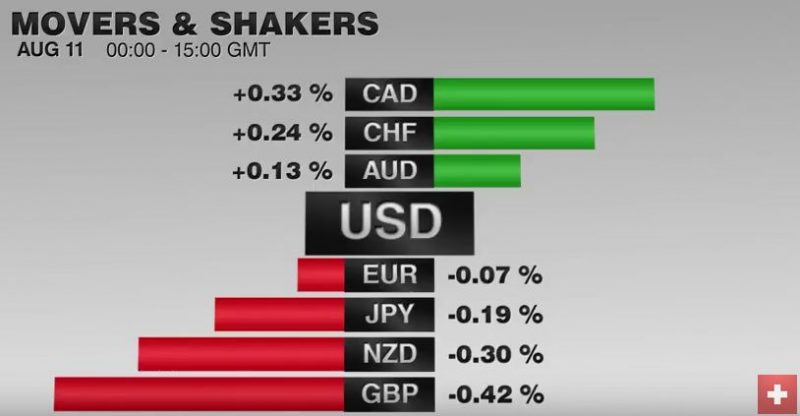

Weekly Speculative Positions: Switch to Small Net Long CHF

Speculators shifted to a 0.1 long Swiss Franc position in the week of August 9. Speculators reduced their exposure on Euro, CHF and Peso, increased it for NZD, CAD and GBP.

Read More »

Read More »

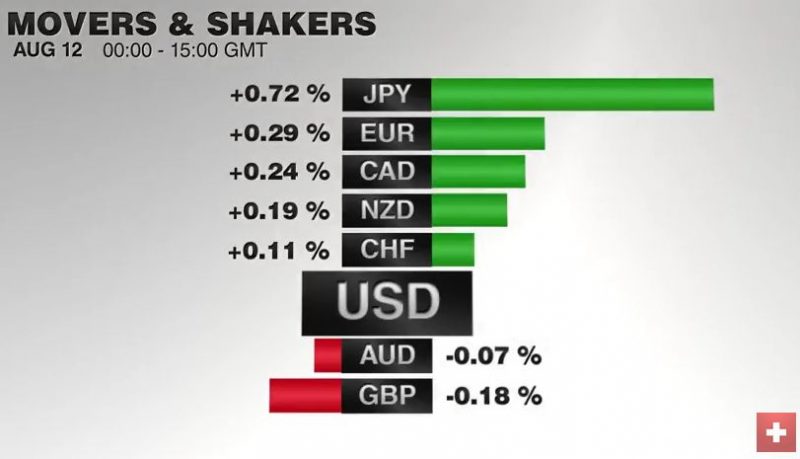

FX Weekly Review, August 08 – August 12: Finally an Improvement of the CHF Index

The CHF index experienced its first good week since many weeks, when we compare it against the dollar index. On a three years interval, the Swiss Franc had a weak performance.

Read More »

Read More »

Emerging Markets: What has Changed

S&P upgraded Korea a notch to AA with a stable outlook. Voters passed the constitutional referendum in Thailand by a wide margin. The IMF and Egypt have reached a staff-level agreement on a 3-year $12 bln. loan program. Argentina’s central bank will begin using a new overnight rate to manage monetary policy. Political uncertainty has returned to Brazil.

Read More »

Read More »

FX Daily, August 12: Summer Markets Grind into the Weekend

There is a general consolidative tone in the capital markets as the week draws to a close. The US retail sales report may offer a brief distraction, but it is unlikely to significantly shift expectations about the trajectory of Fed policy. Indeed, it might not really change investors' information set.

Read More »

Read More »

FX Daily, August 11: Sterling Struggles to Find a Bid, While RBNZ Can’t Knock Kiwi Down

Once again, EUR/CHF reverses in the middle of the week. A part from technical reasons, the weak French CPI (+0.4% YoY) and Italian CPI (-0.2% YoY) exercised downwards pressure on the euro. The US dollar has found steadier footing today after trading heavily yesterday. There are two main themes. The first is sterling’s heavy tone.

Read More »

Read More »

Two Things I Learned Looking for Something Else

LIBOR continues to rise. The relative calm of the markets will likely end next month. The last four months of the year are jammed with key events that have potential to disrupt the markets.

