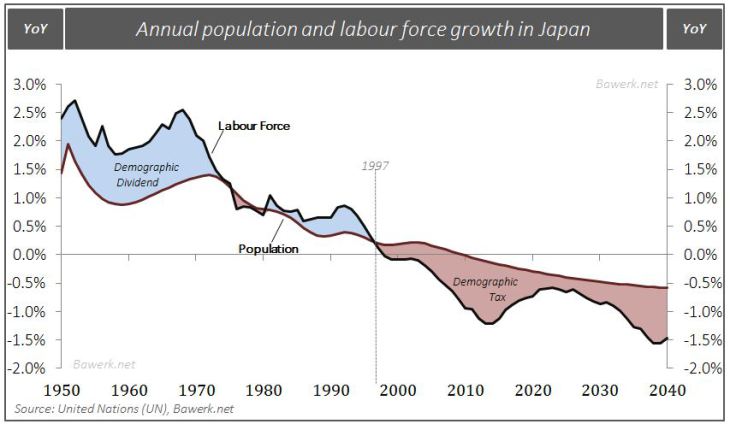

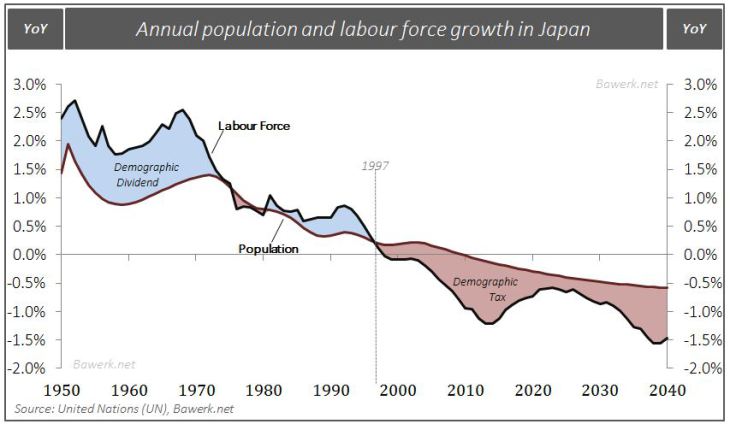

Annual population and labour force growth in Japan

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries. As we all know, Japan has a rapidly ageing population whereby the workforce is getting smaller for every day. Japan has had a demographic growth tax ever since 1997 when population growth overtook potential labour force growth. |

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries. - Click to enlarge |

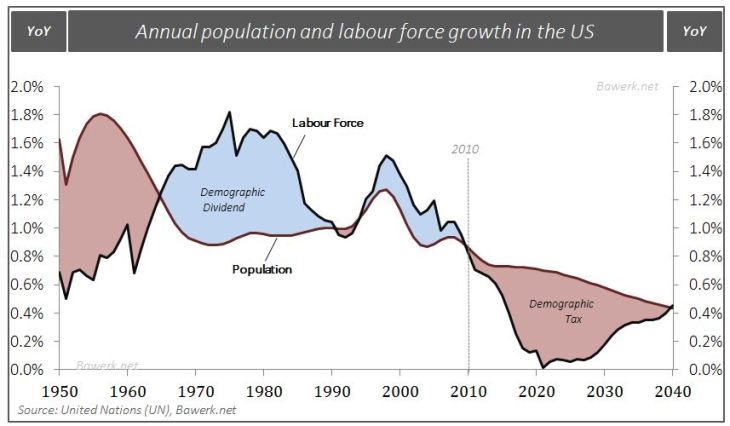

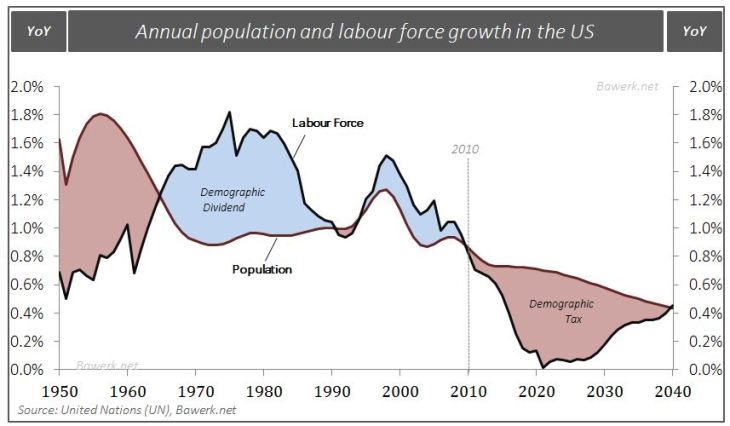

Annual population and labour force growth in the US

The United States on the other hand only started “paying” their demographic tax in 2010 and it was not until very recently it became severe enough to make a large dent in overall growth accounting.

