Tag Archive: newslettersent

Switzerland has most expensive food and drinks in Europe

Switzerland has been ranked the second-most expensive European country behind Iceland for consumer goods, which are 59% higher than the European Union average. Food and non-alcoholic drinks are particularly pricey.

Read More »

Read More »

Bi-Weekly Economic Review

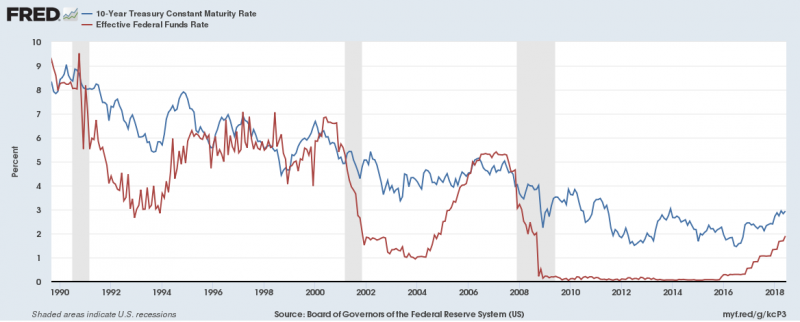

Is the rate hiking cycle almost done? Not the question on everyone’s minds right now so a good time to ask it, I think. A couple of items caught my attention recently that made me at least think about the possibility.

There has been for some time now a large short position held by speculators in the futures market for Treasuries.

Read More »

Read More »

SNB Monetary Assessment June 2018, Introduction

I will begin my remarks with an overview of the situation on the financial markets, before giving an update on the status of the reforms regarding reference interest rates. And in closing I would like to say a few words about our branch office in Singapore, which is celebrating its fifth anniversary. Situation on the financial markets Let me start with the developments on the financial markets.

Read More »

Read More »

Introductory remarks by Fritz Zurbrügg

In my remarks today, I will present the key findings from this year’s Financial Stability Report, published by the Swiss National Bank this morning. In the first part of my speech, I will talk about the big banks, before going on, in the second part, to outline our current assessment of the situation at domestically focused banks.

Read More »

Read More »

Thomas Jordan: Introductory remarks, news conference

It is a pleasure for me to welcome you to the Swiss National Bank’s news conference. I will begin by explaining our monetary policy decision and our assessment of the economic situation. I would also like to briefly touch on the rejection of the sovereign money initiative by the people and the cantons as well as a publication marking the tenth anniversary of the SNB’s educational programme, Iconomix.

Read More »

Read More »

FX Daily, June 21: Dollar Driven Higher

The half-hearted and shallow attempts by the currencies to recover appear to be emboldening the dollar bulls today, The greenback is higher against all major and emerging market currencies today. Demand for dollars is strong enough to offset the broader risk-off environment that is pulling stocks and core yields lower that is usually supportive of the yen.

Read More »

Read More »

Swiss Trade Balance May 2018: Foreign trade overcomes stagnation

After stagnating in previous months, exports rose in May 2018. Seasonally adjusted exports rose 0.9% in one month. Imports were more dynamic, at + 3.8%. Chemistry-pharma and the vehicle sector generated 90% of growth in both traffic directions. The trade balance closed with a surplus of 2.3 billion francs.

Read More »

Read More »

Driving licence loses attraction for young Swiss

The number of people who applied for a Swiss driving licence dropped by 2% last year, with applications from 18- to 24-year-olds down 3%. Some 5.8 million people owned a driving licence for cars in 2017, the Federal Roads Officeexternal link said on Tuesday. This 1% increase was due not only to new drivers but also to foreign licences being exchanged for Swiss ones and natural population growth, it explained.

Read More »

Read More »

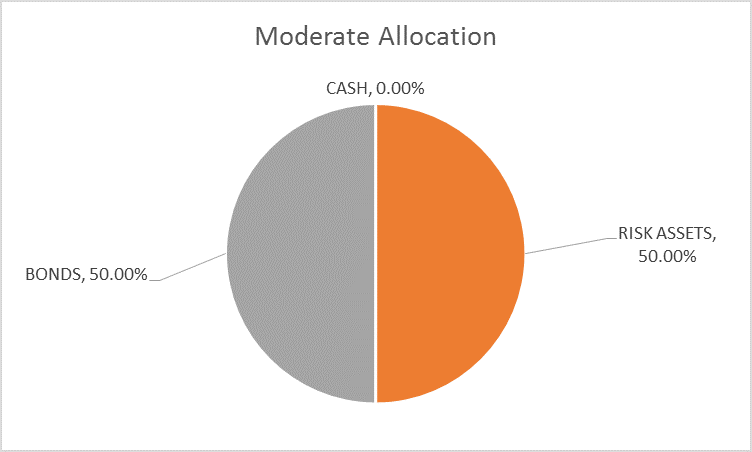

Global Asset Allocation Update

The risk budget is unchanged this month. For the moderate risk investor the allocation to bonds and risk assets is evenly split. There are changes this month within the asset classes. How far are we from the end of this cycle? When will the next recession arrive and more importantly when will stocks and other markets start to anticipate a slowdown?

Read More »

Read More »

In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast with Ronald-Peter Stoeferle

In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast (Episode 5) interview with Ronald-Peter Stoferle. We interview our friend Ronald-Peter Stoeferle, partner in Incrementum in Liechtenstein and author of the must read, annual gold report ‘In Gold We Trust’ in this the fifth episode of the Goldnomics Podcast.

Read More »

Read More »

The Fed’s “Inflation Target” is Impoverishing American Workers

Redefined Terms and Absurd Targets. At one time, the Federal Reserve’s sole mandate was to maintain stable prices and to “fight inflation.” To the Fed, the financial press, and most everyone else “inflation” means rising prices instead of its original and true definition as an increase in the money supply. Rising prices are a consequence – a very painful consequence – of money printing.

