Tag Archive: newslettersent

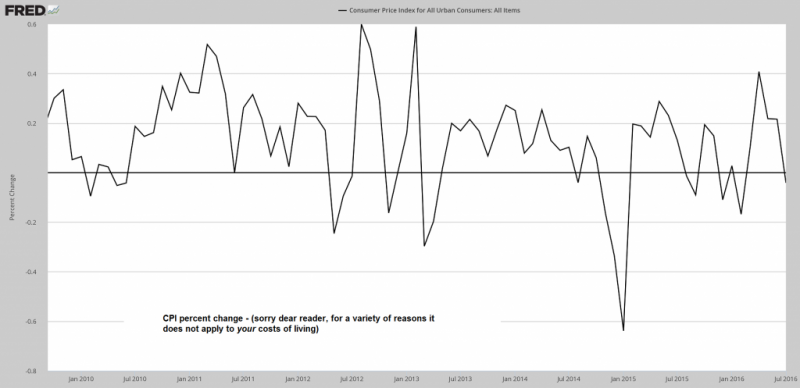

Yarns, Mysteries, and the CPI

Several ill-defined economic data points were unveiled this week. Namely, the Labor Department’s July consumer price index report. According to the government data, on whole, consumer prices for the month didn’t change one iota. In reality, the CPI is so distorted and disfigured it doesn’t really tell us much that’s useful. Empirical experience and common sense are much better indicators of inflation and deflation. What’s more, you don’t have...

Read More »

Read More »

Should we Be Concerned About the Fall in Money Velocity?

A fall in the US velocity of money M2 to 1.44 in June from 1.51 in June last year and 2.2 in May 1997 has alarmed many experts. Note that the June figure is the lowest since January 1959.

Read More »

Read More »

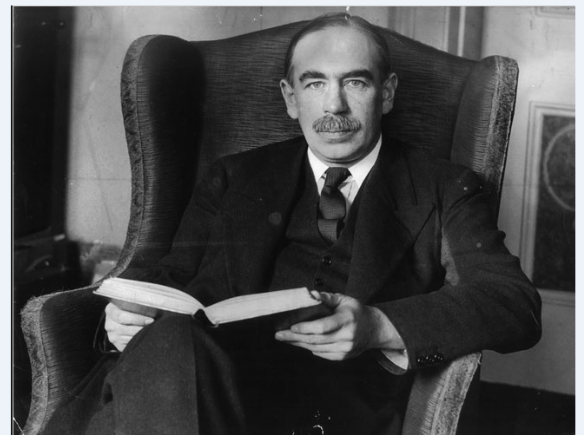

Does the UK Need Even More Stimulus?

“We are all Keynesians now, so let’s get fiscal.” This is one view according to Ambrose Evans-Pritchard from The Telegraph who believes the time is right for the UK government to loosen its fiscal stance. He suggests that the “Bank of England has done everything possible under the constraints of monetary orthodoxy to cushion the Brexit shock. It is now up to the British government to save the economy, and the sooner the better,” — argues the...

Read More »

Read More »

Don’t Expect a Return to a Gold Standard Any Time Soon

Despite trillions of paper currency units poured into the world economies since the start of the financial crisis, there has been no recovery, in fact, all legitimate indicators have shown worsening conditions except, of course, for the pocketbooks of the politically – connected financial elites.

Read More »

Read More »

FX Weekly Preview: Yellen at Jackson Hole

Lastly, a brief word about next week. I will not post my usual piece on macro considerations on Sunday. Here, though, is a brief thumbnail sketch of the top five things I will be watching: Yellen at Jackson Hole at the end of next week: To the extent that she shares her assessment of the economy, I would expect to largely echo the broad sentiment expressed by NY Fed President Dudley.

Read More »

Read More »

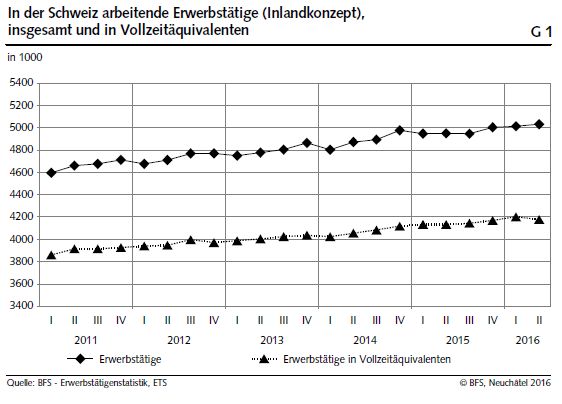

Swiss Labour Force Survey in 2nd quarter 2016: Number of employed persons + 1.6%; unemployment rate (ILO) 4.3%

The number of employed persons in Switzerland rose by 1.6% between the 2nd quarter 2015 and the 2nd quarter 2016. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) increased slightly from 4.2% to 4.3%. The EU's unemployment rate decreased from 9.5% to 8.6%. These are some of the survey results from the Federal Statistical Office (FSO).

