Tag Archive: newslettersent

US Economy – Curious Pattern in ISM Readings

Head Fake Theory Confirmed? This is a brief update on our last overview of economic data. Although we briefly discussed employment as well, the overview was as usual mainly focused on manufacturing, which is the largest sector of the economy by gross output.

Read More »

Read More »

Swiss National Bank: Carl Menger Prize

Despite her incredible money printing and FX purchases, the SNB has many roots in the Austrian School of Economics, a school that maintains that money printing leads to price inflation. One of the major Austrian economists was Carl Menger.

Read More »

Read More »

Cash in a box catches on as Swiss negative rates bite

It’s a sign the world is getting used to negative interest rates when what once seemed bizarre starts looking like the norm. Consider Switzerland, where more and more companies are taking out insurance policies to protect their cash hoards from theft or damage.

Read More »

Read More »

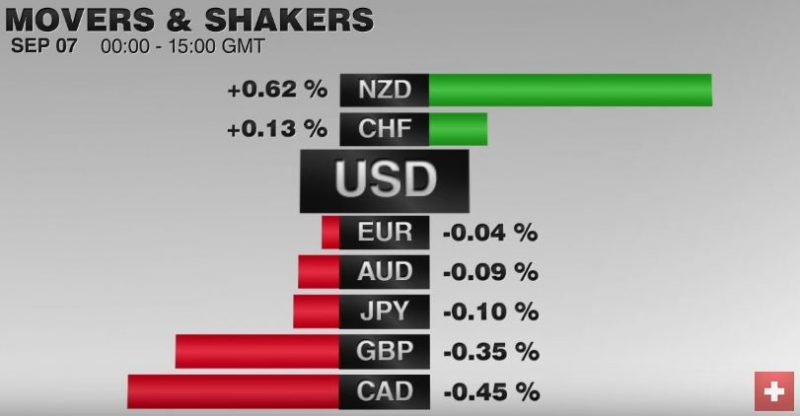

FX Daily, September 07: Dollar Stabilizes, but Hardly Recovers

Disappointing industrial output figures from Germany and UK are helping stabilize the US dollar after yesterday's shellacking. Investors have been fickle about the prospects for a rate hike this month, and the unexpected dramatic slide in the service spurred a downgrading of such expectations, and a flight out of the dollar. It was not simply a quest for yields, though that was part of it. Surely the yen and euro's strength is not a function of...

Read More »

Read More »

UBS handed setback in $2 billion mortgage buy-back lawsuit

A UBS Group AG unit was found by a federal judge to have violated some contracts with mortgage-backed securities trusts that hold loans, putting it at risk of having to buy back more loans or pay damages in a $2 billion lawsuit. U.S. District Judge Kevin Castel Tuesday ruled that UBS Real Estate Securities Inc. had breached warranties on 13 of 20 loans in the trusts that were introduced into evidence in a three-week trial in Manhattan in May.

Read More »

Read More »

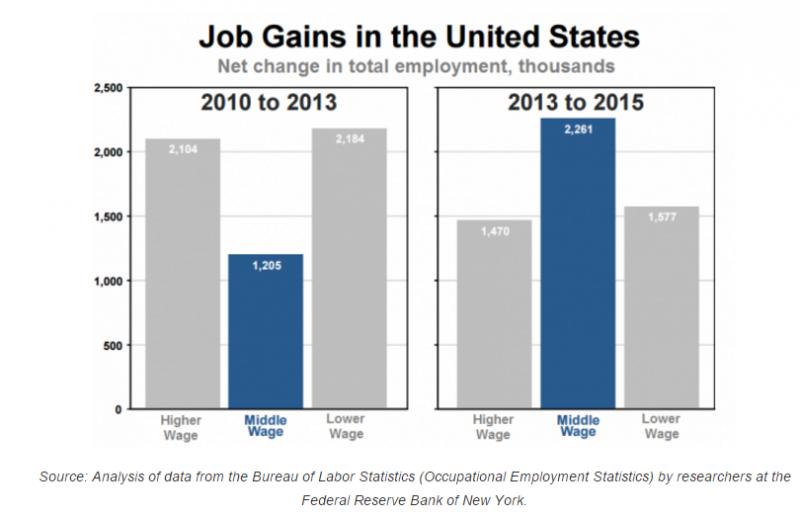

Great Graphic: What Kind of Jobs is the US Creating

The oft repeated generalization about the dominance of low paying jobs is not true for the last few years. This does note refute the disparity of wealth and income in the US. There is a restructuring taking place that favors educated and skilled workers.

Read More »

Read More »

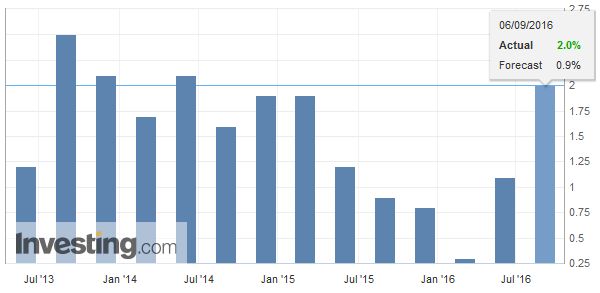

Swiss Q2 GDP: +0.6 percent QoQ, +2.0 percent YoY

Each quarter, the SECO estimates the GDP and its components. The main purpose of these estimations is to provide data that allow for an assessment of the cyclical development of the main macroeconomic aggregats in a timely adequate and credible manner.

Read More »

Read More »

FX Daily, September 6: Dollar Heavy in Quiet Markets

The US dollar is trading heavily against most of the major and emerging market currencies. However, the losses are modest, and the greenback remains within recent ranges. The Antipodean and Scandi bloc currencies are performing best.

