Tag Archive: newslettersent

Are Foreign Investors Done Selling Japanese Equities?

Foreign investors have sold more than JPY8 trillion of Japanese equities through September. Nikkei technicals have improved and the yen has softened. Foreign investors have been net buyers for the past four weeks.

Read More »

Read More »

Emerging Market: Week Ahead Preview

EM ended the week on a soft note, as markets were taken off guard by news that the FBI was reopening its investigation of Hillary Clinton’s emails. Risk off trading hit MXN particularly hard. FOMC meeting this week should be a non-event, but markets are likely to remain volatile ahead of the November 8 elections in the US.

Read More »

Read More »

FX Weekly Preview: Six Thumbnail Sketches of This Week’s Dollar Drivers

Four central banks meet, but expectations for fresh action are low. The US latest election news does not appear to be altering the projected electoral college outcome. UK press are speculating about Carney possibly resigning. We are skeptical.

Read More »

Read More »

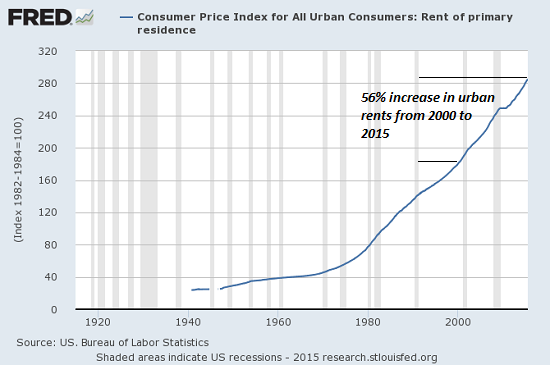

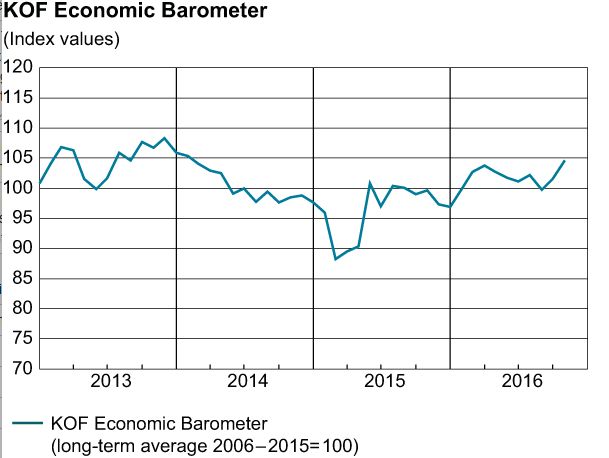

Swiss rents drop, substantially in the Lake Geneva region

Rents have dropped across Switzerland, declining substantially in the Lake Geneva region, according the the property consulting firm Wüest Partner. According to the firm, Swiss rents in the second quarter of 2016 were 1.6% lower than the same quarter in 2015. Geneva saw rents drop by 8.3% over the same period, while the region around Lake Geneva, known as the arc lémanique, saw a fall of 7.2%.

Read More »

Read More »

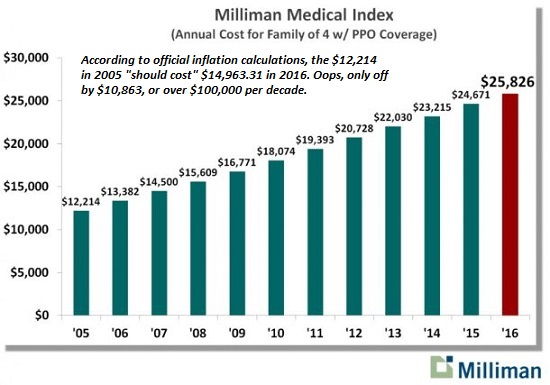

The Bankrupt U.S. Healthcare System

The mainstream became mainstream because it worked: the mainstream advice to "go to college and you'll get a good job" worked, the mainstream financial plan of buying a house to build equity to pass on to your children worked, the mainstream of government regulation worked to the public's advantage at modest cost to taxpayers and the mainstream media, despite being cozy with government agencies such as the C.I.A. and operating as a profit machine...

Read More »

Read More »

Emerging Markets: What has Changed

Chinese President Xi has strengthened his grip on power. Mozambique said it is in “debt distress” and hired advisors for a debt restructuring. South Africa revised its macro forecasts in the Finance Ministry’s Medium-Term Budget Program.Chile’s ruling center-left coalition lost municipal elections.In the EM equity space as measured by MSCI, Poland (+3.2%), Chile (+3.1%), and Hungary (+0.9%) have outperformed this week, while the Philippines...

Read More »

Read More »

The Point of War Is Not to Win

In time, everything goes away. We are confident, for example, that it won’t be too long before the market cracks (please don’t hold us to this forecast, but don’t forget if it turns out to be correct!). U.S. corporate profits are falling. GDP is sinking. Productivity has slumped for the longest period since the 1970s.

