Tag Archive: newsletter

Who’s to Blame for High Energy Prices?

Joe Biden isn't totally to blame for high energy prices...but he's not helping, either. Here are ten things the administration could do NOW to lower oil prices.

Read More »

Read More »

Living in Retirement in Troubled Times

It's Hot; cold coffee brews, Father's Day; living in Retirement in Troubled times; guaranteed income will replace stocks & bonds in investor appeal.

(The last segment of today's live show was truncated by a connectivity failure between Wirecast and Livestream. Here is the full, uncut version of the segment.)

0:00 -It's Hot; Cold Coffee, Father's Day;

4:18 -Living in Retirement in Troubled Times

RIA Advisors Director of Financial Planning,...

Read More »

Read More »

Sicherheit durch Speicher – privat, öffentlich und innerhalb Firmen

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Teespring ► https://unterblog.creator-spring.com/

------

Leiden Sie im Moment auch unter #Lieferengpässen für Dinge, die Sie dringend benötigen? Fehlen Ihnen #Ersatzteile oder kompletter Ersatz? Unsere moderne Wirtschaft hat sich von der #Lagerhaltung weitgehend verabschiedet. Jede noch so kleine Kapitalbindung wurde als negativ gesehen. Nun wendet sich das Blatt. Wer mit...

Read More »

Read More »

Abverkauf an den Aktienmärkten – Leben von Dividenden – www.aktienerfahren.de

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Leerverkäufe erklärt: Hedgefonds wetten 250 Mrd $ gegen den Markt

Bricht der US-Aktienmarkt ein? Hedgefonds wetten 250 Mrd $ gegen den Markt. Saidi geht im heutigen Video auf einen Artikel aus dem Handelsblatt ein.

Read More »

Read More »

Alasdair Macleod: Banker’s Nightmare! Protect Yourself With Silver

▶︎1000x – Enter your Email ▶︎ https://bit.ly/3NZzjHY

▶︎ Subscribe to this YouTube channel ▶︎ https://bit.ly/CompactSilverNews_subscribe

▶︎ Keep your financial education strong with our CompactClub ▶︎ http://bit.ly/CompactClub

Alasdair has been a celebrated stockbroker and Member of the London Stock Exchange for over four decades. His experience encompasses equity and bond markets, fund management, corporate finance and investment strategy. After...

Read More »

Read More »

Money Mistakes to Avoid in a Bear Market

(6/17/22) Richard Rosso channels his inner Janet Yellen; markets have lost all confidence in the Executive Branch and the Federal Reserve; money tips for a bear market: Household liquidity is key for survival; examine spending, and hold off on major purchases; a Recession is necessary for restoring value to the system; recognizing the difference between a reflexive rally & a bullish trend. The Financial Efficacy of Solar Panels; ESG's are about...

Read More »

Read More »

Unheeded warnings: Václav Klaus at the Marmara Forum

This not the first time that Václav Klaus’ astute observations and experience-based predictions turn out to be shockingly accurate years later, and I’m pretty confident it will not be the last. Even before the examples that follow and that he clearly laid out in his address at the Marmara Forum, the former President of the Czech Republic has repeatedly proven to be quite prophetic in his assessment of the future.

Read More »

Read More »

Enteignung von Immobilien und Vermögensabgaben – Aktuelle Infos 2022

Immobilienenteignung und Vermögensabgabe aktuell wahrscheinlicher denn je!

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Thorsten Homepage: https://thorstenwittmann.com/

Enteignungen sind bereits da und Vermögens- und Immobilienabgaben werden immer wahrscheinlicher

Es gibt wieder Neues von der „Enteignungsfront“ und die Enteignungstendenzen schreiten weiter voran in Deutschland.

Hast du den Antrag zum Immobilienregister...

Read More »

Read More »

FINANZRUDEL COMMUNITY TREFFEN 1. JULI 2022 in ZÜRICH 🇨🇭🧳🥳

💰Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

ICH VERSCHENKE...

Ankündigung zum Finanzrudel Community-Treffen in der Insider-Bar in Zürich. Seid gespannt wer alles dabei sein wird dieses mal, für spannenden Austausch untereinander. Bis du auch dabei? Schreib es mir gerne in die Kommentare.

