Tag Archive: newslettersent

Trump is Right About Stocks

It is not often that you get investment advice from a presidential candidate. It is even rarer that you get good advice.

Read More »

Read More »

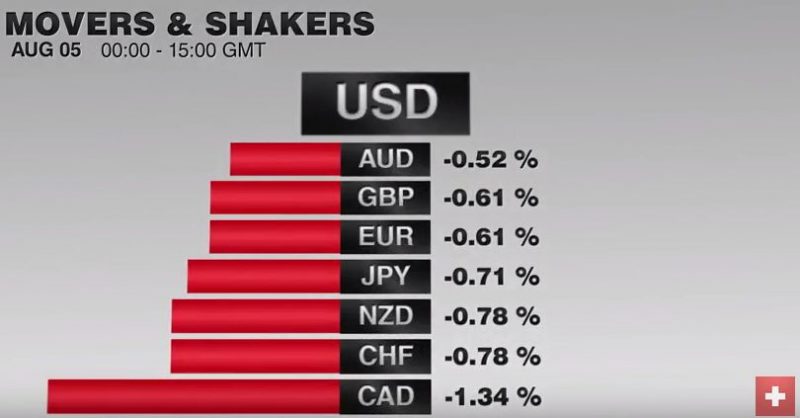

FX Daily, August 05: US Jobs Data on Tap, but Don’t Expect Miracles

The focus is squarely on the US employment data today, ahead of which the capital markets are mostly consolidating yesterday's Bank of England inspired moved. The Australian and New Zealand dollars, alongside sterling, which is up about half a cent after losing two yesterday.

Read More »

Read More »

666: The Number Of Rate Cuts Since Lehman

BofA's Michael Hartnett points out something amusing, not to mention diabolical: following the rate cuts by the BoE & RBA this week, "global central banks have now cut rates 666 times since Lehman."

Read More »

Read More »

Emerging Markets: What has Changed

India’s upper house approved the creation of a Good and Services Tax (GST). The Polish government softened its stance on the proposed Swiss franc loan conversion plan. Support for South Africa’s ruling African. National Congress (ANC) appears to have fallen below 60% for the first time ever. Brazil’s Senate impeachment committee recommended putting President Rousseff on trial.

Read More »

Read More »

Massive Majority Of Europeans Disapprove Of EU Handling Of Refugee Crisis

When the history books are finally written, I believe the tone-deaf handling of the refugee crisis by EU bureaucrats will be seen as one of the primary catalysts in the ultimate disintegration of the European Union. Although I knew many millions across the eurozone were irate about how the refugee crisis was being handled, I had no idea how irate they were until I read the results of a recent survey by the Pew Research enter.

Read More »

Read More »

Investing in Gold in 2016: Global Paradigm Shifts in Politics and Markets

Crumbling Stability. In the past few months, we have witnessed a series of defining events in modern political history, with Britain’s vote to exit the EU, (several) terror attacks in France and Germany, as well as the recent attempted military coup in Europe’s backyard, Turkey. Uncertainty over Europe’s political stability and the future of the EU keeps growing.

Read More »

Read More »

Deflation Is Always Good for the Economy

“Experts” Assert that Inflation is an Agent of Economic Growth. For most experts, deflation, which they define as a general decline in prices of goods and services, is bad news since it generates expectations for a further decline in prices.

Read More »

Read More »

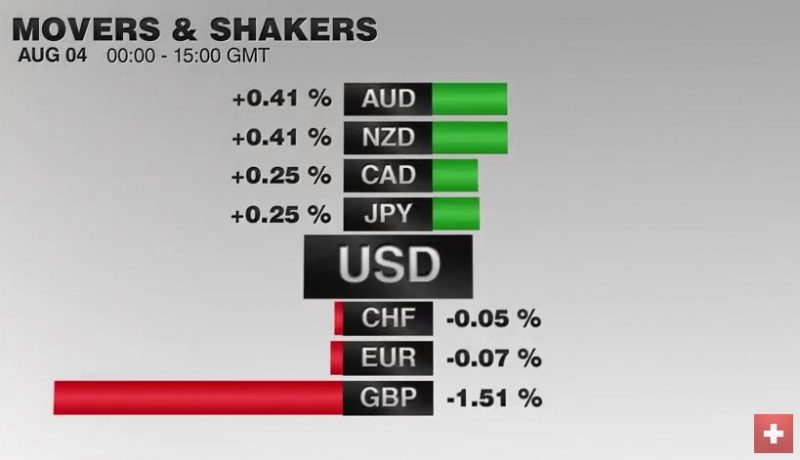

FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak - reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week's sight deposits.

