Tag Archive: newslettersent

Great Graphic: Relative Performance of Bank Stocks–US, Europe, and Japan

MSCI US Bank Index, MSCI European Bank Index and the Japan Topix Bank Index compared. Divergence in the health of the financial sector.

Read More »

Read More »

UBS beats profit estimates as CEO pushes ahead with cost cuts

UBS Group AG beat analysts’ second-quarter profit estimates and said it’s on track to cut costs by 2.1 billion Swiss francs ($2.2 billion) through 2017, with Chief Executive Officer Sergio Ermotti struggling wi...

Read More »

Read More »

Credit Suisse’s turnaround is working, but vulnerable

Brought to you by Investec Switzerland. Just a month ago, Credit Suisse CEO Tidjane Thiam and Deutsche Bank CEO John Cryan risked, as one hedge fund manager put it, becoming the dead men walking of European banking as they struggled to shore up their...

Read More »

Read More »

FX Daily, July 28: Dollar Pulls Back Further Post-FOMC

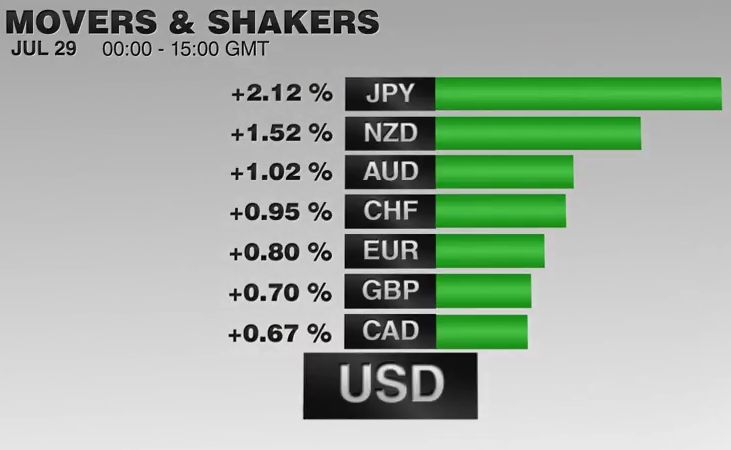

After reversing lower yesterday after the FOMC statement, the US dollar has continued to move lower against the major currencies, save sterling. While the market is not fully confident of a rate cut by the Reserve Bank of Australia, indicative pricing in the derivative markets suggest a UK rate cut has been fully discounted (and a new asset purchase plan may also be announced).

Read More »

Read More »

Fasten Your Seat Belts: Tomorrow Promises to be Tumultuous

Japan reports on labor, consumption, inflation and industrial output before the BOJ meeting. ECB reports inflation and Q2 GDP and the results of the stress test on banks. US reports first look at Q2 GDP.

Read More »

Read More »

Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today's uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of "helicopter money" is about to be unveiled in Japan by the world's most experimental central bank. However, as Nomura's Richard Koo warns, central banks may get much more than they bargained for, because helicopter money "probably marks the end of the road for believers in the omnipotence of monetary policy who have continued to press for further...

Read More »

Read More »

FX Daily, July 27: Yen Falls on Fiscal Stimulus, while Sterling and Aussie Can’t Sustain Upticks

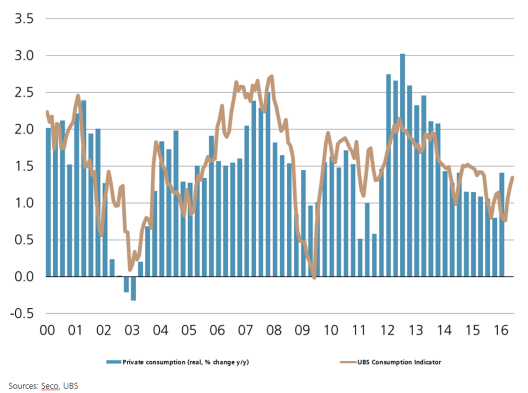

Swiss Franc: The Euro kept on climbing, after yesterday's rapid rise. The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

Read More »

Read More »

Switzerland UBS Consumption Indicator June: Summer tourism inspires confidence

In June, the UBS consumption indicator rose from 1.24 to 1.34 points. This was mainly due to a better performance in the tourism industry as well as a slight improvement in sentiment in the retail trade. However, the situation in the labor market is still strained and is weighing on consumer sentiment.

Read More »

Read More »

Props to Armani!

Champion of the Downtrodden? “Democracy is the theory that the common people know what they want, and deserve to get it good and hard.” – H.L. Mencken. A mass e-mail has been making the rounds lately, and it is quite possible that many of our readers have already seen this. For those who haven’t, we wanted to share this moment of hilarity provided to us by Deep State candidate Hillary Clinton.

Read More »

Read More »

Great Graphic: How the US Recovery Stacks Up

The US recovery may have surpassed the 2001 recovery in Q2. Though disappointing, the recovery has been faster than average from a balance sheet crisis. Although slow, it is hard to see the secular stagnation in the data.

Read More »

Read More »

A Nation of Crooks?

Apples to Oranges. PARIS – The stock market seemed chilled last week, like a corpse waiting for an autopsy. Monday morning, gold was falling in Europe… as investors anticipate a higher dollar. But we’ll return to the markets, the dollar and the absurdities wrought by our money system, tomorrow.

