Tag Archive: newslettersent

L’argent des banques centrales finit dans les paradis fiscaux!

Nous savions que la crise avait laminé les finances des Etats, de l’économie publique et des familles. Jusque là rien de nouveau. Mais en finance, quand quelqu’un perd, il y a en général quelqu’un d’autre qui gagne la même somme et peut-être plus. A moins qu’il ne s’agisse de billets physiques que l’on flambe, c’est comme ça.Nous allons donc nous intéresser aux grands gagnants de la crise financière.

Read More »

Read More »

Fed GDP Projections

“It is not surprising the Fed once again failed to take action as their expectations for economic growth were once again lowered. In fact, as I have noted previously, the Federal Reserve are the worst economic forecasters on the planet.

Read More »

Read More »

The Ruling Elite Has Lost the Consent of the Governed

Brimming with hubris and self-importance, the ruling Elite and mainstream media cannot believe they have lost the consent of the governed. Every ruling Elite needs the consent of the governed: even autocracies, dictatorships and corporatocracies ultimately rule with the consent, however grudging, of the governed.

Read More »

Read More »

Donald, the “Maestro” and the Politically Controlled Fed

The Crazies, Former Federal Reserve Chairman Alan Greenspan, who was once laudably referred to as “Maestro” for his supposed astute stewardship of U.S. monetary policy, commented last week on the nation’s current political and economic climate.

Read More »

Read More »

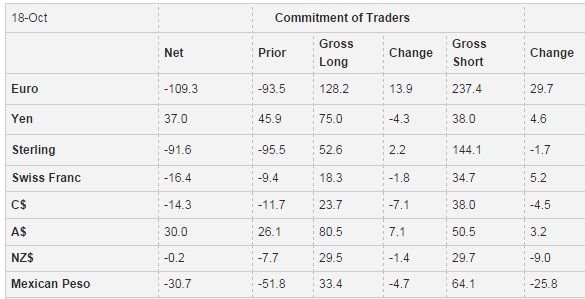

Weekly Speculative Positions: Net Short CHF Position is Increasing

The net short Swiss Franc position against the dollar has risen to the levels seen before the breakdown of the EUR/CHF floor.

It has increased from short 9.4 K contracts to 16.4 K contracts.

In the last week, speculators raised their short positions by 15% for both the euro and CHF. Euro longs against USD were up slightly, while CHF longs were reduced.

Read More »

Read More »

FX Weekly Review, October 17-21: Golden Cross in Dollar Index and Deadman’s Cross in the Euro

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

SNB verteilt Bussenzettel über 1,5 Milliarden pro Jahr

Am 15. Januar 2015 hat die Schweizerische Nationalbank (SNB) erstmals Negativzinsen anstelle des Mindestkurses eingeführ. Unmittelbar danach stürzte der Euro um 20 Prozent ab und erholte sich seither auf knapp 1.10 zum Franken. Klarer und eindeutiger kann man nicht vordemonstriert bekommen, dass Negativzinsen den Euro nicht stärken, den Franken nicht schwächen. Negativzinsen bringen nichts – ausser Gewinne für die SNB.

Read More »

Read More »

Roche revenue gains as sales of breast cancer drugs soar

Roche Holding AG’s third-quarter revenue rose 4.5 percent as its trio of breast-cancer therapies offset stagnating sales of some of its older drugs. Sales climbed to 12.5 billion Swiss francs ($12.6 billion), the Basel, Switzerland-based company said in a statement on Thursday. That compared with the 12.6 billion-franc average estimate of nine analysts surveyed by Bloomberg. Roche doesn’t report third-quarter earnings.

Read More »

Read More »

Nestle forecasts slowest sales growth in decade as pricing ebbs

Nestle SA forecast the slowest full-year sales growth in more than a decade as food companies worldwide struggle against consumer resistance to price increases. Revenue will gain about 3.5 percent on an organic basis in 2016, the Vevey, Switzerland-based maker of Nespresso coffee said Thursday, abandoning a goal for an increase of about 4.2 percent. Growth in the consumer-goods industry is “relatively fragile,” Chief Financial Officer...

Read More »

Read More »

Demographics and a New Old Paradigm

The hangover from the debt crisis and secular stagnation are the two main explanatory models for the low growth and low interest rates. Anew Fed paper brings the focus back to demographics. If true, warns of a protracted period of slow growth, low interest rates.

Read More »

Read More »

Welcome to Neocolonialism, Exploited Peasants!

In my latest interview with Max Keiser, Max asked a question of fundamental importance: (I paraphrase, as the interview has not yet been posted): now that the current iteration of capitalism has occupied every corner of the globe, where can it expand to for its "growth"?

Read More »

Read More »

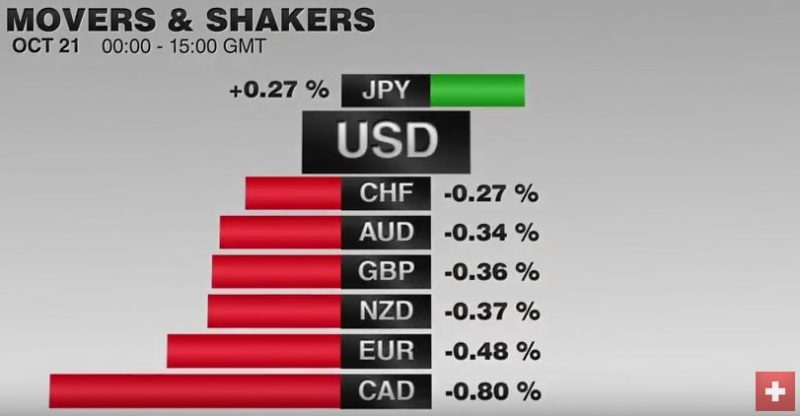

FX Daily, October 21: Greenback Ending Week on Firm Note

The US dollar is firm especially against the European complex and emerging market currencies. The yen continues to be resilient, and exporters are thought be capping the dollar above JPY104. The dollar is lower against the yen for the fourth consecutive session and set to snap a three-week advancing streak.

