Tag Archive: newslettersent

Nestlé plans to move 580 jobs out of Switzerland

Last week, Nestlé announced plans to cut its Swiss workforce by 580. The plans involve restructuring its IT department, with a focus on extending its technology hub in Spain. Over the next 18 months, this re-organization could lead to a reduction of up to 500 IT positions in Switzerland, said the company. A source close to Nestlé told Le News that around two thirds of the cuts will occur in Vevey and the remaining third in Lausanne and at the...

Read More »

Read More »

Dollar and Yen Rise Amid Heightened Anxiety

With what promises to be an acrimonious G7 meeting, from which the isolated US President will depart early, and a broadening pressure in emerging markets, the US dollar turned better bid late yesterday and is recovering further today.

Read More »

Read More »

Swiss Government Pension Fund To Buy Gold Bars Worth Some $700 Million

Swiss Government Pension Fund Allocating 2% Of Pension Fund To Gold Bars. The Swiss government pension fund, Switzerland’s AHV/AVS fund, has decided to diversify into physical gold bars in their substantial CHF35.2bn (€30.5bn) pension portfolio. At the end of last week the first pillar buffer fund tendered a custodianship and storage for CHF 700m (EUR 600m / USD 700m / GBP 525m) in gold bars via IPE Quest.

Read More »

Read More »

‘Much too early’ to lift interest rates, says SNB chairman

The continued volatility surrounding the Italian elections and the threat of global trade wars make it far too early for the Swiss National Bank (SNB) to consider raising rock bottom interest rates, says chairman Thomas Jordan.

Read More »

Read More »

Swiss Prosecutors will not Pursue Novartis over Trump Lawyer Payments

The Office of the Attorney General of Switzerland (OAG) announced on Wednesday that it will not bring proceedings against Novartis in connection with the payments the Swiss pharmaceutical company made to Donald Trump’s personal lawyer.

Read More »

Read More »

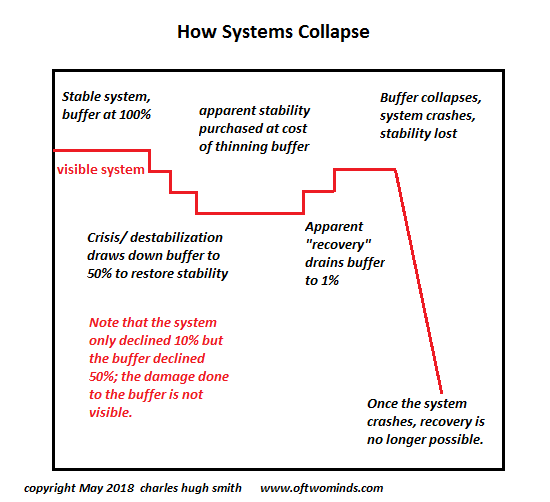

The Three Crises That Will Synchronize a Global Meltdown by 2025

We're going to get a synchronized global dynamic, but it won't be "growth" and stability, it will be DeGrowth and instability. To understand the synchronized global meltdown that is on tap for the 2021-2025 period, we must first stipulate the relationship of "money" to energy:"money" is nothing more than a claim on future energy. If there's no energy available to fuel the global economy, "money" will have little value.

Read More »

Read More »

Europe’s Woes Multiply

The Markit group that provides many of the PMI surveys noted with today's reports that the eurozone outlook has "darkened dramatically." This makes for a poor backdrop for the ECB, which meets next week. However, with price pressures recovering from the Easter-related distortions, the ECB is still on track to finish its asset purchases at the end of the year. This seems largely taken for granted.

Read More »

Read More »

Parliament snubs Swiss expat calls for better banking ties

The Swiss Abroad community has suffered a new setback in its efforts to receive improved access to banking services in Switzerland. The House of Representatives on Tuesday threw out a call on the government to ease the financial woes of expatriates by publishing relevant information on the websites of the foreign ministry and Switzerland’s diplomatic representations abroad for the Swiss overseas communities.

Read More »

Read More »

Greenback Corrects Lower

The consensus narrative is that with rising inflation it is understandable that next week's meeting is live and that the confirmation of such has lifted the euro to ten-day highs, dragging the dollar broadly. However, to accept this is to accept the debasement of language. Until now, we dubbed central bank meeting that could result in action as "live." For example, given that the Fed has not changed interest rates since the hiking cycle began in...

Read More »

Read More »

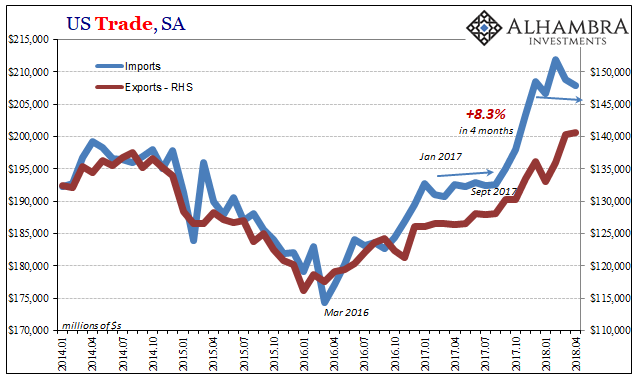

US Trade Settles Down Again

US trade is further leveling off after several months of artificial intrusions. On the import side, in particular, first was a very large and obvious boost following last year’s big hurricanes along the Gulf Coast. Starting in September 2017, for four months the value of imported goods jumped by an enormous 8.3% (revised, seasonally-adjusted). Most of the bump related to consumer and capital goods.

