Tag Archive: newslettersent

Great Graphic: OIl Breaks Down Further

With today's losses the Sept contract has retraced 50% of this year's rally. The oil glut has partly been transformed into a gasoline glut. US rig count is rising and output has increased two weeks in a row.

Read More »

Read More »

European Bank Stress Test: Preview

European bank stress test results will be released a couple hours before the US open on Friday. The focus is on Italy, but other countries' banks may also be identified as needing capital. Within the existing rules are allowances for exceptions. Everyone wants to follow the rules.

Read More »

Read More »

A Fully Automated Stock Market Blow-Off?

About one month ago we read that risk parity and volatility targeting funds had record exposure to US equities. It seems unlikely that this has changed – what is likely though is that the exposure of CTAs has in the meantime increased as well, as the recent breakout in the SPX and the Dow Jones Industrial Average to new highs should be delivering the required technical signals.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended the week on a soft note, as the dollar reasserted broad-based strength against most currencies. The FOMC meeting this week could see the Fed push back against the market’s dovish take on policy, in which case EM would be likely to remain under pressure.

Read More »

Read More »

FX Weekly Preview: BOJ and FOMC Meetings Featured in the Last Week of July

A recent Reuters poll found about half of the 100 economists surveyed expect a hike in Q4, which really means December since the November meeting is too close to the national election. The other half is split between a Q3 rate hike (September) and some time in 2017. That said, two primary dealers anticipate no hike until the end of 2017.

Read More »

Read More »

The Real Reason the “Rich Get Richer”

Time the Taskmaster DUBLIN – “Today’s money,” says economist George Gilder, “tries to cheat time. And you can’t do that.” It may not cheat time, but it cheats far easier marks – consumers, investors, and entrepreneurs. Tempus fugit – every action...

Read More »

Read More »

FX Weekly Review, July 18 – July 22: Will the FOMC Halt the Dollar’s Advance?

The US dollar gained against all the major currencies over the past week. It also rose against many emerging market currencies. A notable exception was the Chinese yuan.

Read More »

Read More »

Household Savings Rate Compared

GDP growth is a bad economic measure. GDP growth in the form of consumption-driven (hyper-) activity (aka Bawerk's "GDC" Gross Domestic Consumption) must finally lead to a depreciating currency, inflation, falling government bond prices and wealth in real terms. Instead, GDP should be driven by investment and the consequent improvements in productivity.

Read More »

Read More »

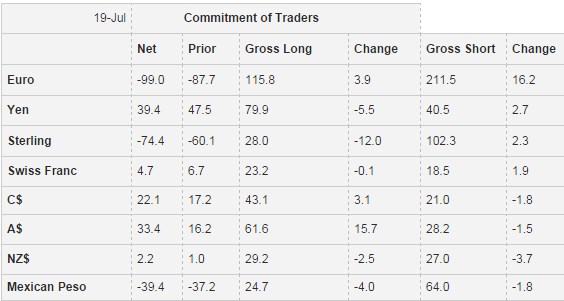

Weekly Speculation Positions: Bullish on Dollar and Dollar-Bloc

Speculators made several significant position adjustments in the CFTC reporting period ending 19 July. They are more Bullish on Dollar and on the Dollar-Bloc currencies.

Read More »

Read More »

The relationship between CHF and gold

Many people think that Switzerland is related to gold due to its inflation-hedging safe-haven status. Historically this is true. With rising U.S. inflation in the 1970s gold appreciated to record-highs. So did the German Mark and even more the Swiss franc, that maintained low inflation levels.

Read More »

Read More »

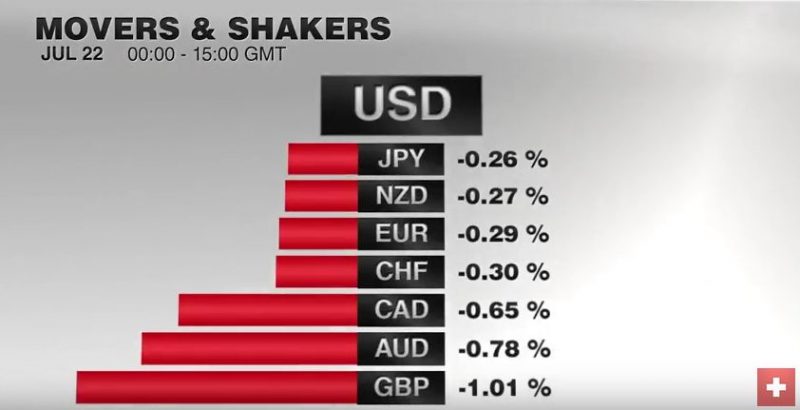

FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US equities yesterday has continued in Asia and Europe today. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 in Europe are both off around 0.5%.