Read More »

Read More »

The Deep State’s Catch-22

What happens if the Deep State pursues the usual pathological path of increasing repression? The system it feeds on decays and collapses. Catch-22 (from the 1961 novel set in World War II Catch-22) has several shades of meaning (bureaucratic absurdity, for example), but at heart it is a self-referential paradox: you must be insane to be excused from flying your mission, but requesting to be excused by reason of insanity proves you're sane.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended last week on a soft note.Fed tightening expectations were buffeted first by hawkish Dudley comments and then by the more balanced FOMC minutes. On net, the markets adjusted the odds for tightening by year-end a little higher from the previous week, and stand at the highest odds since the Brexit vote. Yet despite the strong jobs data in June and July, odds of a move on September 21 or November 2 are still low, with the December 14 meeting...

Read More »

Read More »

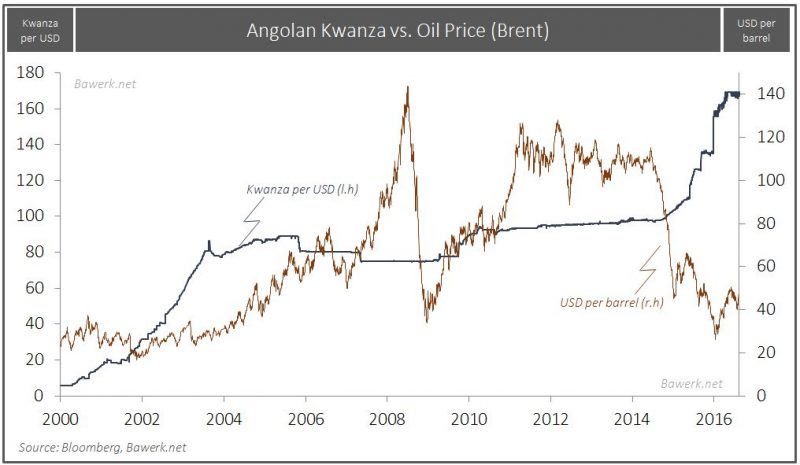

The Dos Santos Succession Saga

Arguably one of the easier calls for us to make after 37 years in power was that President dos Santos would find ways of affording himself another 5 years in. Like any ‘effective’ leader, Mr. Santos made sure the final deal to do just that was stitched up long before the Party Congress formally convenes in Luanda, with a lower level MPLA ‘Central Committee’ already rubber stamping his name in mid-August.

Read More »

Read More »

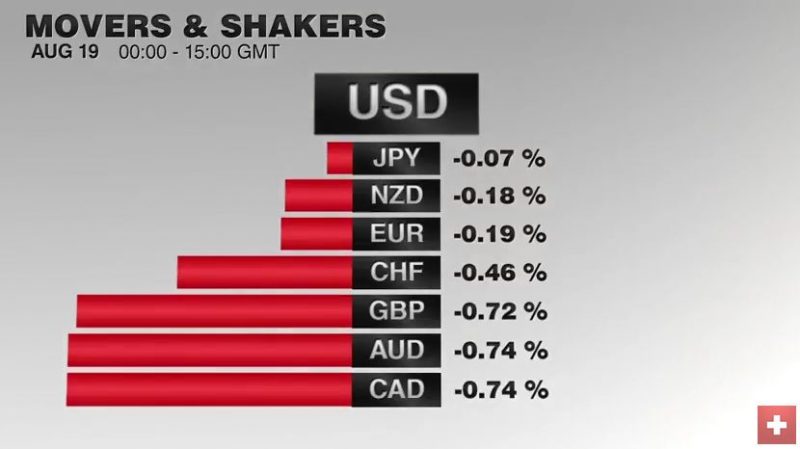

FX Weekly Review, August 15 – August 19: Swiss Franc index improves 5% compared to dollar index

The US dollar lost ground against nearly all the major currencies last week. The sole exceptions were the Australian dollar, where Moody's decision to cut the outlook for five Australian banks wiped out the previous small gain. The Swiss Franc index gained nearly 5% compared to the dollar index.

