Tag Archive: newslettersent

Will the Crazy Global Debt Bubble Ever End?

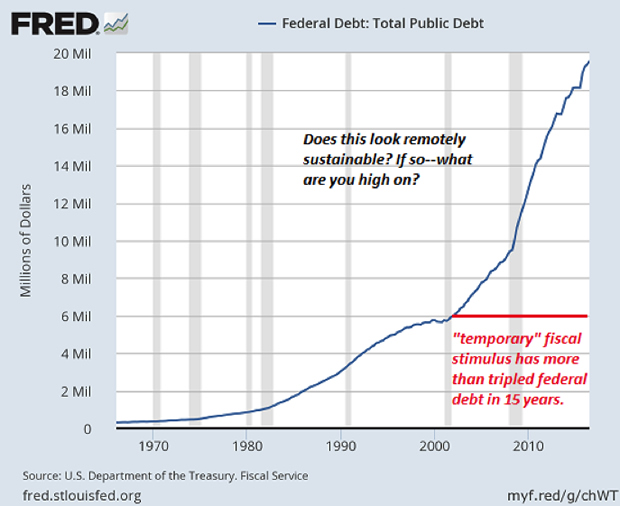

We've been playing two games to mask insolvency: one is to pay the costs of rampant debt today by borrowing even more from future earnings, and the second is to create wealth out of thin air via asset bubbles. The two games are connected: asset bubbles require leverage and credit.

Read More »

Read More »

Drop in the US Unemployment Rate Not Sufficient to Mask Disappointing Report

Poor jobs growth won't challenge June hike expectations but September and balance sheet. Little positive in today's report. Drop in unemployment explained by drop in participation rate. Trade deficit was larger than expected, which may point to slower Q2 growth.

Read More »

Read More »

FX Daily, June 02: Dollar Marks Time Ahead of US Jobs Report

The foreign exchange market is becalmed, leaving the US dollar narrowly mixed. The euro has been confined to less than a 20-pip range through the Asian session and most of the European morning. The news stream is light. The US withdrawal from the Paris Accord may have garnered the headlines, but as a market force, it is difficult to detect the immediate impact.

Read More »

Read More »

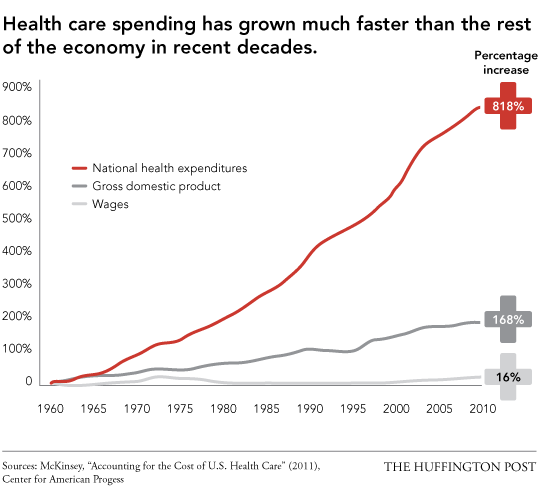

Swiss healthcare ranked third globally for preventing death

A study of data from 195 countries from 1990 to 2015 published recently in the medical journal The Lancet, ranks Switzerland’s healthcare system third. The analysis looked at mortality rates from causes that should not be fatal in the presence of effective medical care. It considered both healthcare access and quality and was designed with the aim of normalising for local environmental and behavioural risks.

Read More »

Read More »

The Internet Helped Kill Inflation In America, Says Credit Suisse

Whether or not San Francisco Fed President John Williams is right about US inflation and employment being about as close to the central bank’s targets as investors have seen - as he told CNBC two days ago - is irrelevant: The central bank is going to raise interest rates two more times this year no matter what happens to consumer prices, says Credit Suisse Chief Investment Officer for Switzerland Burkhard Varnholt.

Read More »

Read More »

Simple (economic) Math

The essence of capitalism is not strictly capital. In the modern sense, the word capital has taken on other meanings, often where money is given as a substitute for it. When speaking about things like “hot money”, for instance, you wouldn’t normally correct someone referencing it in terms of “capital flows.” Someone that “commits capital” to a project is missing some words, for in the proper sense they are “committing funds to...

