Tag Archive: newsletter

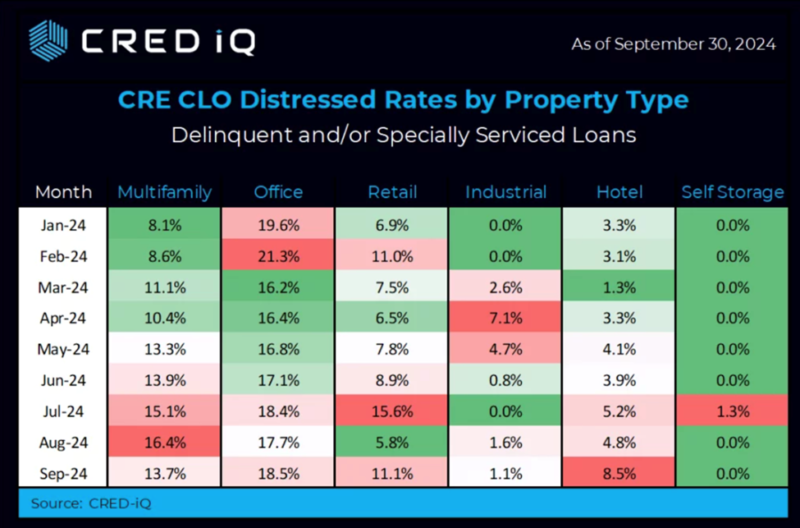

Distress in Commercial Real Estate Bonds Hits All-Time High

Commercial real estate continues to suffer despite the Federal Reserve’s attempt at ameliorating the capital markets with a 50-basis point rate cut in September.The pain is especially apparent in the so-called “CRE-CLO” bond market.

Read More »

Read More »

Showdown in der Chipbranche!

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

ALDAMA IMPLICA A SÁNCHEZ Y MINISTROS EN UNA CORRUPCIÓN ESCANDALOSA

Aldama tira de la manta: acusa a Sánchez, Begoña Gómez, Ávalos, Cerdán y ministros de corrupción.

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!...

Read More »

Read More »

Assisted dying: why Britain should back a change

Should people have the right to choose (https://www.economist.com/leaders/2024/11/21/why-british-mps-should-vote-for-assisted-dying?

Read More »

Read More »

Euro and Sterling are Trying to Stabilize after Sharp Drop on Back of Disappointing Flash PMI

Overview: Weak preliminary PMI readings in Europe, Japan, and Australia, underscore the apparent divergence with the US, sending the dollar broadly higher. The euro is currently recovering from the sell-off that took it to $1.0335 and sent sterling below $1.25. Only the yen, among the G10 currencies, has weathered today's dollar surge. Most emerging market currencies, especially from central Europe, are weaker. Despite the stronger dollar, gold is...

Read More »

Read More »

Draper on War: When Is War Just?

War and Individual Rights by Kai Draper; Oxford University Press, 2016, xii + 254 pp.Many people make fun of analytic philosophy because of its use of imaginary cases, often elaborated with what seems perverse ingenuity. It is better, critics claim, to stick close to reality.

Read More »

Read More »