#community #zurich #Finanzrudel

👉🏽 Alle Infos zum Community-Treffen ►►...

Read More »

Read More »

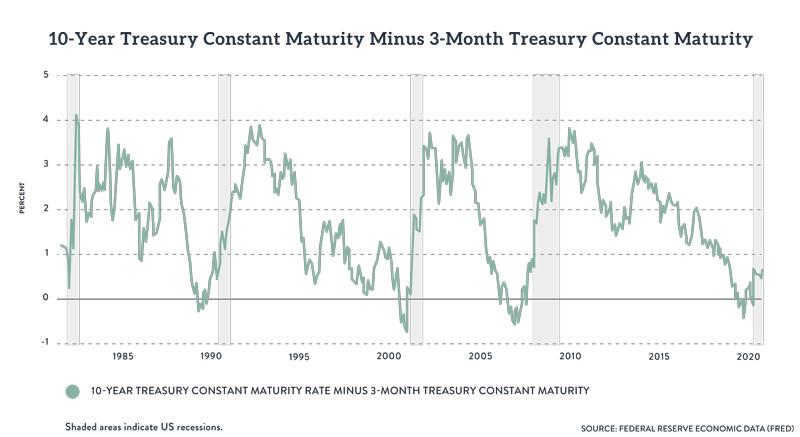

The Inverted Yield Curve and Recession

The “yield curve” refers to a graph showing the relationship between the maturity length of bonds—such as one month, three months, one year, five years, twenty years, etc.—plotted on the x axis, and the yield (or interest rate) plotted on the y axis.1

Read More »

Read More »

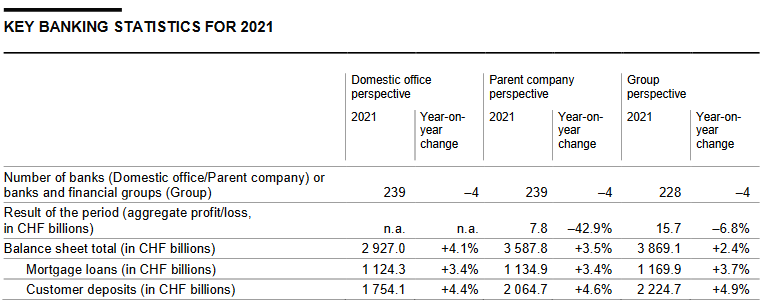

Annual banking statistics for 2021

The Swiss National Bank has today published data on the annual financial statements of banks in Switzerland for the 2021 financial year. For the first time, the published data also comprises bank office data (Domestic office perspective) in addition to the data from individual financial statements (Parent company perspective) and consolidated financial statements (Group perspective).

Read More »

Read More »

The Great Reset: Turning Back the Clock on Civilization

The covid-19 pandemic featured an unprecedented fusion of the interests of large and powerful corporations with the power of the state. Democratically elected politicians in many countries failed to represent the interests of their own citizens and uphold their own constitutions and charters of rights.

Read More »

Read More »

Wie schnell erholt sich die Börse? Wie schützt man sich vor Massenpanik am Aktienmarkt?

Wie war das Anlegerverhalten bei vergangen Krisen? Wie wird Euphorie und Panik individuell wahrgenommen?

_

Dr. Markus Elsässer, Investor und Gründer des Value Fonds

„ME Fonds - Special Values“ [WKN: 663307]

„ME Fonds - PERGAMON“ [WKN: 593117]

_

1.📚 "Dieses Buch ist bares Geld wert" *https://amzn.to/3wr2Vq5

Als Hörbuch *https://amzn.to/3xnT6rW

2.📚 "Des klugen Investors Handbuch" *https://amzn.to/38UCXQg

Als Hörbuch...

Read More »

Read More »

Could Retail “Bagholders” Spark a Rally “Smart Money” Will Be Forced to Chase?

There would be some deliciously karmic justice in the "dumb money" driving a rally that forced the "smart money" to cover their shorts and chase the rally that shouldn't even be happening.

Read More »

Read More »