Tag Archive: newsletter

FX Daily, September 03: Pound Punished in High Drama

A showdown between UK Prime Minister Johnson and Parliament over Brexit pushed sterling below $1.20. The euro is extended its losses after finishing last week below $1.10. Growth concerns are seeing equities retreat. Japanese and Chinese shares managed to eke out gains, but the Asia Pacific and European stocks have been sold.

Read More »

Read More »

Swiss National Bank Presents New 100-Franc Note

The Swiss National Bank (SNB) will begin releasing the new 100-franc note on 12 September 2019, bringing the issuance of the ninth banknote series to a close. The first denomination in the new series, the 50-franc note, entered circulation on 13 April 2016. This was followed by the 20, 10, 200 and 1000-franc notes, which were released at six or twelve-month intervals.

Read More »

Read More »

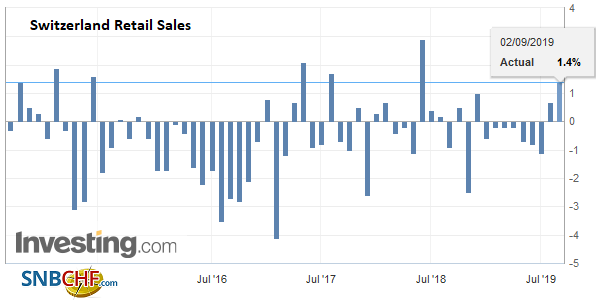

Swiss Retail Sales, July 2019: +1.5 percent Nominal and +1.4 percent Real

Turnover in the retail sector rose by 1.5% in nominal terms in July 2019 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

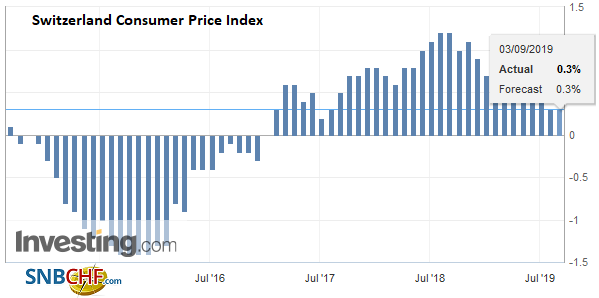

Swiss Consumer Price Index in August 2019: +0.3 percent YoY, Unchanged MoM

The consumer price index (CPI) remained stable in August 2019 compared with the previous month, reaching 102.1 points (December 2015 = 100). Inflation was +0.3% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

What Happened Monday

Markets in the US and Canada were closed on Monday for national Labor Day holidays. Here is a succinct summary of key developments that will set the backdrop for Tuesday. On September 1, the new round of tariffs in the US-China fight took effect. The US placed a 15% tariff on around 3000 Chinese goods that thus far had escaped action.

Read More »

Read More »

Big Difference Which Kind of Hedge It Truly Is

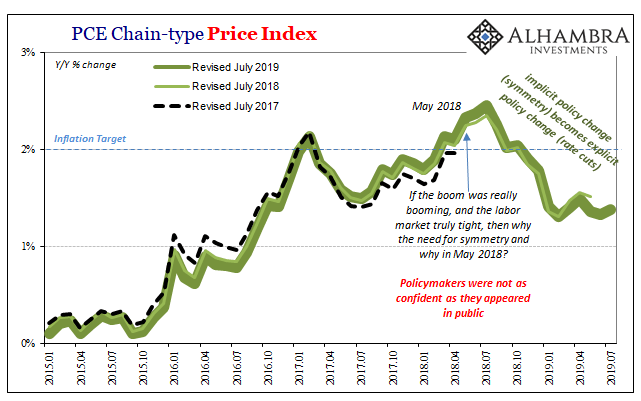

It isn’t inflation which is driving gold higher, at least not the current levels of inflation. According to the latest update from the Bureau of Economic Analysis, the Federal Reserve’s preferred inflation calculation, the PCE Deflator, continues to significantly undershoot. Monetary policy explicitly calls for that rate to be consistent around 2%, an outcome policymakers keep saying they expect but one that never happens.