Read More »

Read More »

Great Graphic: Italian Banks and a German Bank

DB and Italian bank stocks have been moving in tandem. They suffer from fundamentally different problems. The euro has been selling off as the bank shares rebound.

Read More »

Read More »

Swiss Markets Review: SMI underperforms global stocks

The Swiss Market Index is set to finish the week largely unchanged while global stocks gain on positive US third quarter earnings results, favourable central bank statements and a rallying oil price. The S&P 500 saw its biggest advance since September on Wednesday after US banking giants Citigroup, JP Morgan, Morgan Stanley and Wells Fargo all posted better-than-expected quarterly results.

Read More »

Read More »

Cool Video: Double Bloomberg Feature–ECB and US Baby Boomers

This afternoon I had the privilege of being on Bloomberg TV, with anchors Scarlet Fu and Matt Miller. I was joined by an old market friend Bob Sinche. We had a lively discussion (what did you expect?) on two issues. The first was on the ECB. At his press conference earlier today, Draghi indicated that the question of extending QE and tapering was not discussed.

Read More »

Read More »

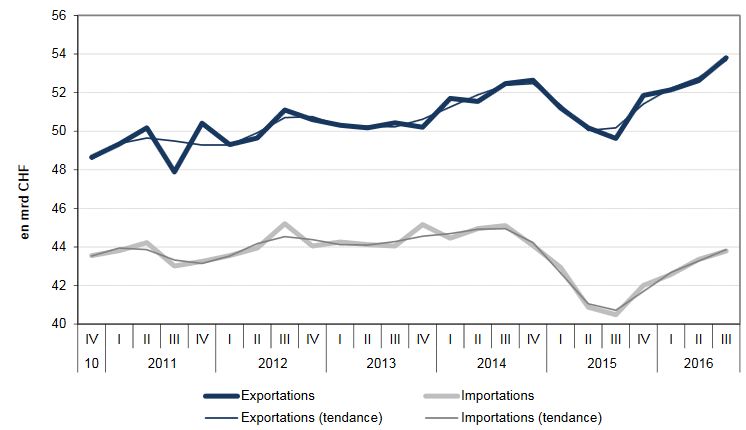

Swiss Quarterly Trade Surplus over 10 bn CHF for the First Time. Exports + 8.1 percent YoY, Imports +7.9 percent in Q3/2016.

In the third quarter of 2016, the Swiss quarterly trade surplus rose over 10 bn. CHF for the first time in history. Exports rose by 8.1% and Imports by 7.9%.

Read More »

Read More »

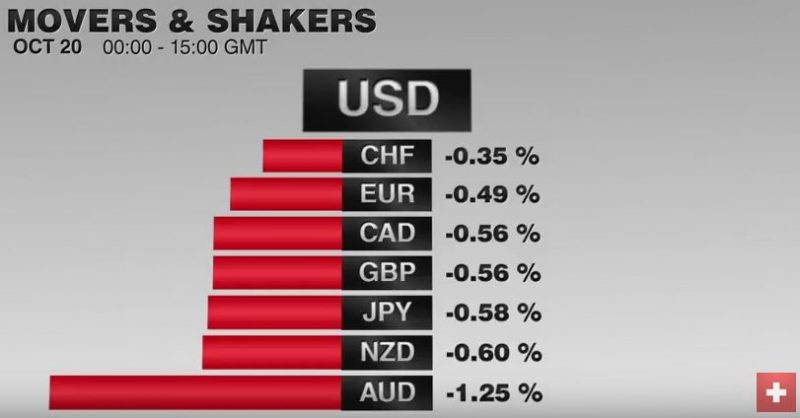

FX Daily, October 20: ECB Unlikely to Shake Dollar’s Slumber

GBP/CHF rates have fallen dramatically over the past month, as Sterling continues to find itself under pressure against the major currencies. However, despite these losses it is not all doom and gloom for those clients holding GBP, as Tuesday’s positive spike for the Pound proved. Currency does not move in a straight line and therefore we will see opportunities for those clients holding GBP to take advantage of, even if a sustainable Sterling...

Read More »

Read More »

A Looming Banking Crisis – Is a Perfect Storm About to Hit?

Andy Duncan of FinLingo.com has interviewed our friend Claudio Grass, managing director of Global Gold in Switzerland. Below is a transcript excerpting the main parts of the first section of the interview on the problems in the European banking system and what measures might be taken if push were to come to shove.

Read More »

Read More »

Draghi Says Nothing to Undermine Expectations of New Action in December

Extending or tapering QE was not discussed, but means little in terms of what the ECB decides in Sept. Draghi said growth risks are on the downside and inflation has yet to enter a meaningful uptrend. Reiterates that abrupt end of purchases is unlikely.

Read More »

Read More »