The Fed has not only failed to fix what’s broken in the U.S. economy–it has actively mad those problems worse.

The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don’t hurt yourself patting your own backs, Fed governors past and present: it’s bad enough that the Fed can’t fix the economy’s real problems–its policies actively make them worse.

After seven long years of politicos and the financial media glorifying the Federal Reserve’s policies as god-like in their power and efficacy, let’s take a quick look at the results of these vaunted policies: ZIRP (zero interest rates), (QE) quantitative easing, both of which are ways of shoving nearly-free money ( a.k.a. liquidity) into the banking sector, where all this free money is supposed to filter into the global economy, working miracles of prosperity.

The stated goal of the Fed’s zero-interest rate policy (ZIRP) and quantitative easing (QE) was to make borrowing easier for both corporations and consumers, the idea being that companies would borrow to invest in new productive capacity and consumers would buy the new goods and services being produced with the Fed’s cheap credit.

The secondary publicly stated goal was to spark a rally in stocks, bonds and real estate that would spark a wealth effect: as households saw their net worth rise, they would feel wealthier and thus more likely to borrow money to buy more goods and services.

Let’s start by stipulating that the Fed’s policies are unprecedented. Keeping interest rates near-zero for over seven years and pumping up its balance sheet from $800 billion to over $4 trillion are both completely off the scale of central bank policy in the U.S.

The most charitable assessment we can make of Fed policy is that the “prosperity” it created is concentrated in the most parasitic and politically powerful sector: finance. Why should we be surprised that the Fed, itself a servant of the banking sector, should devise policies that enrich financiers?

|

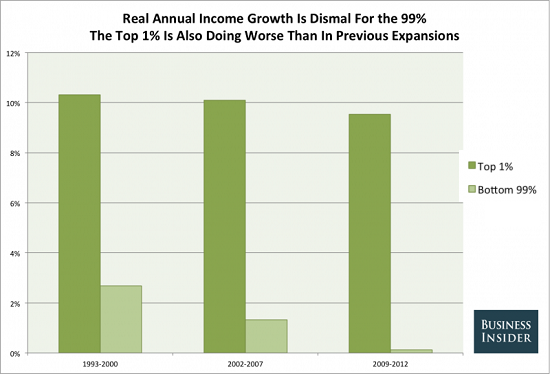

The Fed’s policies have been an unqualified success for financiers and an abject failure for everyone who has to work for a living. The Fed has not just failed to rectify the nation’s obscene inequality in wealth and income; it has actively widened it by handing guaranteed returns to the banks and financiers while stripmining what’s left of the middle and working classes’ non-labor income, i.e. interest on savings.

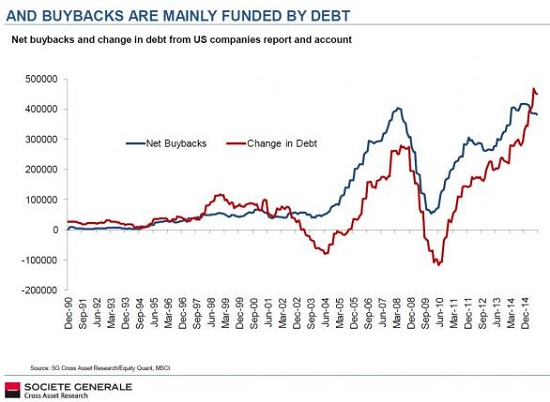

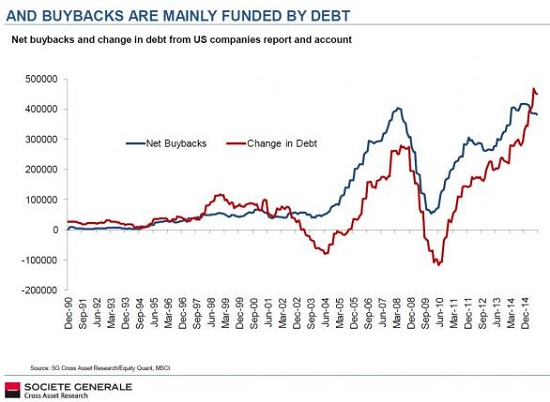

So let’s see what corporations and financiers did with the Fed’s free money for financiers:

