Tag Archive: newslettersent

FX Daily, August 18: US Dollar Pushed Lower, but Do FOMC Minutes Really Trump Dudley?

A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting.

Read More »

Read More »

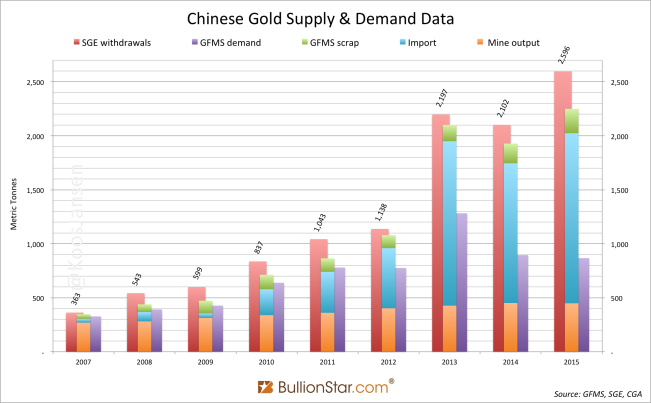

Arizona Considers Issuing a Gold Bond

The Arizona House of Representatives has convened an Ad Hoc Committee on Gold Bonds. The purpose is to explore if and how the state could sell a gold bond. This is an exciting development, as the issuance of a gold bond would be a major step towards a working gold standard.Yours truly is a member of the committee.

Read More »

Read More »

The Need for Higher Wages: Lots of Thunder, No Rain

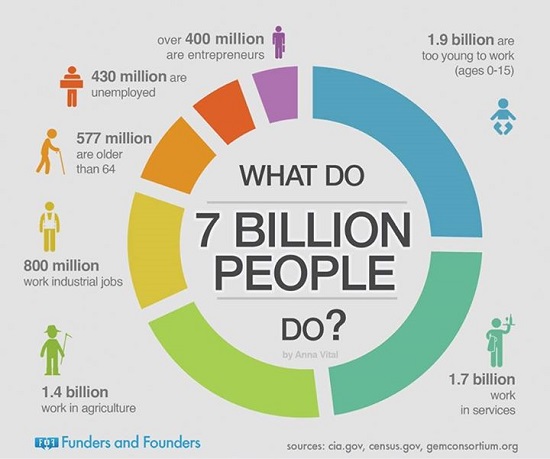

Major central banks and many economists are calling for higher wages. However, they are reluctant to offer proposals to strengthen those institutions who's goal is to boost labor's share of national income. The advocates are more interested in boosting prices than in lifting aggregate demand or addressing the disparity of income and wealth.

Read More »

Read More »

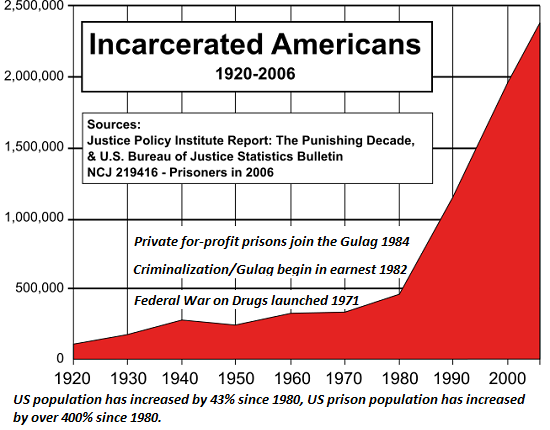

It’s Time to Abolish the DEA and America’s “War on Drugs” Gulag

It's difficult to pick the most destructive of America's many senseless, futile and tragically needless wars, but the "War on Drugs" is near the top of the list.Prohibition of mind-altering substances has not just failed--it has failed spectacularly, and generated extremely destructive and counterproductive consequences.