Read More »

Read More »

September Monthly

Three forces are shaping the investment climate. The US-China trade conflict escalates at the start of September as both will raise tariffs on each other's goods and are threatening another round in mid-December (US 25% tariffs on $250 of Chinese imports will increase to 30% on October 1).

Read More »

Read More »

FX Weekly Preview: Talking and Fighting in the Week Ahead

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull.

Read More »

Read More »

Drivers for the Week Ahead

We remain dollar bulls; this is an important data week for the US. Final August eurozone manufacturing PMIs will be reported Monday; UK reports August PMIs this week. RBA meets Tuesday and is expected to keep rates steady at 1.0%; BOC meets Wednesday and is expected to keep rates steady at 1.75%.

Read More »

Read More »

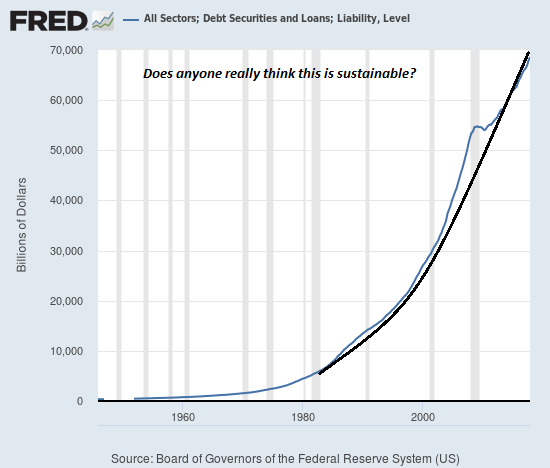

Labor Day Reflections on Retirement and Working for 49 Years

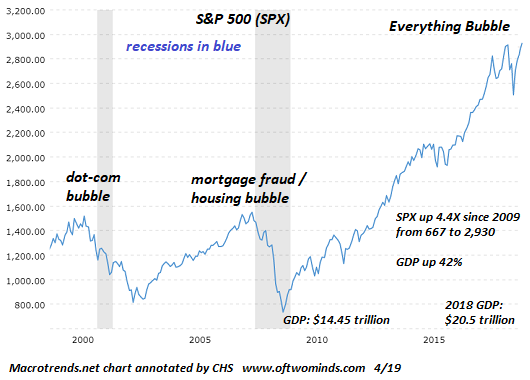

What happens when these monstrous speculative bubbles pop? Let's start by stipulating that if I'd taken a gummit job right out of college, I could have retired 19 years ago. Instead, I've been self-employed for most of the 49 years I've been working, and I'm still grinding it out at 65.

Read More »

Read More »

Most Swiss Election Candidates Favour Raising Retirement age to 67

A majority of the candidates putting themselves forward for election as federal parliamentarians on 20 October 2019 favour raising Switzerland’s retirement age to 67, according to a survey done by Smartvote and reported in the newspaper NZZ am Sonntag.

Read More »

Read More »

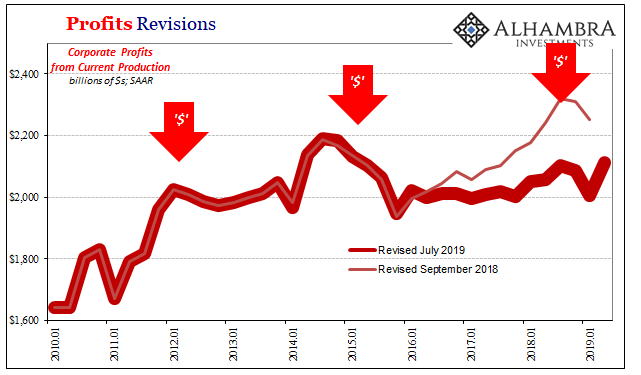

GDP Profits Hold The Answers To All Questions

Revisions to second quarter GDP were exceedingly small. The BEA reduced the estimate by a little less than $800 million out of nearly $20 trillion (seasonally-adjusted annual rate). The growth rate therefore declined from 2.03502% (continuously compounded annual rate) to 2.01824%.