They borrowed billions to buy back their own stocks:

|

The Fed has not only failed to fix what's broken in the U.S. economy--it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don't hurt yourself patting your own backs, Fed governors past and present: it's bad enough that the Fed can't fix the economy's real problems--its policies actively make them worse. - Click to enlarge

|

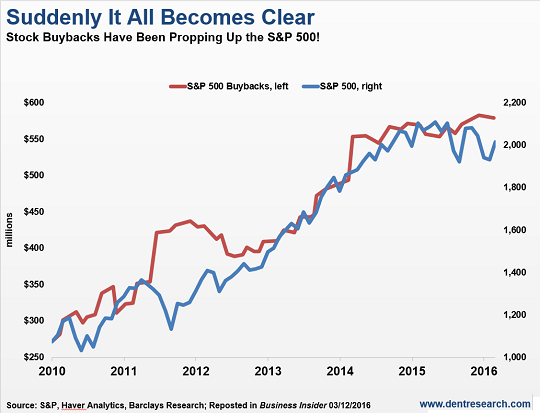

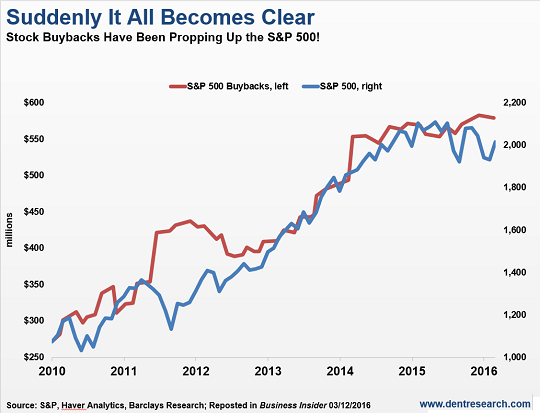

| Which boosted the the value of the stocks, enriching the corporate managers and big shareholders: |

The Fed has not only failed to fix what's broken in the U.S. economy--it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don't hurt yourself patting your own backs, Fed governors past and present: it's bad enough that the Fed can't fix the economy's real problems--its policies actively make them worse. - Click to enlarge

|

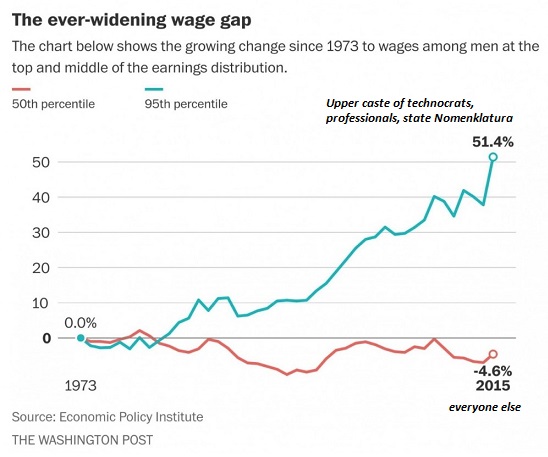

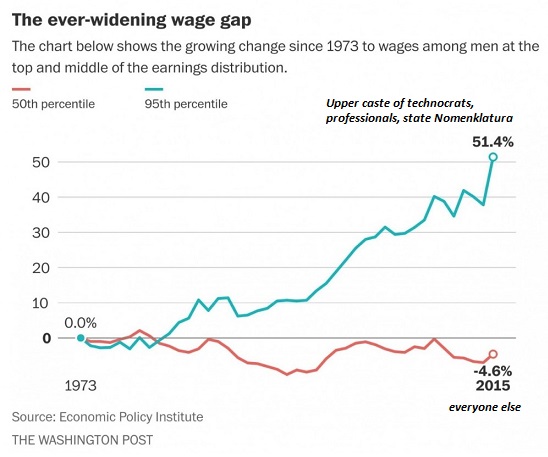

| Did corporations share the wealth with their employees? The top 5% have done very well, the bottom 95%–well, their real incomes stagnated or declined: |

