Tag Archive: newslettersent

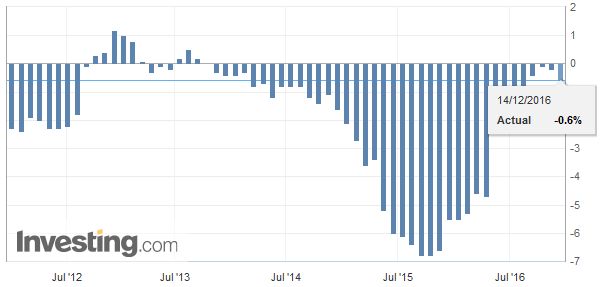

Swiss Producer and Import Price Index, November 2016: +0.1 percent MoM, -0.6 percent YoY

The Producer and Import Price Index rose in November 2016 by 0.1% compared with the previous month, reaching 99.9 points (base December 2015 = 100). The slight rise is due in particular to higher prices for scrap and petroleum products. Compared with November 2015, the price level of the whole range of domestic and imported products fell by 0.6%. These are the findings from the Federal Statistical Office (FSO).

Read More »

Read More »

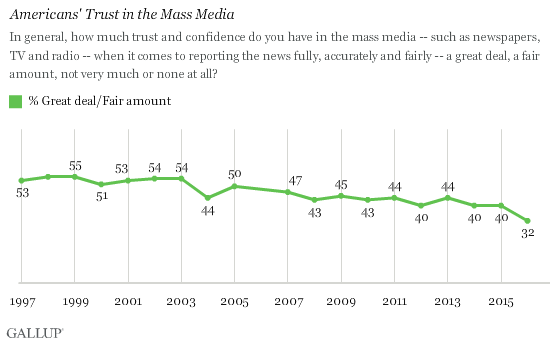

“Fake News”, Censorship, Darwin and Democracy

Perhaps we can start by separating "news" from "analysis" from "commentary." "News" is "he said this, she did that, this happened." Analysis tries to make sense of trends that are apparent in the news longer-term--for example, why did Trump win? Is the economy actually healthy or not? "Commentary" is opinion that establishes a point of view and defends it while attacking other POVs.

Read More »

Read More »

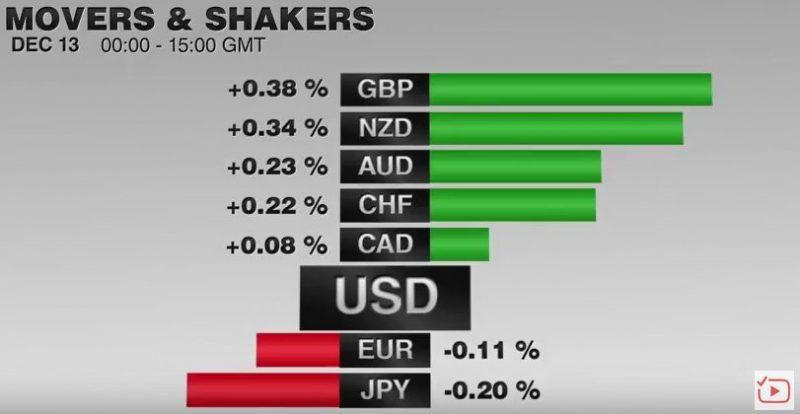

FX Daily, December 13: Narrowly Mixed Dollar Conceals Resilience

The US dollar is little changed against most of the major currencies. The dollar finished yesterday's North American session on a soft note, but follow through selling has been limited. After rallying to near 10-month high above JPY116 yesterday, the greenback finished on session lows near JPY115.00. Initial potential seemed to extend toward JPY114.30, but dollar buyers reemerged near JPY114.75, and it rose back the middle of the two-day range...

Read More »

Read More »

Busy Week for the UK

The UK reports inflation, employment and retail sales this week. The BOE meets but will keep rates steady. The US 2-year premium over the UK is the highest since at least 1992 today.

Read More »

Read More »

Migros Bank could pass on negative interest rates

Because of negative interest, even a savings account earning 0% interest is earning too much reckons the bank’s boss. Soon many banks will be passing on some of the cost of negative interest to their clients, reports 20 Minutes. Migros Bank will need to seriously consider doing the same in 2017.