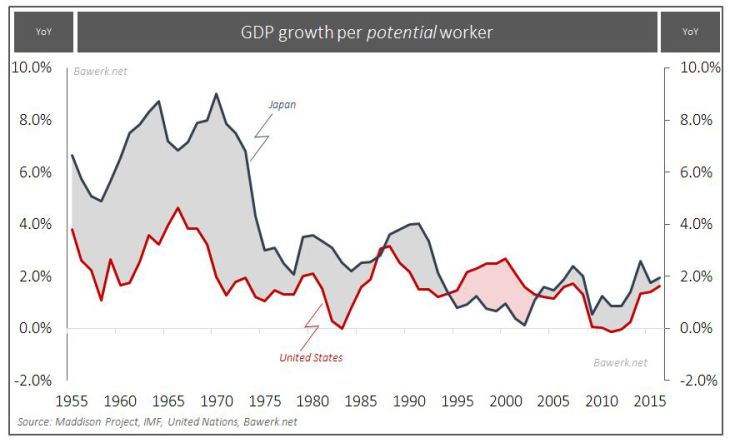

If we adjust for the demographic difference between the US and Japan, the Japanese economy has actually performed much better than the US. In other words, given the resources available, Japan has managed to eke out more real growth than the US. That is not to say Japan is growing on a healthy pace, only that they are able to grow faster (or fall less rapidly) than their potential workforce. The US economy have barely managed to keep up with is workforce; and the demographic tax facing the US from here on will only exacerbate the precarious situation. |

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries. - Click to enlarge |

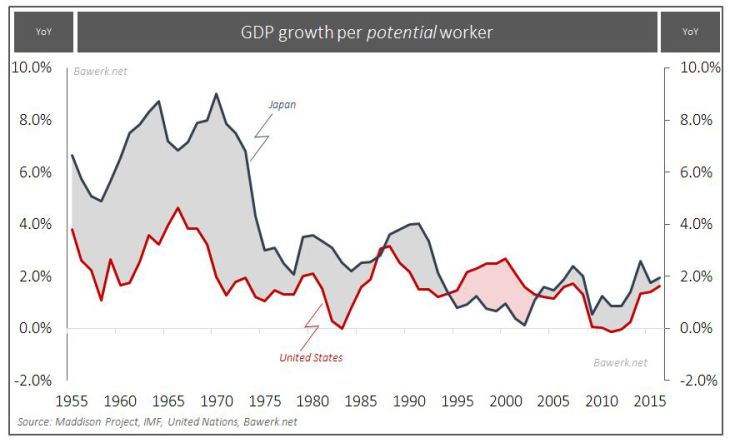

GDP growth per potential worker

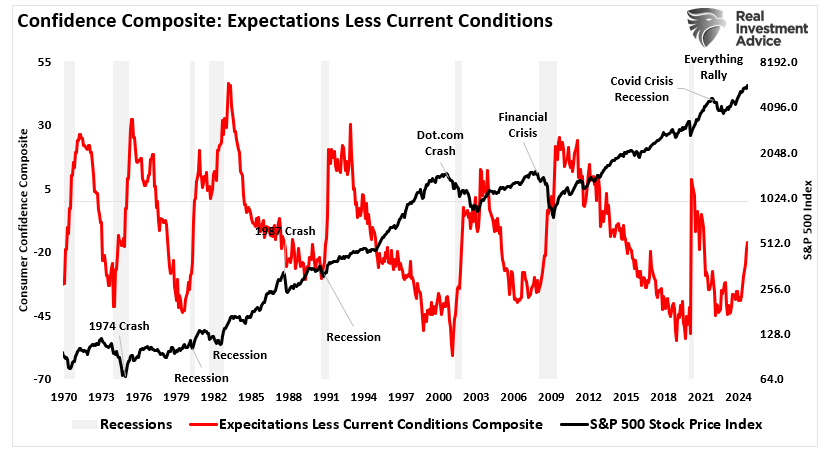

Facing headwinds like that it is safe to say US growth will remain subdued (not to mention the upcoming recession) in the years ahead. This will obviously wreak havoc with public budget projections as tax revenues fall well short of expectations and secular stagnationists crowding the upper echelons of economic policy circles insist on more fiscal spending. The resulting trillion dollar deficit will presumably be funded at negative interest rates with the strong approval of Keynesian hacks and power hungry policymakers. Needless to say, a structurally low growth environment will be blamed on under-consumption and foolish counter cyclical policies will continue to mend a non-existent problem. |