The Fed has not only failed to fix what's broken in the U.S. economy--it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don't hurt yourself patting your own backs, Fed governors past and present: it's bad enough that the Fed can't fix the economy's real problems--its policies actively make them worse. - Click to enlarge

|

|

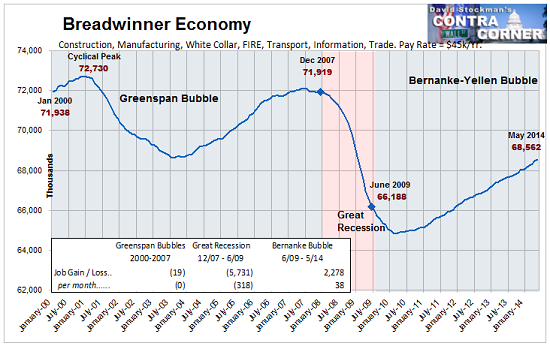

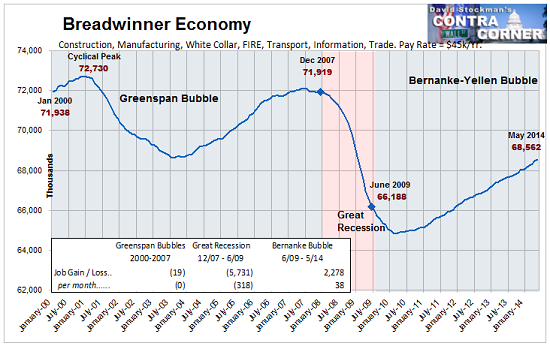

Did corporations and financiers create more breadwinner jobs? That is, full-time jobs that pay enough to support a household (i.e. the employee doesn’t have to live in his/her parents’ basement).

Nope. Breadwinner jobs have declined. The “growth” measured by GDP is mostly increases in prices, not growth in full-time jobs or wages for the bottom 95%.

|

The Fed has not only failed to fix what's broken in the U.S. economy--it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don't hurt yourself patting your own backs, Fed governors past and present: it's bad enough that the Fed can't fix the economy's real problems--its policies actively make them worse. - Click to enlarge

|

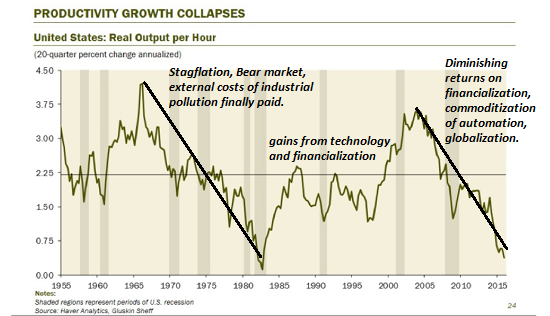

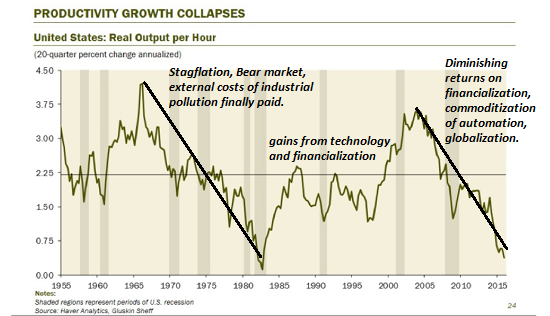

| Did they invest the Fed’s free money for financiers in new productive capacity? No, productivity has tanked: |