Read More »

Read More »

The Climate Changes Back – What Comes Next?

Last year’s El Nino phenomenon temporarily provided succor to climate alarmists, who were increasingly bothered by the “Great Pause” – the fact that the tiny amount of warming experienced since the last cooling cycle ended in the late 1970s had apparently stopped. Despite trace amounts of CO2 in the atmosphere continuing to climb, mother nature decided to disobey alarmist models and temperatures went sideways for about 20 years (or even longer,...

Read More »

Read More »

Who Has To Work The Longest To Afford An iPhone?

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone 6 in under three working days.

Read More »

Read More »

FX Daily, December 12: Dollar and Yen Trade Lower to Start the Week

The US dollar and Japanese yen are trading lower. The tone is largely consolidative, and the foreign exchange market is not main focus today. Instead, the OPEC-non-OPEC agreement before the weekend is arguably the key driver today. Oil prices are up 4.5%-4.8%, lifting bond yields and supporting oil producers' currencies, like the Norwegian krone, Canadian dollar, the Russian ruble and Mexican peso.

Read More »

Read More »

Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday's agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its highest close since September...

Read More »

Read More »

Smart Programs of Capital Destruction

These days everything must be smart. There are smart cities, smart grids, smart policies, smart TVs, smart cars, smart phones, smart watches, smart shoes, and smart glasses. There’s even something called smart underwear. Before long everything around us will be so smart we’ll no longer have to do one critically important thing. We’ll no longer have to think; smart algorithms will think for us. What’s more, the possibilities for not thinking are...

Read More »

Read More »

From Captive Audience to Open Democracy: Why the Mainstream Media Is Freaking Out

In its panicky rush to demonize the independent media via baseless accusations of "fake news," the mainstream press has sunk to spewing "fake news" of its own. Here's The Washington Post's criminally false "fake news" article in case you missed it: Russian propaganda effort helped spread ‘fake news’ during election, experts say.

Read More »

Read More »

Weekly Sight Deposits: No SNB Interventions, Short CHF nearing records

Who has read Milton Friedman knows that the Trump reflation trade is now showing its positive side. US wages are rising by 2.5%, while inflation is still relatively low. According to Friedman, inflation will increase only later.

Read More »

Read More »

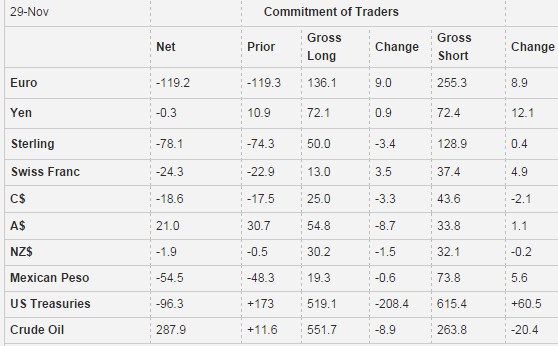

Weekly Speculative Positions: Short CHF Close to Records of 2015

The net short CHF speculative position is close to reaching new records. Shortly before the end of the peg, speculators were net short CHF by 26.4K contracts. Now we are at 25.4K.

Read More »

Read More »

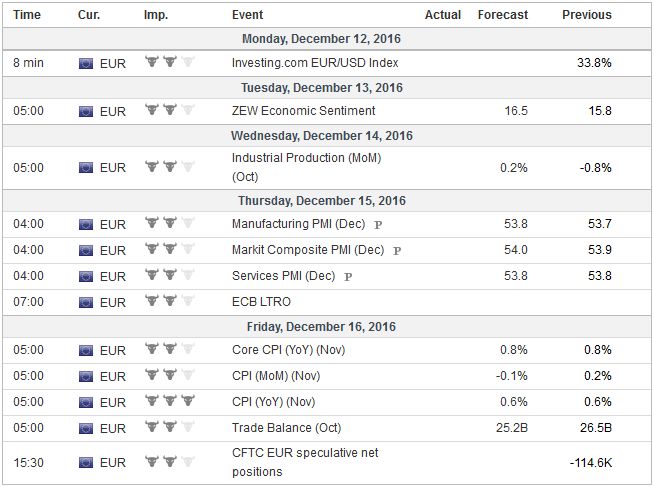

FX Weekly Preview: What the FOMC Says may be More Important than What it Does

FOMC meeting is the last highlight of the year. OPEC and non-OPEC producers strike a deal: optics good and that can lift prices further in near term. Italy will have a new Prime Minister, the fourth unelected PM.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