Read More »

Read More »

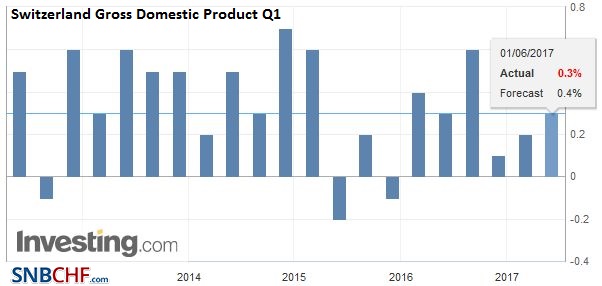

Switzerland GDP Q1 2017: +0.3 percent QoQ, +1.1 percent YoY

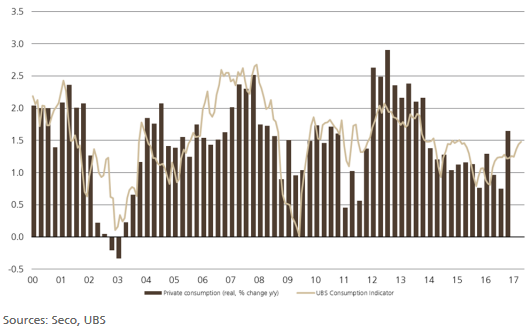

Switzerland’s real gross domestic product (GDP) grew by 0.3 % in the first quarter of 2017*. Private consumption growth expanded only slightly, while government consumption rose moderately. Following the previous quarter’s fall, investment in construction and equipment increased.

Read More »

Read More »

FX Daily, June 01: Greenback Steadies at Lower Levels, Sterling Struggles

The US dollar is mostly firmer against the major currencies. It is consolidating yesterday's losses more than staging much of a recovery. Even sterling, where a YouGov poll has the Tory lead at three percentage points, down from seven previously, is above yesterday's lows. On the other hand, even strong data from Japan did not drive the yen higher.

Read More »

Read More »

Swiss Retail Sales, April: -1.4 percent Nominal and -1.2 percent Real

Real turnover in the retail sector also adjusted for sales days and holidays fell by 1.2% in April 2017 compared with the previous year. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade turnover registered a decline of 2.4%.

Read More »

Read More »

Record research spending defies currency woes

Swiss companies invested record volumes in research and development (R&D) in 2015, despite the franc exploding in value at the start of that year. The private sector was responsible for most of the CHF22 billion ($22.6 billion) R&D spending in 2015, according to official figures released on Monday. This was an increase of 10.5% from the last time such spending was measured by the Federal Statistical Officeexternal link in 2012.

Read More »

Read More »

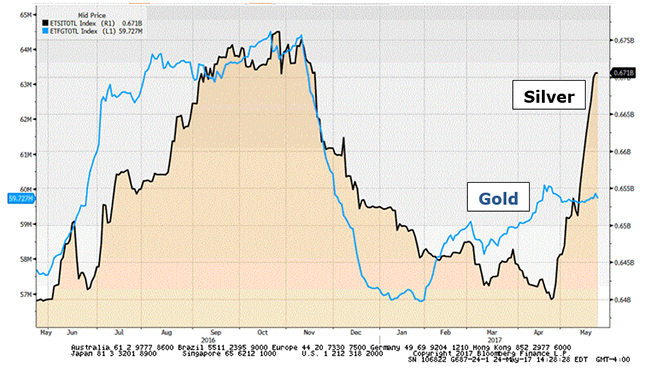

Silver Bullion In Secret Bull Market

Do you think silver is poised to go higher? I sure do. That’s because I’m watching what is going on in the world’s silver ETFs. I’m also watching the mountain of forces that are piling up to push the metal higher.