Read More »

Read More »

Cool Video: CNBC Asia–Mostly about the Redback and Greenback

I was invited to appear on CNBC Asia Rundown show with Pauline Chiou. We discuss the Chinese yuan on the anniversary of last summer's unexpected devaluation. I suggest that most of the things that get observers excited, like the internationalization of the yuan, or the Hong Kong-Shanghai link or, perhaps by the end of the year,a Hong Kong-Shenzhen link are really Chinese machinations that are the result of its contradictions.

Read More »

Read More »

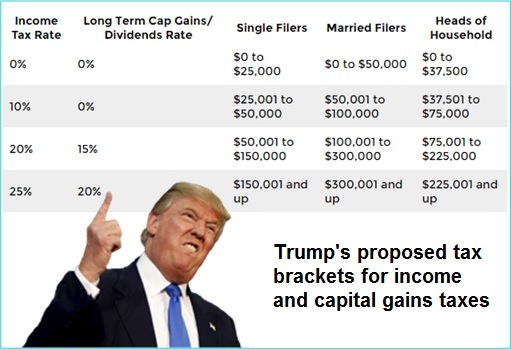

Trump’s Tax Plan, Clinton Corruption and Mainstream Media Propaganda

OUZILLY, France – Little change in the markets on Monday. We are in the middle of vacation season. Who wants to think too much about the stock market? Not us! Yesterday, Republican presidential candidate Donald Trump promised to reform the U.S. tax system.

Read More »

Read More »

Swiss Nominal Wages to Rise by 0.8 Percent

The unions are demanding higher salaries for next year. However, gains are realistic only in individual sectors. In addition, can be expected in Switzerland with a lower purchasing power gain. The workers umbrella organization Travail Suisse and the association Employees Switzerland have launched the 2017 wage round on Tuesday.

Read More »

Read More »

FX Daily, August 10: FX Consolidation Resolved in Favor of Weaker US Dollar

European bourses are mixed, and this is leaving the Dow Jones Stoxx 600 practically unchanged in late-European morning turnover. Financials are the strongest sector (+0.4%), and within it, the insurance sector is leading with a 0.8% advance and banks are up 0.4%. The FTSE's Italian bank index is up 1.4% to extend its recovery into a fifth session.

Read More »

Read More »

Great Graphic: Bullish Emerging Market Equity Index

Liquidity rather than intrinsic value seems to be driving EM assets. MSCI EM equity index looks constructive technically. The chart pattern suggests scope for around 13% gains from here.

Read More »

Read More »

No Fines for Iberia, but Remedial Action Demanded and Possible Loss of Some ESI Funds

Spain and Portugal need to make some relatively small budget adjustments or will be denied some transfer payments. Spain's political situation is fluid, but another window of opportunity to break the logjam is at hand. The euro seems immune to these fiscal developments; some retracement objectives are in sight.

Read More »

Read More »

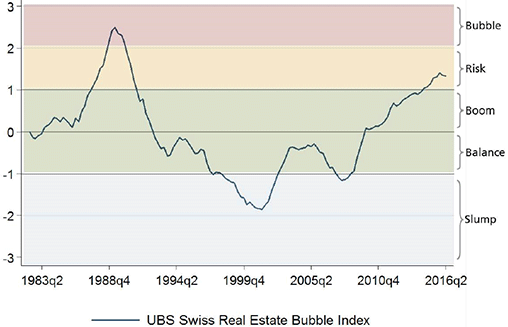

Swiss Real Estate Bubble Index 2Q 2016 continues falling, Still in Risk Zone

The UBS Swiss Real Estate Bubble Index nudged down in 2Q 2016 to 1.32 points and thus remains in the risk zone. This second drop in a row was due to house prices falling in real terms and the declining momentum of mortgage growth. Investments in real estate remain popular due to low interest rates.

Read More »

Read More »

Real vs. Nominal Interest Rates

Calculation Problem. What is the real interest rate? It is the nominal rate minus the inflation rate. This is a problematic idea. Let’s drill deeper into what they mean by inflation. You can’t add apples and oranges, or so the old expression claims. However, economists insist that you can average the prices of apples, oranges, oil, rent, and a ski trip at St. Moritz.

Read More »

Read More »