Read More »

Read More »

More Signs the End is Nigh

Hyperventilating Minds “What has been will be again, what has been done will be done again; there is nothing new under the sun,” explained Solomon in Ecclesiastes, nearly 3,000 years ago. Perhaps the advent of negative yielding debt would have been cause for Solomon to reconsider his axiom. We can only speculate on what his motive would be.

Read More »

Read More »

Emerging Markets: What has Changed

The New York Times reported that the US is preparing to seize $1 bln in assets tied to 1MDB. S&P downgraded Turkey a notch to BB with a negative outlook, citing political uncertainty. Turkish President Erdogan declared a three-month state of emergency. The Nigerian Naira weakened above 300 per dollar for the first time. Brazil’s central bank signaled a longer wait until it cuts rates.

Read More »

Read More »

Swiss markets fluctuate on earnings data

The Swiss Market Index is set to finish the week slightly higher as investors digest second quarter earnings reports and central bank policy announcements.

Read More »

Read More »

Roche CEO worried about U.K. drug research following Brexit

The U.K.’s decision to leave the European Union poses a threat to research and development in the pharmaceutical industry, Roche Holding AG Chief Executive Officer Severin Schwan said. A departure would mean the country would have to set up its own system for approving drugs for sale, a job now done for bloc members by the European Medicines Agency.

Read More »

Read More »

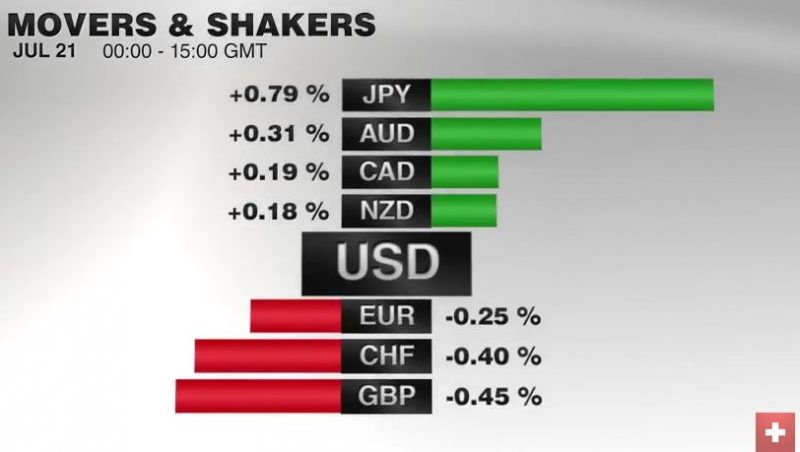

FX Daily, July 21: Monetary Policy Expectations are Driving Foreign Exchange

Monetary policy is said to have lost its impact on the foreign exchange market, as investors scratch their heads at the resilience of currencies with negative interest rates. Yet the price action in the action cannot be understood without recognizing the ongoing importance of monetary policy expectations.

Read More »

Read More »

Effective Fed Funds and Money Markets

Fed funds have been trading firmly. There are several reasons and one of them is the shift that is taking place in the US money markets. Still the risk of a Fed hike has increased, just as speculation increases of easing in other major centers.

Read More »

Read More »

Draghi Does not Surprise and Euro Edges Away from $1.10

Draghi does not show the kind of urgency many bank economists do over the shortage of bonds to buy. Draghi kept options open and suggested a review in September when new staff forecasts are available and more data will be seen. The euro firmed, mostly it seemed on sell the rumor buy the fact, and/or possibly some disappointment that no fresh action was taken.

Read More »

Read More »

FX Daily, July 20: Sterling’s Jump Slows Dollar’s Ascent

It is a bizarre turn of events. Just like the Game of Throne's Westeros is a map of the UK put on top of an inverted Ireland, so too do UK events seem to be a strange permutation of the pre-referendum views. Although sterling and interest rates have not fully recovered from the Brexit decision, equity markets have, and fear of contagion has died down.

Read More »

Read More »