Tag Archive: newslettersent

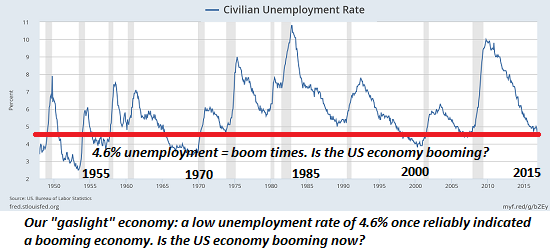

Our “Gaslight” Economy

If you don't like what these charts are saying, please notify The Washington Post to add the St. Louis Federal Reserve to its list of Russian propaganda sites. Yesterday I described our gaslight financial system. Today we'll look at our gaslight economy. Correspondent Jason H. alerted me to the work of author Thomas Sheridan ( Puzzling People: The Labyrinth of the Psychopath), who claims to have coined the term gaslighting.

Read More »

Read More »

Greek Bonds may Soon be Included in ECB Purchases

The ECB accepts Greek bonds as collateral but does not include them in its asset purchases. A new staff-level agreement by the end of the year could change that. Finance ministers imply that Greece's debt is sustainable, but the IMF disagrees.

Read More »

Read More »

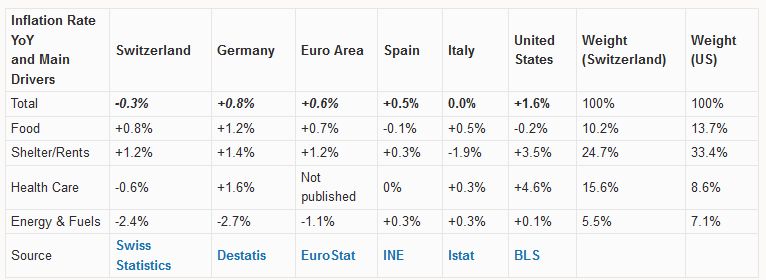

Switzerland Consumer Price Index in November 2016: -0.3 percent against 2015, -0.2 percent against last month

Swiss consumer price inflation remain the lowest in comparison with different countries in the euro zone and the United States. Consumer prices in the U.S. are driven by rising health care costs and asset price inflation in shelter. In Europe, we see the opposite phenomenon: Rents in Italy or Spain are steady or falling. In Germany and Switzerland rent control prevents that asset price inflation moves into consumer prices. In Switzerland, more and...

Read More »

Read More »

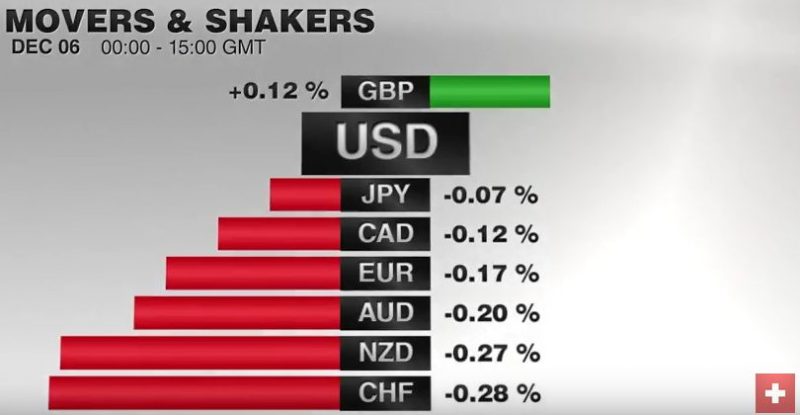

FX Daily, December 06: You Can Almost Hear a Pin Drop

The foreign exchange market is quiet. Ranges are narrow, with the US dollar mostly consolidating against the major currencies. Given the push lower yesterday, the shallowness of its recovery warns of the greenback's downside correction after strong gains last month may not be complete.

Read More »

Read More »