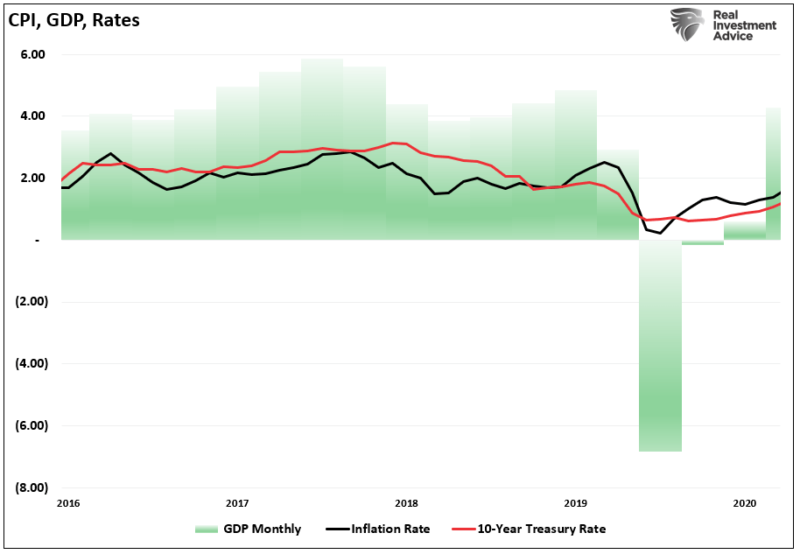

“Trumpflation” Risks Likely Overstated

With the re-election of President Donald Trump, the worries about tariffs and pro-business policies sparked concerns of "Trumpflation." Inflation has been a top concern for policymakers, businesses, and everyday consumers, especially following the sharp price increases experienced over the past few years. However, growing evidence shows inflationary pressures continue to ease significantly, paving the way …

Read More »

Read More »

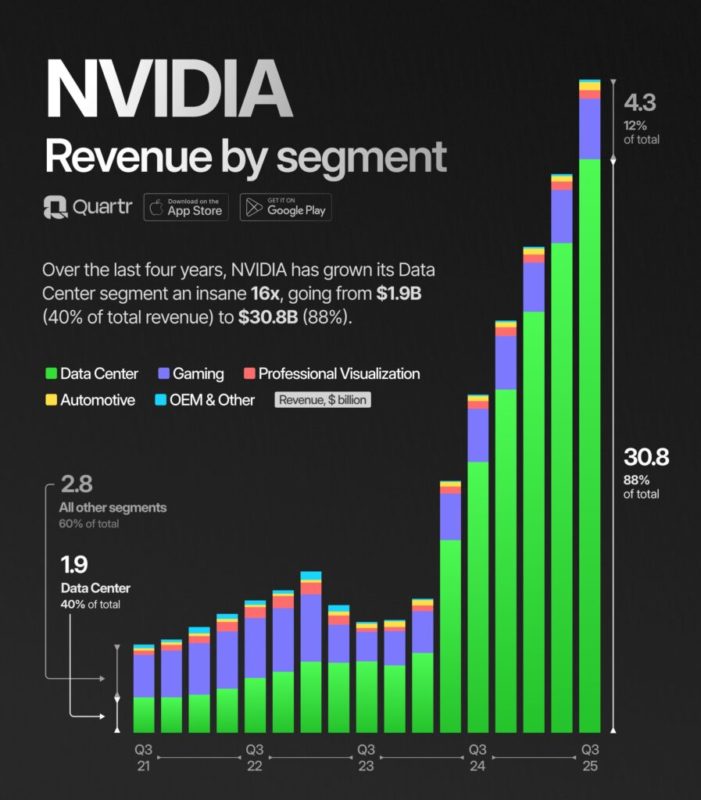

AI Is Steaming To Nvidia’s Benefit

Wall Street's poster child for AI is Nvidia. With an overwhelming market share in AI chip design, Nvidia is up over 200% year to date and a whopping 2680% over the last five years. Driving the price surge are incredible earnings, revenue growth, massive profit margins, and promising outlooks. Since 2020, Nvidia's sales have increased …

Read More »

Read More »

Erzwungene Transformation – das große Missverständnis

Zur Bedeutung des Wortes Transformation ist im Duden zu lesen „das Transformieren; das Transformiertwerden“. Diese Erklärung weist aus Sicht der Sprache auf einen Doppelcharakter hin – der Mensch kann selbst aktiv gestalten oder ein Objekt für die Umgestaltungswünsche anderer Menschen sein.

Read More »

Read More »

Völlige Eskalation in der Ukraine! “Biden will Trump ein Desaster hinterlassen!”

Tucker Carlson erhebt massive Vorwürfe gegen die Biden Administration!

Meine Depotempfehlung: https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

Bildrechte:

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►►...

Read More »

Read More »

USDJPY Technical Analysis – We continue to range around key levels

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

Read More »

Read More »

Was sind Trumps Pläne für die Welt? Drastische Veränderungen stehen uns bevor!

Trump – Teufel oder der Heilsbringer? Was will er wirklich und wen holt er in die Regierung?

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext-yt

Homepage Thorsten Wittmann: https://thorstenwittmann.com/

Was will Trump wirklich?

Er polarisiert wie kaum ein Zweiter. Ich spreche natürlich von Donald Trump.

Wird sich zukünftig etwas ändern auf der Weltbühne?

Oh ja … und zwar gewaltig.

