We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity increases, while REER assumes constant productivity in comparison to trade partners.

On the other side, a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

Third Quarter 2016

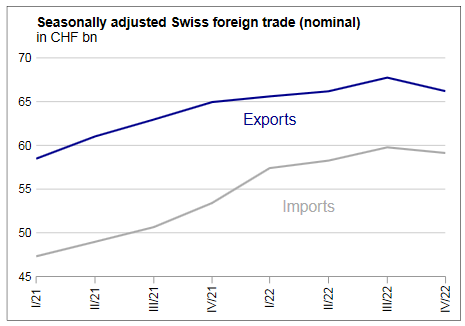

In the third quarter of 2016, the Swiss quarterly trade surplus rose over 10 bn. CHF for the first time in history. Exports rose by 8.1% and Imports by 7.9%. Industries contributing to the rise were jewelry and precious metals (+21%) and pharmaceuticals (+17%)

Exporters could even raise prices, as we see in the difference between nominal and real. The difference between nominal and real reflect the fact that, in particular pharmaceuticals and chemical exporters, could increase their prices in Swiss Franc. Changes in imports and exports are in line. This means that internal demand is in line with demand for exports.

The industry showing the most negative shift was watchmaking (-8%). Stronger pharmaceuticals exports were behind 80% of the rise.

The same quarter of 2014, before the Swiss National Bank abandoned the Swiss franc currency cap of 1.20 in January 2015, exports reached CHF 51.7 billion, 1.5% lower than the third quarter of 2016.