Read More »

Read More »

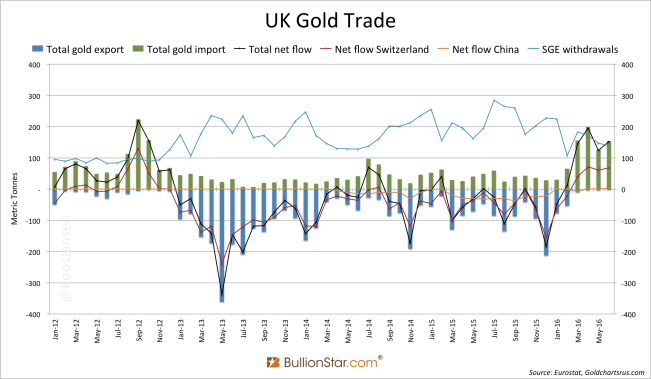

Why Switzerland’s franc is still strong in four charts

Swiss National Bank President Thomas Jordan keeps saying the franc is “significantly overvalued.” And that’s despite the central bank’s record-low deposit rate and occasional currency market interventions.

Read More »

Read More »

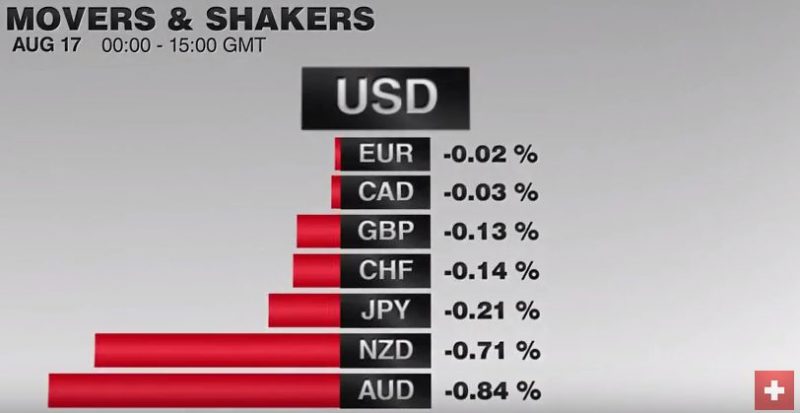

FX Daily, August 17: Dollar Snaps Back

The US dollar is enjoying a mid-week bounce against all the major currencies. It appears that participants in Asia and Europe are giving more credence to NY Fed Dudley's comments yesterday. Although many in the market have given up on a rate hike this year, Dudley reaffirmed his belief that the economy was accelerating in H2 and that the market was being too complacent.

Read More »

Read More »

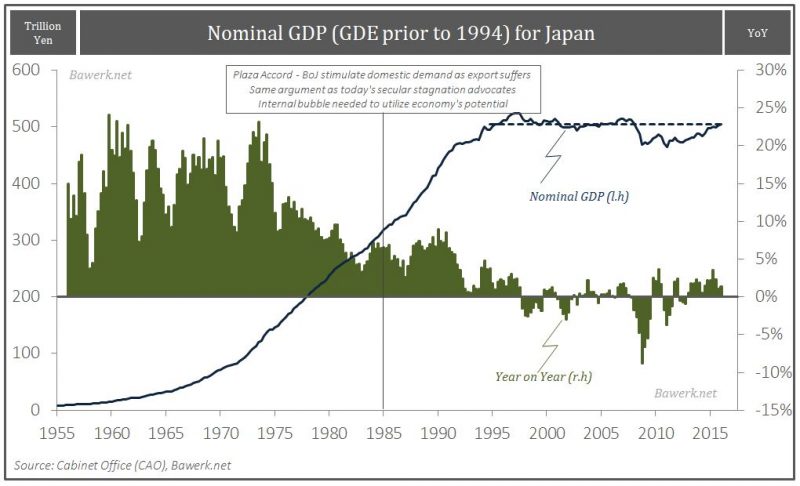

Stupid is What Stupid Does – Secular Stagnation Redux

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries.

Read More »

Read More »

Great Graphic: Aussie Tests Three-Year Downtrend

The Australian dollar's technical condition has soured. Market sentiment may be changing as the MSCI World Index of developed equities posted a key reversal yesterday. It is not clear yet whether the Aussie is correcting lower or whether there has been a trend change.

Read More »

Read More »

Yuan and Why

It is as if Hamlet, the confused prince of Denmark, has taken up residence in Beijing. The famed-prince wrestled with "seeming" and "being". So are Chinese officials. They seem to be relaxing their control over financial markets but are they really? Are they tolerating market forces because they approve what they are doing, such as driving interest rates down or weakening the yuan? If so what happens when the markets do something which they...

Read More »

Read More »

FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think.