Ich habe heute sein neues Kabinett...

Read More »

Read More »

Logs Only Roll In One Direction: Fighting Kinetic Energy

Before anyone gets their hopes up about a reduction in government expenditures resulting from the upcoming Department of Government Efficiency (DOGE), remember that, once rolling, a log rolls in one direction—downhill—until stopped. But have any of us ever tried stopping a log as it accelerates down a hill?The LogAh, the log.

Read More »

Read More »

Dein Paket ist nicht angekommen? #shorts

Du hast etwas bestellt aber Dein Paket ist verschwunden? Dann at Tina hier ein paar Tipps für Dich, was Du jetzt tun kannst.

#Finanztip

Read More »

Read More »

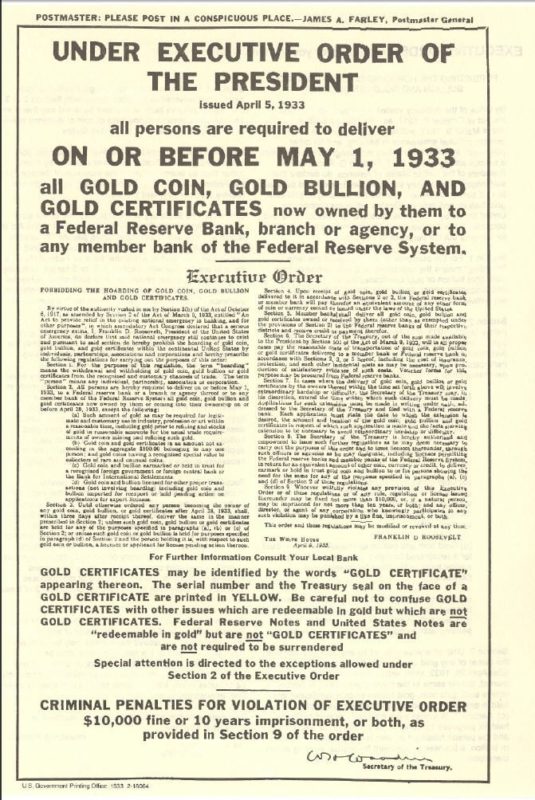

The Fed’s Gold Standard Confusion

Why did the United States abandon the gold standard?

In an article published recently by the Federal Reserve Bank of St. Louis, Maria Hasenstab cites the international gold shortage during the Great Depression. “Countries around the world basically ran out of supply and were forced off the gold standard,” she writes.

Read More »

Read More »

Meine Investitionsphilosophie

Kanal von: https://www.youtube.com/@KLProjektentwicklungGmbH

Seminare, Bücher und Filme von Dr. Dr. Rainer Zitelmann finden Sie hier: https://linktube.com/zitelmann

Der Podcast von Dr. Dr. Rainer Zitelmann: Erfolg, Reichtumsforschung und Finanzen

iTunes: https://podcasts.apple.com/us/podcast/dr-dr-rainer-zitelmann-erfolg-reichtumsforschung-und/id1629889731

Spotify: https://open.spotify.com/show/1E6YAqN5q0qzSzvVooVT9E?si=9cffa670bc224fa5...

Read More »

Read More »

Avec 35 % des ventes, la vignette électronique s’est rapidement imposée en 2024

Pour l’année 2024, les acheteuses et les acheteurs avaient le choix, pour la première fois, entre la vignette autocollante conventionnelle et la vignette électronique. Un bon tiers des personnes ont opté pour la version numérique.

Read More »

Read More »

How AI and Fed Policies Are Shaping the Market

In this episode of the Cashflow Academy podcast, host Andy Tanner is joined by investing experts Noah Davidson and Corey Halliday. They dive into broad market trends, discuss Fed policies, and analyze current market sentiment. The episode also covers topics such as the impact of AI on jobs, the role of consumer confidence, and the significance of hedging in today's financial landscape. Whether you're a seasoned investor or just getting started,...

Read More »

Read More »

Droht wieder ein Goldverbot in der Krise?

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist studierter Bankkaufmann und hilft Menschen auf der Ausbildungsplattform Investorenausbildung durch handfeste Regeln die richtige Aktienauswahl zu treffen und daraus monatliche Einnahmen zu generieren. Und das in jeder Marktphase!

Read More »

Read More »