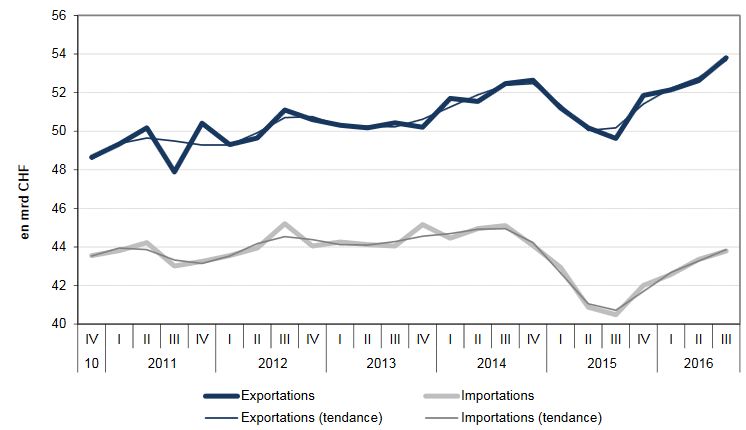

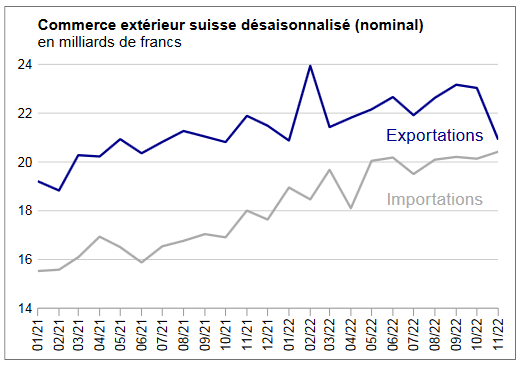

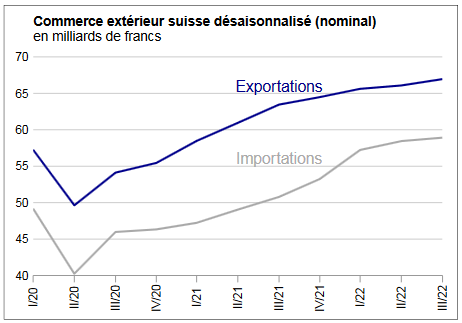

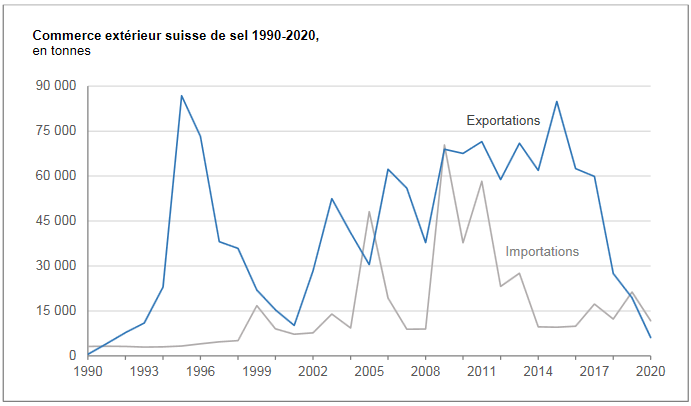

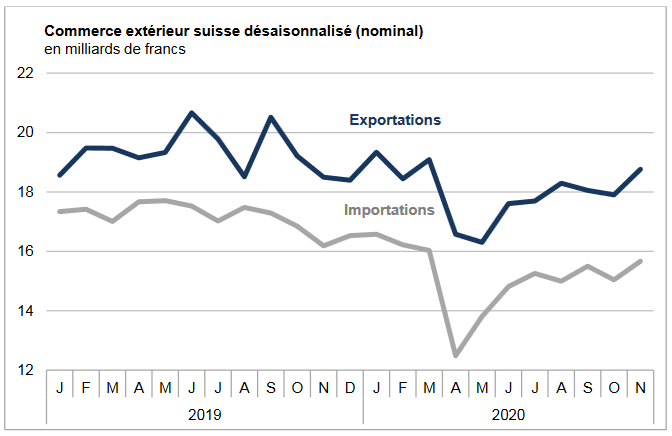

Charts from the Swiss customs data release (in French).

Exports and Imports YoY DevelopmentIn September 2016, Swiss exports were up 7.0% YoY (in real terms: + 1.2%) and imports 8.4% YoY (in real terms: + 5.1%). In short ▲ Machinery and Electronic: first increase after nine quarters of decline ▲ record exports to the USA and Japan ▼ Sixth consecutive decline in watch exports ▼ Trade with the UK falters after Brexit. |

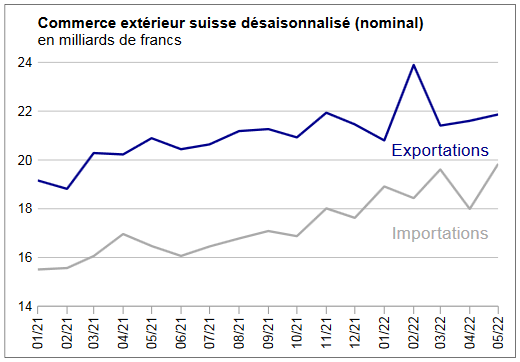

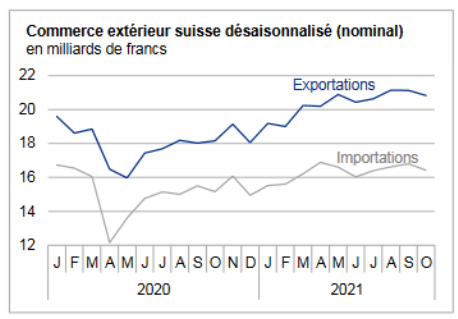

Swiss exports and imports, seasonally adjusted (in bn CHF)(see more posts on Switzerland Exports, Switzerland Imports, ) Source: Swiss Customs - Click to enlarge |

Sector findings▲ jewelry in the lead (+ 21% YoY) ▲ chemicals and pharmaceuticals +17% (3.4 billion CHF) mostly thanks to active ingredients and drugs ▲ precision instruments (instruments and medical devices) posted 8% increase ▲ the machinery and electronics group increased by 2% (+143 million) ▼ watch exports plunged 8% (minus 409 Mio).