The Fed has not only failed to fix what's broken in the U.S. economy--it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don't hurt yourself patting your own backs, Fed governors past and present: it's bad enough that the Fed can't fix the economy's real problems--its policies actively make them worse. - Click to enlarge

|

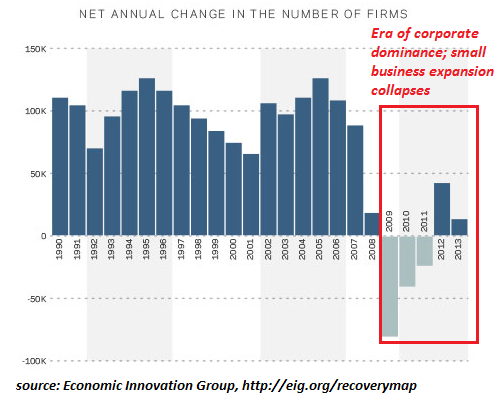

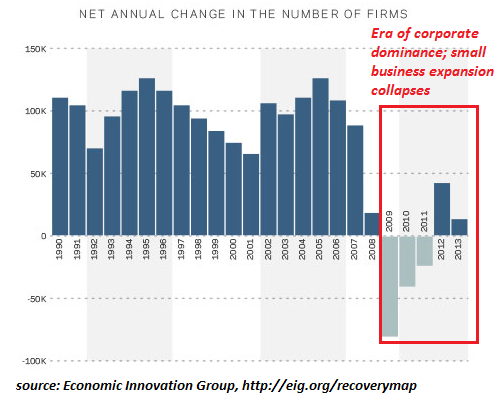

| But the Fed’s near-zero interest rates and easy credit must have encouraged investors and entrepreneurs to launch a tsunami of new businesses, right? Wrong — new business growth has collapsed since the Fed’s policies were put in place: |

The Fed has not only failed to fix what's broken in the U.S. economy--it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don't hurt yourself patting your own backs, Fed governors past and present: it's bad enough that the Fed can't fix the economy's real problems--its policies actively make them worse. - Click to enlarge