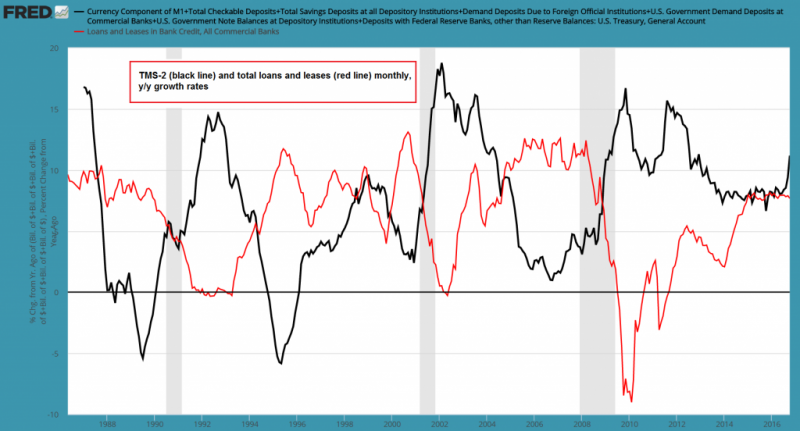

US True Money Supply Growth Jumps, Part 1: A Shift in Liabilities

The growth rates of various “Austrian” measures of the US money supply (such as TMS-2 and money AMS) have accelerated significantly in recent months. That is quite surprising, as the Fed hasn’t been engaged in QE for quite some time and year-on-year growth in commercial bank credit has actually slowed down rather than accelerating of late. The only exception to this is mortgage lending growth – at least until recently. Growth in mortgage loans is...

Read More »

Read More »

Yen and US Yields

Dollar-yen has been driven by the sharp rise in US bond yields. There are some (dollar) bearish divergences in the JPY/USD technicals. US 10-year yields may also be putting in a near-term top.

Read More »

Read More »

Great Graphic: Dollar Index Update

The Dollar Index's technical tone has deteriorated. It is corresponding to the easing of US rates and a narrowing differential. The risk is that the correction can continue in the coming days.

Read More »

Read More »

FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets' attention. Austria turned back the populist right Freedom Party's bid for the presidency. The Freedom Party does not appear to have carried...

Read More »

Read More »

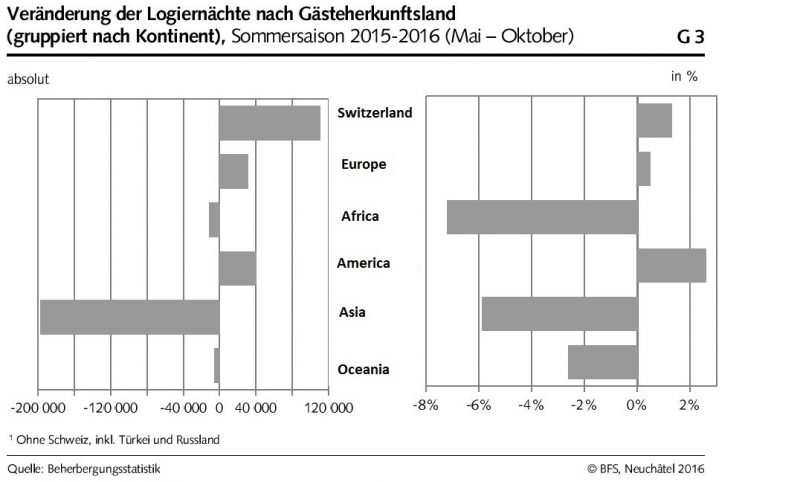

Swiss Tourism this Summer: More Swiss Guests, Less Asian Guests

In the summer months, the Swiss hotels registered more guests from Switzerland. from the United States and from Europe. But there was a sharp decline of guest from Asia.

100'000 more overnight stays from Switzerland could not recover the decrease of 200'000. One important reason for decline is the weakening Chinese currency, that reduced their purchasing power, in dollar but also in CHF.

Read More »

Read More »

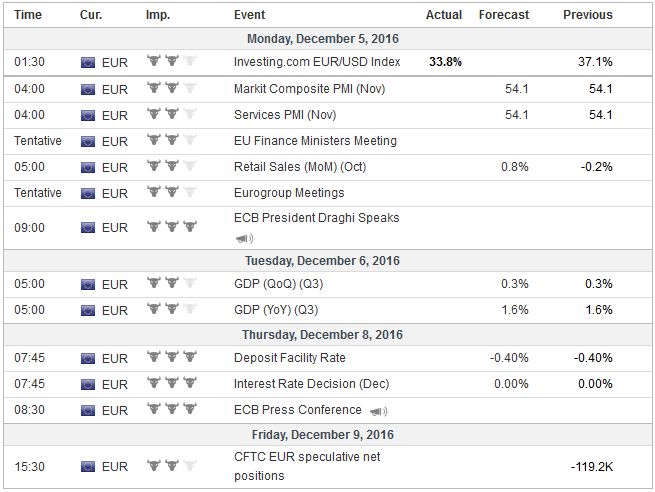

FX Weekly Preview: Focus Shifts toward Europe

US developments have driven the dollar rally and bond market decline over the past three weeks. Attention shifts to European politics and the ECB meeting. Bank of Canada and the Reserve Bank of Australia meet but are unlikely to change policy.