Read More »

Read More »

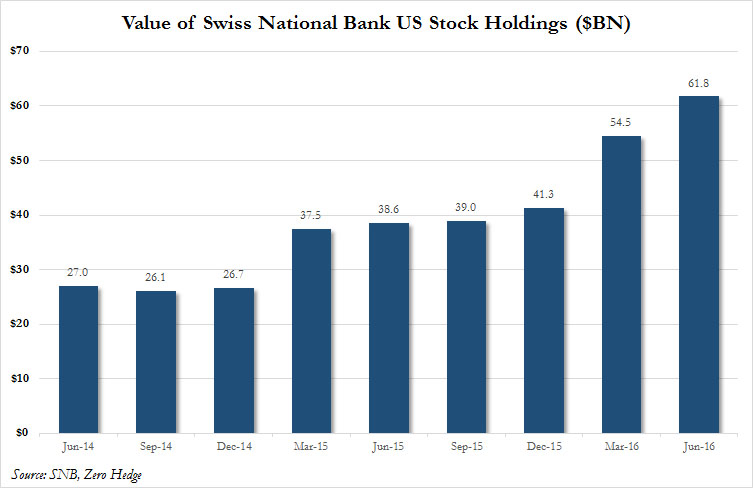

“Mystery” Buyer Revealed: Swiss National Bank’s US Stock Holdings Rose 50 percent In First Half, To Record $62BN

In a month, quarter and year, in which many have scratched their heads trying to answer just who is buying stocks, as both retail and smart money investors have been aggressively selling, yesterday we got the answer.

Read More »

Read More »

Jailing Banksters Will Not Resolve the Economic Crisis

Meet the scapegoats! Three Irish bankers sent to jail: former finance director at the failed Anglo Irish Bank, Willie McAteer (42 months); former Irish Life and Permanent Bank Chief Executive Denis Casey (33 months); and former head of capital markets at the Anglo Irish Bank, John Bowe (24 months).

Read More »

Read More »

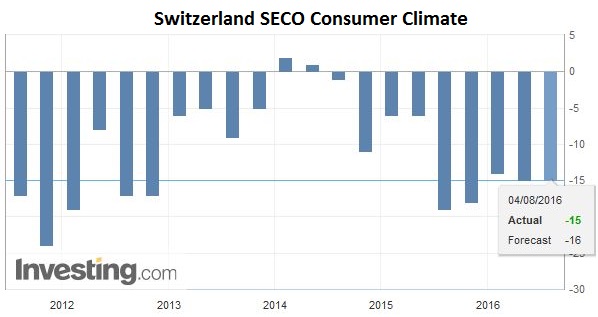

Swiss Consumer Sentiment Remains Subdued

Consumer sentiment remained unchanged between April and July 2016* and is now below the long-term average for the fifth quarter in a row. Most sub-indices also saw no major change, except regarding inflation, with the 1,200 or so individuals questioned expecting prices to rise more sharply over the next twelve months than they had in April.

Read More »

Read More »

Carney Gets Ahead of Market Expectations; Sterling Slumps, Gilts Soar

BOE cuts rates and expands QE. Door is open to more easing. Sterling stabilizes after selling off 2 cents.

Read More »

Read More »

Why Americans Get Poorer

OUZILLY, France – Both our daughters have now arrived at our place in the French countryside. One brought a grandson, James, now 14 months old. He walks along unsteadily, big blue eyes studying everything around him. He adjusted quickly to the change in time zones. And he has adjusted to the French culture, too – he likes gnawing on a piece of tough local bread. But when she has trouble getting the little boy to sleep, our daughter asks Grandpa for...

Read More »

Read More »

Real vs. Nominal Interest Rates

What is the real interest rate? It is the nominal rate minus the inflation rate. This is a problematic idea. Let’s drill deeper into what they mean by inflation. You can’t add apples and oranges, or so the old expression claims. However, economists insist that you can average the prices of apples, oranges, oil, rent, and a ski trip at St. Moritz. This is despite problems that prevent them from agreeing on what should be included.

Read More »

Read More »

FX Daily, August 03: Consolidation Featured

The US dollar is consolidating yesterday's losses. The greenback's upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week's RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week.

Read More »

Read More »

Swiss National Bank’s U.S. equity holdings hit record $61.8 billion last quarter

The value of the Swiss National Bank’s U.S. stock portfolio jumped to a record in June, helped by equity market gains. The holdings climbed to $61.8 billion from $54.5 billion at the end of March, according to calculations by Bloomberg based on the central bank’s regulatory filing to the U.S. Securities and Exchange Commission and published on Wednesday.

Read More »

Read More »

Gorilla or Elephant, Chinese Surplus Capacity is the Challenge

China's excess capacity is one of the most formidable challenges the China and the world face. Unexpectedly, China's steel industry reported a profit in H1 16. M&A for industry rationalization and foreign markets seem to be the main ways China is trying to address the excess capacity.

Read More »

Read More »

FX Daily, August 02: Greenback Slides Despite RBA Rate Cut and 7-year Low in UK Construction PMI

The US dollar is offered against the major currencies, but appreciating against many emerging market currencies, include the South African rand and Turkish lira. Oil prices are trying to stabilize with Brent near $42 and WTI near $40, but the recent losses continue to weigh on the Malaysian ringgit and the Mexican peso.

Read More »

Read More »

Should the Government Give Us Infrastructure?

“Bad” Monopolies? An argument against absolutely free markets comes up often. What about so-called natural monopolies? So-called infrastructure projects (e.g. sewage plants) have high barriers to entry, and are a challenge to true competition.

Read More »

Read More »

Great Graphic: The Decline in Durable Goods Prices

This economic graph is maybe the most important in the last decade. Service prices are rising, while goods prices have steadily fallen. The main reason for us is the possibility to outsource big parts of the durables supply-chain to China and East Asia. This is where productivity growth happens. Prices of services, however, are ever increasing. …

Read More »

Read More »