Read More »

Read More »

Services ISM Sends Greenback Reeling

ISM showed unexpected weakness in Aug non-mfg PMI. Markit measure slipped but not as much as ISM. Odds of a Sept Fed hike slip to about 15%. Watch trendline in Dollar Index near 94.45.

Read More »

Read More »

Our Impoverished, Pathological Society

If asked what's intrinsic to human happiness, most people in consumer societies will offer up answers such as money, status, a nice house, etc. But as Sebastian Junger observes in his book Tribe: On Homecoming and Belonging, what's actually intrinsic to human happiness is: meaningful relationships within a community (i.e. a tribe); opportunities to contribute to the group and to be appreciated; being competent at useful tasks and opportunities for...

Read More »

Read More »

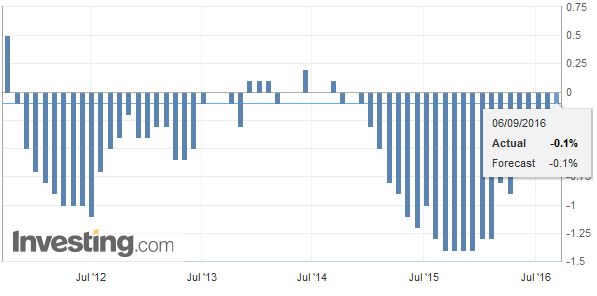

Swiss Consumer Price Index in August 2016: -0.1 percent against 2016, -0.1 percent against last month

We often look at parts of the CPI. For example food inflation is relevant in emerging markets or poorer people in developed nations. Food inflation in Switzerland has risen by 1.3% YoY compared to 0.2% in the U.S., and 1.4% in the eurozone and 1.1% in neighbour Germany. Rents are up +0.2% YoY. Existing Swiss rents are bound to interest rates; therefore they cannot follow the Swiss real estate boom yet.

Read More »

Read More »

A Convocation of Interventionists – Part 1

Modern Economics – It’s All About Central Planning. We are hereby delivering a somewhat belated comment on the meeting of monetary central planners and their courtier economists at Jackson Hole. Luckily timing is not really an issue in this context.

Read More »

Read More »

FX Daily, September 5: While Americans were Celebrating Labor Day

There were several developments that took place while US markets were closed for its Labor Day holiday. Most of the economic news was favorable. This included a strong snap back in the UK service PMI, more evidence that the moral suasion campaign to lift wages in Japan is yielding some success and a rise in the Caixin's China's service PMI.

Read More »

Read More »

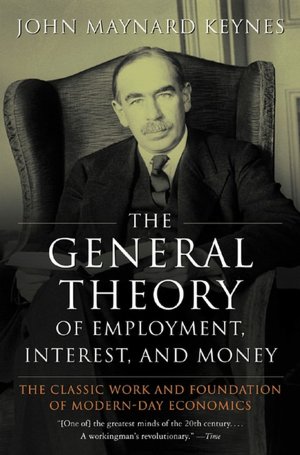

John Maynard Keynes’ General Theory Eighty Years Later

The “Scientific” Fig Leaf for Statism and Interventionism. To the economic and political detriment of the Western world and those economies beyond which have adopted its precepts, 2016 marks the eightieth anniversary of the publication of one of, if not, the most influential economics books ever penned, John Maynard Keynes’ The General Theory of Employment, Interest and Money.

Read More »

Read More »

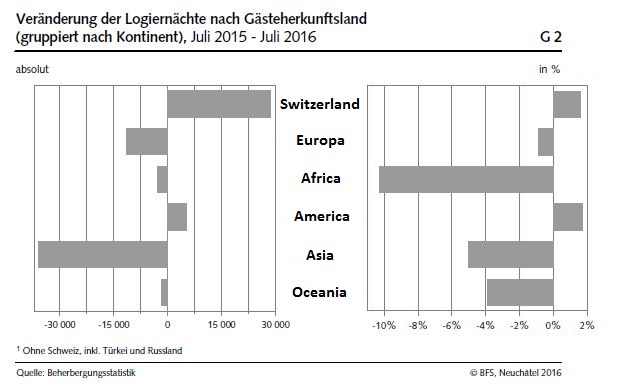

Tourism accommodation statistics in July 2016: Slight decline in overnight stays in July

The Swiss hotel industry registered 4.1 million overnight stays in July 2016, which corresponds to a decrease of 0.4% (-18,000 overnight stays) compared with July 2015. Foreign visitors generated 2.3 million overnight stays, representing a decline of 2.0% (-46,000). Domestic visitors registered 1.8 million overnight stays, i.e. an increase of 1.6% (+29,000). These are provisional results from the Federal Statistical Office (FSO).

Read More »

Read More »

Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »

Read More »

Europe Debates The Burkini: “We Will Colonize You With Your Democratic Laws”

"We will colonize you with your democratic laws." — Yusuf al-Qaradawi, Egyptian Islamic cleric and chairman of the International Union of Muslim Scholars. "Beaches, like any public space, must be protected from religious claims. The burkini is an anti-social political project aimed in particular at subjugating women.

Read More »

Read More »

FX Weekly Preview: Parsing Divergence: Focus Shifts from Fed to ECB

Net-net, the September Fed funds futures contract was little changed on the week. Four high-income central banks meet in the week ahead; the ECB is the only one in play. China accounted for a full three quarters of the US trade deficit in July.

Read More »

Read More »

Labour Productivity, Taxes and Okun’s Law

The great “science” of economics once discovered an empirical relationship between GDP and unemployment that has been dubbed Okun’s Law. It simply states that the unemployment rate rises as GDP contracts, or vice versa, as production shrinks less peo...

Read More »

Read More »