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries. - Click to enlarge |

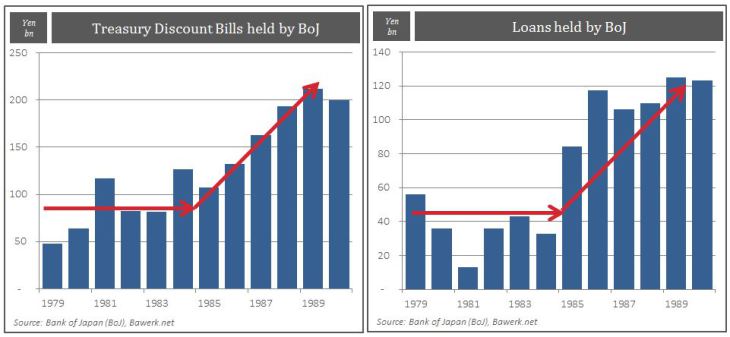

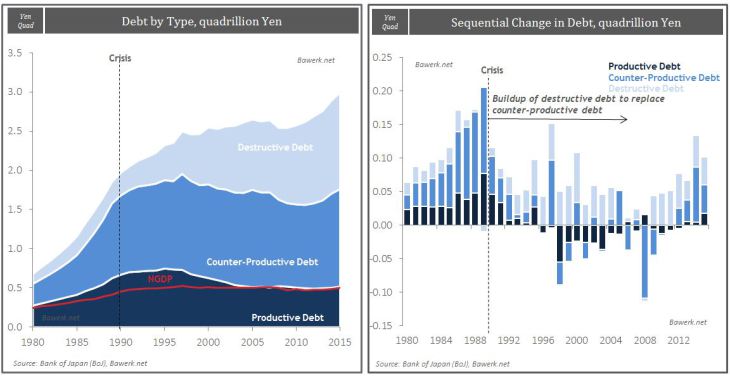

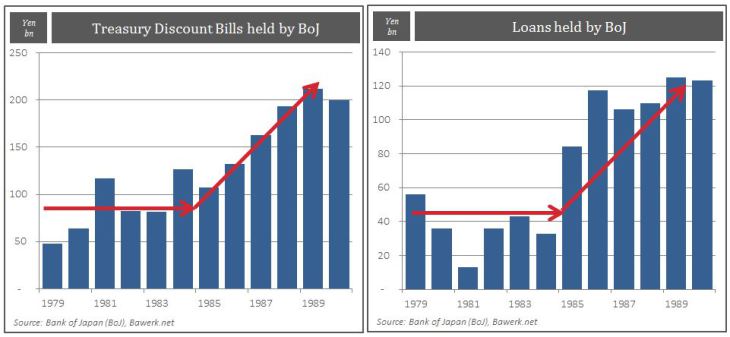

Bank of Japan Basic Loan Rate and Yen Exchange Rate

We heard the story before and we know how that turned out for Japan; as the Plaza Accord of September 1985 strengthened the Yen, Japan’s boom was coming to an end. Reduced demand for their products on international markets led the Japanese leadership to conclude that they faced prospects of a secular stagnation (they didn’t call it that at the time) which could only be rectified by boosting internal demand. The Bank of Japan slashed the basic loan rate in half by expanding their purchases of treasury bills and doling out cheap loans. The ensuing bubble gave the impression that boom times would last as Japan transformed its economy from one dependent on manufacturing and exports to one self-propelled by its wn service sector (sounds familiar?).Initially the bubble policy appeared to be working as nominal growth rates held up, but the growing economy was built on the shaky foundation of an expanding balance sheet at lower interest rates engineered by the central bank. |