Read More »

Read More »

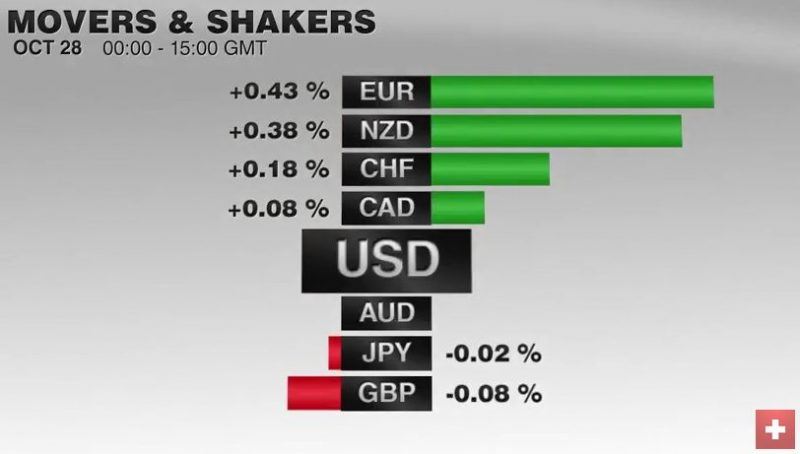

FX Weekly Review, October 24-28: October Surprise Pushes Open Door

The Swiss Franc Index could recover some of the losses as compared to the US dollar index. Still the USD/CHF remains above 0.99. The US dollar rose against most of the major currencies last week, but the upside momentum appeared to be dissipating, even before the FBI's announcement about new Clinton emails. There are a few exceptions like the greenback's performance against the Japanese yen, Canadian dollar, and Swedish krona. The dollar made new...

Read More »

Read More »

UBS reports drop in wealth profit as Ermotti lowers costs

UBS Group AG Chief Executive Officer Sergio Ermotti pledged to continue cost cuts after profit at the wealth-management business fell and the securities unit was hurt by a slump in equities trading. Pretax profit rose 11 percent to 877 million Swiss francs ($883 million) from 788 million francs a year earlier on lower expenses, the Zurich-based bank said in a statement Friday.

Read More »

Read More »

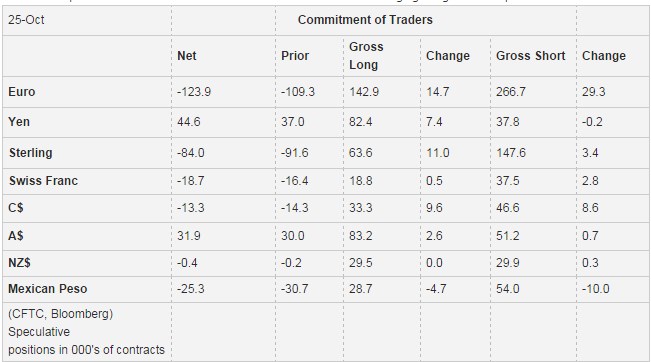

Weekly Speculative Positions: Bottom-Picking Sterling, Swiss Franc Even More Net Short

Speculators increased their Short Swiss Francs to Net 18K contracts. While they started to bottom-pick Sterling.

Not everyone is convinced that sterling will bounce. The bears extended their gross short sterling position by 3.4k contracts to 147.6k. On the eve of the UK referendum, the gross short position was around 94k contracts.

Again speculators, both bulls and bears have rapidly expanded their exposure in recent weeks. In the most...

Read More »

Read More »

Riksbank and Norges Bank Policy Meetings

Six major central banks meeting over the next six sessions. Sweden's Riksbank is the most likely ease policy of these central banks, but it is not particularly likely. Norway is decisively on hold, as fiscal policy does some of the heavy lifting.

Read More »

Read More »

Canada Renews Inflation Target, but Tweaks Core Measures

Canada maintains inflation target of the middle of a 1-3% band. Adopts a trimmed and median core measure like Australia. Market seems to be under-estimating the risk of a BoC rate cut next year.

Read More »

Read More »

Could Inflation Break the Back of the Status Quo?

Political resistance to the oligarchy's financialization skimming operations will eventually cripple central bank giveaways to the financial sector and corporate oligarchs. That inflation and interest rates will remain near-zero for a generation is accepted as "obvious" by virtually the entire mainstream media.

Read More »

Read More »

FX Daily, October 28: Dollar Sidelined, Krona Stabilizes, Rates Firm

The main development here in the last full week of October is the sharp rise in bond yields. US 10-year yields rose nine bp this week coming into today's session, which features the first look at Q3 GDP. The two-year yield is up four bp. European 10-year benchmark yields mostly rose 11-17 bp. UK Gilts were are the upper end of that range. Two-year yields are 3-5 bp higher.

Read More »

Read More »

Brexit brings specter of common EU tax plan, and bodes poorly for Switzerland’s immigration negotiation

Ireland is facing another tax battle with the European Union and this time it will have to fight its own corner. Less than two months after the European Union ordered Ireland to claw back a record 13 billion euros ($14.2 billion) from Apple Inc., saying the nation illegally allowed the iPhone maker to reduce its tax rate, the European Commission will propose legislation for a Common Consolidated Corporate Tax Base on Tuesday.

Read More »

Read More »

Pharma giants drag SMI stocks down

A weak performance from Swiss pharma giants pulled the Swiss Market Index down again this week after investors dropped stocks in the sector on lackluster earnings reports. The peripheral European stocks and Japan managed to buck the trend this week, global stock markets remain under pressure in the run up to US election.

Read More »

Read More »

Yellen and Fischer Still Singing from the Same Song Book

Many see Yellen and Fischer at odds over benefits of high pressure economy. However, this fails to put the comments in the proper context--same message different styles. They are arguing against the doves who don't want to hike this year.

Read More »

Read More »

Ending a Taking Economy and Creating a Giving Economy Part 2

There no longer seems to be a rational alignment between economic cost and value. This means questioning so-called conventional wisdom and critically considering whether or not to own property or even to go to college.

Read More »

Read More »

Jim Grant Puzzled by the actions of the SNB

James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold.

Read More »

Read More »