Read More »

Read More »

The Odds of a Global Food Crisis Are Rising

Given the current abundance of food globally, confidence in permanent food surpluses and low grain prices is high. Few worry that the present abundance of food could be temporary. But the global food supply is more fragile than we might think, despite historically low grain/agricultural commodity prices.

Read More »

Read More »

Great Graphic: Dollar-Yen–Possible Head and Shoulders Continuation Pattern

This technical pattern is most often a reversal pattern, but not always. It may be a continuation pattern in the dollar against the yen. It highlights the importance of the JPY100 level and warns of risk toward JPY92.50. It aligns well with the sequence of macro events.

Read More »

Read More »

Will Ireland Be First Country In World To See Bail-in Regime?

Deposit bail-in risks are slowly being realised in Ireland, after it emerged overnight that FBD, one of Ireland's largest insurance companies, have been moving cash out of Irish bank deposits and into bonds.

Read More »

Read More »

Retail Snails

Second Half Recovery Dented by “Resurgent Consumer”. We normally don’t comment in real time on individual economic data releases. Generally we believe it makes more sense to occasionally look at a bigger picture overview, once at least some of the inevitable revisions have been made. The update we posted last week (“US Economy, Something is Not Right”) is an example.

Read More »

Read More »

FX Daily, August 15: Dollar Eases to Start the New Week

The US dollar closed the pre-weekend session well off its lows that were seen in response to the disappointing retail sales report. It has been unable to sustain the upside momentum, and as North American dealers prepare to return to their posts, it is trading lower against most of the major currencies. The notable exceptions are the Scandi-bloc, which are consolidating last week's gains, and sterling, which remains pinned near $1.29.

Read More »

Read More »

Bretton Woods: RIP

Some romanticists want to have another Bretton Woods fixed exchange rate regime. Bretton Woods had difficulty from nearly the day it went operational. It is misguided to think a new rigid regime is needed or is appropriate.

Read More »

Read More »

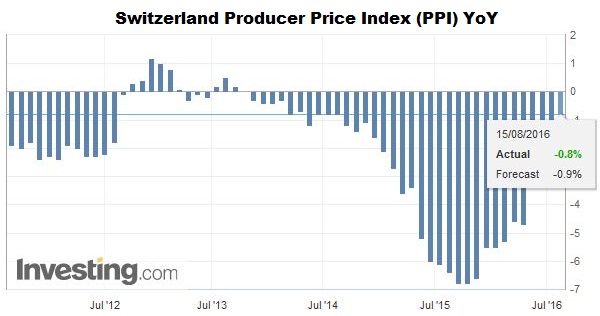

Swiss Producer and Import Price Index, July 2016: +0.1 percent MoM, -0.8 percent YoY

The Producer and Import Price Index fell in July 2016 by 0.1% compared with the previous month, reaching 99.8 points (base December 2015 = 100). This slight decline is due in particular to lower prices for petroleum products and watches. Compared with July 2015, the price level of the whole range of domestic and imported products fell by 0.8%. These are the findings of the Federal Statistical Office (FSO).

Read More »

Read More »

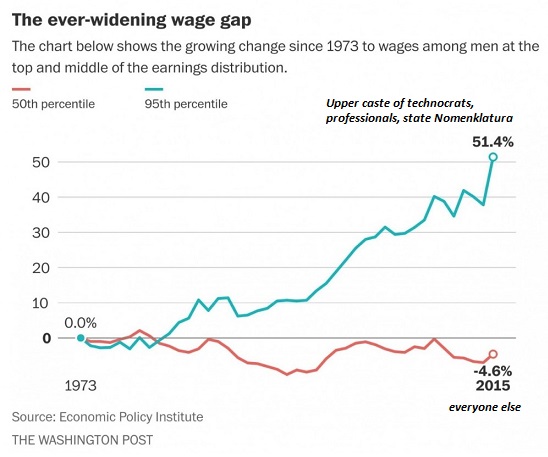

Why Wages Have Stagnated–and Will Continue to Stagnate

Mainstream economists are mystified why wages/salaries are still stagnant after 7+ years of growth / "recovery." The conventional view is that wages should be rising as the labor market tightens (i.e. the unemployment rate is low) and demand for workers increases in an expanding economy.

Read More »

Read More »