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries. - Click to enlarge |

Treasury Discount Bills held by BOJ and Loans held by BOJ

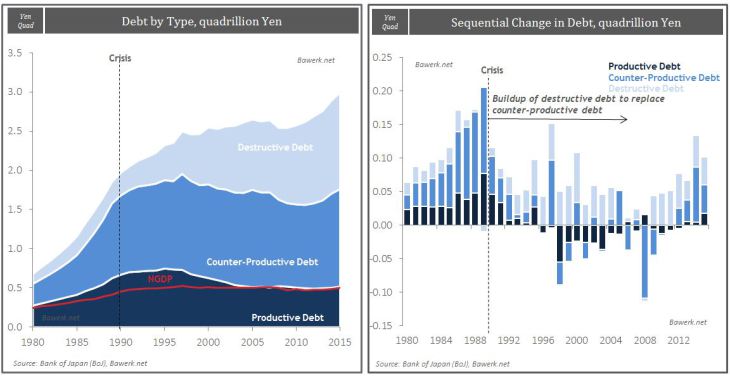

What was really happening was essentially a substitution of productive debt with the intent of making a subsequent sale to counter-productive debt which is not self-liquidating, to maintain the illusion of prosperity. As soon as the Bank of Japan started to raise rates again, counter-productive debt came under pressure as it could not fund itself unless subsidised by the Bank of Japan. When the inevitable bust struck, new bouts of stimuli was applied, but this time counter-productive debt was substituted for pure consumptive, or destructive, debt. |

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries. - Click to enlarge |

| As Keynesian focus on measured aggregates in the present, they could see nothing wrong with this policy. Lower domestic saving was a signal of a strong economy where little purchasing power would leak out of the circular spending stream whereby one man’s liability is another man’s asset. |

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries. - Click to enlarge |

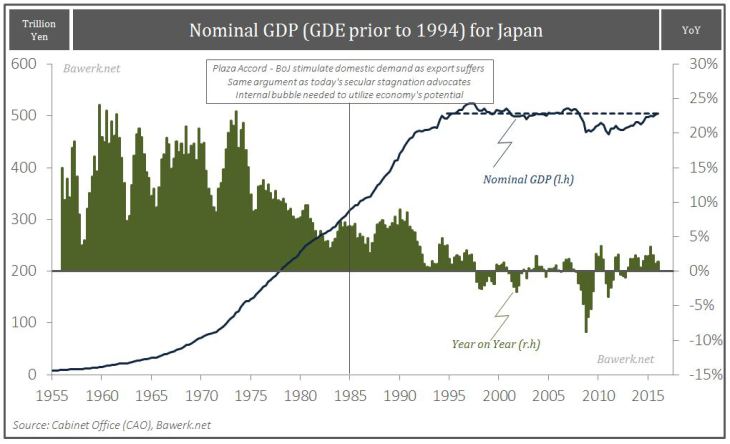

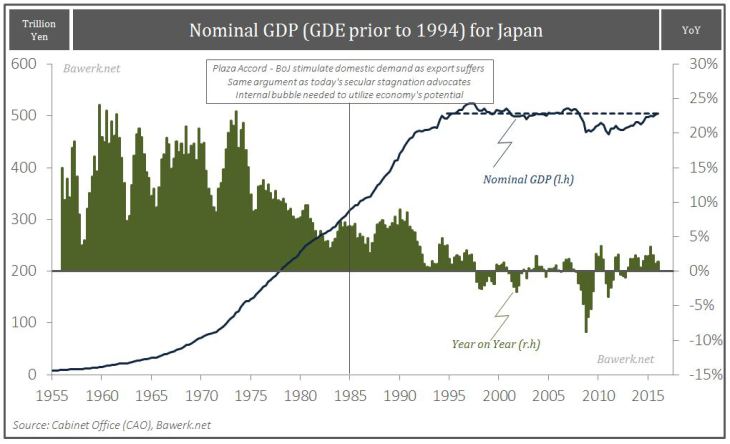

Nominal GDP for Japan

However, in the dis-aggregates something was terribly wrong. Old industries were kept alive by cheap credit, consuming the capital that should bring life to new ones, cementing the pre-Plaza Accord system that were ill fit for the new reality. Believing the post-Plaza Accord policy of bubble blowing was working, the Japanese continued with ZIRP (now NIRP) and QE in order to re-establish Japan’s glory days. Unsurprisingly, it did not work. Income, as measured by nominal GDP stagnated while outlays kept growing alongside the gargantuan public debt burden. |

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries. - Click to enlarge |