Look at this chart. It shows all the metal held by the world’s physical silver ETFs (black line). And all the metal held by the world’s physical gold ETFs (blue line) …

Read More »

Read More »

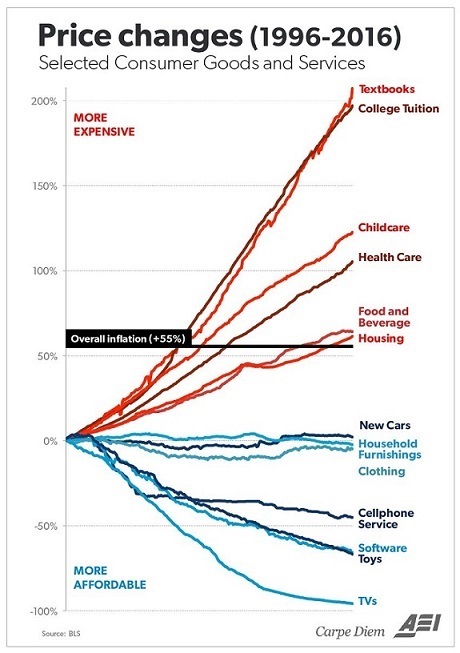

Inflation Isn’t Evenly Distributed: The Protected Are Fine, the Unprotected Are Impoverished Debt-Serfs

The Consumer Price Index (CPI) measure of inflation is bogus on a number of fronts, a reality I've covered a number of times: though the heavily gamed official CPI is under 2% for the past four years, the real rate is 7% to 12%, depending on whether you happen to live in locales with soaring rents/housing and healthcare costs.

Read More »

Read More »

The US and German Relationship

US and German relations may be strained, but this is not unprecedented. It has been fanned by Trump and Merkel's rhetoric. A European sphere of influence seems to have been the force pushing in that direction.

Read More »

Read More »

Wie entsteht Geld? Nicht so, wie Thomas Jordan uns weismachen will

Technik und Wissenschaften haben sich rasant weiterentwickelt. Nur die Volkswirtschaftslehre ist auf ihrem spätbarocken Niveau sitzengeblieben. Die heutigen Notenbanken betreiben eine spätbarocke Geldpolitik, basierend auf Goethes Faust. Mephisto, der Teufel in Goethes Stück, lügt den König an, er könne einfach Geld drucken und einen Wert darauf schreiben: „Zu wissen sei es jedem, der’s begehrt: Der Zettel hier ist tausend Kronen wert.“ So entstehe...

Read More »

Read More »

FX Daily, May 31: Sterling Takes it On the Chin

Projections showing that the UK Tories could lose their outright majority in Parliament in next week's election spurred sterling sales, which snapped a two-day advance. Polls at the end of last week showed a sharp narrowing of the contest, and this saw sterling shed 1.3% last Thursday and Friday.

Read More »

Read More »

Switzerland UBS Consumption Indicator April: Late Easter slows down car sales

The UBS consumption indicator stood at 1.48 points in April, indicating average private consumption growth. The improved mood in the retail sector supported the indicator, while a decline in new car registrations had a negative effect. The index of consumer sentiment measured by the State Secretariat for Economic Affairs also fell slightly.

Read More »

Read More »

What Happened Monday

No impact from the latest North Korean missile test. Polls suggest Tories still ahead for the June 8 election. Prospects of an Italian election this year weighed on Italian stocks and bonds.

Read More »

Read More »

The Attack on Workers, Phase II

It’s been a long row to hoe for most workers during the first 17 years of the new millennium. The soil’s been hard and rocky. The rewards for one’s toils have been bleak.For many, laboriously dragging a push plow’s dull blade across the land has hardly scratched enough of a rut in the ground to plant a pitiful row of string beans. What’s more, any bean sprouts that broke through the stony earth were quickly strangled out by seasonal weeds....

Read More »

Read More »

The Keynesian Cult Has Failed: “Emergency” Stimulus Is Now Permanent

Can we finally admit that eight years of following the Keynesian coloring-book have not just failed, but failed spectacularly? What do we call a status quo in which & emergency measures" have become permanent props? A failure. The "emergency" responses to the Global Financial Meltdown of 2008-09 are, eight years on, permanent fixtures.

Read More »

Read More »