Read More »

Read More »

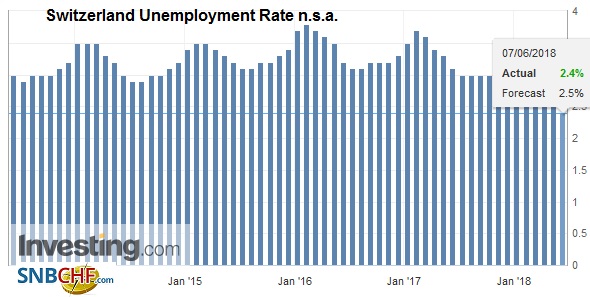

Switzerland Unemployment in May 2018: Down to 2.4percent from 2.5percent, seasonally adjusted unchanged at 2.6percent

Registered Unemployment in May 2018 - According to the State Secretariat for Economic Affairs (SECO) surveys, at the end of May 2018, 109'392 unemployed people were enrolled in the Regional Employment Centers (RAV), 10'389 fewer than in the previous month.

Read More »

Read More »

PostFinance Еxpected to Axe 500 Jobs

Post Finance external link, one of Switzerland’s leading financial institutions, expects to cut up to 500 full-time jobs by the end of 2020. The banking division of the Post Office has launched multiple measures to counter the erosion of profit margins and the resulting decline in revenues.

Read More »

Read More »

More Color on Japanese Capital Flows and the Euro

The euro put in a low on May 29 a little above $1.15. That is nearly a 10.5 cent decline since the three-year high was set in mid-February. The thing that is difficult for investors and analysts to get their head around is that the speculators in the futures market, who as seen as proxies for trend-followers and momentum traders, continue to carry large euro exposure.

Read More »

Read More »

Does Anyone Else See a Giant Bear Flag in the S&P 500?

We all know the game is rigged, but strange things occasionally upset the "easy money bet." "Reality" is in the eye of the beholder, especially when it comes to technical analysis and economic tea leaves.

Read More »

Read More »

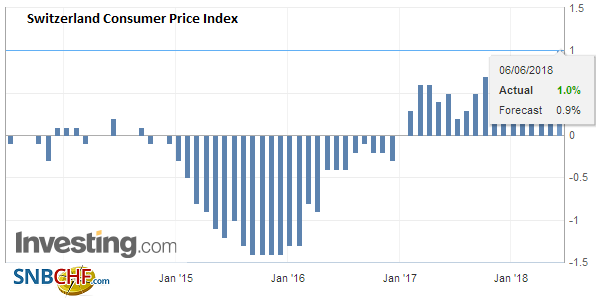

Swiss Consumer Price Index in May 2018: +1.0 percent YoY, +0.4 percent MoM

The consumer price index CPI) increased by 0.4% in May 2018 compared with the previous month, reaching 102.1 points (December 2015=100). Inflation was 1.0% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

No relief for Swiss renters

Every three months the rate of interest used to set Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time it remained at 1.50%. The last time it dropped was 1 June 2017 when it fell to its lowest level since 2008.

Read More »

Read More »

Weekly Technical Analysis: 04/06/2018 – USD/CHF, EUR/JPY, GBP/USD, AUD/USD, WTI

The USDCHF pair managed to break 0.9850 level and closed the daily candlestick below it, which supports the continuation of our bearish overview efficiently in the upcoming period, paving the way to head towards 0.9723 level as a next station, noting that the EMA50 supports the expected decline, which will remain valid for today conditioned by the price stability below 0.9870.

Read More »

Read More »

Bi-Weekly Economic Review: As Good As It Gets?

In the last update I wondered if growth expectations – and growth – were breaking out to the upside. 10 year Treasury yields were well over the 3% threshold that seemed so ominous and TIPS yields were nearing 1%, a level not seen since early 2011. It looked like we might finally move to a new higher level of growth. Or maybe not.

Read More »

Read More »

Espagne, victime des crises, de grands travaux inutiles, et de la… corruption. Nicolas Klein

Dans le contexte morose initié en 2008, l’Espagne était considérée (et l’est encore par beaucoup) comme un « pays à risque » au regard de la rapide dégringolade qu’elle a connue à la suite de la crise des subprimes aux États-Unis d’Amérique. Entre 2007 et 2011, le produit intérieur brut espagnol a reculé de 5 % tandis que le nombre de demandeurs d’emploi passe de 1,7 million à 4,2 millions.

Read More »

Read More »