Tag Archive: newslettersent

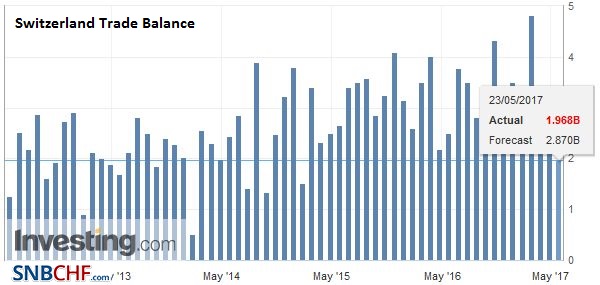

Swiss Trade Balance April 2017: Exports Stagnate

In April 2017, adjusted exports of working days shrank as imports strengthened by 2.3%. Changes in sales were marked by the reluctance of the chemical and pharmaceutical sector. The trade balance has closed with the smallest surplus in the last two years.

Read More »

Read More »

Swiss agriculture under fire at WTO

The European Union and the United States have criticised Switzerland for the over-protection of its agricultural sector. Responding to the questions raised at the Geneva-based World Trade Organization (WTO), Switzerland said it would make an effort to ease protections, on condition that other member states do likewise.

Read More »

Read More »

Swiss authorities concerned about health impact of certain chemicals

A pilot bio-monitoring project in Switzerland will measure traces of pollutants and micronutrient and endocrine disruptors in organic samples. According to 20 Minutes, the impact of certain chemical products worries the authorities. The pilot project was launched last week by the executive branch of Switzerland’s government, known as the Federal Council.

Read More »

Read More »

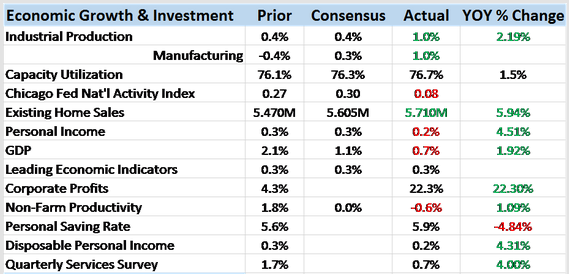

Bi-Weekly Economic Review

The economic data releases since the last update were generally upbeat but markets are forward looking and the future apparently isn’t to their liking. Of course, it is hard to tell sometimes whether bonds, the dollar and stocks are responding to the real economy or the one people hope Donald Trump can deliver when he isn’t busy contradicting his communications staff.

Read More »

Read More »

FX Daily, May 22: Dollar Pushes Back

After being shellacked last week, the US dollar is trading with a firmer bias against all the major currencies, but the euro and New Zealand dollar. To be sure, it is not that a new development has emerged to take investors' minds from intensifying political uncertainty in the US.

Read More »

Read More »

Swiss Press Reacts Positively to Energy Legislation

A majority of commentators in Swiss newspapers are pleased with voters’ decision to withdraw from nuclear power and promote renewable energies, even if the government’s energy strategy leaves many open questions.

Read More »

Read More »

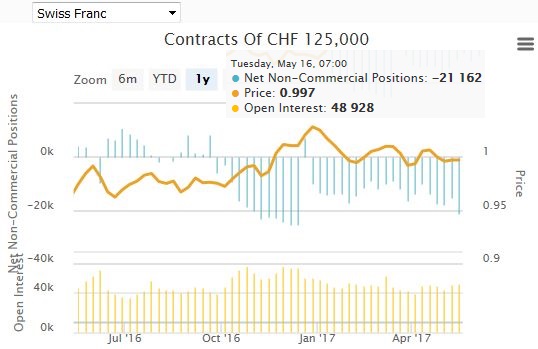

Weekly Speculative Positions (as of May 16): Yen and Aussie Bears Push Forward, while Sterling Bears Continue to Run for Cover

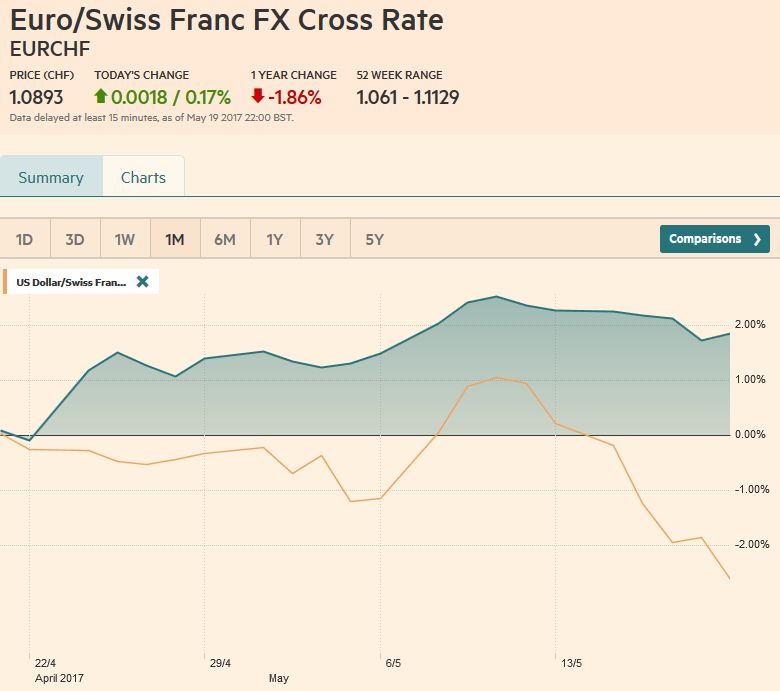

The net short CHF position has risen from 15.2 short to 21.1K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. In the Commitment of Traders reporting week ending May 16, speculators in the futures market made three significant adjustments in the currency futures.