|

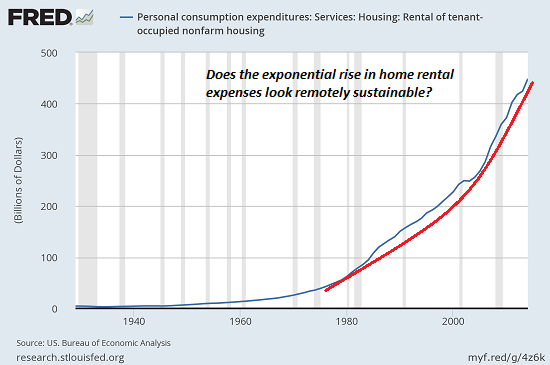

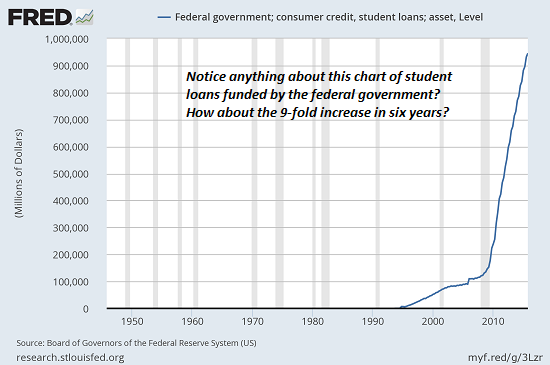

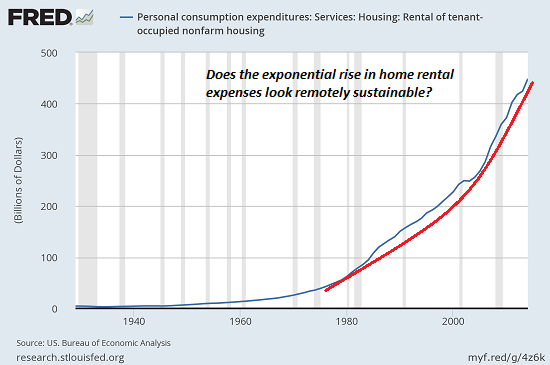

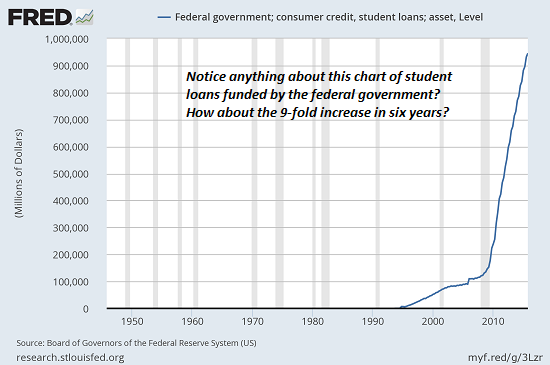

| But certainly the Fed’s policies have kept inflation low, correct? No–not if you pay rent, college tuition or healthcare: |

The Fed has not only failed to fix what's broken in the U.S. economy--it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don't hurt yourself patting your own backs, Fed governors past and present: it's bad enough that the Fed can't fix the economy's real problems--its policies actively make them worse. - Click to enlarge

|

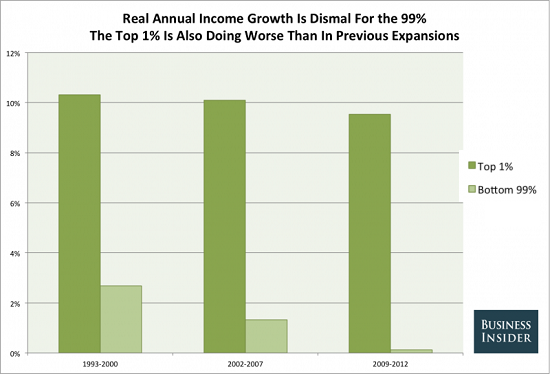

| But surely the Fed’s vaunted wealth effect has trickled down to all households? Not even close–wealth/income inequality has soared: |

The Fed has not only failed to fix what's broken in the U.S. economy--it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don't hurt yourself patting your own backs, Fed governors past and present: it's bad enough that the Fed can't fix the economy's real problems--its policies actively make them worse. - Click to enlarge

|

|

Berkeley economics professor Emmanuel Saez put out an update to his estimates of income inequality, and the headline figure has everybody outraged: 95% of income gains since 2009 have accrued to the top 1%.

The Fed has not only failed to fix what’s broken in the U.S. economy–it has actively made those problems worse. The first step in solving these problems is to eliminate whatever is making them worse–i.e. the Federal Reserve.

|

The Fed has not only failed to fix what's broken in the U.S. economy--it has actively mad those problems worse. The Federal Reserve claims its monetary interventions saved America from economic ruin in 2009, and have bolstered growth ever since. Don't hurt yourself patting your own backs, Fed governors past and present: it's bad enough that the Fed can't fix the economy's real problems--its policies actively make them worse. - Click to enlarge

|

My new book is #5 on Kindle short reads -> politics and social science: Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle ebook, $8.95 print edition) For more, please visit the book’s website.

Full story here

Are you the author?

At readers' request, I've prepared a biography. I am not confident this is the right length or has the desired information; the whole project veers uncomfortably close to PR. On the other hand, who wants to read a boring bio? I am reminded of the "Peanuts" comic character Lucy, who once issued this terse biographical summary: "A man was born, he lived, he died." All undoubtedly true, but somewhat lacking in narrative.

Previous post

See more for 5.) Charles Hugh Smith

Next post

Tags:

newslettersent