Read More »

Read More »

Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

Italy has three options: 1. exit the euro zone and devalue the currency; 2. remain in the euro zone and devalue salaries. 3. go for Japan-like decades-long slow growth with stagnating wages, but also with falling inflation and (positive news!) falling bond yields.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM remains a mixed bag. Despite the negative connotations of a rising US rate environment, EM gathered an element of stability last week as the dollar consolidated its recent gains. Rising commodity prices are also helping EM at the margin, with RUB and COP amongst the best last week on higher oil and CLP on higher copper.

Read More »

Read More »

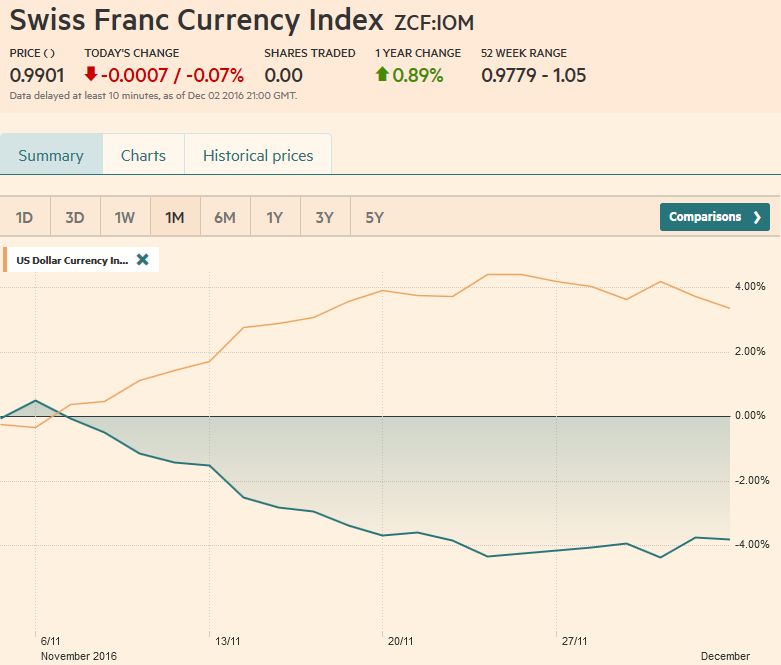

FX Weekly Review, November 28 – December 02: CHF Index still at its 4% loss since U.S. Elections

The Swiss Franc index continued around its 4% loss since the U.S. elections, while the US Dollar index had a 4% increase. The focus shifts to the ECB meeting, where participants are wary of a "hawkish ease".

Read More »

Read More »

Net National Savings Rate, the Best Alternative Indicator to GDP Growth

For us the Net National Savings Rate is the best alternative indictator to GDP growth. It is positively correlated with the change in wealth, with the establishment of future productive capacity, the price of government bonds and currency valuations. But today GDP growth is often negatively correlated to the Net Savings Rate. Hence GDP is often a less useful measure.

Read More »

Read More »

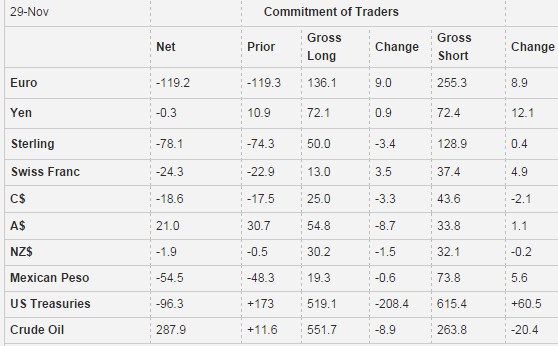

Weekly Speculative Positions: Short CHF Are Increasing

The net short CHF speculative position is close to reaching new records. Shortly before the end of the peg, speculators were net short CHF by 26K contracts. Now we are at 24.3K.

Read More »

Read More »

The War On Cash Is Happening Faster Than We Could Have Imagined

It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos.

Read More »

Read More »

Sunrise beats Swisscom on mobile network coverage

After seven years on top, Swisscom has been beaten by Sunrise. The German telecommunications expert and magazine publisher, connect.de and its partner P3, travelled roughly 7,000 km by car around Switzerland testing Swiss mobile networks. Tests were also made while walking and on trains. The results were published on Tuesday.

Read More »

Read More »

Gold Price Skyrockets in India after Currency Ban – Part IV

The Indian Prime Minister announced on 8th November 2016 that Rs 500 and Rs 1,000 banknotes would no longer be legal tender. Linked are Part-I, Part-II and Part-III updates on the rapidly encroaching police state. The economic and social mess that Modi has created is unprecedented. It will go down in history as an epitome of naivety and arrogance due to Modi’s self-centered desire to increase tax-collection at any cost.

Read More »

Read More »