Read More »

Read More »

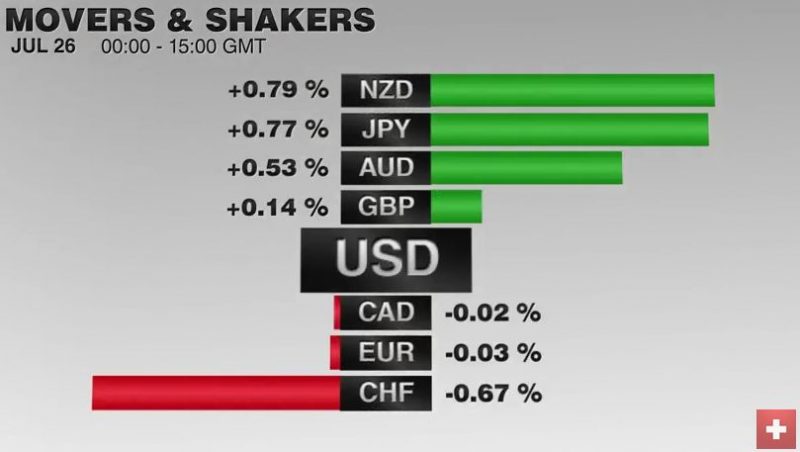

FX Daily, July 26: Strange Day: Yen Soars , Swissie Falls

The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical.

Read More »

Read More »

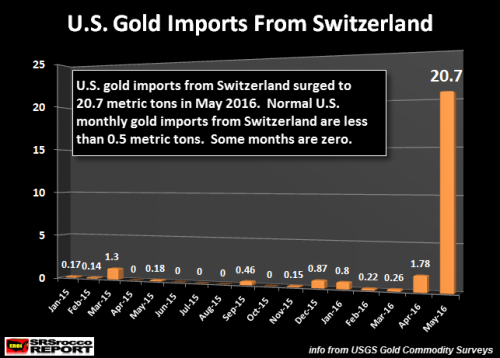

Record Swiss Gold Flow Into The United States

Record Swiss Gold Flow Into The United States. There was a huge trend change in U.S. gold investment in May. Something quite extraordinary took place which hasn’t happened for several decades. While Switzerland has been a major source of U.S. gold exports for many years, the tables turned in May as the Swiss exported a record amount of gold to the United States.

Read More »

Read More »

Fed to Stand Pat, but Statement may be More Constructive

The Fed's nervousness in June has likely largely eased on the back of better economic data and stable international climate. The Fed may reintroduce its risk assessment. Who are the possible dissents?

Read More »

Read More »

European Banks Bad Loans and Coverage

European banks are worrisome. EBA's stress test results will be out at the end of the week. Nonperforming loans are a separate issue, but also need to be addressed.

Read More »

Read More »

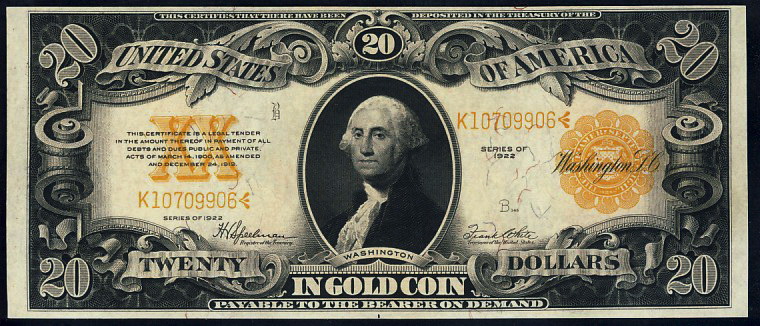

Unsound Money Has Destroyed the Middle Class

DUBLIN – When you start thinking about what money is and how it works, you face isolation, shunning, and possible incarceration. The subject is so slippery – like a bead of mercury on a granite counter top – you become frustrated… and then… maniacal. You begin talking to yourself, because no one else will listen to you. If you are not careful, you may be locked up among the criminally insane.

Read More »

Read More »

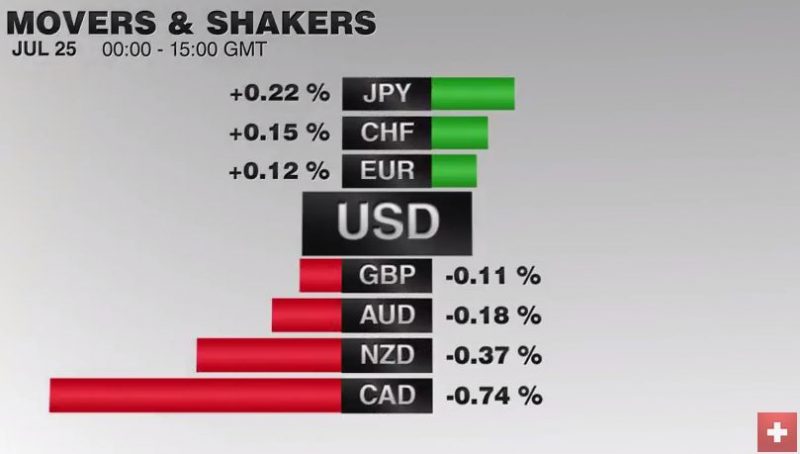

FX Daily, July 25: Big Week Begins Slowly

What promises to be a busy week has begun off slowly. The US dollar has been largely confined to its pre-weekend ranges against most of the major currencies. Equity markets are mostly firmer following the new record highs on Wall Street. The MSCI Asia Pacific Index eked out a small gain (0.1%), with losses in Japan, Taiwan, and Singapore offsetting gains elsewhere.

Read More »

Read More »