Read More »

Read More »

FX Daily, June 20: Fragile Stability

The day began out with equity losses in Asia before a sharp recovery, perhaps initiated in China. The MSCI Asia Pacific Index was up a little more than 0.5%. The Shanghai Composite fell more than 1% before closing 0.25% better.

Read More »

Read More »

Cryptocurrency Technicals – Navigating the Bear Market

Long time readers may recall that we regard Bitcoin and other liquid big cap cryptocurrencies as secondary media of exchange from a monetary theory perspective for the time being. The wave of speculative demand that has propelled them to astonishing heights was triggered by market participants realizing that they have the potential to become money.

Read More »

Read More »

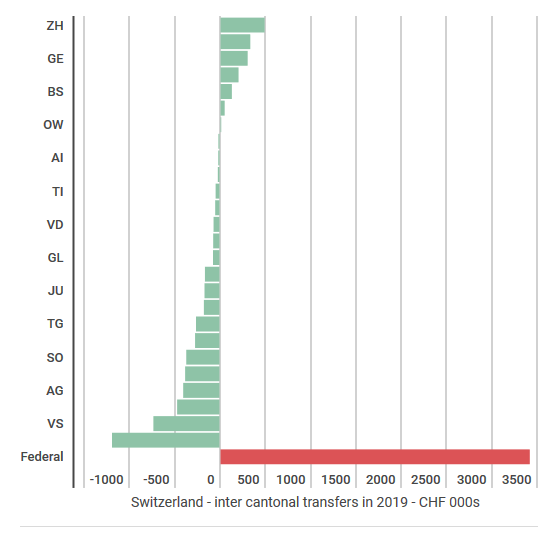

The price of solidarity – Switzerland’s inter-cantonal payments for 2019

In Switzerland, much in life revolves around the canton. Cantons have their own health, social and education systems, parliaments and tax rates. Federal government, based in Bern, is a layer that sits over the top, bringing the cantons together as Switzerland.

Read More »

Read More »

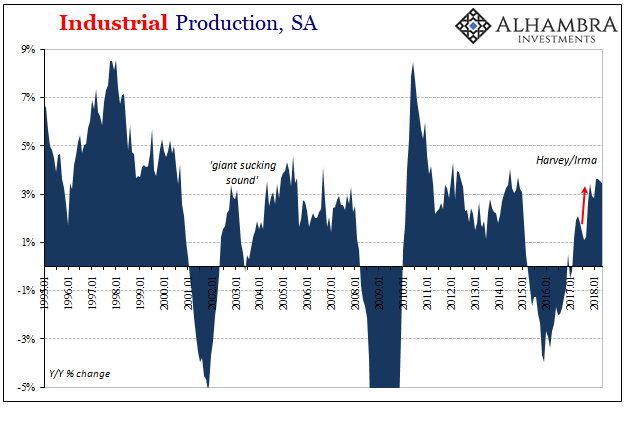

There Isn’t Supposed To Be The Two Directions of IP

US Industrial Production dipped in May 2018. It was the first monthly drop since January. Year-over-year, IP was up just 3.5% from May 2017, down from 3.6% in each of prior three months. The reason for the soft spot was that American industry is being pulled in different directions by the two most important sectors: crude oil and autos.

Read More »

Read More »

FX Daily, June 19: America First Clashes With Made in China 2025

The escalation of trade tensions between the world's two largest economies is scaring investors, who are liquidating equities and buying core bonds. The dollar and yen are the strongest of the major currencies. The Swiss franc is mostly steady as it too is benefiting from the unwinding of risk trades.

Read More »

Read More »

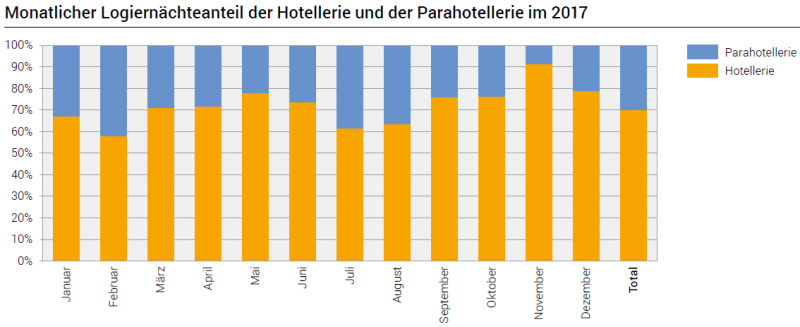

Tourist accommodation in 2017: supplementary accommodation recorded growth in overnight stays of close to 7 percent

In 2017, supplementary accommodation posted a total of 15.9 million overnight stays, i.e. an increase of 6.9% compared with 2016. With 10.8 million units, Swiss visitors represented more than two-thirds of demand (68.3%), i.e. a rise of 7.0%. Foreign visitors registered a 6.6% increase with 5.0 million units. Among this clientele, European visitors generated the most overnight stays with a total of 4.2 million (+8.4%).

Read More »

Read More »

Rail workers stand against proposed cuts

Some 1,400 rail workers took to the streets across the country on Monday to protest a package of cuts and reforms planned by the Swiss Federal Railways. The demonstrations, called for by the Union for public transport workers (SEV), were spread across several Swiss cities: Geneva, Lausanne, Olten, Bern, and Zurich, where the largest event brought together about 350 workers in the late afternoon.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was mixed on Friday but capped off a largely losing week. MYR, CLP, and CNY were the best performers over the last week, while ARS, TRY, and ZAR were the worst. We expect EM FX to continue weakening, but note that with very few fundamental drivers this week, we may see some consolidation near-term.

Read More »

Read More »