|

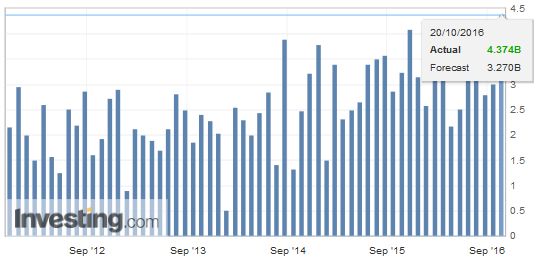

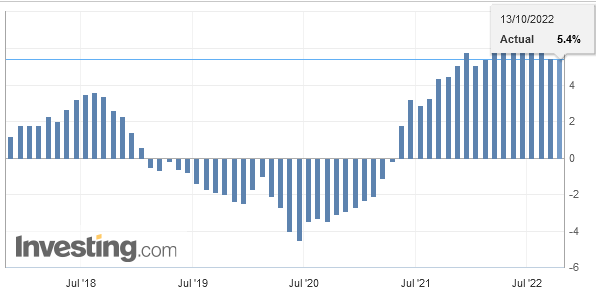

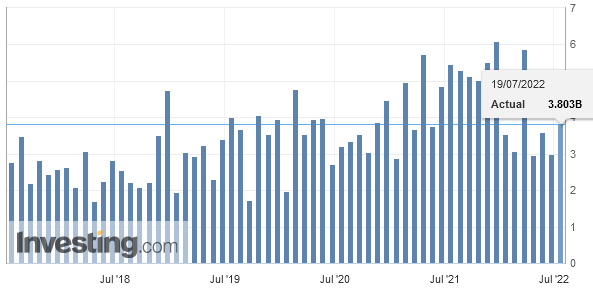

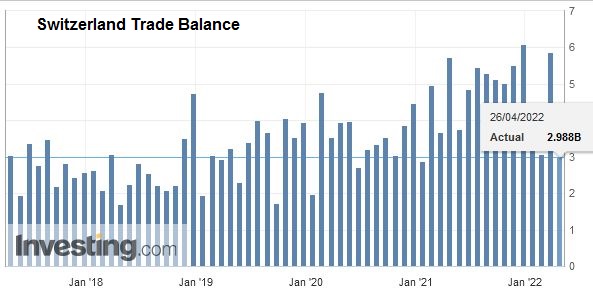

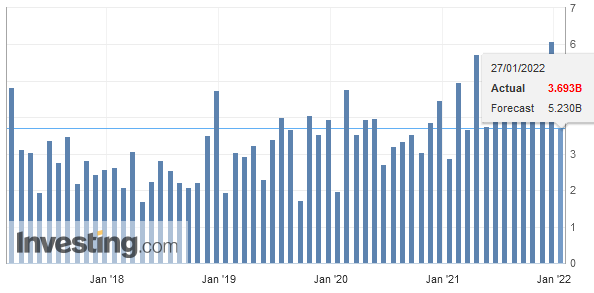

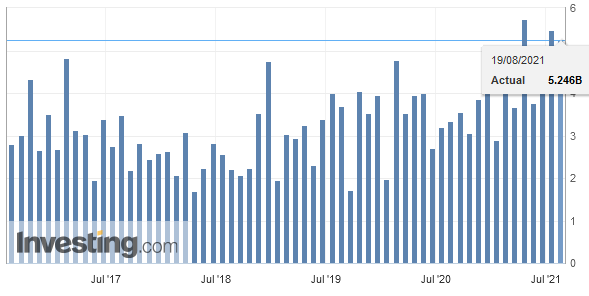

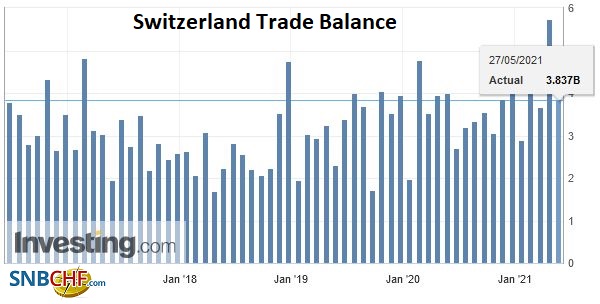

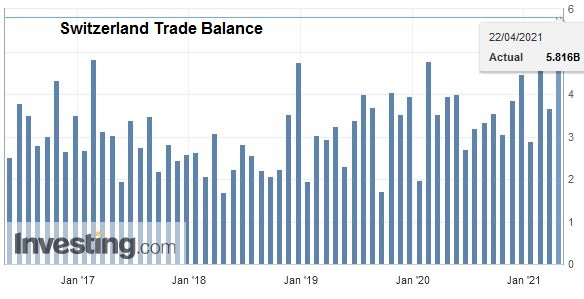

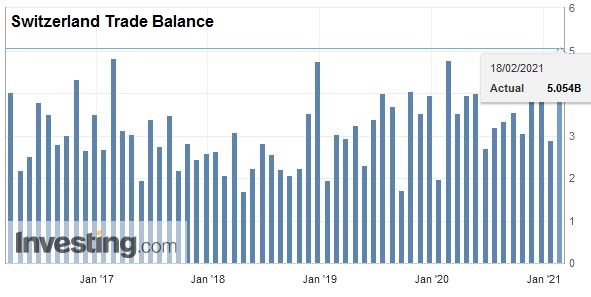

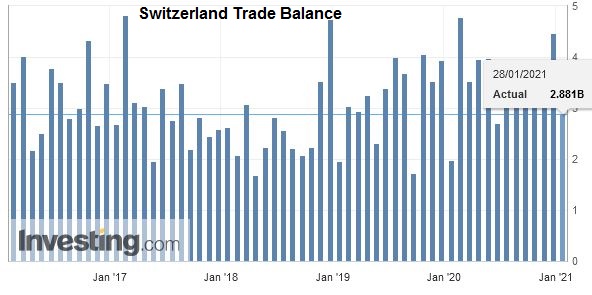

Switzerland Trade Balance(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge |

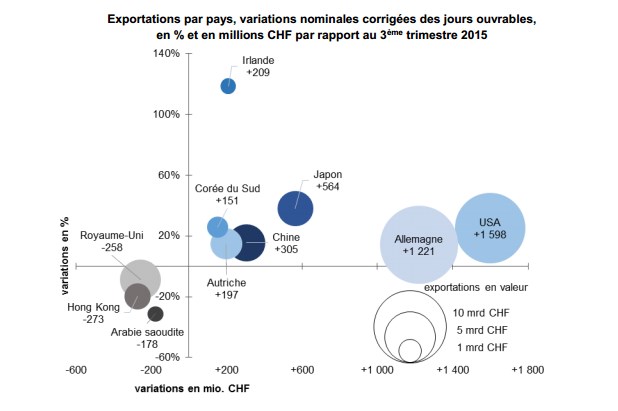

Country FindingsExports to North America (+24%) lead the way. Despite a decline in exports to the UK (CHF -258 million), exports to the EU climbed by 7%, doubling for Ireland. Goods sold to Asia rose by 6%, while exports to Russia were down by CHF 111 million. |

Swiss Exports per Country (Q3/2016 compared to Q3/2015)(see more posts on Switzerland Exports, Switzerland Exports by Country, ) Swiss Exports per Country (Q3/2016 compared to Q3/2015) Source: Swiss Customs - Click to enlarge |

Are you the author? Previous post See more for Next post

Tags: newslettersent,Switzerland Exports,Switzerland Exports by Country,Switzerland Imports,Switzerland Trade Balance

1 comment

Stefan Wiesendanger

2016-10-23 at 15:52 (UTC 2) Link to this comment

I preferred your earlier approach of comparing currencies based on a suitably modified REER. Usually, the REER is calculated based on the relative inflation in each currency as measured by the CPI. You argued convincingly for using an inflation index closer to tradable goods such as the PPI (closer to producer competitiveness) or the import price index (closer to tradable goods). At least close to equilibrium, theoretic as it may be, tradable goods ought to provide an effective channel for exchange rate adaptation.

Using the trade balance for comparing exchange rates as shown here is IMHO inferior. It does not take into account services that in a sense are a substitute for trade in goods (e.g. banks used to hire all engineers; currently, pharmaceutical companies are hiring them). Also, exports and imports are becoming figures that are increasingly hard to interpret because of transfer pricing (with changes currently underway due to changing international tax policies), intra-company trading in globalized supply chains, merchanting and the not so easy separation of trade in valuables (e.g. gold included in some statistics and not in others). In the somewhat unique case of Switzerland, all these items are non-negligible when compared to GDP. Finally given the previously mentioned uncertainties, adding a cursory correction for savings will not set the result right.