Read More »

Read More »

Speculators Make Small Bets in FX, but Bears Run for Cover in Treasuries and Oil

Summer doldrums continue to depress speculative activity in the currency futures market. In the CFTC Commitment of Traders reporting week ending August 16 speculators made small adjustments to gross currency positions. There was only one change more than 6k contracts. Continue reading »

Read More »

Read More »

Swiss market lower this week as US stocks reach new record highs

The Swiss Market Index is set to close lower this week underperforming global equities as US stocks reached new record highs and emerging markets outperformed on a weaker dollar. Oil also made further gains this week as investors bet that talks between OPEC members and other producers may result in action to stabilise the market in the coming weeks.

Read More »

Read More »

FX Daily, August 19: Dollar Recovers into the Weekend

The US dollar is trading firmly ahead of the weekend as part of this week's losses are recouped. The euro is trading within yesterday's range, holding to a little more than a half-cent above $1.13. However, as we have noted, the Asia and European participants appear more dollar-friendly than Americans

Read More »

Read More »

Emerging Markets: What has Changed

China unveiled a second equity link that will allow foreign investors to buy local stocks with fewer restrictions. Saudi Arabia will allow qualified foreign investors to subscribe to local IPOs starting this January. South Africa’s two main opposition parties agreed to informally band together in local governments. The Brazilian central bank decreased the daily intervention amount to 10,000 reverse swap contracts from 15,000 before, just a week...

Read More »

Read More »

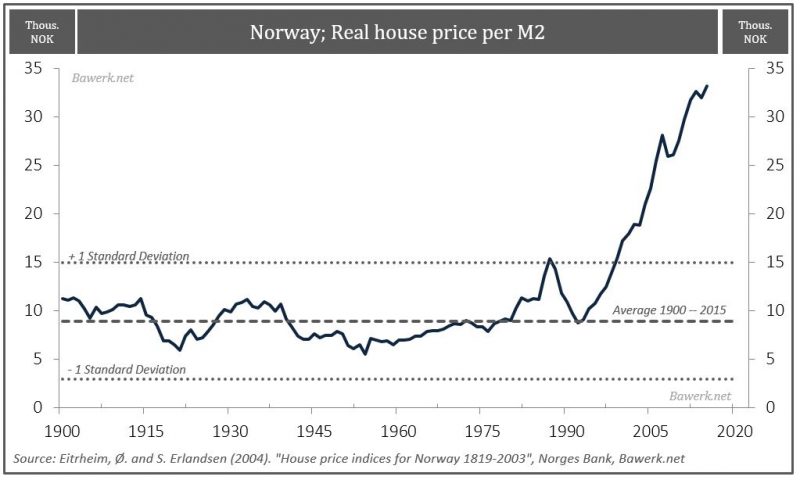

Norway: Towards Stagflation

We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades.

Read More »

Read More »

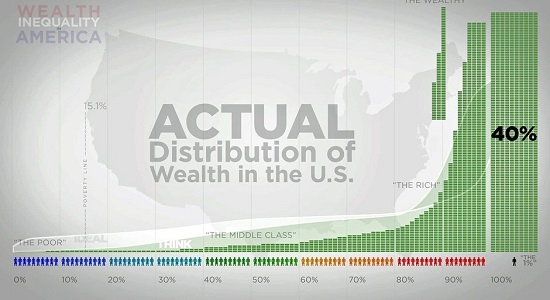

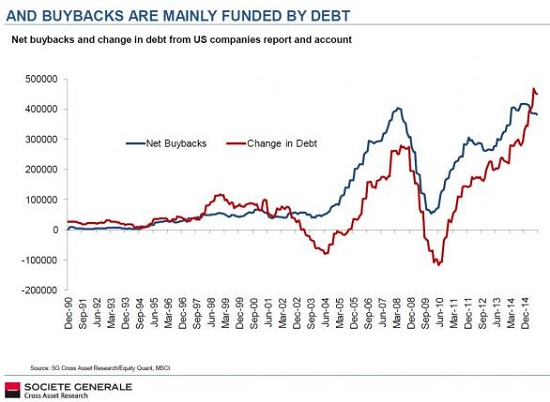

What the Fed Hasn’t Fixed (and Actually Made Worse)

The Fed has not only failed to fix what's broken in the U.S. economy--it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don't hurt yourself patting your own backs, Fed governors past and present: it's bad enough that the Fed can't fix the economy's real problems--its policies actively make them worse.

Read More »

Read More »