Read More »

Read More »

FX Weekly Preview: Nothing Like A Good US Drama

US drama distracts from the difficult and ambitious economic program. European and Japanese developments have been constructive. Bank of Canada is the only G7 central bank that meets, and it is not expected to shift from its cautious stance.

Read More »

Read More »

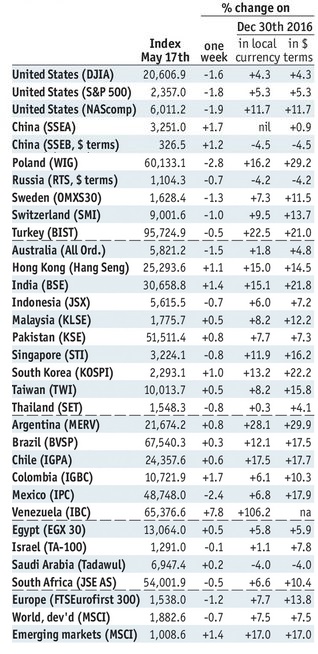

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a firm note, shrugging off political risk that consumed markets earlier in the week. With US rates remaining low, the dollar remains under pressure against the majors, and so EM FX is likely to benefit also. Yet we warn investors not to jump back into EM countries that are inherently riskier, such as Brazil, South Africa, and Turkey. We continue to favor Asia in the current environment.

Read More »

Read More »

Merkel Sends Euro Higher

Markel said the euro was too weak, so it rallied. This is not a new position for Germany. Merkel may now tack to the left since the AfD appears to have been dispatched. Look for Weidmann to begin moderating views or becoming less antagonistic.

Read More »

Read More »

FX Weekly Review, May 15-20: Swiss Franc recovering against EUR

The Swiss Franc recovered a lot of the losses that came with the French elections. That political event was mostly driven by speculators that will close their positions. We expected the EUR to trade around 1.07 to 1.0750 CHF in some time.

Read More »

Read More »

Strong Swiss franc could be over reckons currency strategist at UBS

Tribune de Genève. After more than two years of a highly overvalued franc, relative to the euro, the currency should ease in the near term reckons Thomas Flury, senior currency strategist at UBS. He expects a euro to be worth 1.14 francs in 6 months and 1.16 within a year.

Read More »

Read More »

Political Lobbying on the Rise in Switzerland

Links between parliamentarians in Bern and lobby groups have grown steadily in recent years, according to a study by the Universities of Lausanne and Geneva. Between 2007 and 2015, these sorts of ties between interest groups and politicians increased by 20%.

Read More »

Read More »

New Gold Pool at the BIS Basle, Switzerland: Part 1

“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.”

Read More »

Read More »

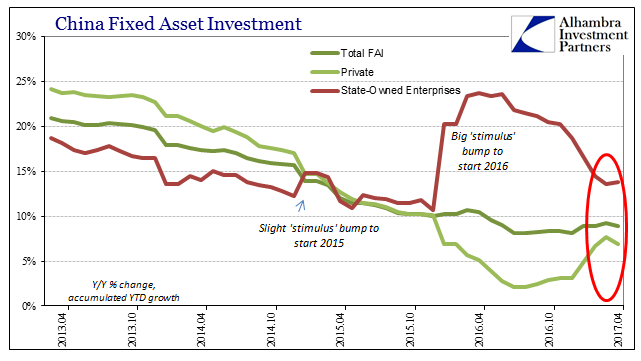

Trying To Reconcile Accounts; China

Chinese economic data for April 2017 has been uniformly disappointing. External trade numbers resembled too much commodity prices, leaving an emphasis on them rather than actual economic forces. The latest figures for the Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment, unfortunately also remained true to the pattern.

Read More »

Read More »

“Sell in May”: Good Advice – But Is There a Better Way?

If you “sell in May and go away”, you are definitely on the right side of the trend from a statistical perspective: While gains were achieved in the summer months in three of the eleven largest stock markets in the world, they amounted to less than one percent on average. In six countries stocks even exhibited losses!

Read More »

Read More »

Emerging Markets: What Has Changed

China’s government approved the creation of a bond link between Hong Kong and the mainland. S&P upgraded Indonesia one notch to investment grade BBB- with stable. Fitch revised the outlook on Vietnam’s BB- rating from stable to positive. Egypt will announce a package of social spending soon. Moody's changed the outlook on Poland's A2 rating from negative to stable.

Read More »

Read More »

6 Swiss regions in Europe’s 10 most prosperous

Six Swiss regions make the top ten most prosperous regions of Europe measured in terms of GDP per person, according to an analysis by the University of Lausanne. The six Swiss regions are Zurich (3rd), Ticino (4th), Basel (5th), the region around Zug (6th), Bern-Solothurn (7th) and Suisse romande, Switzerland French-speaking region (8th).

Read More »

Read More »