Read More »

Read More »

Swiss Research Leads to Cancer Break Through

Researchers at the Paul Scherrer Institute recently deciphered the structure of the CC chemokine receptor 7 (CCR7), a signaling protein. Cancer cells use CCR7 to guide themselves into the lymphatic system, spreading cancer throughout the body. The resulting secondary tumors, called metastases, are responsible for most cancer deaths.

Read More »

Read More »

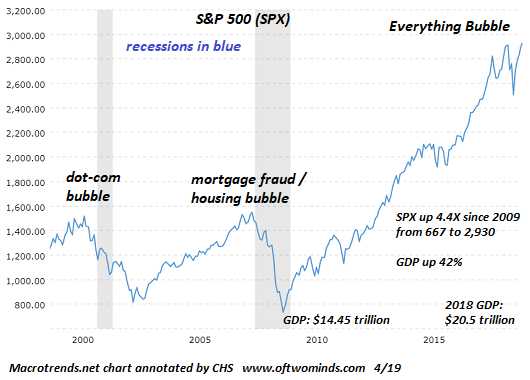

Dear Trump Advisors: Prop the Market Up Now and Lose in 2020, or Let the Market Crash and Win in 2020

One of the more reliable truisms is that Americans vote their pocketbook: if their wallets are being thinned (by recession, stock market declines, high inflation/stagnant wages, etc.), they throw the incumbent out, even if they loved him the previous year when their wallets were getting fatter. (Think Bush I, who maintained high approval ratings but ended up losing the 1992 election due to a dismal economic mood.)

Read More »

Read More »

FX Daily, August 30: US Dollar Finishing August on Firm Note as Euro nears Two-Year Lows

Global equities are advancing at least in part on ideas that trade tensions are easing. China announced it would not take immediate action on the five percentage point increase in levies that the US announced strictly in response to China's retaliatory tariffs. A lull between blows is not the same thing as de-escalation or truce.

Read More »

Read More »

Monthly Macro Monitor: Market Indicators Review

The Treasury market continues to price in lower nominal and real growth. The stress, the urgency, I see in some of these markets is certainly concerning and consistent with what we have seen in the past at the onset of recession. The move in Treasuries is by some measures, as extreme as the fall of 2008 when we were in a full blown panic.

Read More »

Read More »

Swiss Trade with Much of South America should Soon be Tarif Free

A deal agreed between EFTA and the South American Mercosur bloc, which includes Argentina, Brazil, Uruguay and Paraguay, with a combined population of 260 million, is close to signing. EFTA includes Iceland, Liechtenstein, Norway, and Switzerland. Under the deal, 95% of Switzerland’s CHF 3.6 million annual exports to the bloc would be tarif free.

Read More »

Read More »

The Fantasy of Central Bank “Growth” Is Finally Imploding

It was such a wonderful fantasy: just give a handful of bankers, financiers and corporations trillions of dollars at near-zero rates of interest, and this flood of credit and cash into the apex of the wealth-power pyramid would magically generate a new round of investments in productivity-improving infrastructure and equipment, which would trickle down to the masses in the form of higher wages, enabling the masses to borrow and spend more on...

Read More »

Read More »

FX Daily, August 29: Johnson Faces Legal Challenges and Conte may be Given an Extension

The capital markets are calm today, though there does seem to be some optimism creeping back into the market. The Chinese yuan strengthened, snapping a ten-day slide and Italian bank shares index has risen by more than 1% for the fourth consecutive session.

Read More »

Read More »

SNB’s Maechler: Reaffirms Pledges on FX and Intervention, Negative Rates

SNB jawboning CHF lower as concerns mount over global growth fears and a flight to safety. EUR/CHF is already trading close to the lows of the year. The Swiss National Bank's Andréa M Maechler, Member of the Governing Board, has crossed the wires saying that ‘any intervention’ requires an analysis of cost/benefits - plenty of jawboning going on here.

Read More »

Read More »