After the ECB meeting, we saw curve steepening in the eurozone. This is on top of curve steepening in the US since the elections. While we are nowhere near the magnitude of the 2013 Taper Tantrum, these yield curve dynamics remain negative for EM bonds and EM FX. EM equities are a different matter, supported in part by the continued post-election rally in DM equity markets. Higher commodity should also help insulate some EM countries from the...

Read More »

Read More »

Credit Suisse planning more Swiss job cuts

Credit Suisse Group AG is preparing a new cost-savings program that puts as many as 1,300 jobs in Switzerland on the line, according to Schweiz am Sonntag. The plan will be announced Wednesday, when the lender holds its investor day in London, the newspaper said, without saying where it got the information. Credit Suisse’s Swiss unit may slash an additional 1,000 to 1,300 positions, or about eight to 10 percent of the unit’s workforce, it said.

Read More »

Read More »

FX Weekly Review, December 05 – December 09: Dollar Bulls Running Out of Time to See Parity vs Euro in 2016

Swiss Franc Currency Index The Swiss Franc index remained in a losing position compared to the dollar index. However since November 25, it has remained stable. Given that the ECB extended the QE period, the EUR/CHF has fallen to 1.0730 again. USD/CHF The US dollar is finishing the year on a firm note. It rose … Continue reading »

Read More »

Read More »

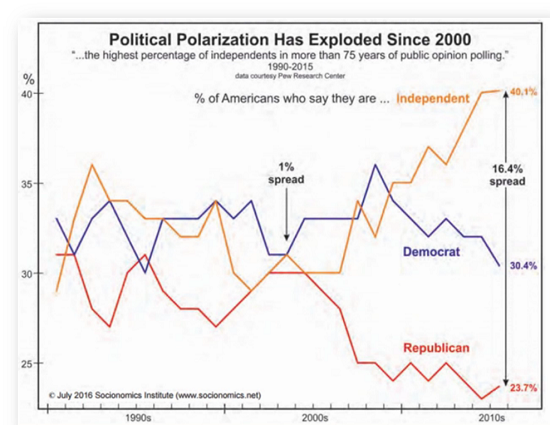

A Disintegrative Winter: The Debt and Anti-Status Quo Super-Cycle Has Turned

With this list of manifestations in hand, we can practically write the headlines for 2017-2025 in advance. How would you describe the social mood of the nation and world? Would anti-Establishment, anti-status quo, and anti-globalization be a good start? How about choking on fast-rising debt? Would stagnant growth, stagnant wages be a fair description? Or how about rising wealth/income inequality? Wouldn't rising disunity and political polarization...

Read More »

Read More »

Which Of These Would You Rather Have In Your Safe?

Let’s say you have two equal size safety deposit boxes. One box you completely fill up with stacks of $100 bills. The other box you fill up with gold. Which of the two is “worth” more? It’s easy to calculate. A stack of 100x $100 bills is 6.14 inches long, 2.61 inches wide, and 0.43 inches tall. That’s a volume of 6.89 cubic inches (112.92 cubic centimeters… and we’ll use the metric system from here on out because it really does make more...

Read More »

Read More »

200 Russian Propaganda Sites, or simply alternative media?

The following is the list of "Russian Propaganda sites", as published by PropOrNot. Several articles by the Washington Post refer to this list. Many sites on that list are based on libertarian ideas and Austrian economics. Those are in favor of a free market economy, they reject central banks and the establishment. The rejection of the U.S. establishment is possibly the only point that are in common with Putin.

Read More »

Read More »